Data Center Generator Market Growth and Recent Trends by 2028

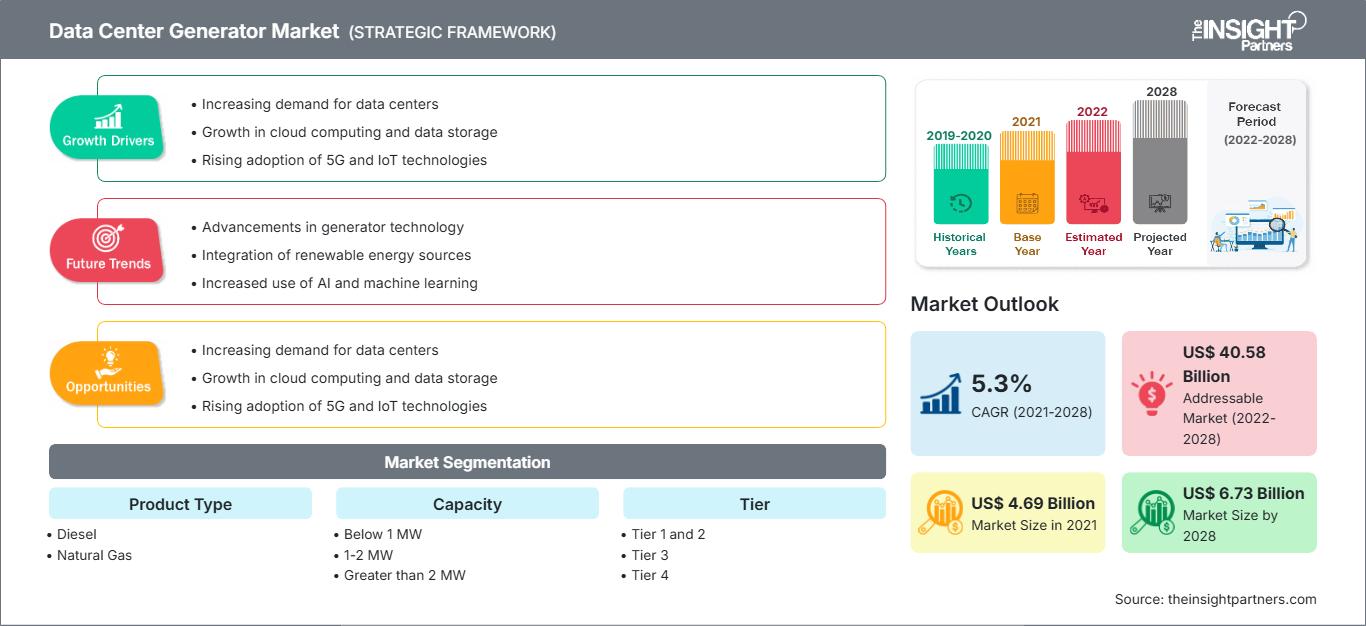

Data Center Generator Market Forecast to 2028 - Analysis By Product Type (Diesel, Natural Gas, and Others), Capacity (Below 1 MW, 1-2 MW, and Greater than 2 MW), and Tier (Tier 1 and 2, Tier 3, and Tier 4)

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Apr 2022

- Report Code : TIPRE00012410

- Category : Energy and Power

- Status : Published

- Available Report Formats :

- No. of Pages : 189

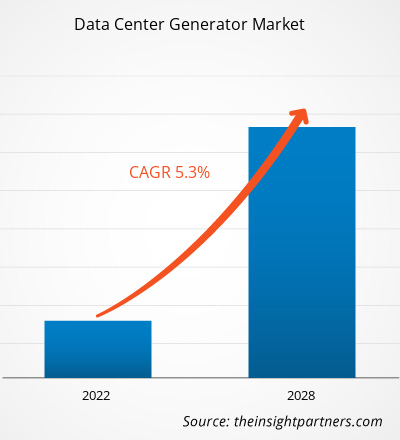

[Research Report] The data center generator market was valued at US$ 4,693.00 million in 2021 and is expected to reach US$ 6,729.53 million by 2028; it is estimated to register a CAGR of 5.3% from 2021 to 2028.

Generators serve as a backup power supply reservoir for data centers during a power outage. A total power outage in a data center may need a system restart, resulting in system downtime, startup challenges, and data loss. Hence, data centers are always backed by a backup power supply provided by generators to avoid such abnormalities and failures. Such benefits are driving the data center generator market growth .

