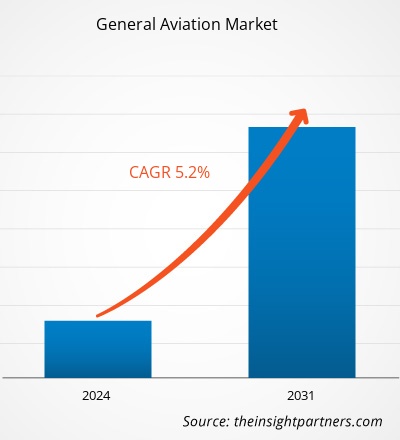

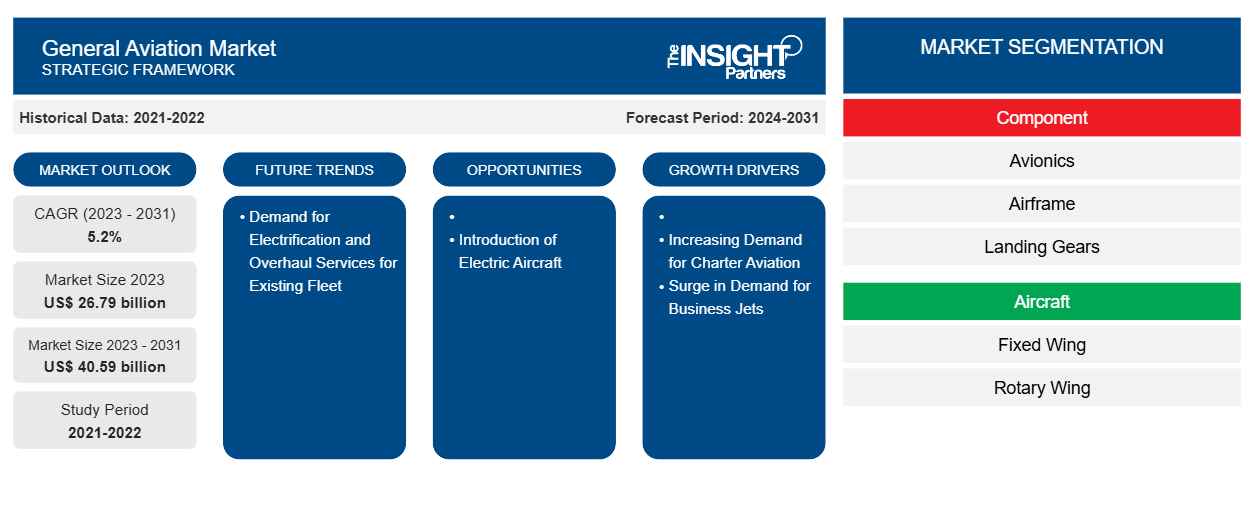

La taille du marché de l'aviation générale devrait atteindre 40,59 milliards USD d'ici 2031, contre 26,79 milliards USD en 2023. Le marché devrait enregistrer un TCAC de 5,2 % en 2023-2031. La demande de services d'électrification et de révision pour la flotte existante devrait rester une tendance clé du marché de l'aviation générale.

Analyse du marché de l'aviation générale

Les entreprises telles que Airbus SE, Boeing Company, Bombardier Inc., Dassault Aviation SA, Embraer SA, Pilatus Aircraft Ltd., Gulfstream Aerospace Corporation, Leonardo SpA, Saab AB et Textron Inc. comptent parmi les principaux fabricants du marché de l'aviation générale. Ces entreprises conçoivent, fabriquent et vendent une large gamme d'avions à des distributeurs, qui les fournissent ensuite aux utilisateurs finaux, tels que les propriétaires de jets privés, les compagnies aériennes privées gouvernementales, les propriétaires d'avions d'affaires et autres, respectivement.

