预计到2031年,航空航天紧固件市场规模将从2024年的40.4412亿美元增至61.6115亿美元。预计2025年至2031年期间,该市场的复合年增长率将达到6.0%。老旧飞机机队的改装可能会在未来几年为市场带来新的趋势。

航空航天紧固件市场分析

航空客运量不断增长,推动航空公司增加航班起降并投入新飞机。飞机维护、大修 (MRO) 活动对于维护部件的可及性、一致性和质量至关重要。航空公司运营商依靠 MRO 服务来确保飞机安全并提高燃油效率。

亚太地区对飞机零部件维护和维修的需求正在激增。航空业的增长可能更多地集中在中国和印度。预计包括新加坡和马来西亚在内的亚太其他地区将成为飞机MRO服务行业增长的主要贡献者。

欧洲和北美地区对扩大飞机机队的投资不断增加,推动了这些地区航空紧固件市场的增长。此外,各国政府也加大了对军用和国防飞机的融资或投资力度,以增强安全保障,增强国防力量。印度、印度尼西亚、泰国和新加坡旅游业的增长也刺激了对飞机机队的需求。

航空航天紧固件市场概况

全球商用、客运和战斗机数量的不断增长推动了航空航天紧固件的应用。不断变化的现代战争形势促使各国政府向国防和军事空军拨出大量资金和财政援助。不断增加的国防开支预算表明政府重视采购先进的战斗机以满足日益增长的安全需求,这推动了对航空航天紧固件的需求。2022 年,美国政府与洛克希德·马丁公司敲定了生产和交付多达 398 架 F-35 战机的合同,总价值 300 亿美元。2023 年,美国确保向波兰出售价值 120 亿美元的阿帕奇攻击直升机。根据这笔交易,波兰预计将从波音公司接收 96 架 AH-64E 阿帕奇攻击直升机。

商用飞机领域窄体和宽体飞机订单数量的增加,推动了北美、欧洲和亚太地区航空紧固件市场的增长。2023年,通用航空整体出货量与2022年相比有所增长。出货量和初步飞机交付量达283亿美元,增长约3.3%。根据通用航空制造商协会的数据,2023年飞机出货量与2022年相比有所增长。活塞式飞机交付量增长约11.8%,达1,682架;公务机交付量从712架增加到730架;涡轮螺旋桨飞机交付量激增约9.6%,达638架。2023年飞机交付价值为234亿美元,较2022年增长约2.2%。

您可以免费定制任何报告,包括本报告的部分内容、国家级分析、Excel 数据包,以及为初创企业和大学提供优惠和折扣

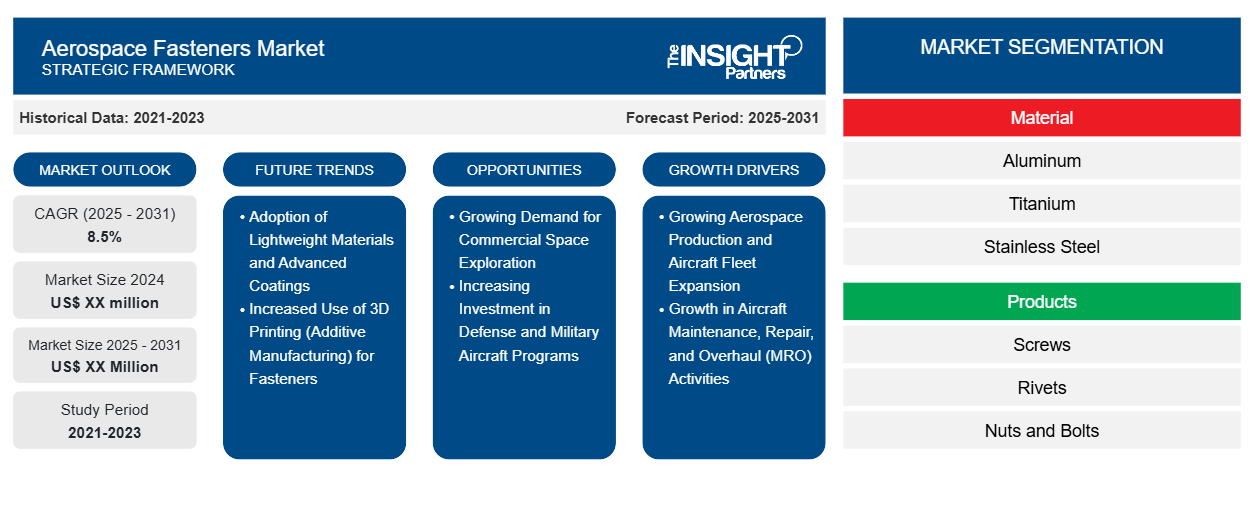

航空航天紧固件市场:战略洞察

-

获取此报告的顶级关键市场趋势。此免费样品将包括数据分析,从市场趋势到估计和预测。

航空航天紧固件市场驱动因素和机遇

钛紧固件在航空航天工业中的应用优势

钛紧固件是航空航天工业中最常用的合金。这些紧固件由钛合金制成,通常以铝和钒作为主要合金元素,以提高强度和其他理想性能。它们的高强度密度比使它们比钢更坚固、更轻。此外,它的耐腐蚀和高温性能使它成为航空航天工业的理想选择。由于它们对极端温度和压力具有很高的耐受性,它们被用于起落架、喷气发动机、风扇叶片、发动机叶片、轴、机身、机翼和螺旋桨。钛紧固件以销钉或螺母形式用于连接飞机组件中的部件。由于它们比任何其他部件轻 40%,对轻量化零件的需求推动了全球对钛紧固件的采用。

