Automotive Tire Aftermarket Market Growth and Analysis by 2031

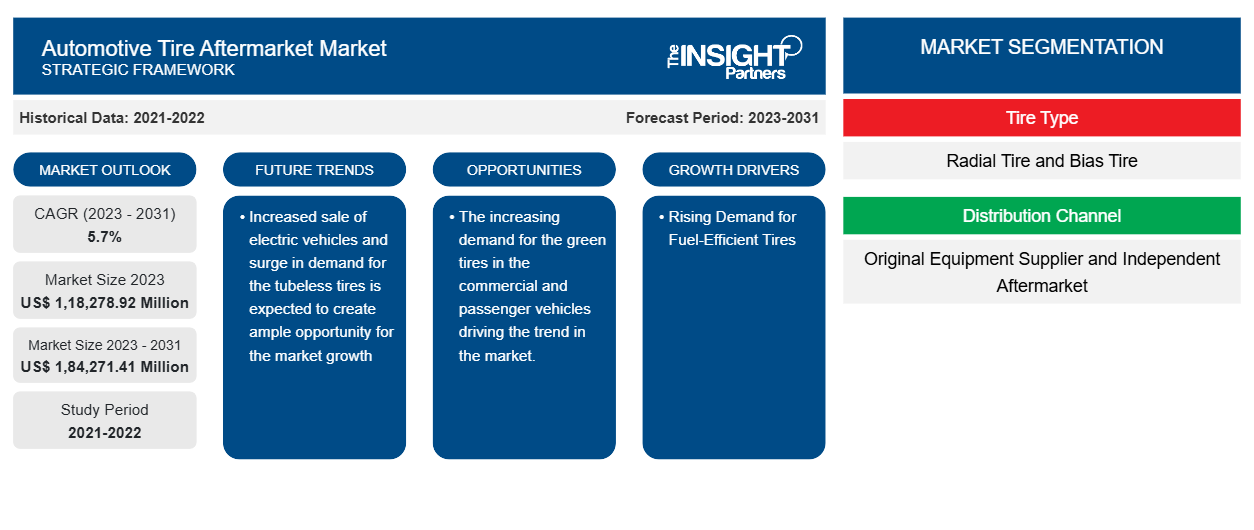

Automotive Tire Aftermarket Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Tire Type (Radial Tire and Bias Tire), Distribution Channel (Original Equipment Supplier and IAM), and Rim Size (13-15, 16-18, 19-21, and more than 21), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles) and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2023-2031- Report Date : Apr 2026

- Report Code : TIPRE00028388

- Category : Automotive and Transportation

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

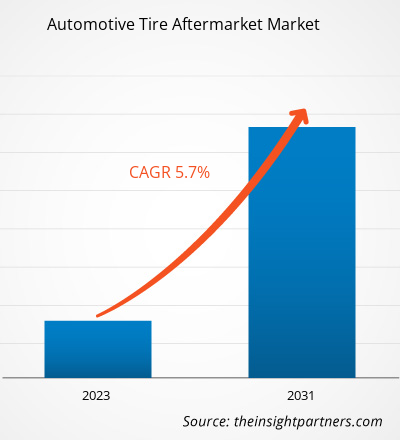

The automotive tire aftermarket market size is projected to reach US$ 1,84,271.41 million by 2031 from US$ 1,18,278.92 million in 2023. The market is expected to register a CAGR of 5.7% during 2023–2031. The increasing demand for the green tires in the commercial and passenger vehicles driving the trend in the market.

Automotive Tire Aftermarket Market Analysis

Manufacturers of brake friction products face a significant challenge as vehicle components live longer. OEMs prefer long-lasting brake friction products that fade less quickly due to controlled friction, reduced wear, reduced noise, and reduced roughness. Additionally, OEMs and manufacturers consider durability across a resistance to water washout, wide service temperature range, clean assembly of brake-Caliper components, road contaminants, and oxidation, and when developing brake friction products. Regenerative braking has been used in battery-operated electric vehicles in recent years. The electric vehicle manufacturers are adopting advanced frictional products to smoothly run the vehicles. Metal rotor discs are used in the manufacturing of electric vehicles. With the increased sales of electric vehicles, the demand for the Automotive Tire Aftermarket market is growing at a rapid pace during the forecast period as these brake frictional products are lighter and highly efficient. Therefore, with the increasing demand for eco-friendly transportation with high demand for electric vehicles, there is expected to be ample opportunity for the Automotive Tire Aftermarket market growth.

Automotive Tire Aftermarket Market Overview

The most significant part of a vehicle is the tire, which is positioned on the rims and transfers vehicle propulsion. Tires also absorb and reduce the impacts of multiple road conditions. Materials such as fabric, wire, natural rubber, carbon black, synthetic rubber, and other chemical compounds are used to manufacture automotive tires. Tire manufacturers are constantly spending on research & development to produce high-performance tires and incorporate nanotechnology into tire manufacturing.