Aperçu du marché de l'aviation générale

L'écosystème du marché de l'aviation générale est diversifié et en constante évolution. Ses parties prenantes sont les fournisseurs de matières premières, les producteurs de composants, les constructeurs d'avions et les utilisateurs finaux. Les principaux acteurs occupent des places dans divers nœuds de l'écosystème du marché. Les fournisseurs de matières premières fournissent des matériaux, notamment de l'acier , du caoutchouc et de l'aluminium, aux fabricants de composants, qui les utilisent ensuite pour fabriquer et concevoir les produits finis. Le produit final est ensuite fourni aux constructeurs d'avions par différents moyens, tels que les ventes directes par l'intermédiaire de distributeurs de l'entreprise ou les ventes à des tiers par l'intermédiaire de distributeurs tiers. Les constructeurs d'avions intègrent les composants d'avions sur leurs avions respectifs.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Facteurs moteurs et opportunités du marché de l'aviation générale

Hausse de la demande de jets d'affaires

La popularité et l’adoption des jets d’affaires devraient augmenter au cours de la prochaine décennie, principalement en raison de l’inclusion de nouveaux modèles dans le service. En Asie-Pacifique, des pays comme la Chine, le Japon et la Corée du Sud représentent ensemble plus des deux tiers de la demande régionale de jets d’affaires et d’hélicoptères chaque année. En outre, la demande de jets d’affaires, en particulier de jets de grande et moyenne taille, est en hausse en Asie du Sud-Est. Gulfstream, Bombardier et Textron figurent parmi les principaux vendeurs de jets d’affaires en Asie-Pacifique. Malgré une baisse des volumes de ventes au cours des deux dernières années, les fabricants de jets d’affaires considèrent la Chine et l’Inde, entre autres, comme des marchés lucratifs.

Lancement des avions électriques – Une opportunité sur le marché de l’aviation générale

L’une des principales préoccupations du secteur de l’aviation concerne les émissions environnementales, car l’industrie aéronautique mondiale représente environ 2,5 % des émissions mondiales de carbone, ce qui entraîne une pollution environnementale. Plusieurs fournisseurs et organismes de recherche aéronautique travaillent au développement de modèles d’avions avancés à faible consommation d’énergie et à faibles émissions, notamment des avions hybrides électriques et entièrement électriques . Les systèmes d’avions électriques sont alimentés par un ou plusieurs moteurs électriques qui entraînent les hélices. L’électricité peut être fournie par diverses méthodes, la plus courante étant les batteries. En 2021, Rolls-Royce a annoncé l’achèvement de son vol inaugural pour une phase d’essais en vol intense de son avion entièrement électrique. Selon l’entreprise, l’avion utilisait un groupe motopropulseur électrique de 400 kW avec le pack de batteries le plus dense en puissance jamais assemblé pour un avion. À terme, l’entreprise souhaite que la vitesse de l’avion dépasse 300 miles par heure, ce qui sera testé dans une autre phase au Royaume-Uni. Le développement de tels avions est susceptible de contribuer à la réduction des niveaux d’émissions de carbone de l’industrie aéronautique dans un avenir proche. Ainsi, le développement des avions électriques offrira d’importantes opportunités de croissance aux acteurs du marché de l’aviation générale au cours de la période de prévision.

Analyse de segmentation du rapport sur le marché de l'aviation générale

Les segments clés qui ont contribué à l’élaboration de l’analyse du marché de l’aviation générale sont les composants et les aéronefs.

- En fonction des composants, le marché de l'aviation générale est divisé en avionique, cellule, trains d'atterrissage, moteurs et autres. Le segment des moteurs détenait une part de marché plus importante en 2023.

- En fonction des aéronefs, le marché de l'aviation générale est divisé en deux catégories : les aéronefs à voilure fixe et les aéronefs à voilure tournante. Le segment des aéronefs à voilure fixe détenait une part de marché plus importante en 2023.

