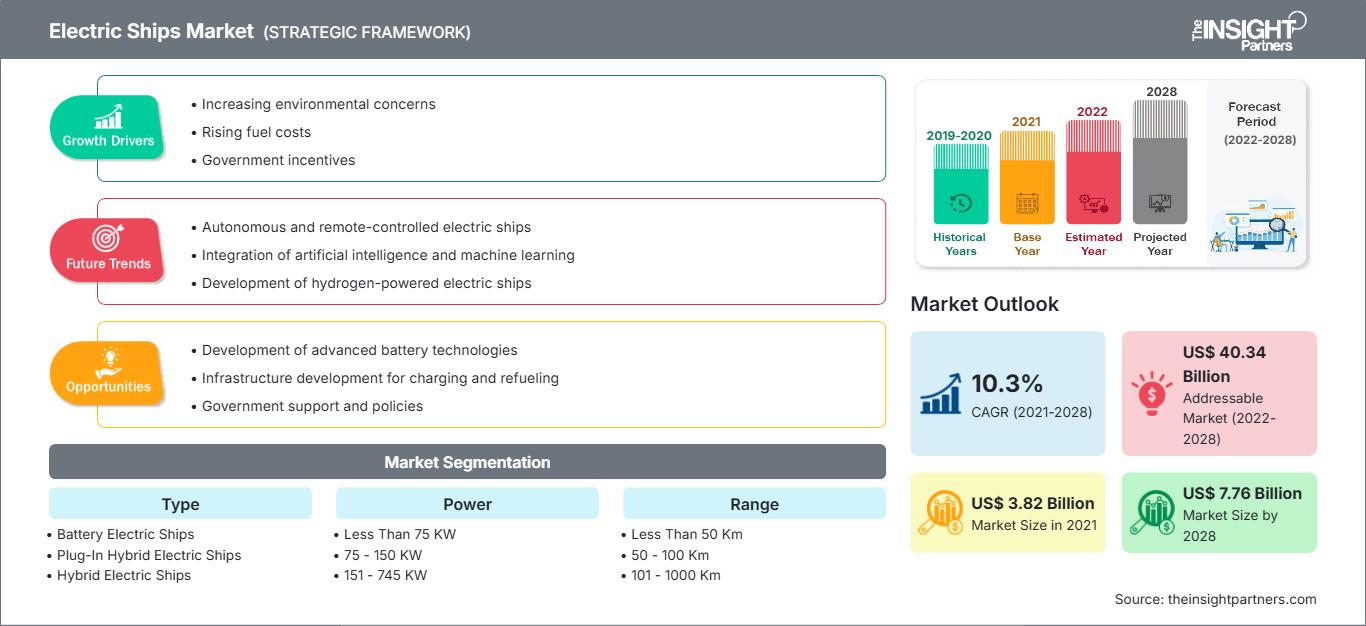

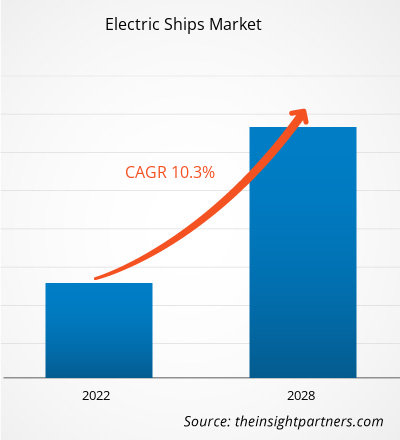

Il mercato delle navi elettriche è stato valutato a 3,82 miliardi di dollari nel 2021 e si stima che crescerà a un CAGR del 10,3% dal 2021 al 2028.

Un'imbarcazione elettrica è qualsiasi imbarcazione o nave la cui tecnologia di propulsione primaria è un sistema di propulsione elettrico. Può essere un'imbarcazione o nave elettrica a batteria, elettrica a celle a combustibile a idrogeno o ibrida elettrica, dai rimorchiatori, traghetti, navi cargo e chiatte alle imbarcazioni turistiche, pescherecci, yacht da crociera e veicoli sottomarini senza pilota (UUV). Le navi elettriche sono azionate elettricamente, a differenza delle navi convenzionali con motore diesel. Queste navi utilizzano un dispositivo di accumulo a batteria come fonte di energia per azionare i motori elettrici. Numerosi tipi di batterie possono essere utilizzati in una nave elettrica, tra cui batterie agli ioni di litio, batterie al piombo e celle a combustibile. Le navi elettriche sono principalmente traghetti e piccole navi passeggeri su vie navigabili interne che navigano interamente a elettricità. Percorrono solo brevi distanze, circa 80 km con una singola carica. Inoltre, le navi alimentate a energia solare vengono utilizzate anche su imbarcazioni leggere che richiedono una bassa potenza. Tuttavia, il fabbisogno energetico delle navi cargo non può essere soddisfatto da un sistema completamente elettrico a causa del peso elevato; per questo motivo, le navi cargo utilizzano un sistema ibrido diesel-elettrico.

