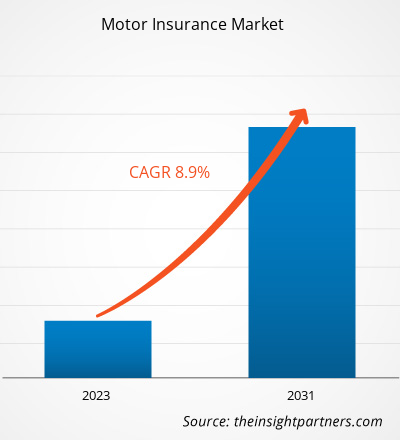

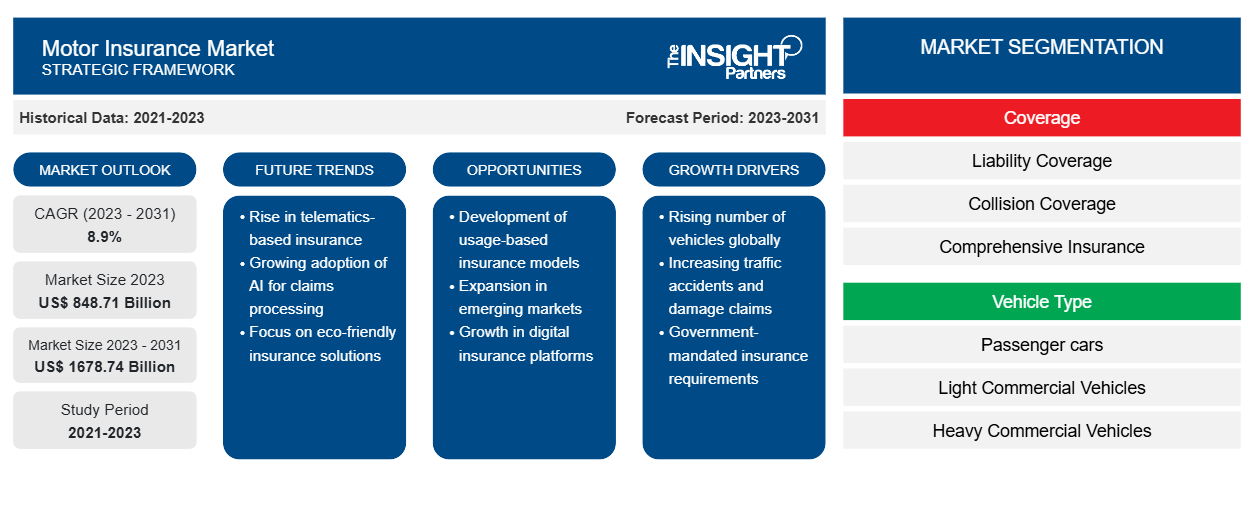

Si prevede che le dimensioni del mercato delle assicurazioni auto cresceranno da 848,71 miliardi di dollari nel 2023 a 1678,74 miliardi di dollari entro il 2031; si prevede che si espanderà a un CAGR dell'8,9% dal 2023 al 2031. Fattori come l'aumento della proprietà di auto e l'aumento delle vendite di automobili stanno guidando la crescita del mercato delle assicurazioni auto.

Analisi del mercato delle assicurazioni auto

Si prevede che il mercato delle assicurazioni auto registrerà una crescita significativa grazie all'adozione di tecnologie avanzate come la telematica e l'intelligenza artificiale. Si prevede che la tecnologia telematica, che prevede l'uso di dispositivi per monitorare il comportamento di guida, svolgerà un ruolo cruciale nelle offerte assicurative personalizzate e nella valutazione del rischio. L'intelligenza artificiale e gli algoritmi di apprendimento automatico possono aiutare gli assicuratori ad automatizzare l'elaborazione dei reclami, il rilevamento delle frodi e il servizio clienti, con conseguente miglioramento dell'efficienza e dell'esperienza del cliente. Gli assicuratori si stanno concentrando sempre di più sul miglioramento dell'esperienza del cliente fornendo servizi digitali fluidi e offerte personalizzate. L'ascesa delle startup Insurtech e delle partnership tra assicuratori tradizionali e aziende tecnologiche sta guidando l'innovazione nel settore. Si prevede che un migliore coinvolgimento del cliente tramite app mobili, elaborazione dei reclami online e assistenza clienti 24 ore su 24, 7 giorni su 7 sarà un'area chiave di attenzione.

