Catalyst Fertilizer Market Size and Competitive Analysis by 2027

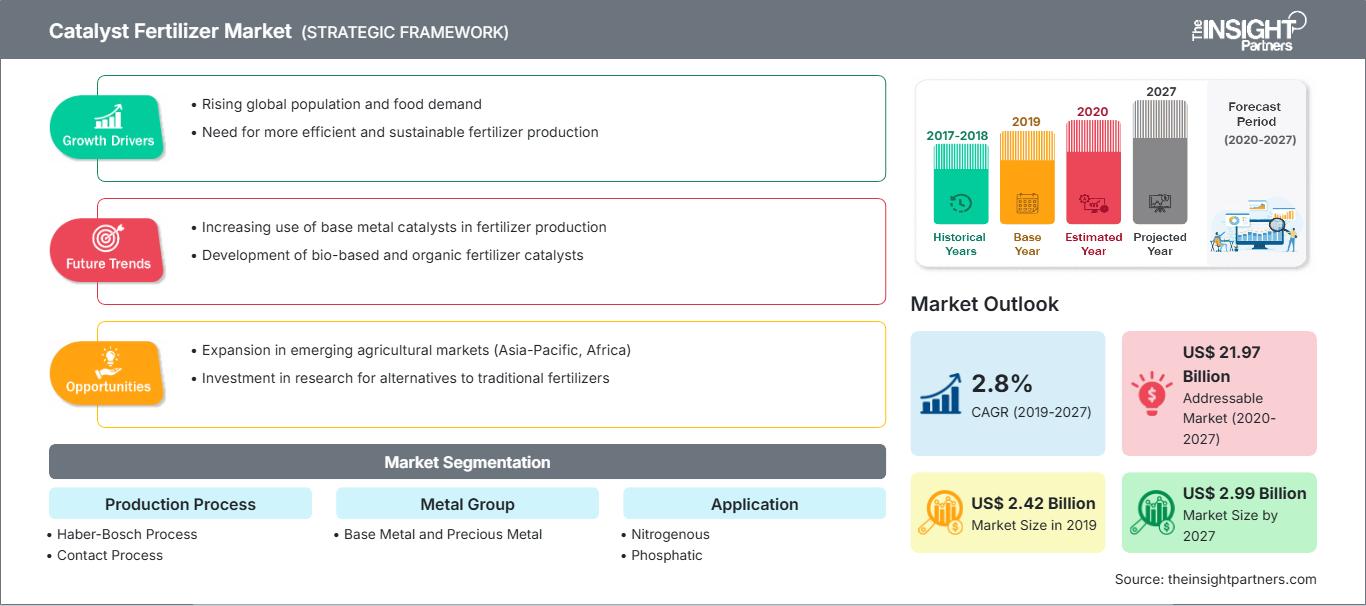

Catalyst Fertilizer Market Forecast to 2027 - Analysis by Production Process (Haber-Bosch Process, Contact Process, and Others); Metal Group (Base Metal and Precious Metal); Application (Nitrogenous, Phosphatic, and Others)

Historic Data: 2017-2018 | Base Year: 2019 | Forecast Period: 2020-2027- Report Date : Aug 2020

- Report Code : TIPRE00005069

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 148

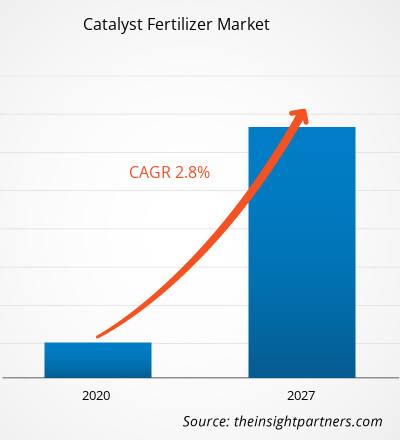

[Research Report] The catalyst fertilizers market was valued at US$ 2,423.32 million in 2019 and is projected to reach US$ 2,992.38 million by 2027; it is expected to grow at a CAGR of 2.8% from 2020 to 2027.

Catalysts are mainly deployed to bring the desired reaction as close as possible to a selected equilibrium point in the shortest possible time for a reversible type of reaction. They speed up the rates of forwarding and backward reaction so as to attain faster equilibrium and remain unaltered without taking part in the chemical reaction. Catalyst increases output and improves process efficiency, at lower cost. Therefore, strong emphasis is given for expansion of catalyst with higher activity, to reduce environmental impact and increase longevity. Based on production process, the catalyst fertilizer market is categorized into Haber-Bosch process, contact process, and others.

In 2019, Asia Pacific contributed to the largest share in the global catalyst fertilizer market. The growth of the catalyst fertilizer market in this region is primarily attributed to the increase in demand for more crop yield. The rise in focus towards land efficiency has perpetually increased which demands the use of catalyst fertilizers to produce mineral fertilizers such as nitrogen fertilizers. Apart from this, the region contributes a substantial share in global fertilizer consumption owing to the growing food security concerns of growing population. Countries such as China and India where the population is growing considerably at higher rate is adding to the demand for food. On the other hand, due to urbanization and industrialization the arable land is declining which is forcing the farmers or crop growers to increase the consumption of fertilizers. Fertilizers have been used for a long time to increase the productivity of crops. This adequate and balanced use of fertilizer may help in feeding the growing population from the available cultivable land. Need for crop intensification and better land use efficiency have raised demand for value-added fertilizers such as catalyst fertilizers in APAC region.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONCatalyst Fertilizer Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Increasing Demand for Liquid Catalyst Fertilizers

