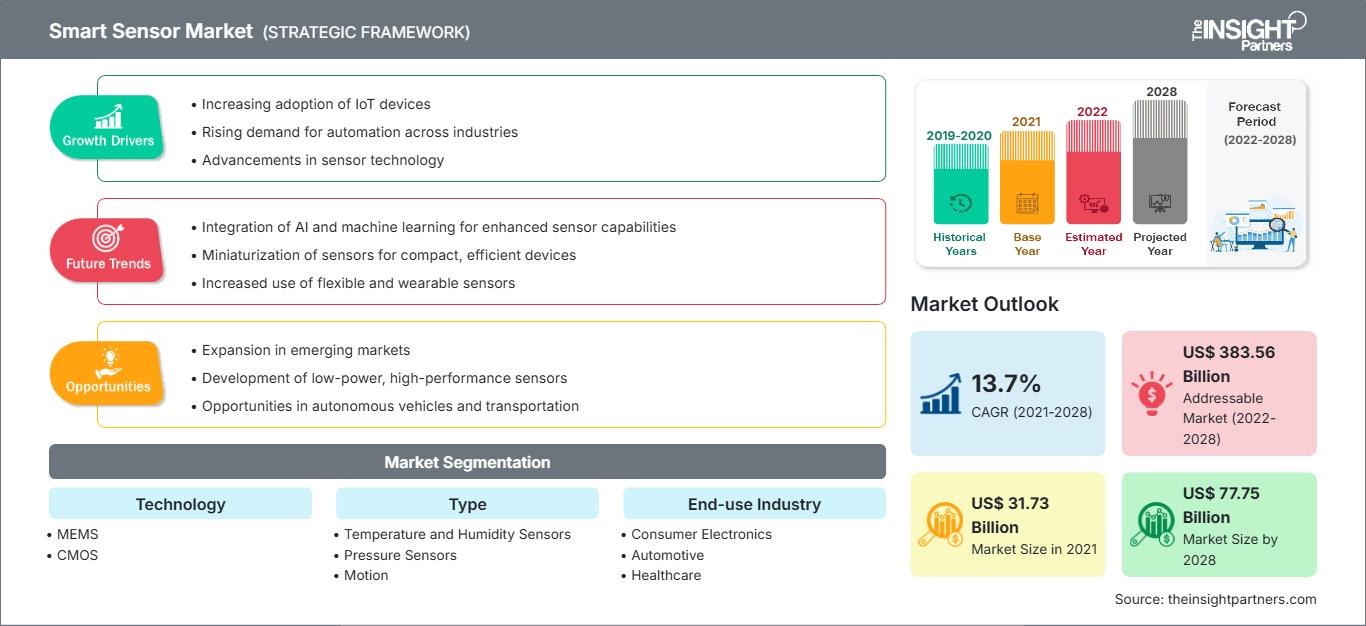

Smart Sensor Market Growth Drivers and Forecast by 2028

Smart Sensor Market Forecast to 2028 - Analysis By Technology (MEMS, CMOS, and Others), Type (Temperature and Humidity Sensors, Pressure Sensors, Motion, and Others), and End-use Industry (Consumer Electronics, Automotive, Healthcare, Manufacturing, Retail, and Others)

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Apr 2022

- Report Code : TIPRE00010129

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 190

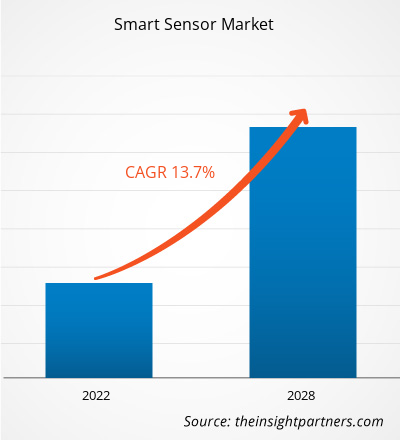

The smart sensor market is expected to grow from US$ 31,731.1 million in 2021 to US$ 77,747.6 million by 2028. It is estimated to grow at a CAGR of 13.7% between 2021 to 2028.

Smart sensor is faster and more accurate than traditional sensors. These sensors are smaller and consume less power than conventional sensors. The use of smart sensors technology in IoT-based devices and consumers electronics and its application in the aerospace & defense, automotive, biomedical & healthcare, industrial automation, building automation, consumer electronics, education, robotics, agriculture, and transportation industries have attracted much interest in the past few years. The increase in usage of smart sensors across the applications is a key factor boosting the smart sensor market size.

With rising safety and security concerns, the demand for smart sensors in consumer electronics is increasing, impacting the smart sensor market. Various sensors, such as night vision IR sensors, sound sensors or microphones, and smart toilets, are used in home automation. Companies incorporate various features, such as automatic cleaning, automatic flushing, tank-leak monitoring, water overflow protection, and health monitoring, into their smart sensors. Lights and fans can be controlled with an automatic system that uses infrared or motion sensors.

