3D Printing Medical Devices Market Growth and Analysis by 2031

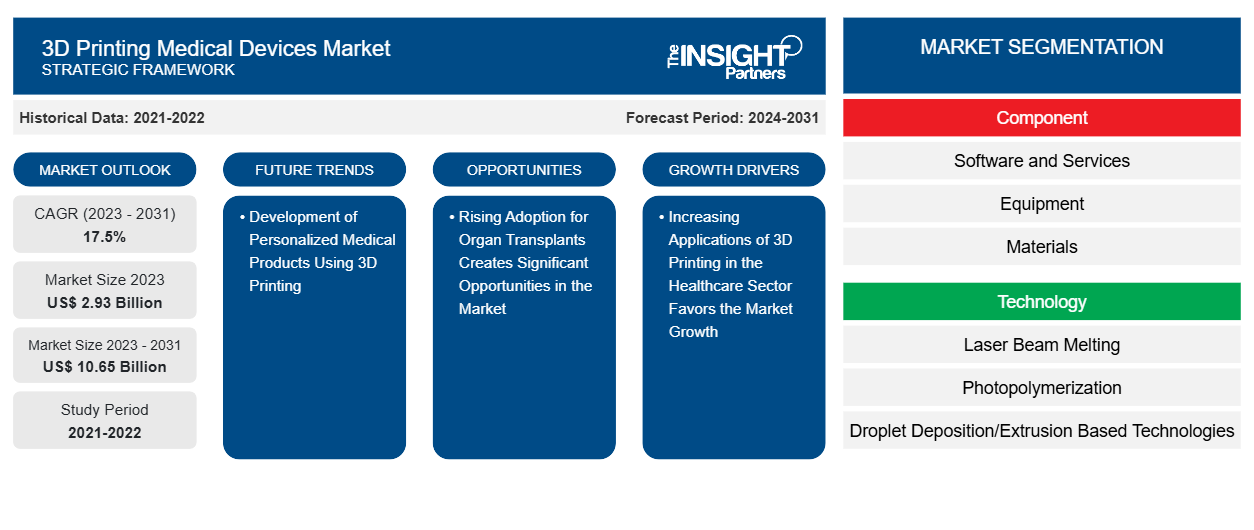

3D Printing Medical Devices Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component [Software and Services, Equipment (3D Printers and 3D Bioprinters), and Materials (Plastics Material, Metal and Metal Alloys, Bioprinting Biomaterial, Wax Material, and Others)], Technology [Laser Beam Melting (Direct Metal Laser Sintering, Selective Laser Sintering, Selective Laser Melting, and Laser Cusing), Photopolymerization (Stereolithography and Others), Droplet Deposition/Extrusion Based Technologies (Fused Deposition Modelling, Multiphase Solidification, and Low Temperature Deposition Manufacturing), and Electron Beam Melting], Application [Custom Prosthetics and Implants (Craniomaxillofacial Implants, Custom Dental Prosthetics and Implants, and Custom Orthopedic Implants), Surgical Guides (Dental Orthopedic, Craniomaxillofacial, and Spinal Guides), Tissue Engineering Products (Bone and Cartilage Scaffolds, and Ligament and Tendons Scaffolds), Surgical Instruments (Surgical Fasteners, Scalpels, and Retractors), Hearing Aids, Wearable Medical Devices, and Standard Prosthetics and Implants], and End-User (Hospitals and Surgical Centers, Dental and Orthopedic Centers, Medical Device Companies, Pharmaceutical and Biotechnology Companies, Academic and Research Institutes, and Others), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Apr 2026

