Asia Pacific Vaccines Market Growth, Size, Share, Trends, Key Players Analysis, and Forecast till 2031

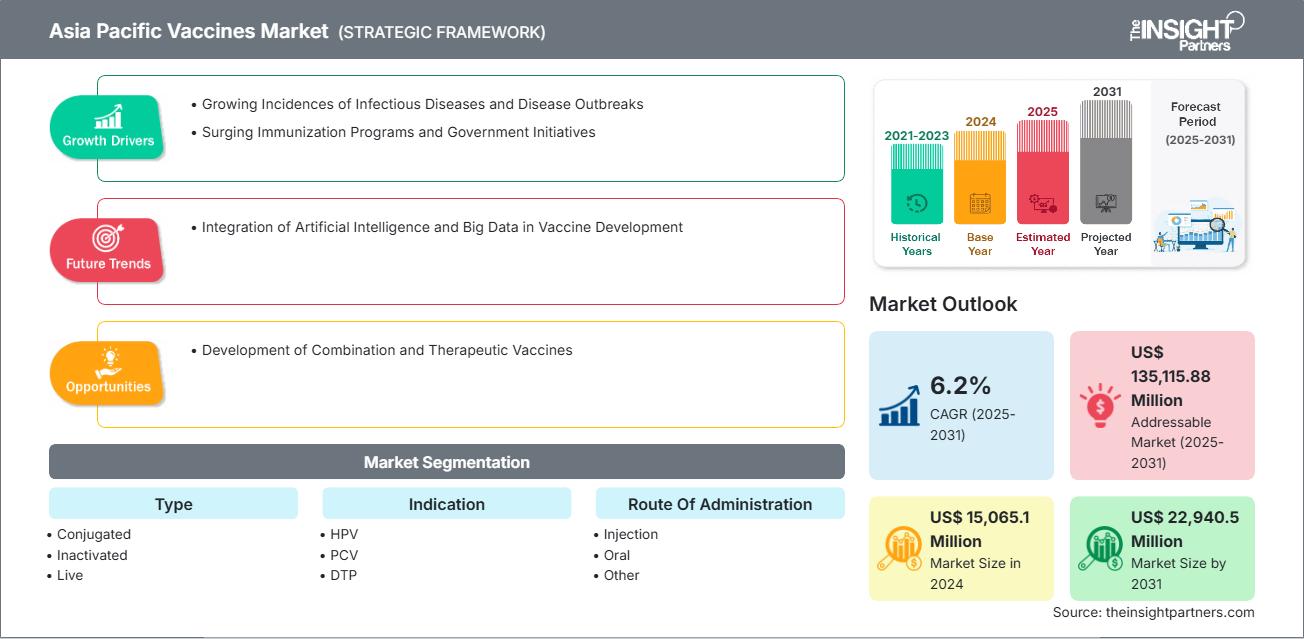

Asia Pacific Vaccines Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Conjugated Vaccines, Inactivated Vaccines, Live Vaccines, Recombinant Vaccines, and Toxoid Vaccines), Indication (HPV, PCV, DTP, Hepatitis, Influenza, Dengue, and Other), Route of Administration (Injection, Oral, and Other), and Age Group (Pediatric and Adult)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Status : Published

- Report Code : TIPRE00005749

- Category : Life Sciences

- No. of Pages : 207

- Available Report Formats :

The Asia Pacific Vaccines Market size is expected to reach US$ 22,940.5 Million by 2031 from US$ 15,065.1 Million in 2024. The market is estimated to record a CAGR of 6.2% from 2025 to 2031.

Executive Summary and Asia Pacific Vaccines Market Analysis:

Asia Pacific has solidified its position as a leading hub for vaccine research and development, leveraging its advantages in cost-efficiency, diverse demographics, and rapid participant recruitment rates. With a significant share in both prophylactic and therapeutic vaccine trials, the region demonstrates strategic importance in shaping the future of global vaccine innovation. According to the Global Health Press, Asia Pacific leads the world with 46% of global prophylactic vaccine trials and 31% of therapeutic vaccine trials, surpassing other regions in both trial volume and operational efficiency.

Additionally, extensive public health campaigns and universal immunization goals have contributed to higher vaccine coverage rates. Additionally, the need for pandemic preparedness in the wake of COVID-19 has intensified investments in research and development, as well as manufacturing capacity. The region's improving healthcare infrastructure and well-established cold chain logistics ensure the efficient storage and distribution of vaccines, even to remote areas.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAsia Pacific Vaccines Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Asia Pacific Vaccines Market Segmentation Analysis:

- By Type, the Asia Pacific Vaccines Market is segmented into Conjugated Vaccines, Inactivated Vaccines, Live Vaccines, Recombinant Vaccines, and Toxoid Vaccines. The Conjugated Vaccines segment held the largest share of the market in 2024.

- By Indication, the Asia Pacific Vaccines Market is segmented into HPV, PCV, DTP, Hepatitis, Influenza, Dengue, and Other. The HPV segment held the largest share of the market in 2024.

- By Route of Administration, the Asia Pacific Vaccines Market is segmented into Injection, Oral, and Other. The injection segment held the largest share of the market in 2024.

- By Age Group, the Asia Pacific Vaccines Market is segmented into Pediatric and Adult. The pediatric segment held the largest share of the market in 2024.

