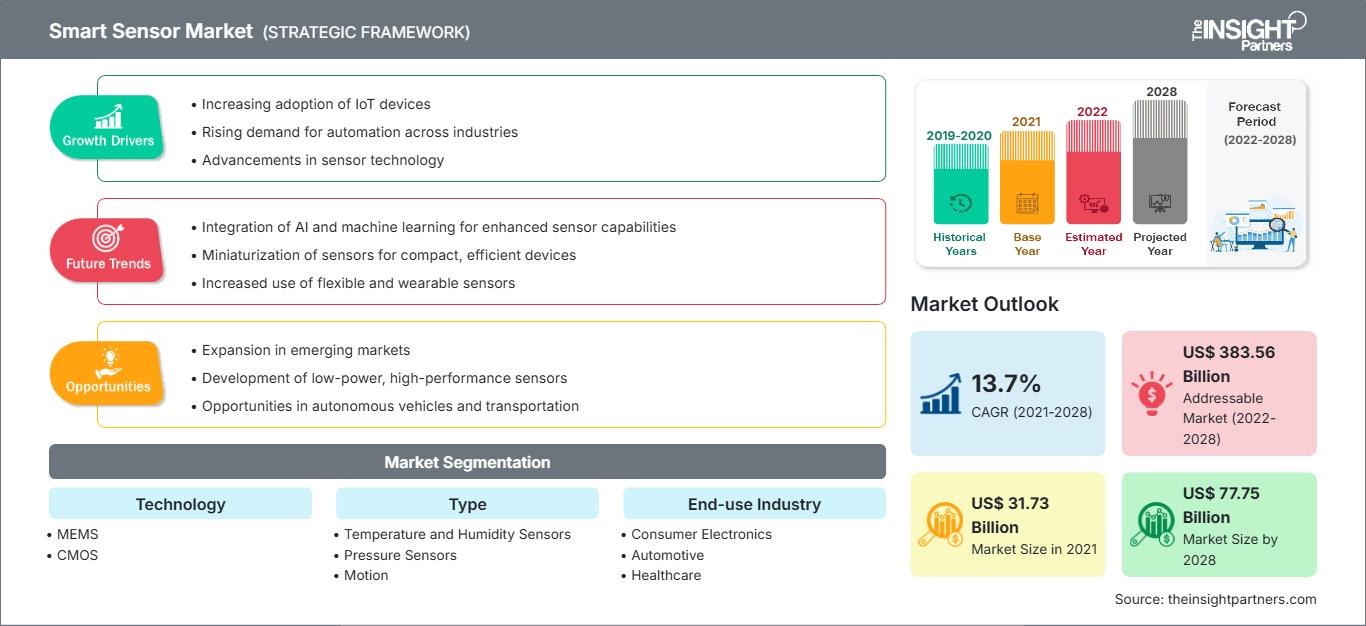

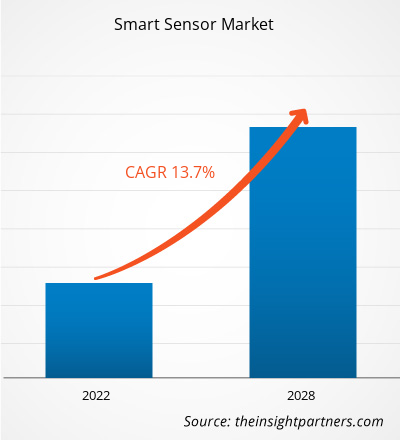

Si prevede che il mercato dei sensori intelligenti crescerà da 31.731,1 milioni di dollari nel 2021 a 77.747,6 milioni di dollari entro il 2028. Si stima una crescita a un CAGR del 13,7% tra il 2021 e il 2028.

I sensori intelligenti sono più veloci e precisi dei sensori tradizionali. Questi sensori sono più piccoli e consumano meno energia rispetto ai sensori convenzionali. L'uso della tecnologia dei sensori intelligenti nei dispositivi basati su IoT e nell'elettronica di consumo e la sua applicazione nei settori aerospaziale e della difesa, automobilistico, biomedico e sanitario, dell'automazione industriale, dell'automazione degli edifici, dell'elettronica di consumo, dell'istruzione, della robotica, dell'agricoltura e dei trasporti hanno suscitato molto interesse negli ultimi anni. L'aumento dell'utilizzo dei sensori intelligenti in tutte le applicazioni è un fattore chiave che sta incrementando le dimensioni del mercato dei sensori intelligenti.