钛合金耐极端温度的能力使其在最严苛的服役条件下也能得到广泛的应用。它在高温下仍能保持结构性能,这对于必须承受喷气发动机高温或大气再入摩擦产生的热量的部件来说至关重要。另一方面,钛合金耐低温的特性使其成为太空探索中不可或缺的组成部分,因为外太空的极寒对太空探索构成了关键挑战。在海军飞机中,钛合金是结构、起落架和紧固件的首选材料,能够抵御海雾和海洋大气的腐蚀。

新兴经济体的维护、修理和大修活动数量不断增加

航空业的蓬勃发展正推动对航空公司MRO服务的需求。发展中经济体,尤其是亚太地区国家,正致力于将MRO服务扩展到商用和军用飞机公司。亚太地区的主要飞机MRO企业包括MTU维护公司、中国广州飞机维修工程有限公司(GAMECO)以及宜捷海特航空服务(中国)有限公司。航空基础设施建设支出、经济发展以及乘客数量的激增推动了飞机维护服务的普及。中产阶级旅行者数量的不断增长,尤其是在新加坡、中国和印度,正在推动航空旅行的发展,并增加该地区对飞机维护服务的需求。马来西亚、新加坡和泰国凭借其完善的MRO枢纽,从航空MRO服务中获得了巨额收入。空中客车、通用电气航空和劳斯莱斯在新加坡都拥有重要的业务。据威斯康星州经济发展局(WEDC)的数据,新加坡拥有120家航空航天公司,占亚太地区MRO服务业的四分之一。紧固件在维护过程中确保飞机的结构安全性和完整性。因此,新兴国家对飞机维护、维修和大修 (MRO) 服务的日益重视,推动了航空航天紧固件市场的增长。

航空航天紧固件市场报告细分分析

有助于得出航空航天紧固件市场分析的关键部分是材料类型、应用、飞机类型和产品类型。根据材料类型,航空航天紧固件市场细分为高温合金、铝、不锈钢、钛和其他。钛合金部分在 2024 年占据最大的市场份额。按应用类型,航空航天紧固件市场细分为机身、发动机、内饰和其他。机身部分在 2024 年占据最大的市场份额。根据飞机类型,航空航天紧固件市场细分为固定翼和旋翼。固定翼部分在 2024 年占据最大的市场份额。按产品类型,航空航天紧固件市场细分为螺钉、铆钉、螺母/螺栓和其他。螺母/螺栓部分在 2024 年占据最大的市场份额。

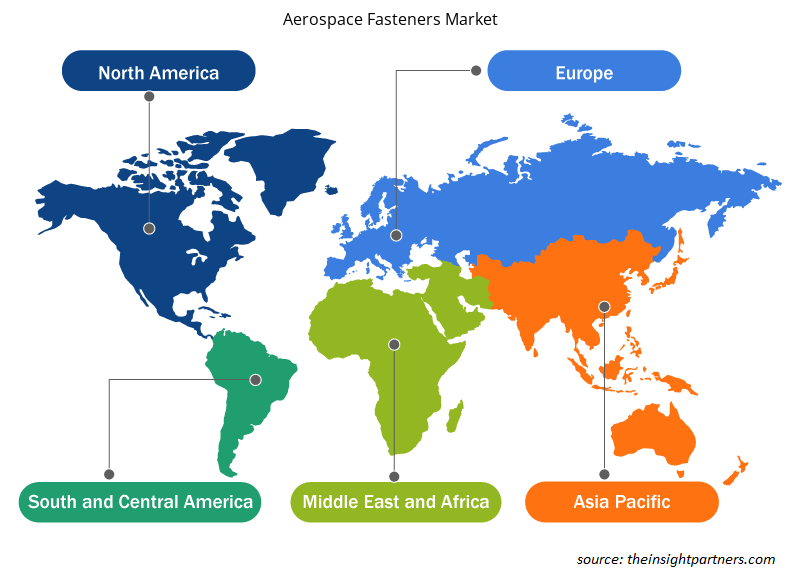

航空航天紧固件市场份额(按地区)分析

航空航天紧固件市场报告的地理范围分为四个主要区域:北美、欧洲、亚太、中东和非洲以及南美。全球航空航天紧固件市场分为北美、亚太、欧洲、中东和非洲以及南美。北美在2024年占据最大的市场份额,为35.1%,预计在预测期内的复合年增长率为5.5%。北美和欧洲的多家不锈钢和高温合金紧固件制造商和供应商推动了市场的增长。TriMas、Precision Castparts Corp.、Howmet Aerospace Inc.、LISI Aerospace SAS、Saturn Fasteners, Inc.、National Aerospace Fasteners Corp.和Raychin Limited是位于北美、欧洲和亚太地区的主要参与者。

