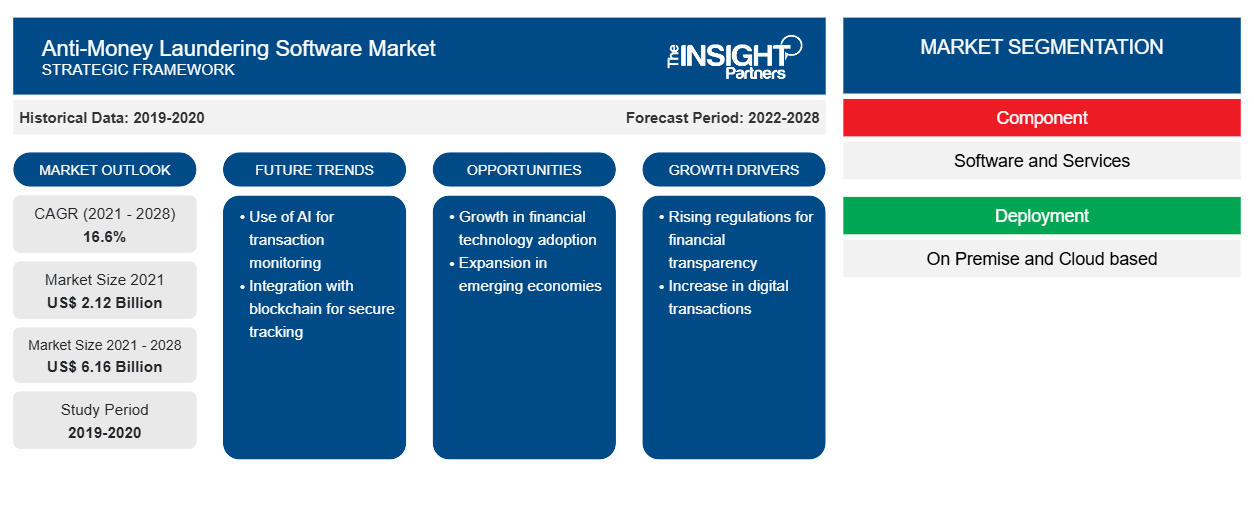

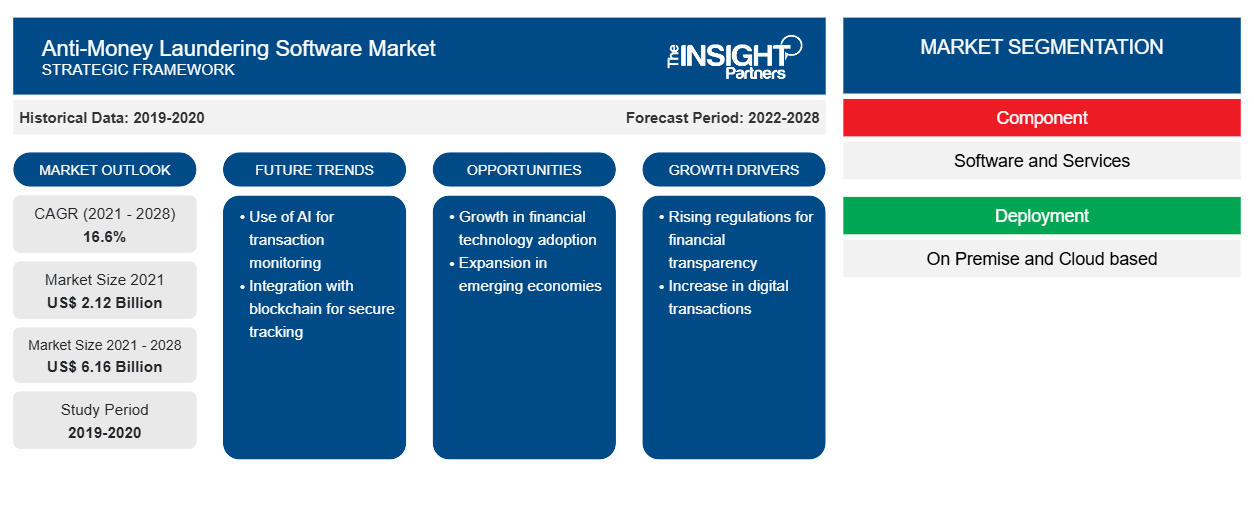

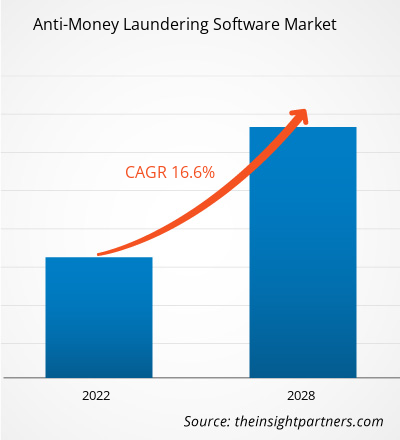

[Research Report] The anti-money laundering software market size is expected to grow from US$ 2,116.3 million in 2021 to US$ 6,162.8 million by 2028; The anti-money laundering software market size is estimated to grow at a CAGR of 16.6% from 2022 to 2028.