Personalizza questo rapporto in base alle tue esigenze

Potrai personalizzare gratuitamente qualsiasi rapporto, comprese parti di questo rapporto, o analisi a livello di paese, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

Mercato delle navi elettriche: Approfondimenti strategici

-

Ottieni le principali tendenze chiave del mercato di questo rapporto.Questo campione GRATUITO includerà l'analisi dei dati, che vanno dalle tendenze di mercato alle stime e alle previsioni.

Impatto della pandemia di COVID-19 sul mercato delle navi elettriche

La pandemia di COVID-19 ha avuto un impatto negativo sul mercato delle navi elettriche. La pandemia ha avuto un impatto globale senza precedenti sulla mobilità umana. In mare aperto, le attività navali sono influenzate dalle severe restrizioni alla circolazione delle persone e dai cambiamenti nei consumi di beni. Alcuni paesi hanno chiuso il settore crocieristico a causa della pandemia di COVID-19. Tuttavia, alcune compagnie di crociera stanno cercando di riprendere le loro attività durante la pandemia. Le attività umane in mare aperto sono state radicalmente modificate dalla pandemia di COVID-19, con segnalazioni di restrizioni portuali e cambiamenti nei modelli di consumo che hanno avuto un impatto su diversi settori marittimi, pesca, traghetti passeggeri e navi da crociera. Tuttavia, in alcune regioni, il trasporto merci è stato dichiarato essenziale durante il lockdown, il che ha creato un'opportunità redditizia per il mercato delle navi elettriche.

Approfondimenti sul mercato delle navi elettriche

Aumento dell'adozione di sistemi di propulsione ibridi ed elettrici per il retrofitting delle navi

Il retrofitting delle navi sta suscitando interesse e sta spingendo armatori e costruttori navali a prolungare la durata delle loro navi esistenti. Tale processo offre l'opportunità di ridurre il consumo di carburante e di rimanere al passo con le più recenti soluzioni ecocompatibili, con un costo contenuto. Il retrofitting sta diventando una pratica comune nel settore marittimo. I costruttori navali si stanno orientando verso l'automazione, integrando le navi di nuova costruzione e riadattando le navi esistenti con sistemi di propulsione ibridi ed elettrici. Questo sistema è una scelta conveniente per il retrofitting di navi obsolete con un enorme potenziale di retrofitting, tra cui traghetti, navi portacontainer, navi da crociera, rimorchiatori e navi cargo. I costruttori navali scelgono di ammodernare le navi con un sistema di propulsione ibrido-elettrico o completamente elettrico, poiché si tratta di un'opzione relativamente più economica rispetto all'acquisto di una nuova nave. Inoltre, diversi costruttori navali europei stanno attivamente ammodernando la loro attuale flotta navale con sistemi di propulsione ibridi ed elettrici. Ad esempio, secondo l'articolo pubblicato da Riviera Maritime Media Ltd, nel marzo 2020 i proprietari di navi da rifornimento offshore (OSV) hanno investito nell'ammodernamento delle flotte alimentate a diesel-elettrico/GNL con propulsione ibrida a batteria, un'iniziativa che sta dando i suoi frutti sia al noleggiatore che all'armatore, e che sta contribuendo a ridurre le problematiche ambientali in Norvegia. Questi fattori hanno portato all'adozione di sistemi di propulsione ibridi ed elettrici per l'ammodernamento delle navi.