Con le crescenti preoccupazioni in materia di sicurezza e protezione, la domanda di sensori intelligenti nell'elettronica di consumo è in aumento, con un impatto sul mercato dei sensori intelligenti. Nella domotica vengono utilizzati vari sensori, come sensori IR per la visione notturna, sensori acustici o microfoni, e WC intelligenti. Le aziende integrano nei loro sensori intelligenti diverse funzionalità, come la pulizia automatica, lo scarico automatico, il monitoraggio delle perdite del serbatoio, la protezione da traboccamento dell'acqua e il monitoraggio della salute. Luci e ventilatori possono essere controllati tramite un sistema automatico che utilizza sensori a infrarossi o di movimento. Inoltre, con il cambiamento dello stile di vita e i nuovi standard di vita moderni, la domanda di cucine modulari integrate con la domotica sta registrando una crescita esponenziale, con un impatto positivo sul mercato dei sensori intelligenti. I produttori stanno sviluppando dispositivi basati su sensori sintetici per monitorare vibrazioni, rumori in cucina, luce, gas, temperatura, calore e temperatura e rumore elettromagnetici, aumentando le dimensioni del mercato dei sensori intelligenti. Ad esempio, Analog Devices, Inc. offre i sensori pHEMT GaAs HMC1126. Si tratta di un amplificatore a basso rumore che opera in un intervallo di frequenza compreso tra 400 MHz e 52 GHz e viene utilizzato in numerose applicazioni, come radio a microonde, terminali ad apertura molto piccola (VSAT), apparecchiature di prova e comunicazioni 5G.

Personalizza questo rapporto in base alle tue esigenze

Potrai personalizzare gratuitamente qualsiasi rapporto, comprese parti di questo rapporto, o analisi a livello di paese, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

Mercato dei sensori intelligenti: Approfondimenti strategici

-

Ottieni le principali tendenze chiave del mercato di questo rapporto.Questo campione GRATUITO includerà l'analisi dei dati, che vanno dalle tendenze di mercato alle stime e alle previsioni.

La tecnologia dei sensori intelligenti ha portato a rapidi progressi tecnologici negli smartphone e nei dispositivi indossabili. Le case automobilistiche richiedono sempre più sensori intelligenti per migliorare la sicurezza e il comfort. L'uso della tecnologia wireless per monitorare e controllare i dispositivi di sicurezza dotati di sensori intelligenti sta diventando sempre più comune. Nel contesto del COVID-19, l'aumento della domanda di dispositivi indossabili dotati di sensori intelligenti, il continuo sostegno governativo alla costruzione di edifici ecosostenibili e la manutenzione predittiva stanno offrendo opportunità redditizie per gli operatori del mercato dei sensori intelligenti.

L'aumento della penetrazione degli smartphone ha alimentato in modo sostanziale la crescita del mercato dei sensori intelligenti. I sensori intelligenti includono sensori popolari, come quelli di movimento, posizione, luce ambientale, accelerometro e giroscopio. I sensori SAR (Specific Absorption Rate) migliorano la connettività per un'ampia gamma di tecnologie wireless, come 5G sub-6/4G/Wi-Fi in smartphone, tablet e laptop. SEMTECH, fornitore leader di semiconduttori, offre i sensori PerSeTM Connect, PerSe Connect Pro e PerSe Control, utilizzabili in diverse applicazioni, come smartphone, laptop, tablet e dispositivi indossabili. Molte aziende stanno sviluppando nuovi e avanzati sensori intelligenti che combinano microcontrollori in un unico package. Le tecnologie moderne, come l'intelligenza artificiale (IA) e l'IoT, consentono questa combinazione in un package di piccole dimensioni. Ad esempio, il BHA250 di Bosch Sensortec può combinare un microcontrollore a 32 bit con un sensore di accelerazione a 14 bit in un package di 2,2 x 2,2 x 0,95 mm³. Inoltre, TE Connectivity ha integrato sensori con connettori per racchiudere le funzionalità in uno spazio ridotto. Questi sviluppi nella tecnologia dei sensori intelligenti stanno influenzando positivamente la crescita del mercato dei sensori intelligenti. Con la crescita del settore dell'elettronica di consumo, come i distributori automatici di bevande intelligenti, i sistemi di domotica intelligente, i computer semplici, gli assistenti digitali (come Alexa) e i dispositivi indossabili, la domanda di sensori intelligenti è aumentata nel mercato dei sensori intelligenti. I prodotti di consumo tradizionali, come laptop, smartphone e televisori, continuano a superare le aspettative, poiché i consumatori continuano ad adottare prodotti nuovi ed emergenti, tra cui dispositivi indossabili, smart speaker ad attivazione vocale e dispositivi per la casa intelligente.

