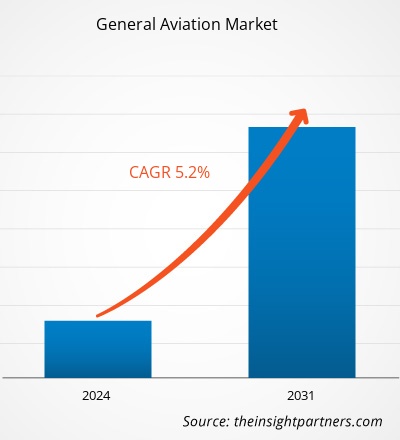

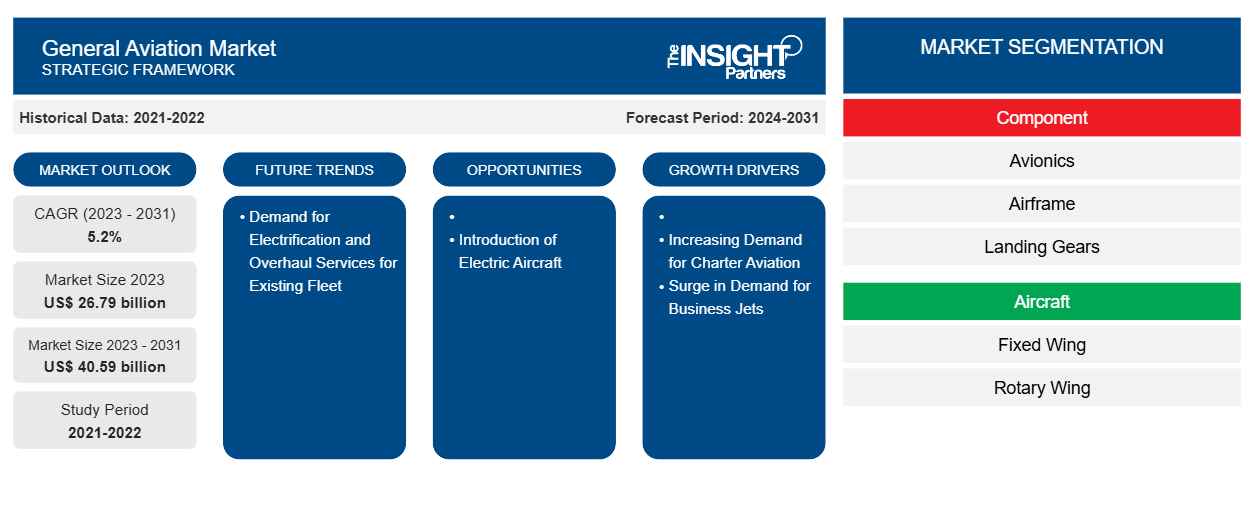

Si prevede che la dimensione del mercato dell'aviazione generale raggiungerà i 40,59 miliardi di dollari entro il 2031, rispetto ai 26,79 miliardi di dollari del 2023. Si prevede che il mercato registrerà un CAGR del 5,2% nel 2023-2031. È probabile che la domanda di servizi di elettrificazione e revisione per la flotta esistente rimanga una tendenza chiave del mercato dell'aviazione generale.

Analisi del mercato dell'aviazione generale

Aziende come Airbus SE, Boeing Company, Bombardier Inc., Dassault Aviation SA, Embraer SA, Pilatus Aircraft Ltd., Gulfstream Aerospace Corporation, Leonardo SpA, Saab AB e Textron Inc. sono tra i principali produttori nel mercato dell'aviazione generale. Queste aziende sono impegnate nella progettazione, produzione e vendita di un'ampia gamma di aeromobili ai distributori, che poi li forniscono agli utenti finali, come proprietari di jet privati, compagnie aeree private governative, proprietari di aeromobili aziendali e altri, rispettivamente.