Asia Pacific Vaccines Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 15,065.1 Million |

| Market Size by 2031 | US$ 22,940.5 Million |

| CAGR (2025 - 2031) | 6.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By By Type

|

| Regions and Countries Covered |

Asia Pacific

|

| Market leaders and key company profiles |

|

Asia Pacific Vaccines Market Players Density: Understanding Its Impact on Business Dynamics

The Asia Pacific Vaccines Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Asia Pacific Vaccines Market Outlook

The World Health Organization (WHO) has identified over 30 priority pathogens that could lead to global public health emergencies. These include influenza A viruses, dengue virus, and monkeypox virus. Recently, there has been a global increase in the frequency of infectious disease outbreaks in humans. These outbreaks are caused by bacteria and viruses, most of which originate in animals or are transmitted by vectors. According to the Influenza Surveillance and Response System (GISRS) from sentinel surveillance locations, SARS-CoV-2 activity has increased globally. As of May 11, 2025, the test positivity rate was 11% across 73 reporting countries, regions, and territories. This rate is comparable to the peak observed in July 2024, which was 12% from 99 countries, and represents an increase from the 2% reported by 110 countries in mid-February 2025.

As of April 2024, the WHO reported over 7.6 million dengue cases, including 3.4 million confirmed cases, over 16,000 severe cases, and more than 3,000 deaths. Currently, 90 countries are experiencing active dengue transmission.

According to the Council on Foreign Relations, during 2022-2023, a global mpox outbreak resulted in 87,000 reported cases and 140 confirmed deaths across 111 countries. WHO declared the outbreak a Public Health Emergency of International Concern (PHEIC).

According to the WHO, in 2022, ~254 million people were living with hepatitis B, and 50 million with hepatitis C. Half of those affected by chronic hepatitis B and C infections were aged between 30 and 54 years, while 12% were children under 18 years old. Across all regions, only 13% of individuals with chronic hepatitis B infection had been diagnosed, and about 3% (i.e., ~7 million) had received antiviral therapy by the end of 2022. For hepatitis C, 36% had been diagnosed, and 20% (i.e., roughly 12.5 million) had received curative treatment. Hepatitis is preventable through vaccination, and various organizations are proposing strategies to prevent premature deaths from hepatitis. As per the WHO estimates, 4.5 million deaths can be prevented in low- and middle-income countries by 2030. WHO Member States are endorsing the WHO's global hepatitis strategy with an aim to reduce new hepatitis infections by 90% and deaths by 65% by 2030.

Outbreaks of contagious diseases significantly increase the public and government demand for vaccines. When diseases such as measles, dengue, or COVID-19 emerge or spread rapidly, the urgency to control the outbreak drives up the demand for vaccinations. For example, the global COVID-19 pandemic created unprecedented demand for vaccines worldwide, with both governments and individuals seeking rapid immunization to curb the spread of the virus and reduce mortality rates. As per the WHO, global immunization efforts have saved an estimated 154 million lives over the past 50 years, which translates to the equivalent of six lives saved every minute each year. The measles vaccination had the most significant impact on reducing infant mortality, accounting for 60% of the lives saved through immunization. As of April 2024, 84% of infants were protected with three doses of vaccine against diphtheria, tetanus, and pertussis (DTP), which serves as the global benchmark for immunization coverage.

Therefore, the surging prevalence of infectious diseases and rising vaccine-preventable disease outbreaks increase the demand for vaccines.

Asia Pacific Vaccines Market Country Insights

By country, the Asia Pacific Vaccines Market is segmented into China, Japan, India, Australia, South Korea, and the Rest of APAC. China held the largest share in 2024.

China is gearing up to supply the world with affordable vaccines that fulfil all efficacy, safety, and quality requirements. China has come a long way since 1978, when it introduced an expanded program on immunization (EPI), and a largely state-run vaccine manufacturing industry grew up to meet the resulting demand. China is currently producing nearly all of the commonly used vaccines for viral diseases such as influenza, measles, rabies (for humans), mumps, rotavirus, hepatitis A and B, and for bacterial diseases, including typhoid, tetanus, and diphtheria.

The first respiratory syncytial virus (RSV) prophylaxis for all infants, Levitra/Beyfortus (nisevizumab injection), a long-acting monoclonal antibody jointly developed by Sanofi and AstraZeneca, has been formally approved for marketing by the National Medical Products Administration (NMPA) of China and is expected to be available in China during 2024-2025. With a single injection, it can provide timely, rapid, and direct immunoprotection against RSV-induced lower respiratory tract infections for all infants (healthy/special health status, full-term/premature, born inside and outside of the season of infection).

Chinese companies such as AIM Vaccine Co., Ltd. are advancing mRNA vaccines, including those targeting RSV, and developing combination vaccines, reflecting a trend toward innovative vaccine platforms.

Asia Pacific Vaccines Market Company Profiles

Some of the key players operating in the market includeAbbott Laboratories, GSK Plc, Pfizer Inc., Merck & Co. Inc., Novartis AG, Sanofi SA, CSL Ltd, Serum Institute of India Pvt Ltd, BioNTech SE, and Sinovac Biotech Ltd.

These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

Asia Pacific Vaccines Market Research Methodology

The following methodology has been followed for the collection and analysis of data presented in this report:

Secondary Research

The research process begins with comprehensive secondary research, utilizing internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

- Company websites, annual reports, financial statements, broker analyses, and investor presentations

- Industry trade journals and other relevant publications

- Government documents, statistical databases, and market reports

- News articles, press releases, and webcasts specific to companies operating in the market

Note:

All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.Primary Research

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

- Validate and refine findings from secondary research

- Enhance the expertise and market understanding of the analysis team

- Gain insights into market size, trends, growth patterns, competitive dynamics, and future prospects

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

- Industry stakeholders: Vice Presidents, Business Development Managers, Market Intelligence Managers, and National Sales Managers

- External experts: Valuation specialists, research analysts, and key opinion leaders with industry-specific expertise

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For