Approfondimenti di mercato basati sulla tipologia

In base alla tipologia, il mercato delle navi elettriche è segmentato in navi elettriche a batteria, navi elettriche ibride plug-in e navi elettriche ibride. Il segmento delle navi ibride elettriche ha guidato il mercato nel 2020. L'affidabilità offerta dalle navi ibride elettriche ne supporta la domanda grazie all'utilizzo di sistemi di propulsione supplementari e alla maggiore velocità, che possono ridurre il rischio di guasti e coprire distanze maggiori in meno tempo. Inoltre, la propulsione ibrida elettrica delle navi può essere alimentata in due modi: elettrica (tramite propulsione diesel-elettrica o a batteria) o meccanica (propulsione diesel diretta). Inoltre, armatori o compagnie di navigazione e logistica in tutto il mondo preferiscono le navi ibride elettriche in quanto consentono un minore consumo di carburante e contribuiscono a ridurre i costi operativi. L'utilizzo della propulsione diesel-elettrica a bassa potenza e della propulsione diesel diretta quando è necessaria un'elevata potenza, ad esempio per la navigazione in acque interne a diverse velocità, consente una riduzione dei costi operativi delle navi elettriche. Questo è un modo più intelligente per utilizzare l'energia disponibile e risparmiare sui costi del carburante utilizzando la propulsione ibrida elettrica delle navi.

Gli operatori che operano nel mercato delle navi elettriche adottano strategie, come fusioni, acquisizioni e iniziative di mercato, per mantenere le proprie posizioni sul mercato. Di seguito sono elencati alcuni sviluppi dei principali attori.

- Nel novembre 2021, BAE Systems ha lanciato un sistema di propulsione e alimentazione di nuova generazione per aiutare gli operatori marittimi a raggiungere zero emissioni. Offre una soluzione flessibile che migliora l'efficienza elettrica e l'autonomia delle imbarcazioni, aumentando la potenza di propulsione e semplificando l'installazione.

- Nel settembre 2020, Kolumbus (azienda di mobilità) e Fjellstrand (costruttore navale) hanno firmato un contratto per la fornitura del primo traghetto veloce completamente elettrico al mondo. Questo progetto ha ricevuto finanziamenti dal programma di ricerca e innovazione Horizon 2020 dell'Unione Europea.

In base alla tipologia, il mercato delle navi elettriche è segmentato in navi elettriche a batteria, navi elettriche ibride plug-in e navi elettriche ibride. In base alla potenza, il mercato delle navi elettriche è segmentato in meno di 75 kW, 75-150 kW, 151-745 kW, 746-7560 kW e oltre 7560 kW. In base all'autonomia, il mercato delle navi elettriche è suddiviso in meno di 50 km, 50-100 km, 101-1000 km e oltre 1000 km. In base alla tipologia di nave, il mercato delle navi elettriche è segmentato in navi da crociera, traghetti, petroliere, navi portarinfuse, pescherecci, cacciatorpediniere, portaerei e altri. In base all'area geografica, il mercato delle navi elettriche è segmentato in cinque regioni principali: Nord America, Europa, Asia Pacifico (APAC), Medio Oriente e Africa (MEA) e Sud America (SAM).

Mercato delle navi elettricheLe tendenze regionali e i fattori che influenzano il mercato delle navi elettriche durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di The Insight Partners. Questa sezione analizza anche i segmenti e la geografia del mercato delle navi elettriche in Nord America, Europa, Asia-Pacifico, Medio Oriente e Africa, America meridionale e centrale.

Ambito del rapporto di mercato sulle navi elettriche

| Attributo del rapporto | Dettagli |

|---|---|

| Dimensioni del mercato in 2021 | US$ 3.82 Billion |

| Dimensioni del mercato per 2028 | US$ 7.76 Billion |

| CAGR globale (2021 - 2028) | 10.3% |

| Dati storici | 2019-2020 |

| Periodo di previsione | 2022-2028 |

| Segmenti coperti |

By Tipo

|

| Regioni e paesi coperti |

Nord America

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli operatori del mercato delle navi elettriche: comprendere il suo impatto sulle dinamiche aziendali

Il mercato delle navi elettriche è in rapida crescita, trainato dalla crescente domanda degli utenti finali, dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando la propria offerta, innovando per soddisfare le esigenze dei consumatori e sfruttando le tendenze emergenti, alimentando ulteriormente la crescita del mercato.

- Ottieni il Mercato delle navi elettriche Panoramica dei principali attori chiave

Profili aziendali

- BAE Systems

- Duffy Electric Boat Company

- Fjellstrand AS

- X Shore

- General Dynamic Electric Boat

- Hurtigruten

- MAN Energy Solutions

- PortLiner

- Siemens Energy

- VARD AS

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato delle navi elettriche

Ottieni un campione gratuito per - Mercato delle navi elettriche