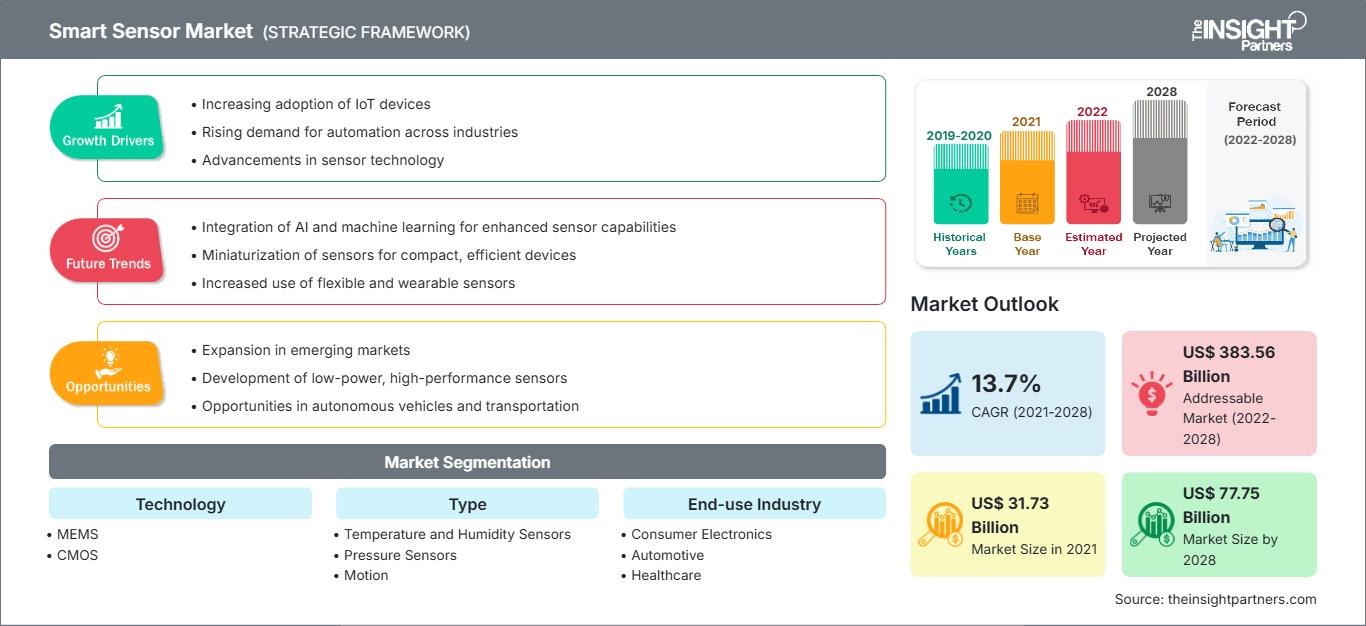

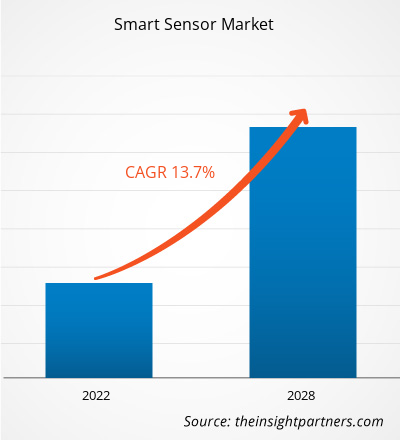

Le marché des capteurs intelligents devrait passer de 31 731,1 millions de dollars américains en 2021 à 77 747,6 millions de dollars américains en 2028. Sa croissance est estimée à un TCAC de 13,7 % entre 2021 et 2028.

Les capteurs intelligents sont plus rapides et plus précis que les capteurs traditionnels. Ces capteurs sont plus petits et consomment moins d'énergie que les capteurs conventionnels. L'utilisation de la technologie des capteurs intelligents dans les appareils IoT et l'électronique grand public, ainsi que son application dans les secteurs de l'aérospatiale et de la défense, de l'automobile, du biomédical et de la santé, de l'automatisation industrielle, de la domotique, de l'électronique grand public, de l'éducation, de la robotique, de l'agriculture et des transports, ont suscité un vif intérêt ces dernières années. L'augmentation de l'utilisation des capteurs intelligents dans toutes les applications est un facteur clé de la croissance du marché des capteurs intelligents.