An automotive tire consists of a tread and a body. The tread provides traction while the body provides containment for a quantity of compressed air. Before rubber was developed, the first few versions of tires were simply bands of metal fitted around wooden wheels to prevent wear and tear. Early rubber tires were solid (not pneumatic). Pneumatic tires are now used on many vehicles, including cars, bicycles, motorcycles, buses, trucks, heavy equipment, and aircraft. Metal tires are still used on locomotives and railcars; however, solid rubber (or other polymers) tires are used in various nonautomotive applications, such as casters, carts, lawnmowers, and wheelbarrows.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAutomotive Tire Aftermarket Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automotive Tire Aftermarket Market Drivers and Opportunities

Rising Demand for Fuel-Efficient Tires

Fuel is one of those commodities whose prices are constantly changing. In recent years, the price has continued to rise rather than fall. Consumers might save money by installing fuel-efficient tires on their vehicles. Fuel-efficient tires are also known as low rolling resistance tires. Rolling resistance is the force necessary to keep the automobile moving at any given speed. The degree of friction exerted on the tires determines the quantity of fuel and energy to be used. Low rolling resistance tires require less power to maintain rolling, thereby reducing total fuel usage. Low rolling resistance tires are in high demand due to growing consumer demand, climate change, and a lower overall carbon footprint of fuel-efficient tires than standard tires. For instance, Michelin Energy Saver A/S All-Season is widely regarded as one of the best fuel-efficient tires and is a popular choice among most drivers. These factors lead to the growth of the automotive tire aftermarket.

Increased sale of electric vehicles and surge in demand for the tubeless tires is expected to create ample opportunity for the market growth

Electric vehicles require specific tires. According to the vehicle manufacturer, its tire must have greater weight than internal combustion cars and transmit more torque to the road when driving after a halt. Tire noise is more noticeable in electric cars than internal combustion vehicles because of their near-silent powertrains, mainly hidden by engine noise. The introduction of electric vehicles and their significantly lower propulsion noise emission allow assessing tire-road noise with higher accuracy via cruise-by measurements, even at speeds where a combustion engine propulsion system would usually disturb the measurement results. The rolling resistance rating provided by the European Union tire label has been used as the primary selection criterion for potential tires for EVs.

Automotive Tire Aftermarket Market Report Segmentation Analysis

Key segments that contributed to the derivation of the automotive tire aftermarket market analysis are tire type, distribution channel, rim size, vehicle type, and geography.

- Based on tire type, market is divided into radial tire and bias tire. Among these, radial tire has larger share in 2023, owing to increasing automotive production.

- Based upon the distribution channel, the market is divided into OES and IAM. Among these original equipment suppliers has the largest share in 2023.

- Depending rim size, the market is divided into 13-15, 16-18, 19-21, and more than 21.

- Depending upon the vehicle type, the market is divided into passenger cars, light commercial vehicles, and heavy commercial vehicles. Among these, passenger vehicles have a larger share in 2023, this is owing to increasing passenger cars sale across the globe.

Automotive Tire Aftermarket Market Share Analysis by Geography

The geographic scope of the automotive tire aftermarket market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

APAC is considered to be the fastest growing economic region, with China and India as the world’s first and third fastest growing economies. Japan is the most technologically advanced country in the region giving an opportunity for the development of automotive tires market. Emerging economies of Southeast Asia such as Vietnam, Malaysia, and Indonesia are experiencing a growth in their passenger car sales, thus the demand for automotive tire aftermarket is anticipated to increase.

The automotive industry plays a significant role in the growth of Europe’s prosperity, as it accounts for a significant portion of the region’s GDP as well as provides jobs to a large number of populations. Due to these factors, the European Commission has taken several initiatives for the development of the automotive industry in the region. For example, CARS 2020 Action Plan and GEAR 2030, among others. These initiatives taken by the European government are expected to support the sustainable growth of the automotive industry in the region. This factor will further support the growth of the automotive tire aftermarket market in Europe.

Automotive Tire Aftermarket

Automotive Tire Aftermarket Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1,18,278.92 Million |

| Market Size by 2031 | US$ 1,84,271.41 Million |

| Global CAGR (2023 - 2031) | 5.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Tire Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Automotive Tire Aftermarket Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Tire Aftermarket Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Automotive Tire Aftermarket Market News and Recent Developments

The automotive tire aftermarket market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Automotive Tire Aftermarket Market are listed below:

- MRF, India's largest tyre manufacturer, recently launched the new STEEL BRACE radials for high-performance motorcycles. The Steel Brace radials are highly specialized tyres made specifically for high-end motorcycles that demand extraordinary performance under extreme conditions. (Source: Company Website, July 2023)

- Continental today presented its most sustainable series tire to date - the UltraContact NXT. With up to 65 percent renewable, recycled and mass balance certified materials, it combines a remarkably high share of sustainable materials with maximum safety and performance. Continental is the first manufacturer to launch a tire with both a high share of sustainable materials and maximum EU tire-label performance in volume production.). (Source: Press Release, June 2023)

Automotive Tire Aftermarket Market Report Coverage and Deliverables

The “Automotive Tire Aftermarket Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Automotive Tire Aftermarket market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Automotive Tire Aftermarket market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Automotive Tire Aftermarket market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Automotive Tire Aftermarket market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For