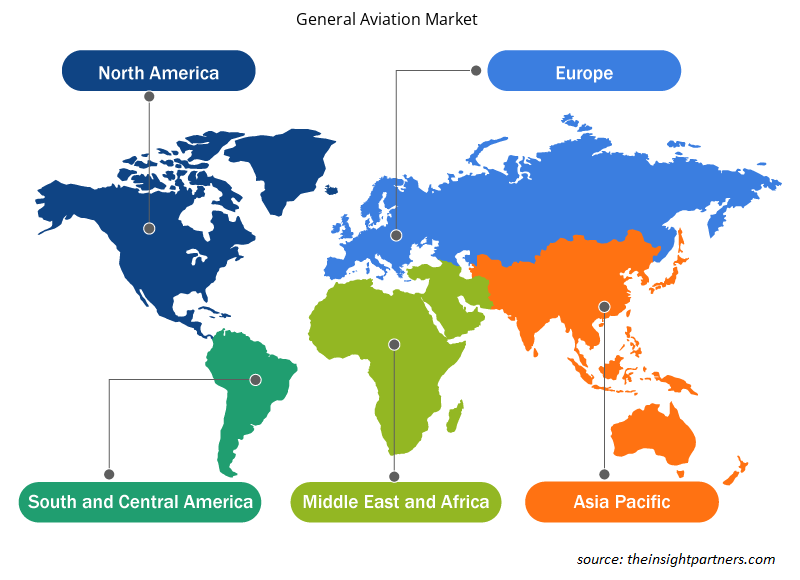

Analyse des parts de marché de l'aviation générale par zone géographique

La portée géographique du rapport sur le marché de l’aviation générale est principalement divisée en cinq régions : Amérique du Nord, Asie-Pacifique, Europe, Moyen-Orient et Afrique et Amérique du Sud.

En 2023, l'Amérique du Nord représentait une part importante du marché mondial de l'aviation générale, suivie de l'Europe et de l'Asie-Pacifique. Aujourd'hui, des petits avions d'entraînement et des hélicoptères aux jets d'affaires intercontinentaux, plus de 440 000 avions d'aviation générale sont opérationnels dans le monde. Environ 205 000 d'entre eux sont basés aux États-Unis. Il existe plus de 5 100 aéroports publics aux États-Unis, tandis que moins de 400 aéroports desservent les compagnies aériennes commerciales. Le nombre moyen de passagers-kilomètres parcourus par un individu en Amérique du Nord est l'un des plus élevés au monde. En outre, l'augmentation du nombre de particuliers fortunés (HNWI), l'accent accru mis sur la sécurité opérationnelle par les organismes de réglementation et les progrès continus dans le développement d'avions de sport légers devraient également favoriser la croissance du marché dans cette région au cours des prochaines années.

Aperçu régional du marché de l'aviation générale

Les tendances et facteurs régionaux influençant le marché de l'aviation générale tout au long de la période de prévision ont été expliqués en détail par les analystes d'Insight Partners. Cette section aborde également les segments et la géographie du marché de l'aviation générale en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu'en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché de l'aviation générale

Portée du rapport sur le marché de l'aviation générale

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 26,79 milliards de dollars américains |

| Taille du marché d'ici 2031 | 40,59 milliards de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 5,2% |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts |

Par composant

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché : comprendre son impact sur la dynamique des entreprises

Le marché de l'aviation générale connaît une croissance rapide, stimulée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché de l'aviation générale sont :

- Airbus

- Boeing

- Leonardo S.p.A.

- Saab AB

- Dassault Aviation

- PILATUS AIRCRAFT LTD

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché de l'aviation générale

Actualités et développements récents du marché de l'aviation générale

Le marché de l'aviation générale est évalué en collectant des données qualitatives et quantitatives issues de recherches primaires et secondaires, qui comprennent des publications d'entreprises importantes, des données d'associations et des bases de données. Voici une liste des évolutions du marché en matière d'innovations, d'expansion commerciale et de stratégies :

- En 2024, Lyte Aviation a lancé une version de 19 places de son avion VTOL à hydrogène-électrique LA-44 destinée aux utilisateurs de l'aviation d'affaires et privée. (Source : Lyte Aviation, communiqué de presse)

- En 2021, Bombardier a dévoilé le nouveau biréacteur d'affaires super-intermédiaire Challenger 3500 dont les systèmes avioniques standards comprennent l'accélérateur automatique, Smart Link Plus et le système de cabine à commande vocale. (Source : Bombardier, Newsletter)

Rapport sur le marché de l'aviation générale : couverture et livrables

Le rapport « Taille et prévisions du marché de l’aviation générale (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines suivants :

- Taille et prévisions du marché de l'aviation générale aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le périmètre

- Dynamique du marché, comme les facteurs moteurs, les contraintes et les opportunités clés

- Tendances du marché de l'aviation générale

- Les cinq forces de Porter détaillées

- Analyse du marché de l'aviation générale couvrant les principales tendances du marché, le cadre mondial et régional, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse du paysage et de la concurrence du secteur de l'aviation générale couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents

- Profils d'entreprise détaillés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché de l'aviation générale

Obtenez un échantillon gratuit pour - Marché de l'aviation générale