Breast Cancer Therapeutics Market Developments and Forecast by 2030

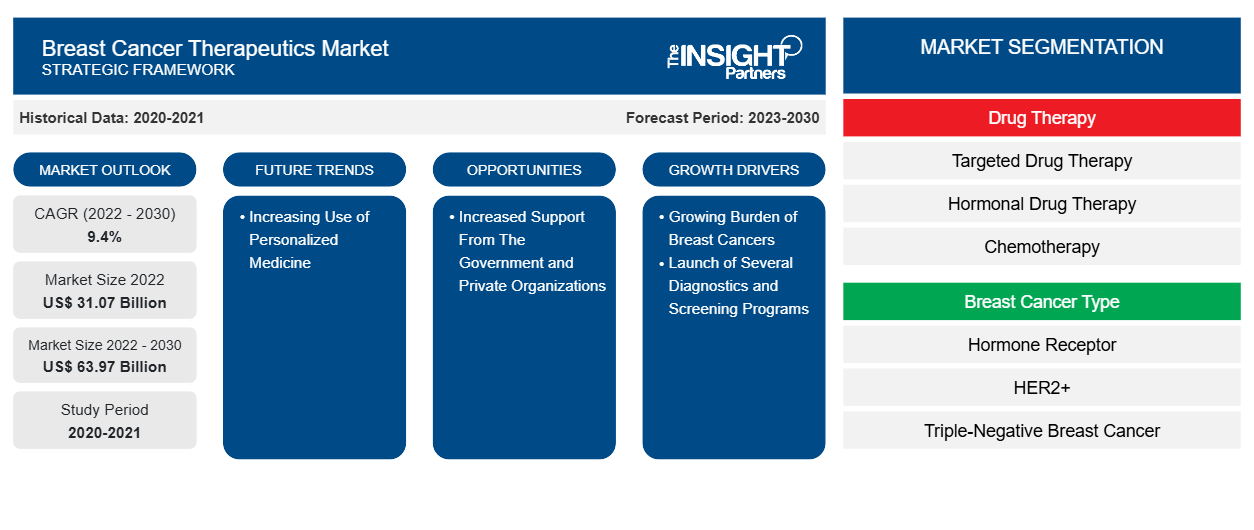

Breast Cancer Therapeutics Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Drug Therapy [Targeted Drug Therapy (Abemaciclib, Ado-Trastuzumab Emtansine, Palbociclib, Trastuzumab, and Other Target Drug Therapies), Hormonal Drug Therapy (Selective Estrogen Receptor Modulators, Aromatase Inhibitors, and Selective Estrogen Receptor Downregulators), Chemotherapy, and Immunotherapy/Biological Therapy], Breast Cancer Type (Hormone Receptor, HER2+, and Triple-Negative Breast Cancer), Distribution Channel (Hospital Pharmacies, Drug Stores and Retail Pharmacies, and Online Pharmacies), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Oct 2023

- Report Code : TIPRE00030059

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 204

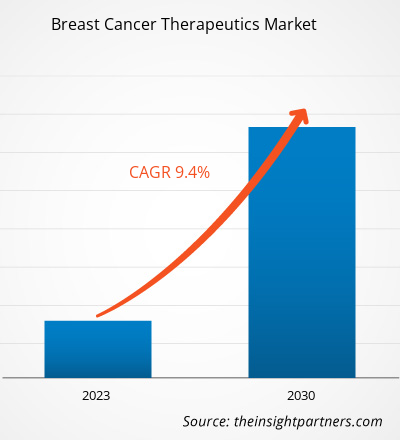

[Research Report] The breast cancer therapeutics market size is projected to grow from US$ 31,073.52 million in 2022 to US$ 63,967.05 million by 2030; it is estimated to record a CAGR of 9.4% during 2022–2030.

Market Insights and Analyst View:

Breast cancer therapeutics is a method of managing breast cancer by using therapeutic approaches such as chemotherapy, targeted therapy, hormone therapy, surgery, and various drugs. These therapies help restrict the growth and multiplication of cancer cells in the breast. The number of patients suffering from breast cancer globally is a key factor accelerating the growth of the market. In addition, the constant launch of new drugs at the global level by established companies fuels the growth of the market. Also, the growing drug pipeline for breast cancer treatment is increasing the competition and driving investment in the breast cancer therapeutics market.

Growth Drivers:

Advancements in personalized medicine, immunotherapy, combination therapies, drug delivery systems, liquid biopsies, AI, and patient-centric approaches are expected to shape the future of breast cancer treatment. These trends aim to improve treatment outcomes, reduce side effects, and enhance breast cancer patients' overall quality of life.