Technological advancements are triggering the number of cyber-criminals. However, FinTech firms have the potential to help banks around the world to stay competitive in the global market. The use of more robust systems combined with advanced technologies in tracking digital currency, machine learning, and connecting data have opened up possibilities to combat money laundering. With increasing consumer adoption and subsequent transaction volumes in competitive FinTech firms in 2019, many firms shifted to automated anti-money laundering practices. The automated anti-money laundering systems provide a negligible number of false positives compared to those generated by traditional data and technology. This reduces the adverse effects of false positives, keeping the operational costs within the expected range.

Considering the growing connection between FinTech and AML solutions, in December 2020, the Association of Certified Anti-Money Laundering Specialists announced the launch of a new certification program for FinTech firms seeking to meet regulatory standards. The association also developed the Certified AML FinTech Compliance Associate program in collaboration with FINTRAIL. The program is built to increase the compliance toolkit of FinTech personnel working in financial crime prevention at the entry level. Thus, the increasing focus of FinTech on implementing AML solutions is propelling the anti-money laundering software market growth.

The clients have no control over the location of the infrastructure; this infers that if a vendor’s data center is breached, the enterprise will have no control over time period of the outage or what data may be conceded. All the clients on clouds share the same infrastructure pool with narrow security protections, configuration and accessibility variances. Keeping the control limitations, security risks, and policy constraints aside, there are several situations where a cloud deployment are more suitable. However, clouds are larger in size when compared to on-premise deployment type, due to which companies associated with cloud are benefitted from seamless, on-demand scalability. The cloud deployment is ideal for organizations that are willing to adopt analytics solutions with low investment. It mainly allows companies to procure the data with all their services, but on an economical expense.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Anti-Money Laundering Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Anti-Money Laundering Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Anti-Money Laundering Software Market

The COVID-19 pandemic accelerated the development of digital technologies. Because of social restrictions worldwide, maximum people now rely on digital platforms to meet their everyday needs. Digital wallets, often known as eWallets, are becoming more popular. As a result of this transition, the likelihood of unlawful money transactions has grown. The FATF has cautioned banks about unlawful money transactions. As a result, demand for AML solutions has surged, and this factor has a significant impact on market growth. Owing to the widespread use of digital platforms, the amount of data on networks is growing, putting more strain on banks' and financial institutions' infrastructure security. Hackers continue to target banks irrespective of several measures taken by them. As a result, the demand for improved AML solutions is growing. Cybercrimes, such as financial frauds, are rising as data on networks grows. Banks and financial institutions are now using data analytics techniques to improve their security procedures.

Lucrative Regions for Anti-Money Laundering Software Market

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights– Anti-Money Laundering Software Market

Rising Demand for Sophisticated Transaction Monitoring Solutions Drives Anti-Money Laundering Software Market Growth

Transaction monitoring is a crucial procedure and key control in AML and countering the financing of terrorism (AML/CFT) policies and procedures of financial institutions. The transaction monitoring solutions allow financial institutions to detect and evaluate whether transactions pose suspicion when considered against customers’ respective profiles. Over the years, the financial regulators have intensified their focus on monitoring AML risk activities, including a thrust for the financial institutes to adopt a suitable transaction monitoring process. Furthermore, regulators expect firms to prove the capability and efficiency of their systems. This demand for a sophisticated transaction monitoring system is predominantly driven by the legislation, such as New York’s Department of Financial Services part 504, and the general move toward the control being evaluated by their outcome quality.

The transaction monitoring software platforms allow the financial institutions to configure a range of monitoring scenarios, perform efficient data analysis, and filter out the genuine suspicious activities from the other false positives; thus, gaining significant traction in the market. This, in response, is accelerating the demand for AML enabled with sophisticated transaction monitoring solutions.

Component-Based Anti-Money Laundering Software Market Insights

The anti-money laundering software market analysis by component, the anti-money laundering software market is segmented into software and services segment. The software segment accounted a larger anti-money laundering software market share in 2021.

Deployment-Based Anti-Money Laundering Software Market Insights

The anti-money laundering software market analysis by deployment, the anti-money laundering software market is segmented into cloud based and on-premise. The on-premise segment accounted a larger anti-money laundering software market share in 2021. A cloud based anti-money laundering software is a web-based software as a service (SaaS) model utilizing enterprise cloud technology.

Product-Based Anti-Money Laundering Software Market Insights

On the basis of product, the anti-money laundering software market is categorized into transaction monitoring, compliance management, currency transaction reporting, and customer identity management. The transaction monitoring segment accounted for the largest share of the market in 2021.

End user-Based Anti-Money Laundering Software Market Insights

Based on end user, the anti-money laundering software market is segmented into healthcare, retail, BFSI, IT & telecom, government and others. The BFSI segment accounted for the largest share of the market in 2021. Rapid developments in financial information, technology and communication has enabled the money to move anywhere in the world with speed and ease.

