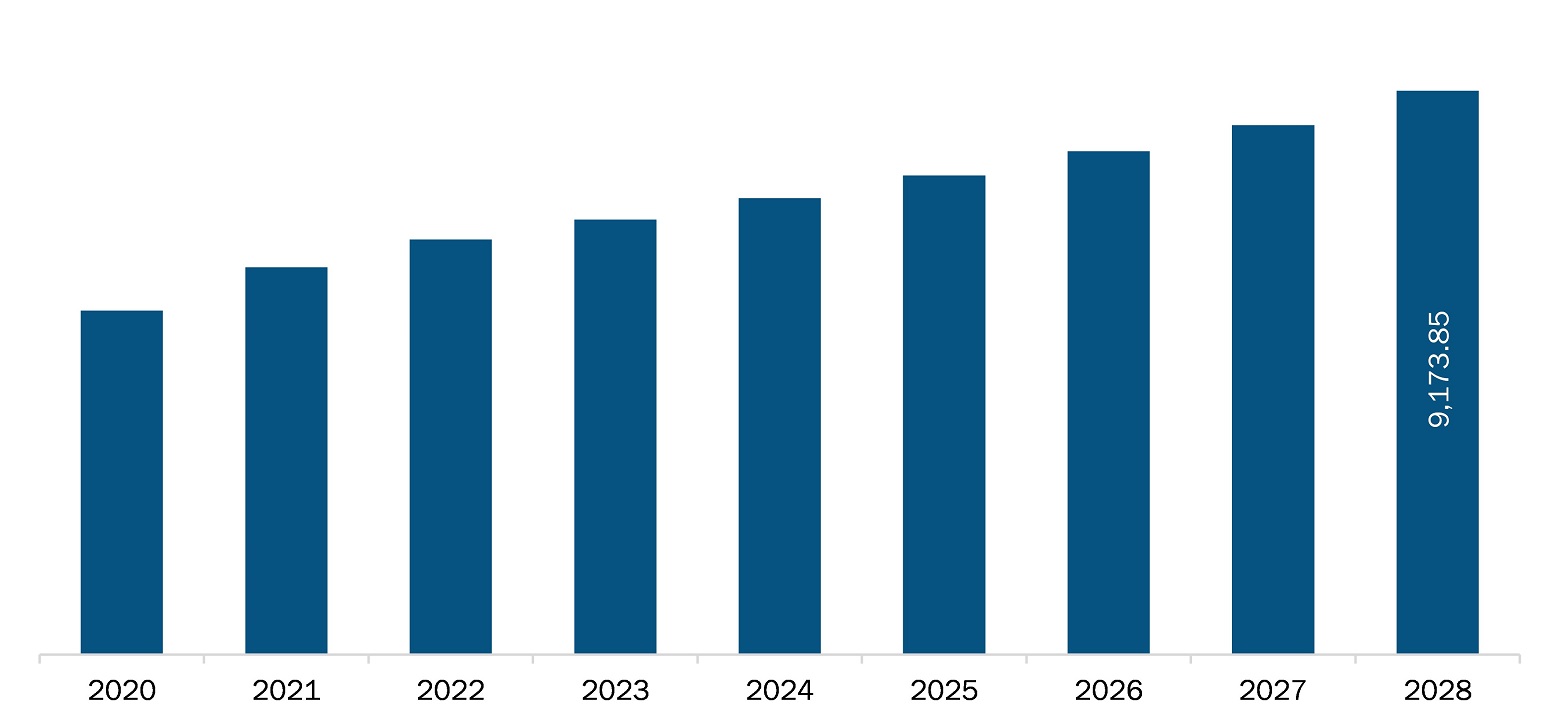

The Asia Pacific dual clutch transmission market is expected to reach US$ 9173.85 million by 2028 from an estimated value of US$ 6301.50 million in 2021; it is likely to grow at a CAGR of 5.5% from 2021 to 2028.

The factors driving the market's growth are the increasing demand for hybrids and DCT in Heavy Commercial Vehicle (HCVs) and the mounting demand for class A/B vehicles. However, the growing adoption of electric vehicles and their high costs may hamper the growth of the Asia Pacific dual clutch transmission market during the forecast period.