Further, with the changing lifestyle and new modern standard of living thus, the demand for modular kitchens integrated with home automation is witnessing exponential growth, positively impacting the smart sensor market. Manufacturers are developing synthetic sensor-based devices to monitor vibration, kitchen sounds, light, gas, temperature, heat, and electromagnetic temperature and noise, increasing the the smart sensor market size. For instance, Analog Devices, Inc. offers HMC1126 GaAs pHEMT sensors. It is a low noise amplifier that operates at a range of 400 MHz-52 GHz and is used in several applications, such as microwave radios, very small aperture terminals (VSATs), test equipment, and 5G communication.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONSmart Sensor Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Smart sensor technology has led to rapid technological advancements in smartphones and wearable devices. Automobile manufacturers are increasingly demanding smart sensors to improve safety and comfort. The use of wireless technology to monitor and control security devices equipped with smart sensors is becoming more common. Amid COVID-19, the surge in demand for smart sensor-enabled wearable devices, ongoing government support for green building construction, and predictive maintenance are offering lucrative opportunities for the smart sensor market players.

The rise in smartphone penetration has been substantially fuelling the smart sensor market growth. Smart sensors include popular sensors, such as motion, position, ambient light, accelerometer, and gyroscope. Specific Absorption Rate (SAR) sensors enhance connectivity for a wide range of wireless technologies, such as 5G sub-6/4G/Wi-Fi in smartphones, tablets, and laptops. SEMTECH, a leading semiconductor supplier, offers PerSeTM Connect, PerSe Connect Pro, and PerSe Control sensors, which can be used in various applications, such as smartphones, laptops, tablets, and wearables.

Many companies are developing new and advanced smart sensors that combine microcontrollers in a single package. Modern technologies, such as AI (Artificial Intelligence) and IoT, enable this combination within small packaging. For instance, Bosch Sensortec's BHA250 can combine a 32-bit microcontroller with a 14-bit acceleration sensor in a 2.2 x 2.2 x 0.95 mm3 package. Further, the TE Connectivity company has integrated sensors with connectors to pack functionality into a small space. These developments in smart sensor technology are positively impacting the smart sensor market growth. With the growth in the consumer electronic industry, such as in smart beverage vending machines, smart home automation systems, simple computers, digital assistants (such as Alexa), and human wearable devices, the demand for smart sensors has increased in the smart sensor market. Traditional consumer products, such as laptops, smartphones, and televisions, continue to exceed expectations as consumers continue to adopt new and emerging products, including wearables, voice-activated smart speakers, and smart home devices.

According to multiple studies, tens of billions of IoT devices will connect to the Internet in the coming years, which will greatly impact the smart sensors market. COVID-19 is driving urban resilience and digital transformation strategy agendas as city governments adjust to a new reality.

Impact of COVID-19 Pandemic on Smart Sensor Market

The emergence of COVID-19 has brought the need to harness and leverage digital infrastructure for remote patient monitoring into sharp focus. Due to the slow development of current viral tests and vaccines, it has been determined that a greater need exists for more robust disease detection and monitoring of individual and population health, which wearable sensors could aid. While the utility of this technology has been used to correlate physiological metrics to daily living and human performance, it is still necessary to apply it to predict the occurrence of COVID-19.

The growing demand for energy-saving devices is driving up market demand for smart sensors in the smart sensors market in North America. Companies are shifting towards energy-efficient energy-saving equipment, as the changing scenario necessitates energy-efficient equipment and products. Further, sensor demand in the smart sensor market has increased across a variety of industries with the lifting of governments' stringent regulations, which are gaining traction in automation industries. In addition, the demand for sensors in the automotive sector is being driven by the desire to reduce the average weight of a car. Lightweight automobiles aid in both fuel efficiency and energy optimization.

Smart Sensor Market Regional InsightsThe regional trends and factors influencing the Smart Sensor Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Smart Sensor Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Smart Sensor Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 31.73 Billion |

| Market Size by 2028 | US$ 77.75 Billion |

| Global CAGR (2021 - 2028) | 13.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Smart Sensor Market Players Density: Understanding Its Impact on Business Dynamics

The Smart Sensor Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Smart Sensor Market top key players overview

Smart Sensor Market Segmentation

Based on technology, the smart sensor market is segmented into MEMS, CMOS, and Others. In 2021, the MEMS segment led the market. Based on type, the smart sensor market is segmented into temperature & humidity sensors, pressure sensors, motion sensors, position sensors, and others. In 2021, the temperature & humidity sensors segment accounted for the largest market share. Based on end-use industry, the smart sensor market is segmented into consumer electronics, automotive, healthcare, manufacturing, retail, and others.

Analog Devices Inc., Infineon Technologies Inc., STMicroelectronics, TE Connectivity, Microchip Technologies, NXP Semiconductor, Siemens AG, ABB Ltd., Robert Bosch GmbH, and Honeywell International are among the key smart sensor market players. In addition to these, several other players were analyzed to understand the overall dynamics of the global smart sensor market.

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For