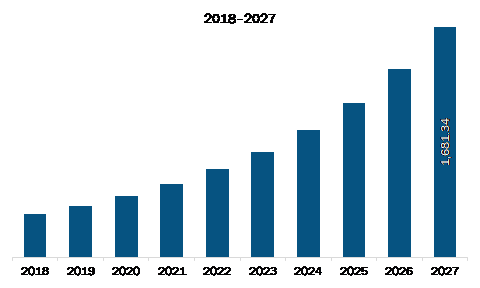

The APAC anti-money laundering solution market is expected to grow from US$ 376.59 million in 2019 to US$ 1,681.34 million by 2027; it is estimated to grow at a CAGR of 17.9 % from 2020 to 2027.

The Australia, China, India, Japan, and South Korea are major economies in APAC. Mounting focus on limiting risks related to digital payment methods is expected to upsurge the APAC anti-money laundering solution market. Several countries across APAC region are witnessing high growth in digitalization in the banking sector. Government initiatives for digitalization have increased the importance of digital payments among consumers. This factor has resulted in the emergence of several digital payment wallets giving tough competition to the banks. Presently, financial technology enables consumers to make transactions through various platforms, such as laptops and mobile devices. The ability to perform financial transactions on laptops and mobile devices is so unified that consumers take it for granted. With the emergence of digital payments, intermediaries are the link between the bank and the end client, leaving banks vulnerable to customer malfeasance. At present, the regulatory across APAC region focus is centered on limiting money-laundering risks related to digital payment methods, such as e-payments and mobile wallets. Further, the top priority is being given to combat cybercrime and limit potential money-laundering risks. Regulators are focused on financial crime and cybersecurity risks in digital payments. Singapore, for instance, passed legislation, which ranks the intermediaries by risk level and allocates tiered capital needs and AML responsibilities. Thus, the huge focus of financial institutions on limiting the digital payment issues is anticipated to propel the APAC anti-money laundering solution market growth.

Further, in case of COVID-19, APAC is highly affected specially the China and India. The governments of APAC countries took all possible steps to reduce the effects of the coronavirus pandemic by announcing lockdown. The temporary shutdown of companies resulted in increased digital channels of communication among the customers and organizations. However, during Q1 and Q2 2020, several companies were temporarily shut, which disrupt the anti-money laundering solution vendors and banks. Thus, the market was slightly impacted. With the release of lockdown, the market again started showing signs of growth. Criminals are taking advantage of the global outbreak to carry out financial fraud, which includes advertising and trafficking in counterfeit products, providing fraudulent investment opportunities. In light of growing threats, businesses in the region are taking necessary steps to identify suspicious behavior, investigating it thoroughly and, where appropriate, reporting it to the relevant authorities. Thus, this surges the demand for an anti-money laundering solution. Since the COVID-19 pandemic outbreak, the banks in the region are now focused on transforming their core operations and are working on AI-based technologies. Further, due to pandemics, the vendors are also focused on offering quality self-service capabilities, which are highly customized as per customer’ requirements.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the APAC anti-money laundering solution market. The APAC anti-money laundering solution market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

APAC Anti-Money Laundering Solution Market Segmentation

APAC Anti-Money Laundering Solution Market – By Component

- Software

- Services

APAC Anti-Money Laundering Solution Market – By Deployment Type

- On-Premises

- Cloud

APAC Anti-Money Laundering Solution Market – By Product

- Transaction Monitoring

- Compliance management

- Currency transaction reporting

- Customer identity management

APAC Anti-Money Laundering Solution Market – ByIndustry

- Healthcare

- BFSI

- Retail

- IT and Telecom

- Government

- Others

APAC Anti-Money Laundering Solution Market, by Country

- Australia

- China

- India

- Japan

- South Korea

- Rest of APAC

APAC Anti-Money Laundering Solution Market -Companies Mentioned

- Accenture

- ACI WORLDWIDE, INC.

- BAE Systems plc

- EastNets.com

- LexisNexis Risk Solutions Group

- Nasdaq Inc.

- NICE Ltd.

- Open Text Corporation

- Oracle Corporation

- SAS Institute Inc.

Asia Pacific Anti-Money Laundering Solution Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 376.59 Million |

| Market Size by 2027 | US$ 1,681.34 Million |

| CAGR (2020 - 2027) | 17.9 % |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For