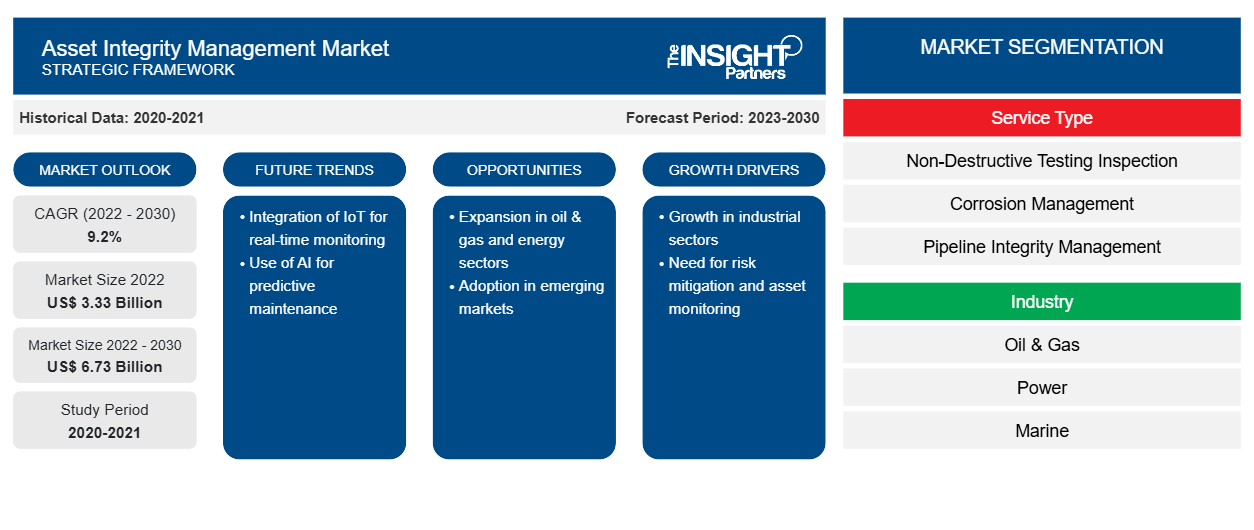

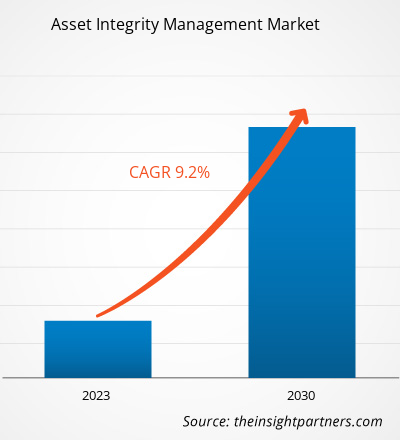

[Research Report] The asset integrity management market was valued at US$ 3.33 billion in 2022 and is expected to reach US$ 6.73 billion by 2030; it is estimated to record a CAGR of 9.2% from 2022 to 2030. The asset integrity management market trends include the integration of IIoT with asset integrity management solutions.

Analyst Perspective:

The asset integrity management market forecast can help stakeholders in this marketplace plan their growth strategies. An asset integrity management system is linked to any asset's activities such as governance and monitoring in order to maintain a firm's successful operation while minimizing dangers and risks. The rise in the need for operational safety of aging assets in risk-based industries is driving the asset integrity management market.

Operational efficiency for assets in oil & gas, mining, and power industries is considered foremost important; thus, regular maintenance of these assets is important to gain maximum productivity. Chemicals and oil & gas products are corrosive and flammable, thus requiring continuous inspection and maintenance of the equipment for overall operational efficiency and safety. Moreover, the expansion of the oil & gas industry with the increase in demand for oil & gas and growth in the power industry across several countries is anticipated to create several opportunities for the asset integrity management market growth during the forecast period.

With the rise in digital transformation in a wide range of industries, the oil & gas industry plays a key role in the industrial revolution and economic growth worldwide. The major factor driving the evolution of this industry is the high demand for electricity, power, automobiles, and aircraft due to the rapidly growing population. Globally, oil supply is expected to increase rapidly to meet the rise in energy demand owing to the depletion of existing oil reserves. According to the International Energy Agency (IEA), as of June 2023, worldwide oil demand is anticipated to increase by 6% between 2022 and 2028 and reach 105.7 million barrels per day (mb/d) due to tremendous demand from the petrochemical and aviation industries. Hence, an increased demand for oil and gas in the petrochemicals and aviation sectors is also propelling the oil & gas industry, facilitating the expansion of the asset integrity management market share.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Asset Integrity Management Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Asset Integrity Management Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Asset Integrity Management Market Overview:

Asset integrity management is a form of asset management standard that focuses on protecting equipment, health, and the environment. It functions effectively and efficiently to maintain the consistent functioning of assets and offers several advantages, including reduced risks and better reliability, increased safety, and improved environmental performance. This is commonly used in the oil & gas, mining, aerospace, and other industries.