2024 年 6 月,空客的 A330-900 飞行测试飞机 — — MSN1795/F-WTTN — — 飞往墨西哥的托卢卡,然后飞往玻利维亚的拉巴斯。此次测试是空客高空测试活动的一部分。空客正致力于提高 A350 和 A330neo 的产量,并致力于推出基于 A330neo 的货机。空客在 2023 年提供了 735 架商用飞机,比 2022 年增长约 11%。空客的商用飞机订单总数为 2,319 架,包括 1,835 架 A320 系列飞机和 300 架 A350 系列飞机。2023 年,波音共交付了 528 架飞机,其中包括 396 架波音 737 喷气式飞机和 73 架梦想飞机。 2024年5月,靛蓝航空与巴西航空工业公司、ATR航空和空客航空合作订购了约100架小型飞机,旨在扩大其区域航线网络。此外,由于新飞机机队产量的增加和维护、维修和大修(MRO)服务的增加,航空航天领域对不锈钢和高温合金紧固件的需求也在增长。

中东、非洲以及南美洲是航空紧固件市场增长的主要贡献者。根据美国联邦航空管理局在中东地区的数据,该地区航空业的年增长率为10%。随着航空运输协定自由化的推进,非洲国家的航空旅客数量不断增加,航空业也随之增长。国际航空运输协会预测,未来20年,非洲各国的航空旅客年增长率将达到约5.9%,与2019年相比,航空旅客数量将增加3亿多人次。中东和非洲各国政府意识到在飞机上安装先进部件的潜力,并致力于提高部件的质量。

航空航天紧固件市场区域洞察

Insight Partners 的分析师已详尽阐述了预测期内影响航空航天紧固件市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的航空航天紧固件市场细分和地域分布。

- 获取航空航天紧固件市场的区域特定数据

航空航天紧固件市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2024年的市场规模 | 40.4412亿美元 |

| 2031年的市场规模 | 61.6115亿美元 |

| 全球复合年增长率(2025-2031) | 6.0% |

| 史料 | 2021-2023 |

| 预测期 | 2025-2031 |

| 涵盖的领域 |

按材料类型

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

航空航天紧固件市场参与者密度:了解其对业务动态的影响

航空航天紧固件市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求又源于消费者偏好的不断变化、技术进步以及对产品优势的认知度不断提高等因素。随着需求的增长,企业正在扩展产品线,不断创新以满足消费者需求,并抓住新兴趋势,从而进一步推动市场增长。

市场参与者密度是指特定市场或行业内企业或公司的分布情况。它表明特定市场空间内竞争对手(市场参与者)的数量相对于其规模或总市值而言。

在航空航天紧固件市场运营的主要公司有:

- 精密铸件公司

- LISI航空航天有限公司

- TriMas 航空航天

- 国家航空紧固件公司

- Howmet 航空航天公司

- STANLEY 工程紧固件

免责声明:以上列出的公司没有按照任何特定顺序排列。

- 获取航空航天紧固件市场主要参与者的概述

航空航天紧固件市场新闻和最新发展

航空航天紧固件市场评估是通过收集一手和二手资料后进行的定性和定量数据进行的,这些数据包括重要的企业出版物、协会数据和数据库。以下列出了航空航天紧固件市场的一些发展情况:

- TriMas宣布已完成此前宣布的对GMT Gummi-Metall-Technik GmbH(简称“GMT”)航空航天业务的收购。GMT的航空航天部门(简称“GMT Aerospace”)总部位于德国,致力于开发和制造各种用于商用和军用航空航天应用的拉杆和橡胶金属防振系统。GMT Aerospace现已成为TriMas Aerospace集团的一部分。(TriMas,新闻稿,2025年2月)

- 明藤株式会社 (MEIDOH Co. Ltd.) 收购了 Pilgrim Screw Corp.(商名为 Pilgrim Aerospace Fasteners)。(明藤株式会社,新闻稿,2024 年 1 月)

- Genesys Industries 宣布已收购 F3 Aerospace (F3) 100% 的股份。Genesys 预计此次收购将在交易完成后 3 个月内提升其盈利。此次交易将创造符合我们长期目标的股权价值。(Genesys Industries,新闻稿,2024 年 9 月)

航空航天紧固件市场报告范围和交付成果

《航空紧固件市场规模和预测(2021-2031)》报告对以下领域进行了详细的市场分析:

- 航空航天紧固件市场规模以及全球、区域和国家层面涵盖的所有关键细分市场的预测

- 航空航天紧固件市场趋势以及市场动态,例如驱动因素、限制因素和关键机遇

- 详细的波特五力模型和 SWOT 分析

- 航空航天紧固件市场分析涵盖主要市场趋势、全球和区域框架、主要参与者、法规和最新市场发展

- 行业格局和竞争分析,包括市场集中度、热图分析、知名企业的市场份额分析以及航空航天紧固件市场的最新发展

- 详细的公司简介

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 航空航天紧固件市场

获取免费样品 - 航空航天紧固件市场