Panoramica del mercato dell'aviazione generale

L'ecosistema del mercato dell'aviazione generale è diversificato e in continua evoluzione. I suoi stakeholder sono fornitori di materie prime, produttori di componenti, costruttori di aeromobili e utenti finali. I principali attori occupano posizioni in vari nodi dell'ecosistema di mercato. I fornitori di materie prime forniscono materiali, tra cui acciaio , gomma e alluminio, ai produttori di componenti, che poi li utilizzano per produrre e progettare i prodotti finali. Il prodotto finale viene poi fornito ai produttori di aeromobili tramite diversi mezzi, come vendite dirette tramite distributori aziendali o vendite a terzi tramite distributori terzi. I produttori di aeromobili integrano i componenti aeronautici nei rispettivi aeromobili.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

-

Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità del mercato dell'aviazione generale

Aumento della domanda di jet privati

Si prevede che la popolarità e l'adozione dei jet aziendali aumenteranno nel prossimo decennio, principalmente a causa dell'inclusione di nuovi modelli nel servizio. Nell'area Asia-Pacifico, paesi come Cina, Giappone e Corea del Sud insieme rappresentano più di due terzi della domanda regionale di jet aziendali ed elicotteri ogni anno. Inoltre, la domanda di jet aziendali, in particolare per i jet di grandi e medie dimensioni, è in aumento nell'Asia sud-orientale. Gulfstream, Bombardier e Textron sono tra i principali venditori di jet aziendali nell'area Asia-Pacifico. Nonostante un calo nei volumi di vendita negli ultimi due anni, i produttori di jet aziendali stanno considerando Cina e India, tra gli altri, come mercati redditizi.Gulfstream, Bombardier, and Textron are among the major sellers of business jets in Asia-Pacific. Despite a dip in the sales volumes in the last two years, business jet manufacturers are considering China and India, among others, as lucrative markets.

Introduzione di aeromobili elettrici: un'opportunità nel mercato dell'aviazione generale

Una delle principali preoccupazioni nel settore dell'aviazione sono le emissioni ambientali, poiché l'industria aeronautica globale è responsabile di circa il 2,5% delle emissioni globali di carbonio, causando inquinamento ambientale. Diversi fornitori e organizzazioni di ricerca aeronautica hanno lavorato allo sviluppo di modelli di aeromobili avanzati a basso consumo energetico e basse emissioni, tra cui aeromobili ibridi elettrici e completamente elettrici . I sistemi degli aeromobili elettrici sono alimentati da uno o più motori elettrici che azionano le eliche. L'elettricità può essere fornita da vari metodi, il più comune dei quali è la batteria. Nel 2021, Rolls-Royce ha annunciato il completamento del suo volo inaugurale per un'intensa fase di test di volo del suo aeromobile completamente elettrico. Secondo l'azienda, l'aereo utilizzava un propulsore elettrico da 400 kW con il pacco batteria più denso di potenza mai assemblato per un aeromobile. Alla fine, l'azienda desidera che la velocità dell'aeromobile superi le 300 miglia orarie, il che verrà testato in un'altra fase nel Regno Unito. È probabile che lo sviluppo di tali aeromobili contribuisca ad abbassare i livelli di emissioni di carbonio dell'industria aeronautica nel prossimo futuro. Pertanto, lo sviluppo di velivoli elettrici offrirà significative opportunità di crescita per gli operatori del mercato dell'aviazione generale durante il periodo di previsione.powertrain with the most power-dense battery pack ever assembled for an aircraft. Eventually, the company wants the aircraft’s speed to exceed 300 miles per hour, which will be tested in another phase in the UK. The development of such aircraft is likely to contribute to the lowering of the carbon emission levels of the aviation industry in the near future. Thus, the development of electric aircraft will provide significant growth opportunities for the general aviation market players during the forecast period.

Analisi della segmentazione del rapporto sul mercato dell'aviazione generale

I segmenti chiave che hanno contribuito alla derivazione dell'analisi del mercato dell'aviazione generale sono i componenti e gli aeromobili.

- In base ai componenti, il mercato dell'aviazione generale è suddiviso in avionica, cellula, carrello d'atterraggio, motore e altri. Il segmento motore ha detenuto una quota di mercato maggiore nel 2023.

- In base agli aeromobili, il mercato dell'aviazione generale è diviso in ala fissa e ala rotante. Il segmento ad ala fissa ha detenuto una quota di mercato maggiore nel 2023.