Panoramica del mercato delle assicurazioni auto

- L'assicurazione auto, nota anche come assicurazione veicolo o assicurazione auto, è un tipo di polizza assicurativa che fornisce copertura per veicoli a motore come auto, moto, camion e veicoli commerciali. È una polizza obbligatoria in molti paesi per proteggere il pubblico in generale da eventuali incidenti che potrebbero verificarsi sulla strada.

- L'assicurazione basata sull'utilizzo (UBI) sta guadagnando popolarità, consentendo alle compagnie di assicurazione di offrire premi personalizzati in base al comportamento di guida individuale. L'UBI utilizza dati telematici per tracciare fattori come chilometraggio, velocità e modelli di guida, consentendo alle compagnie di assicurazione di offrire sconti ai conducenti prudenti. Queste tendenze del mercato delle assicurazioni auto offrono alle compagnie di assicurazione un'opportunità per attrarre clienti offrendo piani assicurativi flessibili e personalizzati.

- La crescente adozione di veicoli elettrici (EV) presenta nuove opportunità e sfide per il settore delle assicurazioni auto. Gli assicuratori dovranno sviluppare prodotti assicurativi specializzati e modelli di valutazione del rischio per gli EV, considerando fattori quali durata della batteria, infrastruttura di ricarica e costi di riparazione. Questo passaggio agli EV apre strade agli assicuratori per fornire opzioni di copertura innovative e attrarre clienti attenti all'ambiente.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

-

Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità del mercato assicurativo automobilistico

L'aumento del numero di incidenti guiderà il mercato delle assicurazioni auto

- La crescita del mercato delle assicurazioni auto è influenzata da vari fattori trainanti che contribuiscono alla determinazione delle tariffe delle assicurazioni auto. Un fattore significativo è il crescente numero di incidenti, collisioni stradali e incidenti. Questi incidenti svolgono un ruolo fondamentale nel determinare i prezzi delle assicurazioni in quanto comportano reclami e potenziali perdite finanziarie per gli assicuratori. L'aumento degli incidenti può essere attribuito a diversi motivi, tra cui la guida distratta, come l'invio di messaggi o la conversazione al telefono durante la guida, che è diventata un problema diffuso in molte città.

- Inoltre, anche la posizione del veicolo assicurato influisce sulle tariffe assicurative, con premi più elevati spesso riscontrati nelle grandi aree metropolitane dove il reddito disponibile è più elevato. L'assicurazione auto fornisce copertura per vari aspetti, tra cui il costo delle persone ferite, le spese mediche, i mancati guadagni, le riparazioni del veicolo e i danni alla proprietà derivanti da incidenti. Di conseguenza, le persone stanno sempre più adottando l'assicurazione auto per proteggersi da potenziali perdite finanziarie, portando a una maggiore domanda di assicurazione auto sul mercato.

Analisi della segmentazione del rapporto sul mercato delle assicurazioni auto

- In base alla copertura, il mercato è segmentato in copertura di responsabilità civile, copertura collisione, assicurazione completa e altre. Si prevede che il segmento di copertura di responsabilità civile detenga una quota di mercato sostanziale dell'assicurazione auto nel 2023.

- La copertura di responsabilità è una componente fondamentale dell'assicurazione auto che fornisce protezione finanziaria alla parte assicurata nel caso in cui causi danni alla proprietà di qualcun altro o ferisca un'altra persona. È in genere un requisito obbligatorio nella maggior parte degli stati e delle province. La copertura di responsabilità aiuta a coprire i costi delle riparazioni della proprietà, le spese mediche, le spese legali e altri danni correlati derivanti da un incidente per il quale l'assicurato è in colpa. I limiti e i dettagli specifici della copertura possono variare a seconda della polizza assicurativa e della giurisdizione.