- Report Code : TIPMD00002652

- Category : Life Sciences

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

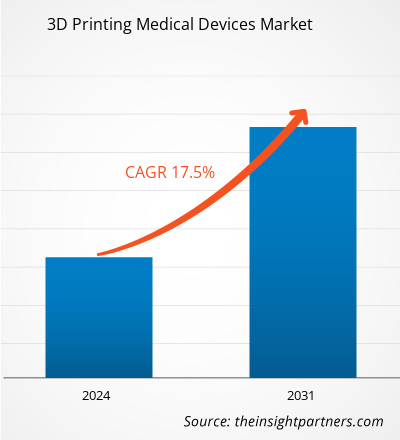

The 3D printing medical devices market size is projected to reach US$ 10.65 billion by 2031 from US$ 2.93 billion in 2023. The market is expected to register a CAGR of 17.5% during 2023–2031. The development of personalized medical products using 3D printing will likely remain a key trend in the market.

3D Printing Medical Devices Market Analysis

The market for medical devices made with 3D printing is well-established. The rising use of 3D printing in the healthcare sector drives adoption and contributes to the market's overall expansion. The increasing number of organ transplant procedures has increased the demand for 3D printing medical devices. Such a bolstering element affects the expansion of the market as a whole. Shortly, creating customized medical products through 3D printing will present a profitable prospect for market expansion.

3D Printing Medical Devices Market Overview

In recent decades, implantable medical devices have seen an increase in the use of 3D printing technology because of its accuracy and capacity for optimal material utilization. The traumatology, orthopedic surgery, and dentistry fields stand to gain the most from these instruments. No matter how complicated, implantable medical devices of any shape can be produced using 3D printing technology without experiencing processing problems. It can resolve issues about creating and producing intricate implantable medical devices. Implantable medical devices that are personalized and customized can also be made using the 3D printing process.

The second most prevalent dental condition worldwide is tooth decay. With only slight variations depending on gender, orthodontic issues are common in both genders. The potential for customized products is driving advances in 3D printing for medical and dental applications, cost savings on small-scale productions, ease of sharing and processing patient image data, and improvements in education. Limited publications are available on applications in the specialties of periodontics and endodontics. The 3D printing technique primarily focuses on oral surgery and prosthodontics applications, followed by orthodontics. Surgeons can perform operations on a realistic physical anatomy model with advanced image processing due to the clinical use of 3D printing technology.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATION3D Printing Medical Devices Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

3D Printing Medical Devices Market Drivers and Opportunities

Increasing Applications of 3D Printing in the Healthcare Sector Favors the Market Growth.

A wide range of medical devices with intricate geometry or features corresponding to a patient's specific anatomy are produced using 3D printers. A standard design prints a few devices, after which numerous replicas of the same device are created. The patient-specific imaging data is used to develop additional devices, also called patient-matched or patient-specific devices. The intended use of printed goods and the printer's ease of use are two considerations for choosing 3D printing technology. The most popular technology for 3D printing medical devices is powder bed fusion. This method works with various materials, including nylon and titanium, used in medical devices. Using CT and MRI scans, 3D printing makes creating tactile reference models specific to each patient inexpensive and easy. By offering a different viewpoint, these models assist doctors in better preparing for surgeries, significantly reducing the time and money needed for the actual procedure in an operating room. Patients may gain from this through increased satisfaction, decreased anxiety, and accelerated recovery.

Furthermore, introducing novel biocompatible materials for 3D printing in medicine facilitates the creation of fresh surgical instruments and methods, all aimed at enhancing the surgical experience for patients. Sterilable fixation trays, contouring templates, and implant sizing models are among the instruments that can be produced via 3D printing. These can be used to size implants in the operating room before the initial cut, saving surgeons time and enhancing accuracy during intricate procedures.