The asset integrity management market is anticipated to witness growth in the coming years. This is attributed to various factors, including an increase in the need for operational safety of aging assets in risk-based industries and strict government-led safety regulations. Furthermore, the expansion of the oil & gas industry, along with the increase in demand for oil and gas, is expected to create growth opportunities for the market players in the coming years. However, the cost involved in non-value-added maintenance and improper operation of assets hampers the asset integrity management market growth.

Asset Integrity Management Market Driver:

Increase in Need for Operational Safety of Aging Assets in Risk-Based Industries

Asset integrity management software protects the capability of an asset to perform its functions effectively, as well as manages corporate assets to gain profitability. Asset integrity management software offers various services, including design, inspection, maintenance, and operations, which highly impact the integrity of infrastructure and equipment. It also provides auditing, inspections, overall quality processes, and other tools for the effective integrity management of assets. Industries such as petrochemicals, oil & gas, renewable energy, power, and infrastructure opt for these services to achieve increased productivity while meeting environmental and safety concerns. These industries are risk-based and highly asset-based; hence, maintenance and inspection of such assets are essential. In the oil & gas industry, performance and operational risk levels are dependent upon the integrity of the assets, such as subsea equipment, platform topsides, structures, gas processing plants, pipelines, refineries, compressors, and gas distribution networks, throughout the value chain. Operational efficiency for assets is highly necessary in oil & gas, mining, and power industries; thus, regular maintenance of these assets is important to gain maximum productivity. Thus, the necessity of operational safety with the help of asset integrity management solutions is driving the asset integrity management market.

Chemicals and oil & gas products are corrosive and flammable and require continuous inspection and maintenance of the equipment for overall operational efficiency and safety. The asset integrity management services ensure improved reliability, productivity, and safety of the equipment to achieve quality performance sustainably. Various market players across the globe are providing asset integrity management software to manage performance and operational risk. For example, DNV Group AS provides the Synergi asset integrity software suite, which offers a core platform to support effective risk-based integrity management in risk-based industries such as oil & gas. Thus, the need for operational safety of aging assets in risk-based industries is among the factors contributing to the growing asset integrity management market size.

Segment Analysis:

The asset integrity management market is bifurcated into service type and industry. Based on service type, the market is segmented into non-destructive testing (NDT) inspection, corrosion management, pipeline integrity management, structural integrity management, risk-based inspection (RBI), and others. Based on industry, the market is segmented into oil & gas, power, marine, mining, aerospace, and others.

Regional Analysis:

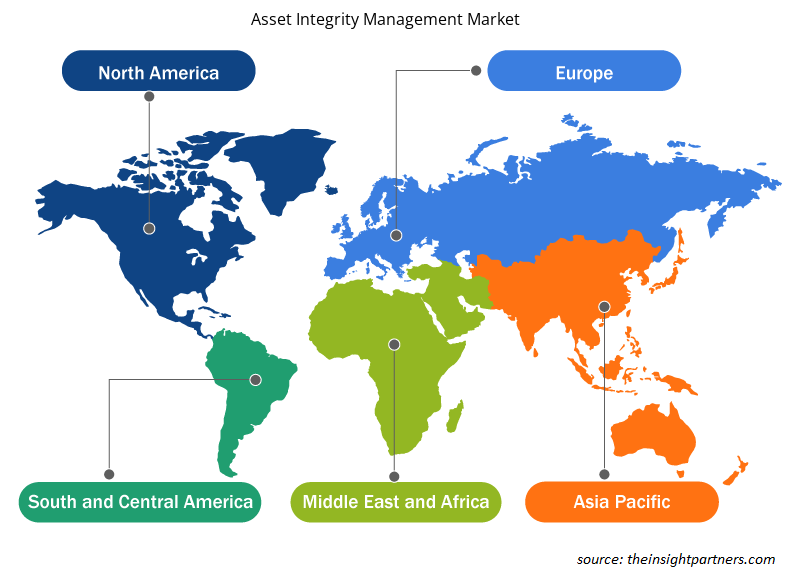

The asset integrity management marketreport includes North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. In terms of revenue, North America dominated the asset integrity management market share. The North America asset integrity management market is segmented into the US, Canada, and Mexico. All three countries are witnessing increased adoption of asset integrity management services during the last few years. Oil & gas, chemical, power, and natural resource industries rely on proprietary infrastructure to run their operation, and this infrastructure is rapidly aging, which increases the risk of failure.

In the oil & gas industry, the infrastructure of the majority of mature oil fields is old, which leads to corrosion, scaling, and damaged well equipment and causes other well-integrity problems. These issues increase the operational risk for companies and utilities, requiring more capital in infrastructure upgrade projects. The oil & gas industry in North America needs to follow several government policies and regulations to protect the environment, preserve cultural resources, and protect workers’ health and safety. The region's upstream and midstream infrastructure is enormous.