The application of dual-clutch transmission is efficiently boosting the driving experience as it improves acceleration and offers smooth gear shifting. Hence, DCT is gradually being used in vehicles across developing economies like China, India, and South Korea. Furthermore, the rising adoption of hybrid vehicles across the globe, coupled with the increasing integration of DCT, is creating attractive sales opportunities. Hybrid vehicles are designed for better fuel efficiency, minimum CO2 emissions, and more power. The HCVs obtain electrical energy generated from different sources, such as dual clutch transmission systems. Thus, it can conserve energy by shutting down the engine when the car is parked, idle, or when the electric motor's energy is sufficient to drive the vehicle without assistance from the ICE. The integration of DCTs in vehicles tends to offer better fuel economy than automatic transmissions and smoother performance than manual transmissions. As the DCTs shift smoothly and with a high degree of precision, they have often been preferred in the arena of performance, and therefore, they are being integrated with HCVs. This is creating a huge opportunity for DCT manufacturers to design efficient DCTs. The main benefits of dual-clutch transmissions (DCTs) are a higher energy efficiency than automatic transmission systems with torque converters and the capability to fill the torque gap during gear shifts to allow seamless longitudinal acceleration profiles. Therefore, DCTs are viable alternatives to automated manual transmissions (AMTs).

For vehicles equipped with engines that can generate considerable torque, significant clutch-slip energy losses occur during power-on gear shifts. As a result, DCTs need wet clutches for effective heat dissipation. However, with the rising demand for low-end cars such as hatchbacks, the market for the hot hatch is gaining traction. Hot hatches generate a considerable amount of power compared to their standard version cars and are the OEMs transmission of choice are DCTs. So, the concept of hot hatches is consistently rising, and so is the demand for faster shifting transmissions. Torque converters are a great choice with less space; however, enthusiasts in this category are demanding much faster-shifting DCTs. Thus, it is expected that with the rise in demand for hot hatches in the future, the demand for DCTs is also set to increase.

COVID-19 that emerged in China has affected several neighboring countries such as India, South Korea, and Japan. The governments in Asia Pacific are taking possible steps to reduce novel coronavirus effects by announcing lockdowns, which is impacting the revenue generated by the market. China and India are among the leading manufacturing sectors in the region and the most affected countries in the Asia Pacific region. Several markets have witnessed negative growth trends in the first half of 2020, and the lockdown has severely impacted the automotive sector across the region. In Japan, the vehicle sales crossed 326,000 units in August 2020, declining 16% on a Y-o-Y basis.

Similarly, in South Korea, the new vehicles sales in the country from the top five automakers—Hyundai, Kia, SsangYong Motor, Renault, and General Motors—have declined close to 6%, reaching around 112,000 units. Thus, with the declining vehicle sales in Asia Pacific, the demand for dual clutch transmission was decreased in 2020. However, in 2021, with the relaxation of lockdown measures and the beginning of the vaccination process, the manufacturing of passenger cars and commercial cars has started again. Therefore, this will lead to the growth of the dual clutch transmission market in the region.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

ASIA PACIFIC DUAL CLUTCH TRANSMISSION MARKET SEGMENTATION

By Vehicle Type

- Passenger Car

- Commercial Vehicle

By Propulsion Type

- Internal Combustion Engine (ICE)

- Hybrid

By Vehicle Segment

- A/B

- C

- D

- E and Above

- SUV

By Forward Gears

- 6 and Below

- 7

- 8 and Above

By Country

- India

- South Korea

- Japan

- China

- Rest of Asia Pacific

Company Profiles

- Magna International Inc.

- Schaeffler Technologies AG & Co. KG

- BorgWarner Inc.

- Daimler AG

- Volkswagen AG

- ZF Friedrichshafen AG

- OC Oerlikon Management AG

- Ricardo

- Renault Group

- Hyundai Transys

Asia Pacific Dual Clutch Transmission Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 6301.50 Million |

| Market Size by 2028 | US$ 9173.85 Million |

| CAGR (2021 - 2028) | 5.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Vehicle Type

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For