Early disease detection plays a major role in improving patient outcomes and survival rates. Various organizations and healthcare providers are implementing screening programs to detect breast cancer at an initial stage when it is more treatable. The World Health Organization released a new Global Breast Cancer Initiative Framework in February 2013 that serves as a plan for fulfilling the goal of saving 2.5 million people from breast cancer by 2040. To achieve this, the new Framework, unveiled ahead of the World Cancer Day campaign, urges nations to follow the three pillars of health promotion for early detection, prompt diagnosis, and thorough management of breast cancer. These programs often include mammography, clinical breast exams, and self-breast exams to identify any abnormalities or signs of breast cancer. Implementing these programs has increased awareness and early detection of breast cancer cases, resulting in higher demand for effective therapeutics.

In addition, many advancements in diagnostic technologies have been witnessed across the globe. The National Library of Medicine states that early detection and precise diagnosis are essential for enhancing prognosis. Breast cancer assessment frequently makes use of radiographic imaging modalities such as digital mammography (DM), digital breast tomosynthesis (DBT), magnetic resonance imaging (MRI), ultrasound, and nuclear medicine procedures. Histopathology (HP) is the gold standard for determining the presence of cancer. Furthermore, using artificial intelligence (AI) technology to depict medical images quantitatively has significant potential for improving breast cancer segmentation, diagnosis, and prognosis. These technologies help healthcare providers identify the extent and characteristics of the tumor, allowing them to develop personalized treatment plans. Thus, the launch of diagnostic and screening programs, coupled with advancements in diagnostic technologies, contributes to the breast cancer therapeutics market growth.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONBreast Cancer Therapeutics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Breast Cancer Therapeutics Market” is segmented on the basis of drug therapy, breast cancer type, distribution channel, and geography. Based on drug therapy, the market is segmented into targeted drug therapy, hormonal drug therapy, chemotherapy, and immunotherapy/biological therapy. In terms of breast cancer type, the breast cancer therapeutics market is segmented into hormone receptor, HER2+, and triple-negative breast cancer. Based on distribution channel, the market is categorized into hospital pharmacies, drug stores and retail pharmacies, and online pharmacies. The breast cancer therapeutics market, based on geography is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Spain, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

The breast cancer therapeutics market, by drug therapy, is segmented into targeted drug therapy, hormonal drug therapy, chemotherapy, and immunotherapy/biological therapy. The targeted drug therapy segment held the largest share of the market in 2022 and is estimated to register the highest CAGR in the market during 2022–2030. Targeted drugs block the growth of breast cancer cells either by destroying cancer cells or slowing down their growth. Currently, targeted therapy is normally used in combination with traditional chemotherapy. Targeted therapy helps block the action of an abnormal protein (such as HER2) that promotes the growth of breast cancer cells. The targeted therapy is divided into abemaciclib, ado-trastuzumab emtansine, Palbociclib, trastuzumab, and others. Trastuzumab (Herceptin) or lapatinib (TYKERB) can be prescribed to a woman whose lab tests reveal that her breast tumor contains an excessive amount of HER2. Kadcyla, Afinitor/Afinitor Disperz/Zortress, and Lynparza are a few of the crucial targeted therapeutic products. In August 2023, the Food and Drug Administration (FDA) approved trastuzumab deruxtecan (Enhertu) for adults with non-small cell lung cancer with a certain kind of mutation in the HER2 gene. It is regarded as the first targeted therapy for HER2-mutant lung cancer.

Targeted therapy has gained notable traction in developed and emerging countries to treat breast cancer. With new product launches and the availability of an overwhelming number of medications, the targeted therapy segment is expected to hold a significant share of the breast cancer therapeutics market.

Based on breast cancer type, the breast cancer therapeutics market is segmented into hormone receptor, HER2+, and triple-negative breast cancer. The hormone receptor segment held the largest market share in 2022 and is anticipated to grow at the fastest rate during 2022–2030. Estrogen and progesterone promote the growth of several breast cancers, known as hormone-sensitive or hormone-dependent breast cancers. Hormone receptors are proteins found on the surface of breast cancer cells that interact with hormones in the body and get activated when hormones bind to them. The activated receptors initiate changes in the expression of particular genes, stimulating cell growth. Hormone therapy is a common type of treatment for hormone receptor-positive breast cancer, including SERMs and aromatase inhibitors, representing a significant proportion of all incidence cases. The hormone receptor segment is likely to experience growth due to an increasing number of breast cancer cases diagnosed yearly.