The US is the largest producer of oil and natural gas, which involves exploration, refining, and transportation activities. Also, in the US, drillers added new oil rigs, which brought the total number of oil rigs to 862. The US has over 2.5 million km of oil and gas pipelines, whereas Canada has ~800,000 km of pipelines. As a result of its massive and aging infrastructure, North America is likely to dominate the market during the forecast period. Further, the US has a few of the oldest power generation systems in the world. The US is the world's leading energy producer, and hydraulic fracturing and horizontal drilling are technologies that helped increase energy production in this country. Thus, strict government regulations and the presence of a huge gas pipeline network are expected to generate opportunities to increase the adoption of asset integrity management across various industries, which is likely to fuel the North America asset integrity management market growth.

Key Player Analysis:

The asset integrity management market analysis is based on the annual performances of major players such as SGS AG; Intertek Group plc; Aker Solutions ASA; Bureau Veritas SA; Fluor Corporation; DNV GL AS; John Wood Group PLC; Oceaneering International, Inc.; Rosen Group; and Cybernetix SA. Several other essential asset integrity management market players were analyzed to get a holistic view of the market and its ecosystem. The asset integrity management market report emphasizes the key factors driving the market and prominent players' developments.

Asset Integrity Management Market Regional Insights

The regional trends and factors influencing the Asset Integrity Management Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Asset Integrity Management Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Asset Integrity Management Market

Asset Integrity Management Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 3.33 Billion |

| Market Size by 2030 | US$ 6.73 Billion |

| Global CAGR (2022 - 2030) | 9.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Service Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Asset Integrity Management Market Players Density: Understanding Its Impact on Business Dynamics

The Asset Integrity Management Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Asset Integrity Management Market are:

- SGS SA

- Intertek Group Plc

- Aker Solutions ASA

- Bureau Veritas SA

- Fluor Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Asset Integrity Management Market top key players overview

Recent Developments:

Companies in the asset integrity management market focus on both inorganic and organic strategies for their business growth. A few recent key market developments by the above asset integrity management market players are listed below:

- In May 2023, SGS participated in the Middle East Asset Integrity Management Conference and Showcase (AIMCS) in Abu Dhabi, UAE. The event was organized under the technical chairmanship of ADNOC Gas Processing. Over 300 industry experts and professionals were invited to discuss the latest trends and best practices in asset integrity management.

- In March 2021, Stork, a Fluor company, was awarded a two-year contract extension by Chrysaor Holdings Limited to deliver offshore integrated specialist asset integrity services in the UK. The company will continue delivering an inclusive range of asset management solutions and capabilities to extend the offshore assets' life cycle through this contract for the Armada, Everest, and Lomond platforms in the central North Sea.

Frequently Asked Questions

Which is the leading service type segment in the asset integrity management market?

The non-destructive testing (NDT) inspection segment led the asset integrity management market with a significant share in 2022 and corrosion management segment is expected to grow with the highest CAGR.

What are the driving factors impacting the asset integrity management market?

Increase in need for operational safety of aging assets in risk-based industries and stringent government safety regulations are driving factors of asset integrity management market.

What is the estimated market size for the asset integrity management market in 2022?

The asset integrity management market was estimated to be valued at US$ 3.33 billion in 2022 and is projected to reach US$ 6.73 billion by 2030; it is expected to grow at a CAGR of 9.2% during the forecast period.

Which is the fastest-growing region in asset integrity management market?

APAC is anticipated to grow with the highest CAGR over the forecast period.

Which key players hold the major market share of the asset integrity management market?

The key players holding majority shares in the asset integrity management market include Fluor Corporation, Aker Solutions, Intertek Group plc, John Wood Group PLC, and Bureau Veritas.

What are the future trends of the asset integrity management market?

The integration of digital twin and IIoT with asset integrity management software is expected to drive the growth of the asset integrity management market in the coming years.

What will be the asset integrity management market size by 2030?

The asset integrity management market is expected to reach US$ 6.73 billion by 2030.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Parking Meter Apps Market

- eSIM Market

- Advanced Distributed Management System Market

- Online Exam Proctoring Market

- Electronic Data Interchange Market

- Barcode Software Market

- Maritime Analytics Market

- Cloud Manufacturing Execution System (MES) Market

- Robotic Process Automation Market

- Digital Signature Market

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Asset Integrity Management Market

- SGS SA

- Intertek Group Plc

- Aker Solutions ASA

- Bureau Veritas SA

- Fluor Corp

- DNV Group AS

- John Wood Group Plc

- ROSEN Group

- TechnipFMC plc

- Oceaneering International Inc

Get Free Sample For

Get Free Sample For