Adhesives and Sealants Market Size and Competitive Analysis by 2030

Adhesives and Sealants Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Resin Type [Adhesives (Epoxy, Polyurethane, Acrylic, and Others), and Sealants (Silicone Sealant, Urethane Sealant, Acrylic Sealant, Polysulfide Sealant, and Others)], by End-Use Industry (Automotive, Aerospace, Paper and Packaging, Building and Construction, Electrical and Electronics, Medical, and Others)

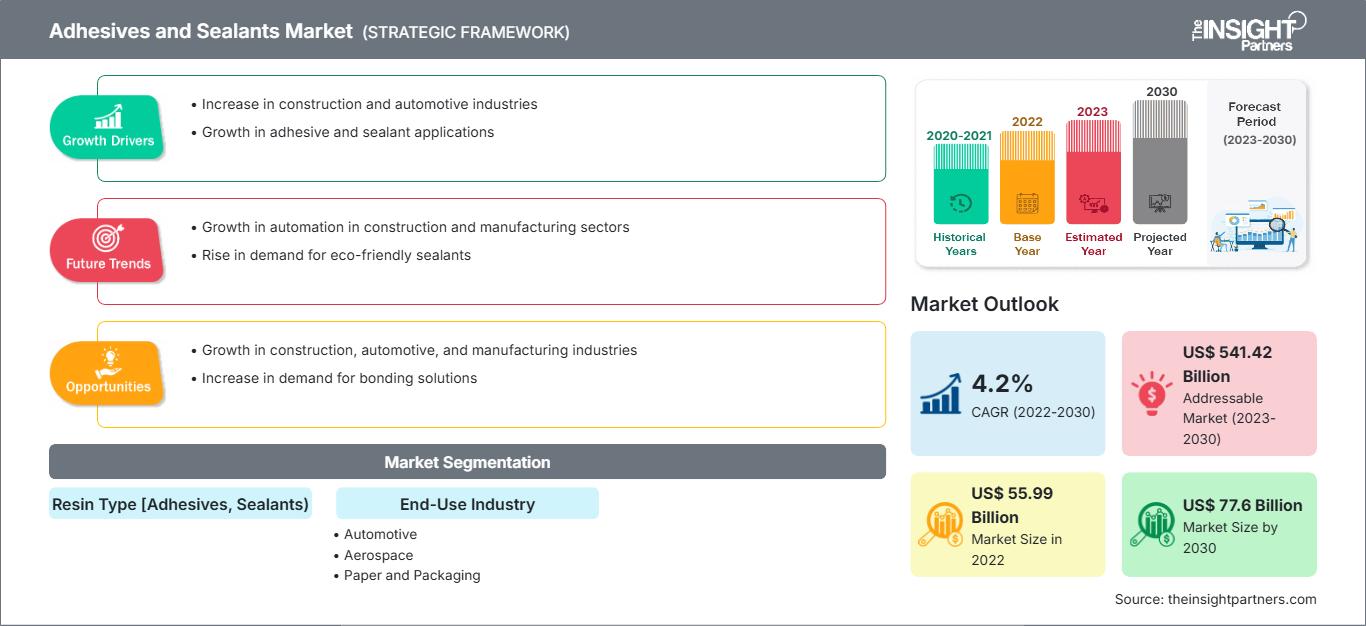

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Status : Published

- Report Code : TIPRE00003665

- Category : Chemicals and Materials

- No. of Pages : 230

- Available Report Formats :

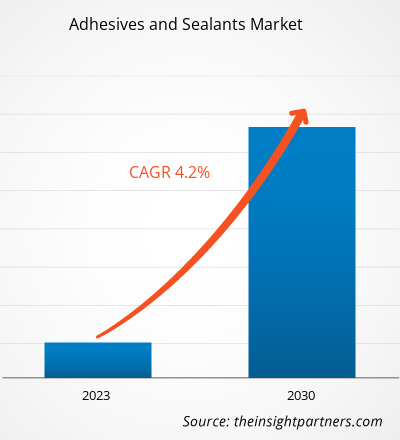

[Research Report] The adhesives and sealants market size was valued at US$ 55,986.03 million in 2022 and is expected to reach US$ 77,598.29 million by 2030; it is estimated to register a CAGR of 4.2% from 2022 to 2030.