Rising Adoption for Organ Transplants Creates Significant Opportunities in the Market

The use of 3D printing technology in organ transplantation has become increasingly advantageous. 3D bioprinters have undergone numerous iterations and enhancements to satisfy quality requirements and expectations. As a result, creating and developing 3D printers is constantly evolving, with a broader range of applications. By speeding up the production of medical devices, 3D printers help save lives. They aid in resolving the issues of organ donor scarcity and recipient organ rejection. It also enables medical professionals to treat a large number of patients quickly. Without easily accessible environments that provide blood, oxygen, and vital nutrients, organs cannot survive. It is possible to create secure environments for transplanted organs using 3D printing technology. Because they are bio-printed instead of castrated, 3D printers significantly impact organ replacement in the medical field. This reduces the time spent looking for suitable donors. Therefore, the result is anticipated to have substantial positive effects on society, especially regarding quality of life. Promising uses of 3D bioprinting include the creation of artificial tissues and organs, which could completely transform the field of regenerative medicine.

3D Printing Medical Devices Market Report Segmentation Analysis

Key segments that contributed to deriving the 3D printing medical devices market analysis are component, technology, application, and end user.

- Based on components, the 3D printing medical devices market is divided into software and services, equipment, and materials. The equipment segment held the most significant market share in 2023.

- By technology, the market is categorized into laser beam melting, photopolymerization, droplet deposition/extrusion-based technologies, and electron beam melting. The photopolymerization segment held the largest share of the market in 2023.

- By application, the market is segmented into custom prosthetics and implants, tissue engineering products, surgical guides, surgical instruments, wearable medical devices, hearing aids, standard prosthetics and implants, and others. The custom prosthetics and implants segment held the largest share of the market in 2023.

- By end user, the market is segmented into hospitals and surgical centres, dental and orthopaedic centres, medical device companies, academic and research institutes, pharmaceutical and biotechnology companies, and others. The hospitals and surgical centers segment held the largest share of the market in 2023.0

3D Printing Medical Devices Market Share Analysis by Geography

The geographic scope of the 3D printing medical devices market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America consists of three countries: the US, Canada, and Mexico. The US is the largest market for 3D printing medical devices, followed by Canada and Mexico. Nearly 200,000 amputations are done annually in the United States alone, and prosthetic replacements or alterations can be costly and time-consuming, with prices ranging from $5,000 to $50,000. Since prosthetics are such individualized devices, each must be made to order or tailored to the wearer's specifications. These days, AM technology is frequently utilized to create prosthetic components tailored to each patient's anatomy, ensuring a perfect fit. AM is used in places where prosthetics come into contact with patients because of its capacity to create intricate geometries from various materials. AM technology has developed a wide range of products, from comfortable prosthetic leg connections to intricate, highly customized facial prosthetics for cancer patients.

Organovo, a US-based medical laboratory and research company, has experimented with printing intestinal and liver tissue to aid in the in vitro study of organs and developing drugs for specific diseases. The company announced pre-clinical data in May 2018 regarding the liver tissue's functionality in a type 1 tyrosinemia program. Tyrosine is an amino acid that the body cannot metabolize because of an enzyme deficiency.

3D Printing Medical Devices

3D Printing Medical Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2.93 Billion |

| Market Size by 2031 | US$ 10.65 Billion |

| Global CAGR (2023 - 2031) | 17.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

3D Printing Medical Devices Market Players Density: Understanding Its Impact on Business Dynamics

The 3D Printing Medical Devices Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

3D Printing Medical Devices Market News and Recent Developments

The 3D printing medical devices market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the 3D printing medical devices market are listed below:

- Align Technology, Inc. a leading global medical device company that designs, manufactures, and sells the Invisalign system of clear aligners, iTero intraoral scanners, and exocadCAD/CAM software for digital orthodontics and restorative dentistry, announced that it has completed the acquisition of privately-held Cubicure GmbH, a pioneer in direct 3D printing solutions for polymer additive manufacturing that develops, produces, and distributes innovative materials, equipment, and processes for novel 3D printing solutions. (Source: Align Technology, Inc., Press Release, January 2024)

3D Printing Medical Devices Market Report Coverage and Deliverables

The “3D Printing Medical Devices Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- 3D printing medical devices market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- 3D printing medical devices market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- 3D printing medical devices market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the 3D printing medical devices market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For