Avec les préoccupations croissantes en matière de sécurité, la demande de capteurs intelligents dans l'électronique grand public augmente, ce qui a un impact sur le marché des capteurs intelligents. Divers capteurs, tels que les capteurs infrarouges de vision nocturne, les capteurs sonores ou les microphones, et les toilettes intelligentes, sont utilisés en domotique. Les entreprises intègrent diverses fonctionnalités à leurs capteurs intelligents, comme le nettoyage et la chasse d'eau automatiques, la surveillance des fuites de réservoir, la protection contre les débordements d'eau et la surveillance de l'état de santé. Les lumières et les ventilateurs peuvent être contrôlés par un système automatique utilisant des capteurs infrarouges ou de mouvement.

De plus, avec l'évolution des modes de vie et le nouveau standard de vie moderne, la demande de cuisines modulaires intégrées à la domotique connaît une croissance exponentielle, ce qui impacte positivement le marché des capteurs intelligents. Les fabricants développent des dispositifs à base de capteurs synthétiques pour surveiller les vibrations, les bruits de cuisine, la lumière, le gaz, la température, la chaleur, ainsi que la température et le bruit électromagnétiques, augmentant ainsi la taille du marché des capteurs intelligents. Par exemple, Analog Devices, Inc. propose les capteurs pHEMT HMC1126 GaAs. Il s'agit d'un amplificateur à faible bruit qui fonctionne dans une gamme de 400 MHz à 52 GHz et est utilisé dans plusieurs applications, telles que les radios micro-ondes, les terminaux à très petite ouverture (VSAT), les équipements de test et la communication 5G.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d’une personnalisation sur n’importe quel rapport - gratuitement - y compris des parties de ce rapport, ou une analyse au niveau du pays, un pack de données Excel, ainsi que de profiter d’offres exceptionnelles et de réductions pour les start-ups et les universités

Marché des capteurs intelligents: Perspectives stratégiques

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

La technologie des capteurs intelligents a permis des avancées technologiques rapides dans les smartphones et les appareils portables. Les constructeurs automobiles exigent de plus en plus de capteurs intelligents pour améliorer la sécurité et le confort. L'utilisation de la technologie sans fil pour surveiller et contrôler les dispositifs de sécurité équipés de capteurs intelligents se généralise. Dans le contexte de la COVID-19, la forte demande d'appareils portables équipés de capteurs intelligents, le soutien continu des gouvernements à la construction de bâtiments écologiques et la maintenance prédictive offrent des opportunités lucratives aux acteurs du marché des capteurs intelligents.

La pénétration croissante des smartphones a considérablement stimulé la croissance du marché des capteurs intelligents. Les capteurs intelligents comprennent des capteurs populaires, tels que les capteurs de mouvement, de position, de lumière ambiante, d'accéléromètre et de gyroscope. Les capteurs de débit d'absorption spécifique (DAS) améliorent la connectivité pour un large éventail de technologies sans fil, telles que la 5G sub-6/4G/Wi-Fi sur les smartphones, les tablettes et les ordinateurs portables. SEMTECH, fournisseur leader de semi-conducteurs, propose les capteurs PerSeTM Connect, PerSe Connect Pro et PerSe Control, utilisables dans diverses applications, telles que les smartphones, les ordinateurs portables, les tablettes et les objets connectés. De nombreuses entreprises développent de nouveaux capteurs intelligents avancés qui associent des microcontrôleurs dans un seul boîtier. Les technologies modernes, telles que l'IA (intelligence artificielle) et l'IoT, permettent cette combinaison dans un format compact. Par exemple, le BHA250 de Bosch Sensortec peut associer un microcontrôleur 32 bits à un capteur d'accélération 14 bits dans un boîtier de 2,2 x 2,2 x 0,95 mm³. De plus, TE Connectivity a intégré des capteurs avec des connecteurs pour intégrer des fonctionnalités dans un espace réduit. Ces avancées technologiques dans le domaine des capteurs intelligents ont un impact positif sur la croissance du marché des capteurs intelligents. Avec la croissance du secteur de l'électronique grand public, notamment des distributeurs automatiques de boissons intelligents, des systèmes domotiques intelligents, des ordinateurs simples, des assistants numériques (comme Alexa) et des objets connectés, la demande de capteurs intelligents a augmenté sur ce marché. Les produits de consommation traditionnels, tels que les ordinateurs portables, les smartphones et les téléviseurs, continuent de dépasser les attentes, car les consommateurs continuent d'adopter des produits nouveaux et émergents, notamment des objets connectés, des enceintes intelligentes à commande vocale et des appareils domestiques intelligents.

