Biocomposites Market Size and Competitive Analysis by 2028

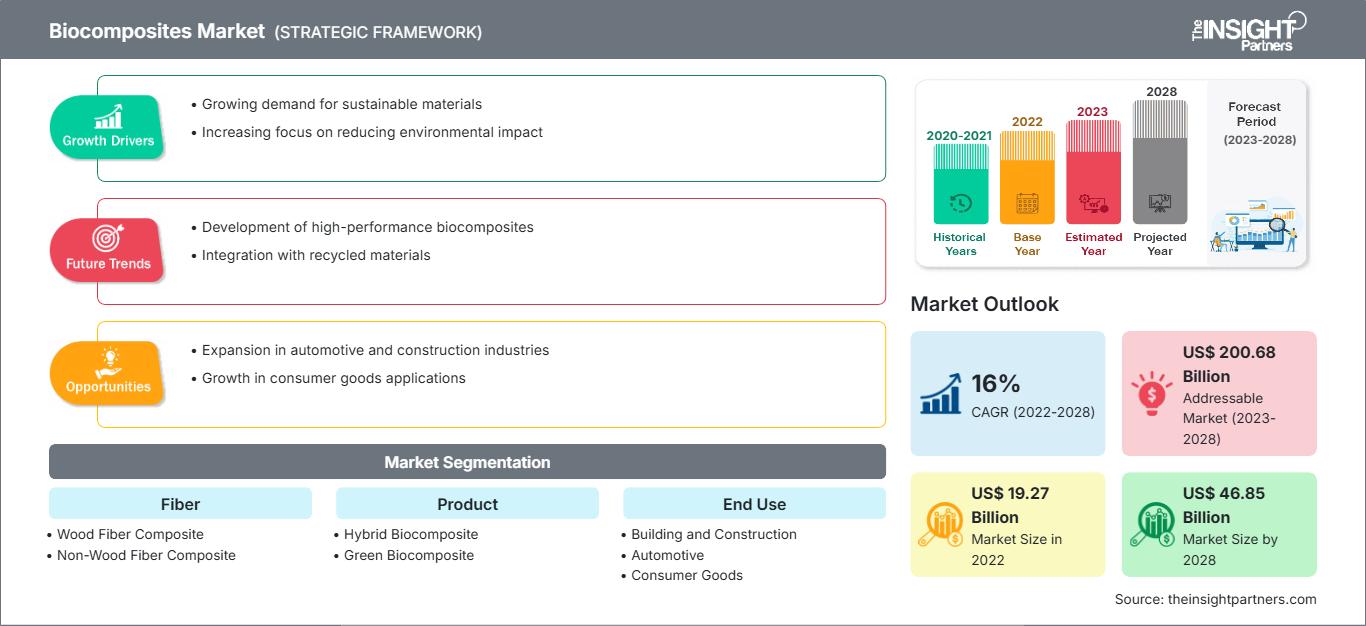

Biocomposites Market Size and Forecasts (2022 - 2028), Global and Regional Growth Opportunity Analysis By Fiber (Wood Fiber Composite and Non-Wood Fiber Composite); Product (Hybrid Biocomposite and Green Biocomposite), End Use(Building and Construction, Automotive, Consumer Goods, and Others), and Geography

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2028- Report Date : Jun 2022

- Report Code : TIPRE00003222

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 150

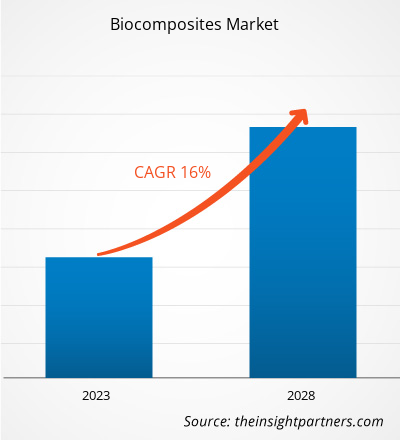

[Research Report] The biocomposites market is expected to grow from US$ 19,268.62 million in 2022 to US$ 46,851.39 million by 2028; it is estimated to grow at a CAGR of 16% from 2022 to 2028.

MARKET ANALYSIS

Biocomposites are materials formed by reinforcement of natural fibers and matrix (resin). The interest in biocomposites is rapidly growing among end use industries as applications in fundamental research, packaging, construction, military applications, aerospace, railway coaches, and automobiles due to many potential benefits such as ease in availability, high specific strength, light weight, biodegradability, recyclability, cheaper in cost, and renewability. The biocomposites are being highly used in the automotive industry for the manufacturing of interior panels. As biocomposites are eco-friendly, they are replacing polymer composites in various applications at a high price.

