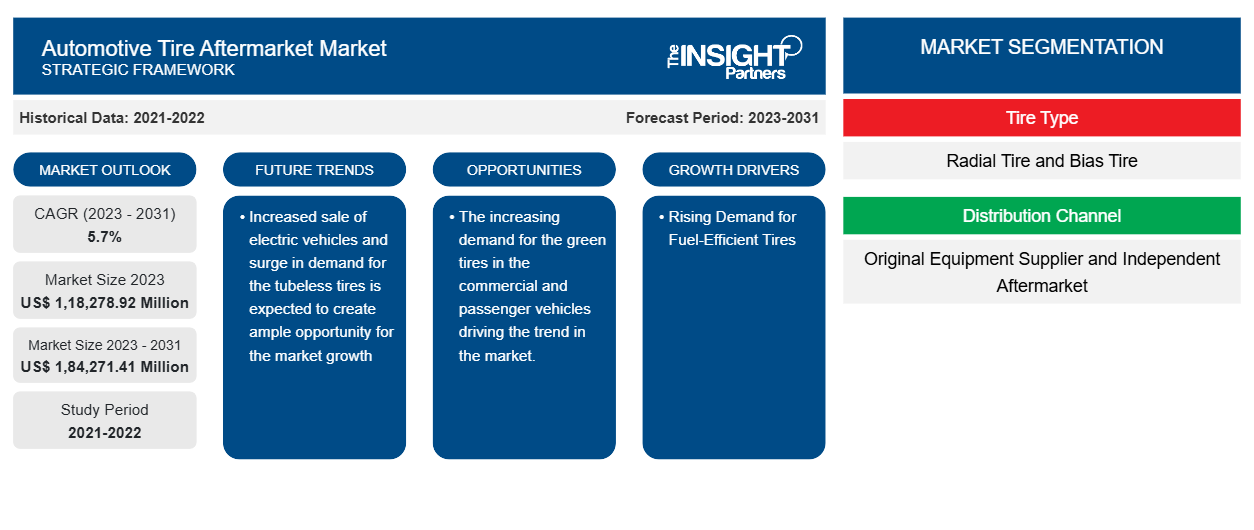

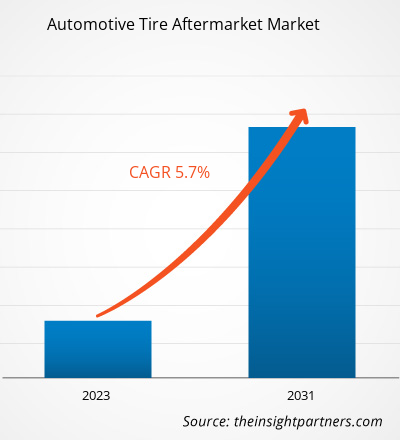

The automotive tire aftermarket market size is projected to reach US$ 1,84,271.41 million by 2031 from US$ 1,18,278.92 million in 2023. The market is expected to register a CAGR of 5.7% during 2023–2031. The increasing demand for the green tires in the commercial and passenger vehicles driving the trend in the market.

Automotive Tire Aftermarket Market Analysis

Manufacturers of brake friction products face a significant challenge as vehicle components live longer. OEMs prefer long-lasting brake friction products that fade less quickly due to controlled friction, reduced wear, reduced noise, and reduced roughness. Additionally, OEMs and manufacturers consider durability across a resistance to water washout, wide service temperature range, clean assembly of brake-Caliper components, road contaminants, and oxidation, and when developing brake friction products. Regenerative braking has been used in battery-operated electric vehicles in recent years. The electric vehicle manufacturers are adopting advanced frictional products to smoothly run the vehicles. Metal rotor discs are used in the manufacturing of electric vehicles. With the increased sales of electric vehicles, the demand for the Automotive Tire Aftermarket market is growing at a rapid pace during the forecast period as these brake frictional products are lighter and highly efficient. Therefore, with the increasing demand for eco-friendly transportation with high demand for electric vehicles, there is expected to be ample opportunity for the Automotive Tire Aftermarket market growth.

Automotive Tire Aftermarket Market Overview

The most significant part of a vehicle is the tire, which is positioned on the rims and transfers vehicle propulsion. Tires also absorb and reduce the impacts of multiple road conditions. Materials such as fabric, wire, natural rubber, carbon black, synthetic rubber, and other chemical compounds are used to manufacture automotive tires. Tire manufacturers are constantly spending on research & development to produce high-performance tires and incorporate nanotechnology into tire manufacturing.

