Breath Analyzer Market Trends and Analysis by 2030

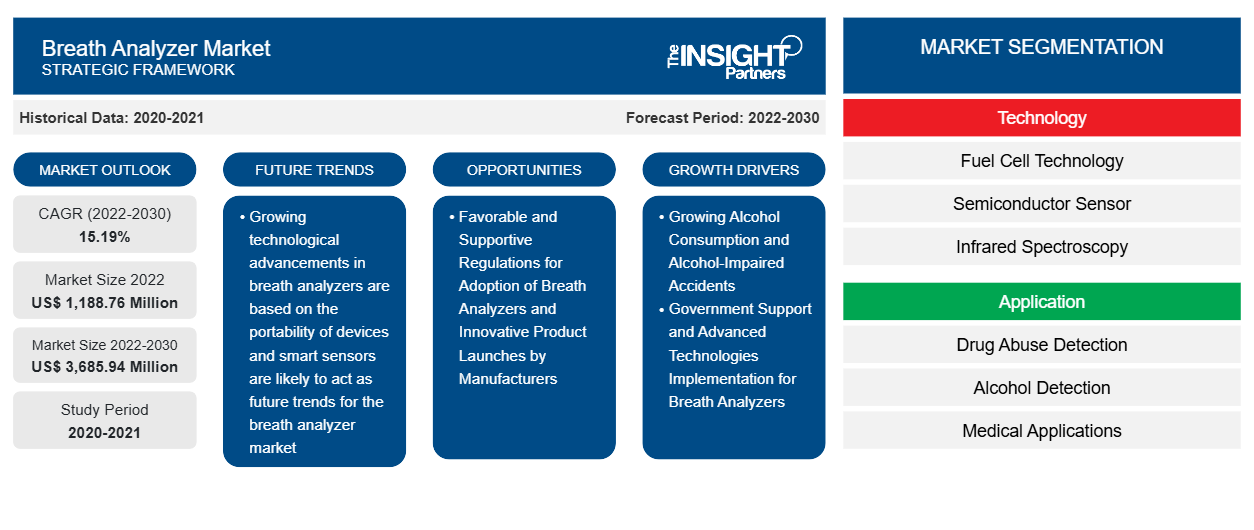

Breath Analyzer Market Size and Forecast (2020-2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Fuel Cell Technology, Semiconductor Sensor, Infrared Spectroscopy, and Others), Application (Drug Abuse Detection, Alcohol Detection, and Medical Applications), End User (Law Enforcement Agencies, Hospitals & Diagnostic Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2022-2030- Report Date : Nov 2023

- Report Code : TIPRE00004181

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 169

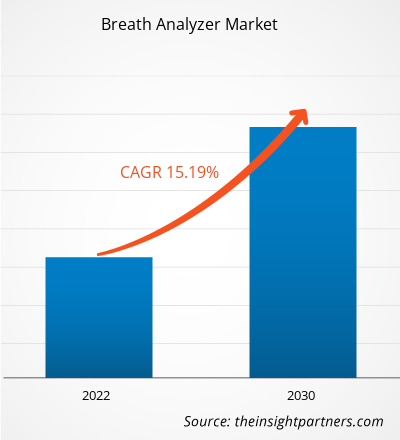

The breath analyzer market size is projected to reach US$ 3,685.94 million by 2030 from US$ 1,188.76 million in 2022. The market is expected to register a CAGR of 15.19% during 2022–2030. Growing technological advancements in breath analyzers are based on the portability of devices and smart sensors are likely to remain key trends in the market.

Breath Analyzer Market Analysis

Breath analyzers are essential tools in detecting narcotics, asthma, alcohol, tuberculosis, and other diseases. Breath analyzers are also increasing in popularity as the demand for accurate blood alcohol levels (BAC) in the workplace grows. They are non-invasive, driving up the demand for breath analyzers. Breath analyzers are essential tool for monitoring drugs, alcohol, tuberculosis, asthma, and other diseases. Therefore, the demand for this system is expected to continue to increase. The popularity of e-commerce platforms has also contributed to the awareness and availability rate of this segment. Customers receive products quickly, which leads to the expansion of manufacturers' distribution networks. E-commerce has dramatically increased the availability of a wide range of analytical devices in the industry. Additionally, for the purpose of detection and diagnosis of diseases such as TB and chronic obstructive pulmonary disease (COPD) there has been a rising demand from hospitals that has fuelled market expansion.