Analisi regionale del mercato assicurativo automobilistico

L'ambito del rapporto di mercato è principalmente suddiviso in cinque regioni: Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e Sud America. Il Nord America sta vivendo una rapida crescita e si prevede che detenga una quota di mercato significativa delle assicurazioni auto. Il mercato in Nord America è un settore significativo e dinamico che fornisce copertura per automobili e veicoli. Questo mercato è caratterizzato da un'ampia gamma di fornitori di assicurazioni che offrono varie polizze per soddisfare le diverse esigenze dei consumatori. In Nord America, l'assicurazione auto è obbligatoria nella maggior parte degli stati e delle province, garantendo ai conducenti una protezione finanziaria in caso di incidenti, danni alla proprietà o lesioni personali. Il mercato è altamente competitivo, con numerose compagnie assicurative che competono per attrarre clienti attraverso prezzi competitivi, opzioni di copertura e vantaggi aggiuntivi. Fattori come la crescita della popolazione, l'urbanizzazione e un aumento della proprietà di veicoli contribuiscono alla crescita costante del mercato in Nord America.

Approfondimenti regionali sul mercato assicurativo automobilistico

Le tendenze regionali e i fattori che influenzano il mercato delle assicurazioni auto durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del mercato delle assicurazioni auto in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e Sud e Centro America.

- Ottieni i dati specifici regionali per il mercato delle assicurazioni auto

Ambito del rapporto sul mercato delle assicurazioni auto

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2023 | 848,71 miliardi di dollari USA |

| Dimensioni del mercato entro il 2031 | 1678,74 miliardi di dollari USA |

| CAGR globale (2023-2031) | 8,9% |

| Dati storici | 2021-2023 |

| Periodo di previsione | 2023-2031 |

| Segmenti coperti |

Per copertura

|

| Regioni e Paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli operatori del mercato assicurativo automobilistico: comprendere il suo impatto sulle dinamiche aziendali

Il mercato delle assicurazioni auto sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali compagnie che operano nel mercato delle assicurazioni auto sono:

- Gruppo Ammiraglio plc

- Allianz

- Compagnia di assicurazioni Allstate

- GEICO

- ICICI Lombard

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato assicurativo automobilistico

"Analisi del mercato assicurativo automobilistico"è stato effettuato in base alla copertura, al tipo di veicolo, all'applicazione e alla geografia. In termini di copertura, il mercato è segmentato incopertura di responsabilità civile, copertura collisione, assicurazione completa e altre. In base al tipo di veicolo, il mercato è segmentato in autovetture, veicoli commerciali leggeri e veicoli commerciali pesanti . In base all'applicazione, il mercato è segmentato in assicurazione auto personale e assicurazione auto commerciale. In base alla geografia, il mercato è segmentato in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e Sud America.

Notizie e sviluppi recenti del mercato assicurativo automobilistico

Le aziende adottano strategie inorganiche e organiche come fusioni e acquisizioni nel mercato. La previsione del mercato delle assicurazioni auto è stimata in base a vari risultati di ricerche secondarie e primarie, come pubblicazioni aziendali chiave, dati di associazioni e database. Di seguito sono elencati alcuni recenti sviluppi chiave del mercato:

- A marzo 2024, State Farm, una delle più grandi compagnie assicurative, ha subito perdite finanziarie sostanziali nel 2023 dopo essersi ritirata dal mercato dei proprietari di case in California. Nonostante un aumento del numero di polizze per le sue compagnie assicurative property and casualty, State Farm ha riscontrato perdite di sottoscrizione dovute all'elevata gravità dei sinistri e a significativi eventi catastrofici che hanno avuto un impatto sia sul settore assicurativo auto che su quello dei proprietari di case.

[Fonte: State Farm, sito web aziendale]

Copertura e risultati del rapporto sul mercato delle assicurazioni auto

Il rapporto di mercato su "Dimensioni e previsioni del mercato delle assicurazioni auto (2021-2031)", fornisce un'analisi dettagliata del mercato che copre le seguenti aree: -

- Dimensioni e previsioni del mercato a livello globale, regionale e nazionale per tutti i principali segmenti di mercato interessati dall'indagine.

- Dinamiche di mercato quali fattori trainanti, limitazioni e opportunità chiave.

- Principali tendenze future.

- Analisi PEST e SWOT dettagliate

- Analisi del mercato globale e regionale che copre le principali tendenze del mercato, gli attori chiave, le normative e i recenti sviluppi del mercato.

- Analisi del panorama industriale e della concorrenza che comprende la concentrazione del mercato, l'analisi della mappa di calore, gli attori chiave e gli sviluppi recenti.

- Profili aziendali dettagliati.

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Rapporti correlati

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato delle assicurazioni auto

Ottieni un campione gratuito per - Mercato delle assicurazioni auto