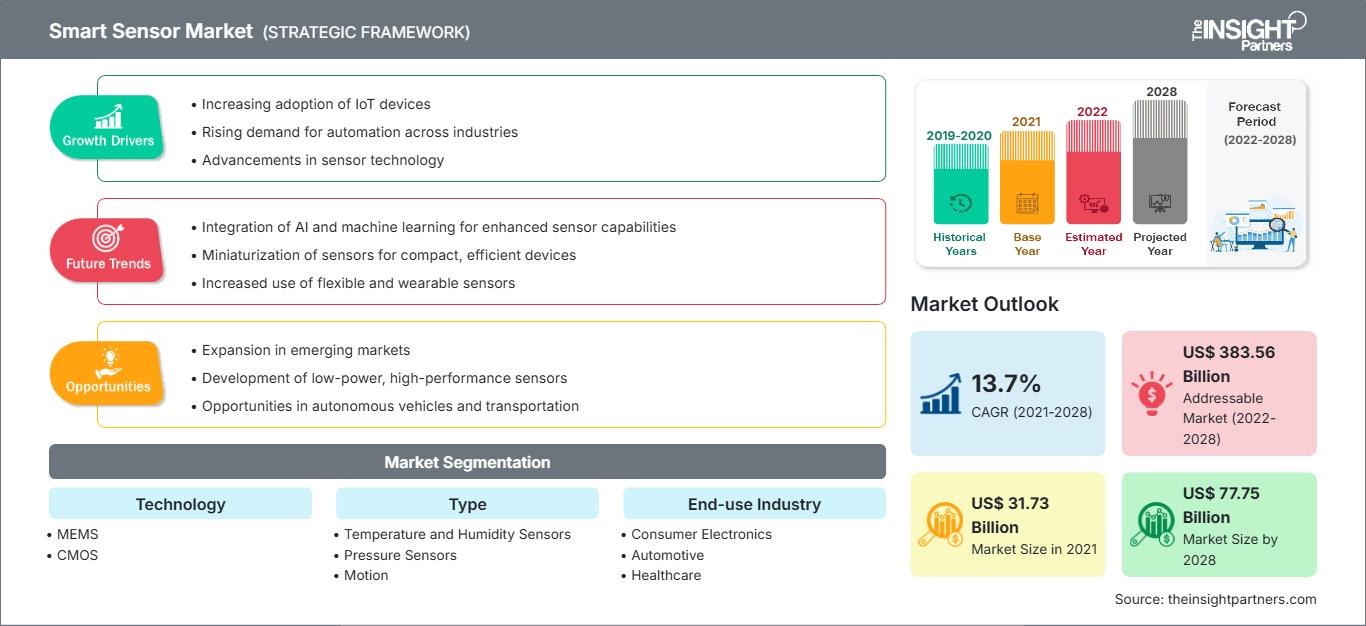

Se espera que el mercado de sensores inteligentes crezca de US$ 31.731,1 millones en 2021 a US$ 77.747,6 millones en 2028. Se estima que crecerá a una CAGR del 13,7 % entre 2021 y 2028.

Los sensores inteligentes son más rápidos y precisos que los sensores tradicionales. Son más pequeños y consumen menos energía que los convencionales. El uso de la tecnología de sensores inteligentes en dispositivos basados en el IoT y la electrónica de consumo, así como su aplicación en los sectores aeroespacial y de defensa, automotriz, biomédico y sanitario, automatización industrial, automatización de edificios, electrónica de consumo, educación, robótica, agricultura y transporte, ha despertado un gran interés en los últimos años. El aumento en el uso de sensores inteligentes en diversas aplicaciones es un factor clave que impulsa el tamaño del mercado de sensores inteligentes.

Ante la creciente preocupación por la seguridad, la demanda de sensores inteligentes en la electrónica de consumo está en aumento, lo que impacta el mercado de estos sensores. Diversos sensores, como sensores infrarrojos de visión nocturna, sensores de sonido o micrófonos, e inodoros inteligentes, se utilizan en la domótica. Las empresas incorporan diversas funciones, como limpieza y descarga automáticas, monitoreo de fugas de tanques, protección contra desbordamientos de agua y monitoreo de la salud, en sus sensores inteligentes. Las luces y los ventiladores se pueden controlar con un sistema automático que utiliza sensores infrarrojos o de movimiento.

Además, con el cambio de estilo de vida y la nueva calidad de vida moderna, la demanda de cocinas modulares integradas con domótica está experimentando un crecimiento exponencial, lo que impacta positivamente en el mercado de sensores inteligentes. Los fabricantes están desarrollando dispositivos basados en sensores sintéticos para monitorizar vibraciones, sonidos de cocina, luz, gas, temperatura, calor, y temperatura y ruido electromagnéticos, lo que amplía el mercado de sensores inteligentes. Por ejemplo, Analog Devices, Inc. ofrece los sensores pHEMT HMC1126 GaAs. Se trata de un amplificador de bajo ruido que opera en un rango de 400 MHz a 52 GHz y se utiliza en diversas aplicaciones, como radios de microondas, terminales de muy pequeña apertura (VSAT), equipos de prueba y comunicaciones 5G.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado de sensores inteligentes: perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

La tecnología de sensores inteligentes ha impulsado rápidos avances tecnológicos en teléfonos inteligentes y dispositivos portátiles. Los fabricantes de automóviles demandan cada vez más sensores inteligentes para mejorar la seguridad y la comodidad. El uso de tecnología inalámbrica para monitorear y controlar dispositivos de seguridad equipados con sensores inteligentes es cada vez más común. En el contexto de la COVID-19, el aumento de la demanda de dispositivos portátiles con sensores inteligentes, el continuo apoyo gubernamental a la construcción de edificios sostenibles y el mantenimiento predictivo ofrecen oportunidades lucrativas para los actores del mercado de sensores inteligentes.