Players operating in the anti-money laundering software market are mainly focused on the development of advanced and efficient products.

- In January 2022, Oracle announced its partnership with Arachnys, to provide cloud-native CRI platform of Arachnys to get integrated with and enhance Oracle’s Financial Services Financial Crime and Compliance Management (FCCM) solution suite.

- In April 2021, Accenture successfully completed the acquisition of Exton Consulting, a French consulting firm involved in offering banking strategy support across Europe.

Company Profiled:

- ACI Worldwide

- SAS Institute

- Oracle Corporation

- BAE Systems

- Accenture

- Verafin Inc.

- Safe Banking Systems LLC

- Eastnets Holding Ltd.

- Ascent Technology Consulting

- Opentext Corporation

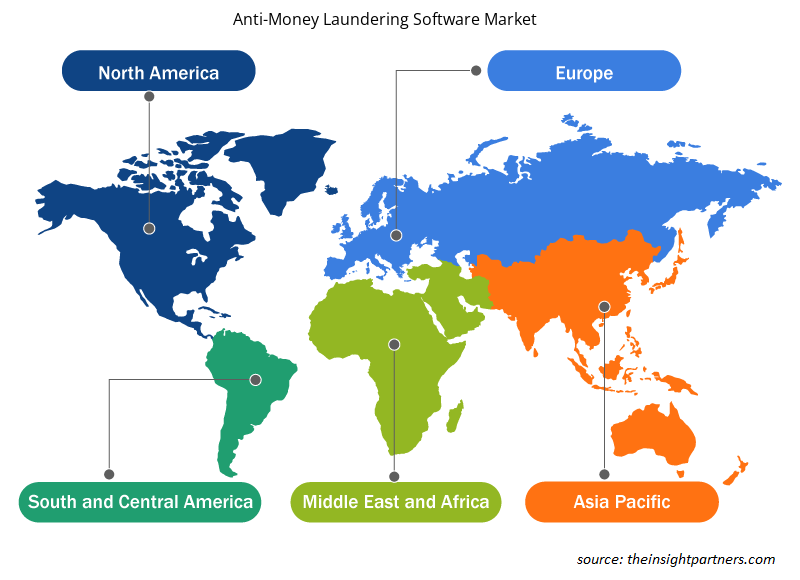

Anti-Money Laundering Software Market Regional Insights

The regional trends and factors influencing the Anti-Money Laundering Software Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Anti-Money Laundering Software Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Anti-Money Laundering Software Market

Anti-Money Laundering Software Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2.12 Billion |

| Market Size by 2028 | US$ 6.16 Billion |

| Global CAGR (2021 - 2028) | 16.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Anti-Money Laundering Software Market Players Density: Understanding Its Impact on Business Dynamics

The Anti-Money Laundering Software Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Anti-Money Laundering Software Market are:

- ACCENTURE

- ACI WORLDWIDE

- ASCENT TECHNOLOGY CONSULTING

- BAE SYSTEMS

- EASTNETS HOLDING LTD.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Anti-Money Laundering Software Market top key players overview

Frequently Asked Questions

What is the estimated global market size for Anti-money laundering software market in 2028?

The Anti-money laundering software market is estimated to grow at 6162.8 million US dollars in 2028 at a CAGR of 16.6%.

What are the driving factors impacting the global anti-money laundering software market?

The Increasing focus of FinTech on implementing automated anti-money laundering systems and Rising demand for sophisticated transaction monitoring solutions are driving the anti-money laundering software market

What are the future trends in the Anti-money laundering software market?

The Information sharing among banks and other financial institutions and Increased use of artificial intelligence are the future trends for the Anti-money laundering market.

Which are the key players holding the major market share in the Anti-money laundering software market?

Accenture, Open Text Corporation, Oracle, BAE Systems and SAS are the five key players holding the major market share in the Anti-money laundering software market.

Which country is holding major market share of Anti-money laundering market?

North America is holding major market share of Anti-money laundering market.

Which is the leading product segment in the Anti-money laundering software market?

Transaction Monitoring is the leading product segment in the Anti-money laundering software market.

What is the incremental growth of Anti-money laundering software market during the forecast period?

The incremental growth of Anti-money laundering software market during the forecast period is US $ 3711.2 million.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Parking Meter Apps Market

- eSIM Market

- Advanced Distributed Management System Market

- Online Exam Proctoring Market

- Electronic Data Interchange Market

- Barcode Software Market

- Maritime Analytics Market

- Cloud Manufacturing Execution System (MES) Market

- Robotic Process Automation Market

- Digital Signature Market

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Anti-Money Laundering Software Market

- ACCENTURE

- ACI WORLDWIDE

- ASCENT TECHNOLOGY CONSULTING

- BAE SYSTEMS

- EASTNETS HOLDING LTD.

- OPENTEXT CORPORATION

- ORACLE CORPORATION

- NICE Ltd.

- SAS INSTITUTE

- Nasdaq Inc

Get Free Sample For

Get Free Sample For