Based on distribution channel, the breast cancer therapeutics market is segmented into hospital pharmacies, drug stores and retail pharmacies, and online pharmacies. The hospital pharmacies segment held the largest market share in 2022. The online pharmacies segment is anticipated to register the highest CAGR during 2022–2030. The hospital pharmacy plays a crucial role in the management of breast cancer therapeutics. They are responsible for compounding and dispensing, monitoring drug safety, medication management, educating patients, and other factors. Breast cancer is one of the most widespread cancers worldwide, and the demand for effective therapeutics is steadily increasing. Hospital pharmacies are responsible for procuring, storing, and dispensing chemotherapy medications and other treatments related to breast cancer to ensure that patients receive the right treatment in time. These pharmacies are also in authority to manage the inventory and storage of these drugs, ensuring that they are stored and handled in accordance with strict regulations. Their collaborative efforts with oncologists and healthcare teams ensure that breast cancer patients receive optimal, personalized therapeutics and comprehensive care throughout their treatment journey. Hospital pharmacies remain instrumental in delivering timely and effective breast cancer treatments, significantly impacting patients’ outcomes in battling the disease.

High dependency of patients on these pharmacies for chemotherapy medications and administration of therapies, growing demands from patients for various treatments, and enhanced availability of medication in hospital pharmacies favor the growth of the segment.

Regional Analysis:

Based on geography, the breast cancer therapeutics market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. North America captured a significant share of the global market in 2022. The market growth in the region is attributed to the rising prevalence of breast cancer and rising R&D investments for developing novel treatments. In addition, a growing number of market players are expanding their geographical footprint in North American countries. Breast cancer is one of the most common types of cancer and has a sizable market for therapies. According to the Centers for Disease Control and Prevention, in 2020, 239,612 new cases of breast cancer were reported among women in the US, of which ~42,273 have succumbed to death. For every 100,000 women, 119 new breast cancer cases in women were reported, of which nearly 19 have died. Additionally, in 2022, according to the Canadian Cancer Society, about 28,600 Canadian women were diagnosed with breast cancer, accounting for about 25% of all new cancer cases in women.

Chemotherapy, immunotherapy, targeted therapy, and hormonal therapy are a few of the available therapeutic options. While hormonal therapy seeks to stop the hormones that support the growth of specific forms of breast cancer, chemotherapy uses medicines to destroy cancer cells. Immunotherapy uses the body's immune system to combat cancer cells, whereas targeted therapy concentrates on specific chemicals implicated in cancer growth. The need for efficient therapies is partly fueled by the nation's high prevalence of breast cancer.

Furthermore, improvements in medical technology and research have sparked the creation of ground-breaking treatments that can enhance patient outcomes. Several large pharmaceutical companies, including Pfizer, Novartis, Roche, AstraZeneca, and Eli Lilly, dominate the therapeutic market for breast cancer in the US. These businesses make significant investments in research and development to introduce novel and enhanced medicines to the market. Regulations and policies put in place by the government also affect the market. New medications and therapies for breast cancer treatment are approved by the government agencies of the Food and Drug Administration (FDA). Therefore, in the upcoming years, the therapeutic market for breast cancer is anticipated to expand further.

Breast Cancer Therapeutics Market Regional InsightsThe regional trends and factors influencing the Breast Cancer Therapeutics Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Breast Cancer Therapeutics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Breast Cancer Therapeutics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 31.07 Billion |

| Market Size by 2030 | US$ 63.97 Billion |

| Global CAGR (2022 - 2030) | 9.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Drug Therapy

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Breast Cancer Therapeutics Market Players Density: Understanding Its Impact on Business Dynamics

The Breast Cancer Therapeutics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Breast Cancer Therapeutics Market top key players overview

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global breast cancer therapeutics market are listed below:

- In February 2023, Gilead Sciences, Inc. received US Food and Drug Administration (FDA) approval Trodelvy (sacituzumab govitecan-hziy) for the treatment of adult patients with unresectable locally advanced or metastatic hormone receptor (HR)-positive, human epidermal growth factor receptor 2 (HER2)-negative breast cancer who have received endocrine-based therapy and at least two additional systemic therapies in the metastatic setting..

- In November 2022, Eli Lilly and Company launched the additional indication for Ramiven (abemaciclib), following approval from the Drugs Controller General of India (DCGI), in combination with endocrine therapy for adjuvant treatment in adult patients with Hormone Receptor (HR)-positive, HER2 negative, node-positive EBC at high risk of recurrence.

- In January 2020, Eisai Co., Ltd launched the in-house developed anticancer agent Halaven in China. In China, Halaven received new drug approval for its use in treating patients with locally advanced or metastatic breast cancer, previously treated with at least two prior chemotherapy regimens.

Competitive Landscape and Key Companies:

Eli Lilly and Co, Eisai Co Ltd, Novartis AG, AstraZeneca Plc, Pfizer Inc, Gilead Sciences Inc, Merck & Co Inc, Genentech Inc, Teva Pharmaceutical Industries Ltd, and Amgen Inc are among the major breast cancer therapeutics companies. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For