An automotive tire consists of a tread and a body. The tread provides traction while the body provides containment for a quantity of compressed air. Before rubber was developed, the first few versions of tires were simply bands of metal fitted around wooden wheels to prevent wear and tear. Early rubber tires were solid (not pneumatic). Pneumatic tires are now used on many vehicles, including cars, bicycles, motorcycles, buses, trucks, heavy equipment, and aircraft. Metal tires are still used on locomotives and railcars; however, solid rubber (or other polymers) tires are used in various nonautomotive applications, such as casters, carts, lawnmowers, and wheelbarrows.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Tire Aftermarket Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Tire Aftermarket Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automotive Tire Aftermarket Market Drivers and Opportunities

Rising Demand for Fuel-Efficient Tires

Fuel is one of those commodities whose prices are constantly changing. In recent years, the price has continued to rise rather than fall. Consumers might save money by installing fuel-efficient tires on their vehicles. Fuel-efficient tires are also known as low rolling resistance tires. Rolling resistance is the force necessary to keep the automobile moving at any given speed. The degree of friction exerted on the tires determines the quantity of fuel and energy to be used. Low rolling resistance tires require less power to maintain rolling, thereby reducing total fuel usage. Low rolling resistance tires are in high demand due to growing consumer demand, climate change, and a lower overall carbon footprint of fuel-efficient tires than standard tires. For instance, Michelin Energy Saver A/S All-Season is widely regarded as one of the best fuel-efficient tires and is a popular choice among most drivers. These factors lead to the growth of the automotive tire aftermarket.

Increased sale of electric vehicles and surge in demand for the tubeless tires is expected to create ample opportunity for the market growth

Electric vehicles require specific tires. According to the vehicle manufacturer, its tire must have greater weight than internal combustion cars and transmit more torque to the road when driving after a halt. Tire noise is more noticeable in electric cars than internal combustion vehicles because of their near-silent powertrains, mainly hidden by engine noise. The introduction of electric vehicles and their significantly lower propulsion noise emission allow assessing tire-road noise with higher accuracy via cruise-by measurements, even at speeds where a combustion engine propulsion system would usually disturb the measurement results. The rolling resistance rating provided by the European Union tire label has been used as the primary selection criterion for potential tires for EVs.

Automotive Tire Aftermarket Market Report Segmentation Analysis

Key segments that contributed to the derivation of the automotive tire aftermarket market analysis are tire type, distribution channel, rim size, vehicle type, and geography.

- Based on tire type, market is divided into radial tire and bias tire. Among these, radial tire has larger share in 2023, owing to increasing automotive production.

- Based upon the distribution channel, the market is divided into OES and IAM. Among these original equipment suppliers has the largest share in 2023.

- Depending rim size, the market is divided into 13-15, 16-18, 19-21, and more than 21.

- Depending upon the vehicle type, the market is divided into passenger cars, light commercial vehicles, and heavy commercial vehicles. Among these, passenger vehicles have a larger share in 2023, this is owing to increasing passenger cars sale across the globe.

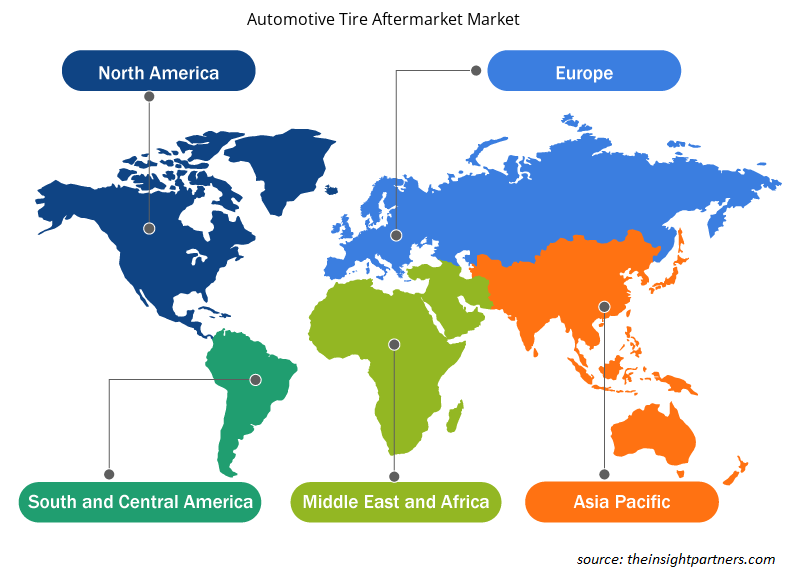

Automotive Tire Aftermarket Market Share Analysis by Geography

The geographic scope of the automotive tire aftermarket market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

APAC is considered to be the fastest growing economic region, with China and India as the world’s first and third fastest growing economies. Japan is the most technologically advanced country in the region giving an opportunity for the development of automotive tires market. Emerging economies of Southeast Asia such as Vietnam, Malaysia, and Indonesia are experiencing a growth in their passenger car sales, thus the demand for automotive tire aftermarket is anticipated to increase.