Catalyst fertilizers are used to grow all types of crops, but the rate of application depend on the soil fertility that is measured by the soil test. There is a rising trend in using liquid fertilizer as they are less labor extensive in comparison to the dry form of catalyst fertilizers. The liquid fertilizers are applied as an irrigation system and a starter fertilizer in rows to the crops that help in the efficient usage of plant nutrients and minimizes environmental issues. There is an increasing demand for liquid catalyst fertilizers owing to the increasing need to meet the food demand that is generated from the rapidly growing population. The need for nitrogen, potassium, and phosphorous fertilizers have incremented owing to the demand for food grains and concerns regarding the depletion of groundwater resources that favors the market for liquid catalyst fertilizers. Various steps are being raised by the European Fertilizers Manufacturing Association (EMA) for the purpose of implementing a product stewardship program that aims to enhance agricultural productivity using liquid catalyst fertilizers. Besides this, the Association of American Plant Food Control Officials (AAPFCO) has led the introduction of advanced models for crop growth enhancers in North America. It has developed standards for the inspection techniques and encourage the adoption of effective and adequate approaches towards farming that favors the market for liquid catalyst fertilizers. Moreover, the farmers in several agricultural-based countries like China and India are focusing on developing soil protection products that have suitable applications in any climatic condition; therefore, the implementation of advanced technologies that proffers and evenly nutrient supply of nitrogen, phosphate and potassium contents will propel liquid catalyst fertilizers market. Foliar feeding, which is done through leaves supply nutrients to those parts of the plants that lack the required nutrients and also to the roots that are stressed. The farmers today are learning the benefits of liquid catalyst fertilizers over dry forms, which is bolstering well the wide-scale acceptance of liquid catalyst fertilizers worldwide.

Production Process Insights

The catalyst fertilizer market based on production process has been segmented into Haber-Bosch Process, contact process, and others. The Haber-Bosch Process is expected to register the fastest CAGR during 2020–2027.The Haber process is also called the Haber–Bosch process, which is an artificial nitrogen fixation process and is one of the main industrial procedure for the production of ammonia today. The process converts atmospheric nitrogen to ammonia (NH3) by a reaction with hydrogen using a metal catalyst under the high temperatures and pressures. The Haber–Bosch process relies on catalysts to accelerate the hydrogenation of N2. The catalysts are "heterogeneous," meaning that they are solid that interact on gaseous reagents. The catalyst typically consists of finely divided iron bound to an iron oxide carrier containing promoters, possibly including aluminum oxide, potassium oxide, calcium oxide, and magnesium oxide.

Metal Group Insights

The catalyst fertilizer market based on metal group is segmented into base metal and precious metal. The base metal segment is expected to grow at fastest growth rate during the forecast period of 2019-2027. The base metal is basically a common and inexpensive metal, as opposed to a precious metal such as gold or silver. A long-time goal of alchemists was the transmutation of a base (low grade) metal into precious metal. Cobalt, iron, and nickel catalysts have been investigated in parallel with palladium catalysts for carbon-carbon bond formation, and it has been found that when supported by the appropriate ligands, nickel and cobalt can enable efficient coupling reactions allowing the formal addition of carbon-hydrogen bonds in unsaturated systems. Metals such as Ni, Mo, Co, Rh, Pt, Pd, etc., are widely utilized as a catalyst in chemical and petrochemical industries as well as fertilizer industries. They are generally supported mainly on porous materials like alumina and silica through precipitation or impregnation processes. Chelating agents are the most effective extracts that can be introduced in the soil washing fluid to enhance heavy metal extraction from contaminated soils. The main advantages of chelating agents in soil cleanup, include high efficiency of metal extraction, high thermodynamic stabilities of the metal complexes formed, good solubility of the metal complexes, and low adsorption of the chelating agents on soils, but very few workers have attempted chelating agent to extract metals from spent catalyst.

Clariant, DuPont de Nemours, Inc., Haldor Topsøe, Johnson Matthey amongst others are the key players present in the global catalyst fertilizer market. These companies are implementing new product development and mergers and acquisition strategies to enlarge the customer base and gain significant market share across the world, which, in turn permit the players to maintain their brand name globally.

Report Spotlights

- Progressive industry trends in the global catalyst fertilizer market help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the global catalyst fertilizer market from 2017 to 2027

- Estimation of global catalyst fertilizer demand across various industries

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry to predict market growth

- Recent developments to understand the competitive market scenario and global catalyst fertilizer demand

- Market trends and outlook coupled with factors driving and restraining the growth of the global catalyst fertilizer market

- Decision-making process by understanding strategies that underpin commercial interest with regard to global catalyst fertilizer market growth

- Global catalyst fertilizer market size at various nodes of market

- Detailed overview and segmentation of the global catalyst fertilizer market, as well as its dynamics in the industry

- Global catalyst fertilizer market size in various regions with promising growth opportunities

The regional trends and factors influencing the Catalyst Fertilizer Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Catalyst Fertilizer Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Catalyst Fertilizer Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 2.42 Billion |

| Market Size by 2027 | US$ 2.99 Billion |

| Global CAGR (2019 - 2027) | 2.8% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Production Process

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Catalyst Fertilizer Market Players Density: Understanding Its Impact on Business Dynamics

The Catalyst Fertilizer Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Catalyst Fertilizer Market top key players overview

Global Catalyst Fertilizer Market, byProduction Process

- Haber-Bosch Process

- Contact Process

- Others

Global Catalyst Fertilizer Market, by Metal Group

- Base Metal

- Precious Metal

Global Catalyst Fertilizer Market, by Application

- Nitrogenous

- Phosphatic

- Others

Company Profiles

- Clariant

- DuPont de Nemours, Inc.

- Haldor Topsøe

- Johnson Matthey

- LKAB Minerals AB

- PDIL

- Quality Magnetite

- QuantumSphere, Inc.

- Axens

- Agricen

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For