MARKET ANALYSIS

Adhesives are used to form a tight bond between two surfaces, whereas sealants are used to fill or seal gaps to restrict the movement of fluids. Adhesives and sealants have major applications in construction, automotive, aerospace, paper & packaging, woodwork, and electrical & electronics industries. Epoxy adhesives have high tensile strength and effectively bond with metals. Epoxy and acrylic adhesives also find application in glass surface adhesion but do not offer good aesthetics. Sealants are available in several types according to the specific application, of which silicone sealant, urethane sealant, and acrylic sealant are widely used.

GROWTH DRIVERS AND CHALLENGES

Strong growth of construction and automotive industries, and increasing demand for adhesives and sealants from the paper and packaging industry are the factors driving the adhesives and sealants market. Infrastructure advancement comprises projects related to roads, ports, railways, airports, and industrial infrastructure. Rising construction activities in many countries, including the US, China, India, and Saudi Arabia, create lucrative opportunities for the adhesives and sealants market during the forecast period. As per a report published by the European Automobile Manufacturers’ Association, motor vehicle production rose by 1.3% globally from 2020 to 2021; a total of 79.1 million motor vehicles, including 61.6 million passenger cars, were produced globally in 2021. According to a report by the Bureau of Transportation Statistics, China is one of the dominant markets for producing passenger cars and commercial vehicles. In the automotive industry, adhesives and sealants provide solutions for bonding interior or exterior car components. Hence, the strong growth of the automotive industry in various countries across the world bolsters the demand for adhesives and sealants. Rising consumer preference for packaged food products is creating demand for high-quality food packaging products that can keep food fresh for a longer period. Further, online retail has been growing consistently in recent years. The e-commerce industry has been growing in many countries, which is positively impacting the demand for different packaging products. Volatility in prices of raw materials used in adhesives and sealants manufacturing pose a challenge to the adhesives and sealants market. The rise in crude oil prices due to fluctuating global economic conditions is further boosting the price of petroleum resins. In 2022, DIC Corporation reported revised sales prices of epoxy resins and epoxy resin curing agents due to an increase in raw material prices and supply–demand gap. The rise in raw material prices leads to a strain on product profitability and margins. Thus, fluctuation in the prices of raw materials restrains the adhesives and sealants market growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAdhesives and Sealants Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The "Global Adhesives and Sealants Market Analysis to 2030" is a specialized and in-depth study with a major focus on global market trends and growth opportunities. The report aims to provide an overview of the global market with detailed market segmentation on the basis of resin type, end-use industry, and geography. The report provides key statistics on the consumption of adhesives and sealants worldwide along with their demand in major regions and countries. In addition, the report provides a qualitative assessment of various factors affecting the adhesives and sealants market performance in major regions and countries. It also includes a comprehensive analysis of the leading players in the adhesives and sealants market and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, market trends, and lucrative opportunities that would, in turn, aid in identifying the major revenue pockets.

Further, ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global adhesives and sealants market, which helps understand the entire supply chain and various factors affecting the market growth.

SEGMENTAL ANALYSIS

The global adhesives and sealants market is segmented on the basis of resin type and end-use industry. Based on resin type, the adhesives and sealants market is bifurcated into adhesives (epoxy, polyurethane, acrylic, and others) and sealants (silicone sealant, urethane sealant, acrylic sealant, polysulfide sealant, and others). On the basis of end-use industry, the market is segmented into automotive, aerospace, paper and packaging, building and construction, electrical and electronics, medical, and others. Based on resin type, the adhesives segment accounted for a larger share of the adhesives and sealants market in 2022. Adhesives are used to bond different substrates such thermosets and thermoplastics, composites, metals, elastomers, wood and wood products, glass and ceramics, and sandwich and honeycomb structures. They are highly used in the construction, consumer goods, packaging, and transportation industries. Sealants possess several properties such as durability, hardness, exposure resistance, and adhesion. Most common sealants are water-based latex, acrylic, butyl, polysulfide, silicon, polyisobutylenes, and polyurethane. Based on end-use industry, the building and construction segment accounted for the largest market share in 2022. In the building & construction industry, sealants connect and join various parts and materials to the main structure. Adhesives are used for laminating paper and cardboard, gluing labels, and lining food packages such as beverage cans. In the electrical & electronics industry, adhesives and sealants contribute directly to the manufacturing of electronic parts and their long-term operation. In the medical industry, adhesives and sealants such as silicone, polyurethane, acrylic, and bioadhesives play a crucial role. In the aerospace industry, adhesives are used for the interior, exterior, and engine compartments of aircraft. Adhesives & sealants provide solutions for bonding internal and external car parts in the automotive industry.