GROWTH DRIVERS AND CHALLENGES

The increasing use of sustainable building materials has aided the biocomposites market growth. The construction industry is one of the firmest emergent sectors in rapid urbanization owing to the growing population in urban areas. This urbanization makes the industry the most astonishing consumer of materials, most of them from non-renewable resources. According to the report from the Global Alliance for Building and Construction, the construction sector is one of the most harmful to the environment. According to the study, the construction sector is responsible for 39% of the carbon dioxide emissions dispersed in the environment, for 36% of consumption global energy and for 50% of the extraction of raw materials. Emissions are mainly responsible for climate change and increases the earth’s temperature. Conventional construction materials are highly resource and energy-intensive. Hence, there is a rising concern and awareness about hazards from conventional building materials that have both social and environmental impact. In order to address these issues, new materials and technologies are being developed in the construction industry. Biocomposites are sustainable building materials help eliminate non-renewable waste, reduce raw material usage, and cut fossil-fuel consumption. Interest in using biocomposites in the construction industry is increasing globally, as these materials are made from renewable, recyclable, biodegradable sources and have a wide range of uses as structural and non-structural building elements. However, there are few disadvantages of natural fiber composites such as poor fiber-matrix interfacial bonding, poor wettability, and water absorption. These challenges affect the strength and performance of end products. The hydrophilic nature of biocomposites tend to absorb water from the immediate environment which causes the composite to swell. All these factors are expected to hinder the biocomposites market growth during the forecast period.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONBiocomposites Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The "Global Biocomposites Market Analysis to 2028" is a specialized and in-depth study with a major focus on the global biocomposites market trends and growth opportunities. The report aims to provide an overview of the global biocomposites market with detailed market segmentation by fiber, product, end use, and geography. The global biocomposites market has been witnessing high growth over the recent past and is expected to continue this trend during the forecast period. The report provides key statistics on the consumption of biocomposites worldwide along with their demand in major regions and countries. In addition, the report provides the qualitative assessment of various factors affecting the biocomposites market performance in major regions and countries. The report also includes a comprehensive analysis of the leading players in the biocomposites market and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, market trends, and lucrative biocomposites market opportunities that would, in turn, aid in identifying the major revenue pockets.

Further, ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global biocomposites market, which helps understand the entire supply chain and various factors affecting the market growth.

SEGMENTAL ANALYSIS

The global biocomposites market is segmented based on fiber, product, end use. Based on fiber, the biocomposites market is bifurcated as wood fiber composite and non-wood fiber composite. Based on product, the market is classified as hybrid biocomposite and green biocomposite. On the basis of end use the market is segregated as building and construction, automotive, consumer goods, and others.

Based on fiber, the wood fiber composite segment accounted for a significant biocomposites market share. The main disadvantage of wood fiber composites is their moisture sensitivity however, with increasing research and development manufacturers are producing wood fiber components with higher moisture resistance, greater rigidity and a lower coefficient of thermal expansion. On the basis of product hybrid composite led the biocomposites market with a largest market share. Based on end use building and construction segment is dominating the biocomposite market. Biocomposites in the building are used for framing, walls and wallboard, window frames, doors, flooring, decorative paneling, cubicle walls, and ceiling panels. The use of biocomposites for temporary and adjustable building components reduces landfill waste when interior designs within the structure are modified.

REGIONAL ANALYSIS

The report provides a detailed overview of the global biocomposites market with respect to five major regions, namely, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South & Central America. Asia Pacific accounted for a significant share of the market and is valued at more than US$ 9,300 million in 2022. Asia Pacific comprises several developing and developed economies such as China, India, Japan, South Korea, and Australia. The critical factor contributing to its growth is the increasing demand from building & construction and transportation for end-use industries. The high demand for biocomposites is primarily observed in China, Japan, India, and South Korea. Also, the increase in foreign direct investment (FDI) in transportation and infrastructure sectors is expected to drive the demand for biocomposites during the next few years. Europe is also expected to witness considerable growth valued at approximately US$ 11,000 million in 2028, owing to the increasing government spending on infrastructure building. Furthermore, in North America, there has been a widespread usage of biocomposites in residential & commercial construction, consumer products and the automotive sector. This has created lucrative opportunities in biocomposites market. The biocomposites market in North America is augmented to grow at CAGR of 15.0% during the forecast period.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

Partnership, acquisitions, and new product launches were found to be the major strategies adopted by the players operating in the global biocomposites market.

- In May 2022, Arkema planned to launch its new solution for recyclable and ever more efficient composites.

- In Mar 2021, Fiberon announced the launch of wildwood composite cladding, providing the unrivaled beauty and warmth of wood combined with the durability of high-performance, low-maintenance materials.

The regional trends and factors influencing the Biocomposites Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Biocomposites Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Biocomposites Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 19.27 Billion |

| Market Size by 2028 | US$ 46.85 Billion |

| Global CAGR (2022 - 2028) | 16% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Fiber

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Biocomposites Market Players Density: Understanding Its Impact on Business Dynamics

The Biocomposites Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Biocomposites Market top key players overview

IMPACT OF COVID/IMPACT OF GEOPOLITICAL SCENARIO/IMPACT OF RECESSION

Lockdowns, travel restrictions, and business shutdowns due to the COVID-19 pandemic adversely affected economies and industries in various countries in North America, Europe, Asia Pacific (APAC), South & Central America, and the Middle East & Africa (MEA). The crisis disturbed global supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. Various companies announced possible delays in product deliveries and a slump in future sales of their products in 2020. Further, the international travel bans imposed by various governments in Europe, Asia Pacific, and North America forced several companies to discontinue their collaboration and partnership plans. All these factors hampered the chemicals & materials industry in 2020 and early 2021, thereby restraining the growth of various markets related to this industry, including the biocomposites market.

Before the COVID-19 outbreak, the biocomposites market was mainly driven by the rising demand from automotive and building & construction industries. However, in 2020, various industries had to slow down their operations due to disruptions in value chains caused by the shutdown of national and international boundaries. The COVID-19 pandemic disrupted the supply chain of key raw materials and disturbed manufacturing processes due to restrictions imposed by government authorities in various countries. However, the economies revived their operations. The previously postponed construction projects were resumed, further providing an opportunity for the biocomposite market players to regain normalcy.

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Some of the key players operating in the biocomposites market include TTS; Lingrove; Bcomp Ltd; UPM; Flexform Technologies; Tecnaro GmbH; Fiberon; Arkema; Trex Company, Inc.; and HempFlax Group B.V. among others.

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For