Selon de nombreuses études, des dizaines de milliards d'appareils IoT se connecteront à Internet dans les années à venir, ce qui aura un impact considérable sur le marché des capteurs intelligents. La COVID-19 stimule les programmes de résilience urbaine et de transformation numérique, tandis que les administrations municipales s'adaptent à une nouvelle réalité.

Impact de la pandémie de COVID-19 sur le marché des capteurs intelligents

L'émergence de la COVID-19 a mis en évidence la nécessité d'exploiter et de tirer parti de l'infrastructure numérique pour la surveillance à distance des patients. En raison de la lenteur du développement des tests viraux et des vaccins actuels, il a été déterminé qu'il existe un besoin accru de détection des maladies et de surveillance plus robustes de la santé individuelle et de la population, que les capteurs portables pourraient contribuer à renforcer. Bien que l'utilité de cette technologie ait été mise à profit pour corréler des paramètres physiologiques à la vie quotidienne et aux performances humaines, son application reste nécessaire pour prédire l'apparition de la COVID-19.

La demande croissante d'appareils économes en énergie stimule la demande de capteurs intelligents en Amérique du Nord. Les entreprises se tournent vers des équipements économes en énergie, car l'évolution de la situation nécessite des équipements et des produits économes en énergie. De plus, la demande de capteurs sur le marché des capteurs intelligents a augmenté dans divers secteurs avec la levée des réglementations gouvernementales strictes, qui gagnent du terrain dans les secteurs de l'automatisation. De plus, la demande de capteurs dans le secteur automobile est stimulée par la volonté de réduire le poids moyen des voitures. Les automobiles légères contribuent à la fois à l'efficacité énergétique et à l'optimisation énergétique.

Marché des capteurs intelligentsLes tendances régionales et les facteurs influençant le marché des capteurs intelligents tout au long de la période de prévision ont été analysés en détail par les analystes de The Insight Partners. Cette section aborde également les segments et la géographie du marché des capteurs intelligents en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu'en Amérique du Sud et en Amérique centrale.

Portée du rapport sur le marché des capteurs intelligents| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2021 | US$ 31.73 Billion |

| Taille du marché par 2028 | US$ 77.75 Billion |

| TCAC mondial (2021 - 2028) | 13.7% |

| Données historiques | 2019-2020 |

| Période de prévision | 2022-2028 |

| Segments couverts |

By Technologie

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché des capteurs intelligents : comprendre son impact sur la dynamique des entreprises

Le marché des capteurs intelligents connaît une croissance rapide, portée par une demande croissante des utilisateurs finaux, due à des facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une meilleure connaissance des avantages du produit. Face à cette demande croissante, les entreprises élargissent leur offre, innovent pour répondre aux besoins des consommateurs et capitalisent sur les nouvelles tendances, ce qui alimente la croissance du marché.

- Obtenez le Marché des capteurs intelligents Aperçu des principaux acteurs clés

Segmentation du marché des capteurs intelligents

Sur la base de la technologie, le marché des capteurs intelligents est segmenté en MEMS, CMOS et autres. En 2021, le segment MEMS était le leader du marché. Sur la base du type, le marché des capteurs intelligents est segmenté en capteurs de température et d'humidité, capteurs de pression, capteurs de mouvement, capteurs de position, etc. En 2021, le segment des capteurs de température et d'humidité représentait la plus grande part de marché. Sur la base du secteur d'utilisation finale, le marché des capteurs intelligents est segmenté en électronique grand public, automobile, santé, fabrication, vente au détail, etc.

Analog Devices Inc., Infineon Technologies Inc., STMicroelectronics, TE Connectivity, Microchip Technologies, NXP Semiconductor, Siemens AG, ABB Ltd., Robert Bosch GmbH et Honeywell International comptent parmi les principaux acteurs du marché des capteurs intelligents. En plus de ceux-ci, plusieurs autres acteurs ont été analysés pour comprendre la dynamique globale du marché mondial des capteurs intelligents.

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Rapports connexes

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des capteurs intelligents

Obtenez un échantillon gratuit pour - Marché des capteurs intelligents