Analisi della quota di mercato dell'aviazione generale per area geografica

L'ambito geografico del rapporto sul mercato dell'aviazione generale è suddiviso principalmente in cinque regioni: Nord America, Asia Pacifico, Europa, Medio Oriente e Africa e Sud America.

Nel 2023, il Nord America ha rappresentato una quota importante nel mercato globale dell'aviazione generale, seguito da Europa e Asia Pacifica. Oggigiorno, dai piccoli aerei da addestramento ed elicotteri ai jet aziendali intercontinentali, sono operativi in tutto il mondo oltre 440.000 velivoli per l'aviazione generale. Circa 205.000 di questi hanno sede negli Stati Uniti. Ci sono oltre 5.100 aeroporti pubblici negli Stati Uniti, mentre meno di 400 aeroporti servono compagnie aeree commerciali. La media di miglia passeggeri percorse da un individuo in Nord America è una delle più alte al mondo. Inoltre, si prevede che l'aumento del numero di individui ad alto patrimonio netto (HNWI), la maggiore enfasi sulla sicurezza operativa da parte degli enti normativi e i continui progressi nello sviluppo di un velivolo sportivo leggero aiuteranno anche la crescita del mercato in questa regione nei prossimi anni.

Approfondimenti regionali sul mercato dell'aviazione generale

Le tendenze regionali e i fattori che influenzano il mercato dell'aviazione generale durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del mercato dell'aviazione generale in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e America meridionale e centrale.

- Ottieni i dati specifici regionali per il mercato dell'aviazione generale

Ambito del rapporto sul mercato dell'aviazione generale

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2023 | 26,79 miliardi di dollari USA |

| Dimensioni del mercato entro il 2031 | 40,59 miliardi di dollari USA |

| CAGR globale (2023-2031) | 5,2% |

| Dati storici | 2021-2022 |

| Periodo di previsione | 2024-2031 |

| Segmenti coperti |

Per componente

|

| Regioni e Paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli attori del mercato: comprendere il suo impatto sulle dinamiche aziendali

Il mercato dell'aviazione generale sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato dell'aviazione generale sono:

- Aereo

- Il boeing

- Leonardo SpA

- Saab AB

- Aviazione Dassault

- AEROMOBILI PILATUS LTD

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato dell'aviazione generale

Notizie e sviluppi recenti del mercato dell'aviazione generale

Il mercato dell'aviazione generale viene valutato raccogliendo dati qualitativi e quantitativi dopo la ricerca primaria e secondaria, che include importanti pubblicazioni aziendali, dati associativi e database. Di seguito è riportato un elenco degli sviluppi nel mercato per innovazioni, espansione aziendale e strategie:

- Nel 2024, Lyte Aviation ha introdotto una versione da 19 posti del suo velivolo VTOL a idrogeno-elettrico LA-44, destinato agli utenti dell'aviazione privata e aziendale. (Fonte: Lyte Aviation, comunicato stampa)

- Nel 2021, Bombardier ha presentato il nuovo jet aziendale di medie dimensioni Challenger 3500, i cui sistemi avionici standard includono l'acceleratore automatico, Smart Link Plus e il sistema di cabina ad attivazione vocale. (Fonte: Bombardier, Newsletter)

Copertura e risultati del rapporto sul mercato dell'aviazione generale

Il rapporto “Dimensioni e previsioni del mercato dell’aviazione generale (2021-2031)” fornisce un’analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato dell'aviazione generale a livello globale, regionale e nazionale per tutti i segmenti di mercato chiave coperti dall'ambito

- Dinamiche di mercato come fattori trainanti, vincoli e opportunità chiave

- Tendenze del mercato dell'aviazione generale

- Le cinque forze di Porter in dettaglio

- Analisi del mercato dell'aviazione generale che copre le principali tendenze del mercato, il quadro globale e regionale, i principali attori, le normative e i recenti sviluppi del mercato

- Analisi del panorama e della concorrenza del settore dell'aviazione generale che copre la concentrazione del mercato, l'analisi della mappa di calore, i principali attori e gli sviluppi recenti

- Profili aziendali dettagliati

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato dell'aviazione generale

Ottieni un campione gratuito per - Mercato dell'aviazione generale