REGIONAL ANALYSIS

The report provides a detailed overview of the global adhesives and sealants market with respect to five major regions—North America, Europe, Asia-Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. Asia Pacific accounted for a significant share in the adhesives and sealants market and valued at more than US$ 25 billion in 2022. The electronics manufacturing industry is an important part of manufactured exports for several Asian countries, including China, South Korea, and Japan. Adhesives provide a strong bond during electronics assembly while protecting components against potential damage. The growing construction and packaging industries in the region are creating massive demand for adhesives and sealants. The Europe adhesives and sealants market is expected to reach ~US$ 17 billion in 2030. The surge in investments by European governments and private companies in infrastructure building and construction projects is driving the growth of the adhesives and sealants market. Further, players operating in Europe are focusing on adopting strategies such as new product launches and business expansion to stay competitive in the market. The North America adhesives and sealants market witnessed strong demand from the construction industry supported by government grants for infrastructure developments and rising investments in technology and research programs in the aerospace industry. North America adhesives and sealants market is expected to witness considerable growth, growing at a CAGR of around 4% from 2022 to 2030.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

The report provides a detailed overview of the global adhesives and sealants market with respect to five major regions—North America, Europe, Asia-Pacific (APAC), the Middle East & Africa (MEA), and South & Central America.

- In 2023, Dow Inc expanded its silicone sealant products for photovoltaic assembly, namely DOWSIL PV product line with six silicone-based sealants and adhesives solutions.

- In 2023, 3M Co launched a medical adhesive that sticks to the skin for 28 days and is intended for use with a wide range of health monitors, sensors, and long-term medical wearables.

Adhesives and Sealants Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 55.99 Billion |

| Market Size by 2030 | US$ 77.6 Billion |

| Global CAGR (2022 - 2030) | 4.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Resin Type [Adhesives, Sealants)By End-Use Industry

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Adhesives and Sealants Market Players Density: Understanding Its Impact on Business Dynamics

The Adhesives and Sealants Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

IMPACT OF COVID-19 PANDEMIC/IMPACT OF GEOPOLITICAL SCENARIO/IMPACT OF RECESSION

Industries such as construction, automotive, electronics, and paper & packaging have been the major consumers of adhesives and sealants. In 2020, these industries had to slow down their operations due to disruptions in the value chain caused by government regulations and trade restrictions. Moreover, lockdowns imposed by different countries hampered the inventory levels of many manufacturers in the same year. The shortage of manpower resulted in the reduction in adhesives and sealants production and distribution operations. Additionally, government restrictions and other COVID-19 related-precautions reduced the operational capacities of stakeholders in the adhesives and sealants value chain.

In late 2021, the global adhesives and sealants market began recovering from the losses incurred in 2020, with the revival of end-use industries such as automotive, aerospace, and construction. Expansion in production capacities in the chemicals & materials industry post COVID-19 pandemic in many regions such as Asia Pacific and North America can create lucrative opportunities for the adhesives and sealants market in the coming years.

COMPETITIVE LANDSCAPE AND KEY COMPANIES

A few of the key players operating in the adhesives and sealants market are Henkel AG and Co KGaA, HB Fuller Company, Sika AG, 3M Co, Huntsman International LLC, Dow Inc, Wacker Chemie AG, Parker Hannifin Corp, Dymax Corporation, and Astro Chemical Company Inc.

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For