El aumento en la penetración de los teléfonos inteligentes ha impulsado considerablemente el crecimiento del mercado de sensores inteligentes. Entre estos sensores se incluyen sensores populares como los de movimiento, posición, luz ambiental, acelerómetros y giroscopios. Los sensores de tasa de absorción específica (SAR) mejoran la conectividad para una amplia gama de tecnologías inalámbricas, como 5G sub-6/4G/Wi-Fi en teléfonos inteligentes, tabletas y portátiles. SEMTECH, proveedor líder de semiconductores, ofrece los sensores PerSe™ Connect, PerSe Connect Pro y PerSe Control, que pueden utilizarse en diversas aplicaciones, como teléfonos inteligentes, portátiles, tabletas y wearables.

Muchas empresas están desarrollando sensores inteligentes nuevos y avanzados que combinan microcontroladores en un solo encapsulado. Tecnologías modernas, como la IA (Inteligencia Artificial) y el IoT, permiten esta combinación en un formato compacto. Por ejemplo, el BHA250 de Bosch Sensortec puede combinar un microcontrolador de 32 bits con un sensor de aceleración de 14 bits en un encapsulado de 2,2 x 2,2 x 0,95 mm³. Además, TE Connectivity ha integrado sensores con conectores para integrar funcionalidad en un espacio reducido. Estos avances en la tecnología de sensores inteligentes están impactando positivamente en el crecimiento del mercado de sensores inteligentes. Con el crecimiento de la industria electrónica de consumo, como las máquinas expendedoras de bebidas inteligentes, los sistemas de automatización del hogar inteligente, las computadoras sencillas, los asistentes digitales (como Alexa) y los dispositivos portátiles, la demanda de sensores inteligentes ha aumentado en dicho mercado. Los productos de consumo tradicionales, como portátiles, smartphones y televisores, siguen superando las expectativas a medida que los consumidores adoptan productos nuevos y emergentes, como los wearables, los altavoces inteligentes activados por voz y los dispositivos domésticos inteligentes.

Según múltiples estudios, decenas de miles de millones de dispositivos IoT se conectarán a internet en los próximos años, lo que impactará significativamente el mercado de sensores inteligentes. La COVID-19 está impulsando las agendas estratégicas de resiliencia urbana y transformación digital a medida que los gobiernos municipales se adaptan a una nueva realidad.

Impacto de la pandemia de COVID-19 en el mercado de sensores inteligentes

La aparición de la COVID-19 ha puesto de manifiesto la necesidad de aprovechar la infraestructura digital para la monitorización remota de pacientes. Debido al lento desarrollo de las pruebas y vacunas virales actuales, se ha determinado una mayor necesidad de una detección y monitorización más robusta de la enfermedad, tanto individual como poblacional, para lo cual los sensores portátiles podrían contribuir. Si bien esta tecnología se ha utilizado para correlacionar métricas fisiológicas con la vida diaria y el rendimiento humano, aún es necesario aplicarla para predecir la incidencia de la COVID-19.

La creciente demanda de dispositivos de ahorro energético está impulsando la demanda de sensores inteligentes en el mercado norteamericano. Las empresas están optando por equipos de bajo consumo, ya que el panorama cambiante exige equipos y productos energéticamente eficientes. Además, la demanda de sensores inteligentes ha aumentado en diversas industrias con la eliminación de las estrictas regulaciones gubernamentales, que están cobrando fuerza en las industrias de automatización. Asimismo, la demanda de sensores en el sector automotriz se ve impulsada por el deseo de reducir el peso promedio de los automóviles. Los automóviles ligeros contribuyen tanto a la eficiencia del combustible como a la optimización energética.

Perspectivas regionales del mercado de sensores inteligentes

Los analistas de The Insight Partners han explicado detalladamente las tendencias regionales y los factores que influyen en el mercado de sensores inteligentes durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de sensores inteligentes en Norteamérica, Europa, Asia Pacífico, Oriente Medio y África, y Sudamérica y Centroamérica.

Alcance del informe de mercado de sensores inteligentes

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2021 | US$ 31.73 mil millones |

| Tamaño del mercado en 2028 | US$ 77.75 mil millones |

| CAGR global (2021-2028) | 13,7% |

| Datos históricos | 2019-2020 |

| Período de pronóstico | 2022-2028 |

| Segmentos cubiertos |

Por tecnología

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de sensores inteligentes: comprensión de su impacto en la dinámica empresarial

El mercado de sensores inteligentes está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y un mayor conocimiento de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una descripción general de los principales actores clave del mercado de sensores inteligentes

Segmentación del mercado de sensores inteligentes

Según la tecnología, el mercado de sensores inteligentes se segmenta en MEMS, CMOS y otros. En 2021, el segmento MEMS lideró el mercado. Por tipo, el mercado de sensores inteligentes se segmenta en sensores de temperatura y humedad, sensores de presión, sensores de movimiento, sensores de posición, entre otros. En 2021, el segmento de sensores de temperatura y humedad representó la mayor cuota de mercado. Según el sector de uso final, el mercado de sensores inteligentes se segmenta en electrónica de consumo, automoción, salud, manufactura, comercio minorista, entre otros.

Analog Devices Inc., Infineon Technologies Inc., STMicroelectronics, TE Connectivity, Microchip Technologies, NXP Semiconductor, Siemens AG, ABB Ltd., Robert Bosch GmbH y Honeywell International se encuentran entre los principales actores del mercado de sensores inteligentes. Además de estos, se analizaron otros actores para comprender la dinámica general del mercado global de sensores inteligentes.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de sensores inteligentes

Obtenga una muestra gratuita para - Mercado de sensores inteligentes