Breath Analyzer Market Overview

Asthma and COPD are diseases that require accurate diagnosis in the early stages through innovative medical devices like breath analyzers. The increasing drunk driving cases leads to road accidents. For the prevention of these increasing accident the government has introduced some mandatory laws. In addition, integration of AI technologies into breath analyzers has further enabled real-time data processing, improved precision of BAC testing, and competitive advantage to the market players. Advances in the effective diagnosis of other lung diseases have also increased the demand for such devices in the healthcare industry and their potential uses. Furthermore, increasing public awareness regarding use of illegal drug and alcohol activities is also leading to increasing demand for breath analyzers from various law enforcement agencies for keeping the environment drug and alcohol-free, which is further expected to boost the demand for breath analyzers.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONBreath Analyzer Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Breath Analyzer Market Drivers and Opportunities

Government Support and Advanced Technologies Implementation for Breath Analyzers to Favor Market

In November 2021, Congress mandated that all cars must have an in-built advanced drunk and impaired driving prevention technology capable of detecting drunk drivers by the police. The mandate was included in the US$ 1.5 trillion infrastructure bill that was signed in 2021. According to the WHO 2023 report, after the contentious debate, Brazil's supreme court declared the country's "Drink-Driving Law" completely constitutional in August 2022. This is due to crashes standing as one of the top three causes of death among Brazilian population aged between 5 and 39 years. Thus, government support and implementation of new advanced technologies to detect alcohol-impaired drivers resulting in controlling road traffic crashes boost the breath analyzers market growth.

Favorable and Supportive Regulations for Adoption of Breath Analyzers and Innovative Product Launches by Manufacturers

In May 2023, Cannabix Technologies Inc., a manufacturer of breath testing devices, announced the development of contactless alcohol breathalyzer (CAB) technology in the workplace and in-cabin vehicles. The company ran a pilot testing of its workplace CAB in Montana-based Friedel LLC in March 2023. Further, in June 2021, the Breath Alcohol Permit Program approved breath analysis instruments and full-fledged incorporated by the US Department of Transportation/National Highway Traffic Safety Administration (NHTSA). Thus, launches of innovative products and fast approvals by the regulatory/authorized bodies for the adoption of breath analyzers are expected to provide lucrative opportunities for the breath analyzer manufacturers in the long run.

Breath Analyzer Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Breath Analyzer market analysis are technology, application, and end user.

- Based on technology, the breath analyzer market is segmented into fuel cell technology, semiconductor sensor, infrared spectroscopy, and others. The fuel cell technology segment held the largest market share in 2022 and the same is expected to register highest CAGR during the forecast period.

- By application, the market is segmented into drug abuse detection, alcohol detection, and medical application. The medical application segment held the largest share of the market in 2022.

- By end user, the market is segmented into drug law enforcement agencies, hospital & diagnostic centers, and others. The hospitals & diagnostic centers segment held the largest share of the market in 2022 and is anticipated to register highest CAGR during 2020–2030.

Breath Analyzer Market Share Analysis by Geography

The geographic scope of the Breath Analyzer market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the market. The growth factors of the breath analyzer market in North America are the rising number of road accidents due to drinking and technological advancements in breath analyzers. The US held the largest market share in the breath analyzer market. Major market players such as Abbott, Thermo Fisher Scientific, Inc., and Intoximeter are present in the US which is expected to drive the market growth in the country. Further, the increasing number of road accidents and alcohol-impaired incidents in the country boosts the overall market growth. However, the rising alcohol testing for law enforcement purposes, workplace safety, and personal use of breath analyzers are expected to lead to substantial market growth in the US.

Breath Analyzer Market Regional Insights

The regional trends and factors influencing the Breath Analyzer Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Breath Analyzer Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Breath Analyzer Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,188.76 Million |

| Market Size by 2030 | US$ 3,685.94 Million |

| Global CAGR (2022-2030) | 15.19% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Breath Analyzer Market Players Density: Understanding Its Impact on Business Dynamics

The Breath Analyzer Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Breath Analyzer Market top key players overview

Breath Analyzer Market News and Recent Developments

The breath analyzer market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the breath analyzer market are listed below:

- Cannabix Technologies Inc. a manufacturer of breath testing devices, announced the development of contactless alcohol breathalyzer (CAB) technology in the workplace and in-cabin vehicles. (Cannabix Technologies Inc., Press Release, May 2023)

- Drager launches the new Alcotest 6000, an improvement from the Alcotest 5820. The Alcotest 6000 identifies alcohol-impaired individuals, helping lawmakers and employers make effective decisions before the subject becomes a liability. (Drager, Press Release, April 2023)

- The E-Nose device developed at NASA’s Ames Research Center in California’s Silicon Valley using patented nanosensors and nanosensor array technologies is a smartphone-based device derived from technology used to help monitor air quality inside spacecraft, but NASA advanced it to detect COVID-19 by “sniffing” a person’s breath. (The eNose Company, Press Release, April 2021)

Breath Analyzer Market Report Coverage and Deliverables

The “Breath Analyzer Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Breath analyzer market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Breath analyzer market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Breath analyzer market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the breath analyzer market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For