Secondo diversi studi, decine di miliardi di dispositivi IoT si connetteranno a Internet nei prossimi anni, il che avrà un impatto significativo sul mercato dei sensori intelligenti. Il COVID-19 sta guidando i programmi strategici per la resilienza urbana e la trasformazione digitale, mentre le amministrazioni cittadine si adattano a una nuova realtà.

Impatto della pandemia di COVID-19 sul mercato dei sensori intelligenti

L'emergere del COVID-19 ha posto in primo piano la necessità di sfruttare e sfruttare le infrastrutture digitali per il monitoraggio remoto dei pazienti. A causa del lento sviluppo degli attuali test virali e vaccini, è emersa la crescente necessità di un rilevamento più affidabile delle malattie e di un monitoraggio più approfondito della salute individuale e della popolazione, che i sensori indossabili potrebbero contribuire a migliorare. Sebbene l'utilità di questa tecnologia sia stata utilizzata per correlare parametri fisiologici alla vita quotidiana e alle prestazioni umane, è ancora necessario applicarla per prevedere l'insorgenza del COVID-19.

La crescente domanda di dispositivi a risparmio energetico sta incrementando la domanda di sensori intelligenti nel mercato dei sensori intelligenti in Nord America. Le aziende si stanno orientando verso apparecchiature a risparmio energetico, poiché lo scenario in continua evoluzione richiede apparecchiature e prodotti a basso consumo energetico. Inoltre, la domanda di sensori nel mercato dei sensori intelligenti è aumentata in diversi settori con l'allentamento delle severe normative governative, che stanno guadagnando terreno nei settori dell'automazione. Inoltre, la domanda di sensori nel settore automobilistico è trainata dal desiderio di ridurre il peso medio di un'auto. Le automobili leggere contribuiscono sia all'efficienza del carburante che all'ottimizzazione energetica.

Mercato dei sensori intelligentiLe tendenze regionali e i fattori che influenzano il mercato dei sensori intelligenti durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di The Insight Partners. Questa sezione illustra anche i segmenti e la geografia del mercato dei sensori intelligenti in Nord America, Europa, Asia-Pacifico, Medio Oriente e Africa, America meridionale e centrale.

Ambito del rapporto sul mercato dei sensori intelligenti

| Attributo del rapporto | Dettagli |

|---|---|

| Dimensioni del mercato in 2021 | US$ 31.73 Billion |

| Dimensioni del mercato per 2028 | US$ 77.75 Billion |

| CAGR globale (2021 - 2028) | 13.7% |

| Dati storici | 2019-2020 |

| Periodo di previsione | 2022-2028 |

| Segmenti coperti |

By Tecnologia

|

| Regioni e paesi coperti |

Nord America

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli operatori del mercato dei sensori intelligenti: comprendere il suo impatto sulle dinamiche aziendali

Il mercato dei sensori intelligenti è in rapida crescita, trainato dalla crescente domanda degli utenti finali, dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando la propria offerta, innovando per soddisfare le esigenze dei consumatori e sfruttando le tendenze emergenti, alimentando ulteriormente la crescita del mercato.

- Ottieni il Mercato dei sensori intelligenti Panoramica dei principali attori chiave

Segmentazione del mercato dei sensori intelligenti

In base alla tecnologia, il mercato dei sensori intelligenti è segmentato in MEMS, CMOS e altri. Nel 2021, il segmento MEMS ha guidato il mercato. In base alla tipologia, il mercato dei sensori intelligenti è segmentato in sensori di temperatura e umidità, sensori di pressione, sensori di movimento, sensori di posizione e altri. Nel 2021, il segmento dei sensori di temperatura e umidità ha rappresentato la quota di mercato maggiore. In base al settore di utilizzo finale, il mercato dei sensori intelligenti è segmentato in elettronica di consumo, automotive, sanità, produzione, vendita al dettaglio e altri.

Analog Devices Inc., Infineon Technologies Inc., STMicroelectronics, TE Connectivity, Microchip Technologies, NXP Semiconductor, Siemens AG, ABB Ltd., Robert Bosch GmbH e Honeywell International sono tra i principali attori del mercato dei sensori intelligenti. Oltre a questi, sono stati analizzati diversi altri attori per comprendere le dinamiche generali del mercato globale dei sensori intelligenti.

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Rapporti correlati

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato dei sensori intelligenti

Ottieni un campione gratuito per - Mercato dei sensori intelligenti