The automotive industry plays a significant role in the growth of Europe’s prosperity, as it accounts for a significant portion of the region’s GDP as well as provides jobs to a large number of populations. Due to these factors, the European Commission has taken several initiatives for the development of the automotive industry in the region. For example, CARS 2020 Action Plan and GEAR 2030, among others. These initiatives taken by the European government are expected to support the sustainable growth of the automotive industry in the region. This factor will further support the growth of the automotive tire aftermarket market in Europe.

Automotive Tire Aftermarket Market Regional Insights

The regional trends and factors influencing the Automotive Tire Aftermarket Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Automotive Tire Aftermarket Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automotive Tire Aftermarket Market

Automotive Tire Aftermarket Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1,18,278.92 Million |

| Market Size by 2031 | US$ 1,84,271.41 Million |

| Global CAGR (2023 - 2031) | 5.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Tire Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

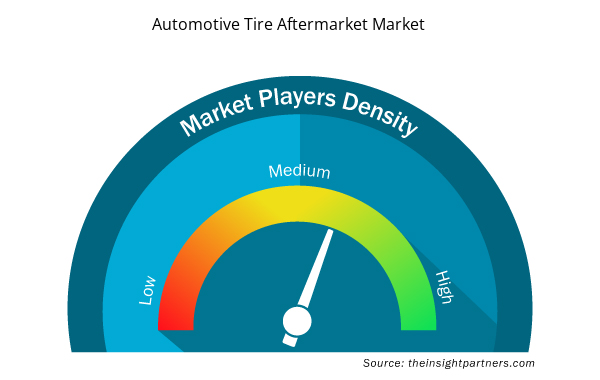

Automotive Tire Aftermarket Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Tire Aftermarket Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automotive Tire Aftermarket Market are:

- APOLLO TIRES LTD

- Continental AG

- PIRELLI AND C. S.P.A.

- Sumitomo Rubber Industries, Ltd.

- THE GOODYEAR TIRE AND RUBBER COMPANY

- YOKOHAMA RUBBER CO., LTD

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automotive Tire Aftermarket Market top key players overview

Automotive Tire Aftermarket Market News and Recent Developments

The automotive tire aftermarket market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Automotive Tire Aftermarket Market are listed below:

- MRF, India's largest tyre manufacturer, recently launched the new STEEL BRACE radials for high-performance motorcycles. The Steel Brace radials are highly specialized tyres made specifically for high-end motorcycles that demand extraordinary performance under extreme conditions. (Source: Company Website, July 2023)

- Continental today presented its most sustainable series tire to date - the UltraContact NXT. With up to 65 percent renewable, recycled and mass balance certified materials, it combines a remarkably high share of sustainable materials with maximum safety and performance. Continental is the first manufacturer to launch a tire with both a high share of sustainable materials and maximum EU tire-label performance in volume production.). (Source: Press Release, June 2023)

Automotive Tire Aftermarket Market Report Coverage and Deliverables

The “Automotive Tire Aftermarket Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Automotive Tire Aftermarket market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Automotive Tire Aftermarket market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Automotive Tire Aftermarket market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Automotive Tire Aftermarket market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Tire Type, Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, UAE, UK, US

Frequently Asked Questions

Which region dominated the automotive tire aftermarket market in 2023?

Asia Pacific is expected to dominate the automotive tire aftermarket market in 2023.

What are the driving factors impacting the Automotive Tire Aftermarket market?

Increase the demand for replacement of the tires in emerging countries such as India, China, and Japan drive the market growth. Also, increased demand for the fuel-efficient tires drives the market growth.

What are the future trends of the automotive tire aftermarket market?

The modern technologies such as ESC, adaptive cruise control adoption is driving the market trend.

Which are the leading players operating in the automotive tire aftermarket market?

Continental AG, PIRELLI AND C. S.P.A., Sumitomo Rubber Industries, Ltd., The Goodyear Tire and Rubber company, Yokohama Rubber Co., Ltd, Zhongce Rubber Group Co. Ltd., Nexen Tire America Inc., Bridgestone Corporation, Michelin.

What would be the estimated value of the automotive tire aftermarket market by 2031?

The Automotive Tire Aftermarket market size is projected to reach US$ 17,261.8 million by 2031 from US$ 11,809.2 million in 2023.

What is the expected CAGR of the automotive tire aftermarket market?

The market is expected to register a CAGR of 4.9% during 2023–2031.

Get Free Sample For

Get Free Sample For