These generators do not require an existing power supply to operate, which is a significant driving element for the market. In addition, prominent manufacturers manufacture generators with customized capacity in response to changing customer demands. Such systems can scale up and down by the power requirements of the data center. This adaptability is likely to increase the demand for data center generators, thereby boosting the market growth. Several cloud service providers have increased their output because of the rise in demand for edge data centers worldwide. Google, for example, spent US$ 3.3 billion in 2019 to expand its data center presence in Europe. Furthermore, the market is likely to benefit from the increased development of hyper-scale facilities and the rise in implementing diesel rotary uninterruptible power supply (DRUPS).

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONData Center Generator Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Data Center Generator Market Insights

Increase in Number of Data Centers

There are already around seven billion internet-connected devices in this age of data, and that figure is growing. Many of them produce huge amounts of data, which must be recorded, routed, stored, assessed, and retrieved. Manufacturers rely on big data and data analytics to improve the efficiency, productivity, security, and cost-effectiveness of their operations as the Internet of Things (IoT) and Industry 4.0 take hold. On the other hand, data management in-house is becoming increasingly complicated, time-consuming, and costly. To save energy and infrastructure costs, even huge firms like Cisco consider shutting down portions of their own internal data centers.

The rise in penetration of connected devices and easy access to the internet, coupled with the reduced cost of internet services, are propelling the demand for data storage globally. The need for data storage is also surging due to the increasing demand for big data analytics and cloud-based services, such as online content comprising movies, apps, videos, and social media. Therefore, cloud-based companies deploy IT space in their data centers. Several industries are exploring the cloud offerings and discovering the benefits of data center services to support their needs related to the cloud. These developments are directly influencing the increase in the use of the Internet of Things (IoT), thereby resulting in the construction of a large number of data centers across the world. For instance, Colt has announced the development of its hyperscale data centers in Europe and Asia-Pacific, following the sale of 12 edge colocation centers across Europe. The corporation has purchased ten new plots of land in London, Frankfurt, Paris, and undisclosed locations in Japan that will allow it to create roughly 100 MW of IT power. Therefore, the increasing number of data centers boosts the need for data center generators to get sufficient power supplies, which is driving the data center generator market growth.

Product Type-Based Market Insights

Data center generators have been experiencing a rise in demand from across the globe in recent years. Companies provide three types of data center generators – diesel, natural gas, and bi-fuel. In January 2022, Cummins Power Generation announced that it had been awarded for its power solutions by the China data center industry. The company manufactures diesel data center generators. In January 2021, TRG Datacenters announced the upgrade of its Texas data center. The company is planning to install a bi-fuel option for power backup.

Capacity-Based Market Insights

In terms of capacity, the data center generator market size is segmented into below 1 MW, 1–2 MW, and greater than 2 MW. Below 1 MW is the most prominent capacity in data center generators. The facilities with a capacity of more than 10 MW are adopting generators of greater than 2 MW. Generators below 1 MW power capacity are usually adopted in modular data center deployments. The adoption of generators with below 1 MW power capacity is expected to increase the deployment of data centers. They are being adopted by small-scale data center operators in developing economies as they are less costly. The rise in manufacturing of hyper scale facilities in emerging economies would decline the dependency on generators having low capacity in the coming years.

The data center generator market players adopt strategies such as mergers, acquisitions, and market initiatives to maintain their positions in the market. A few developments by key data center generator market players are listed below:

- ABB LTD has introduced new shaft generator technology. This new generator brings flexibility and ease of installation to many vessels, including bulk carriers and container carriers. The AMZ 1400 permanent magnet shaft generator is optimized for converter control and enables better efficiency than induction.

- Caterpillar to Launch Demonstration Project Using Hydrogen Fuel Cell Technology for Backup Power at Microsoft Data Center. This project enables Caterpillar to collaborate with industry leaders to take a large step toward commercially viable power solutions that also support the customers in making their operations more sustainable.

The regional trends and factors influencing the Data Center Generator Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Data Center Generator Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Data Center Generator Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 4.69 Billion |

| Market Size by 2028 | US$ 6.73 Billion |

| Global CAGR (2021 - 2028) | 5.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Data Center Generator Market Players Density: Understanding Its Impact on Business Dynamics

The Data Center Generator Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Data Center Generator Market top key players overview

The global data center generator market is segmented based on product type, capacity, and tier. Based on product type, the data center generator market is segmented into diesel, natural gas, and others. In terms of capacity, the data center generator market is segmented into less than 1 MW, 1–2 MW, and greater than 2 MW. Further, based on tier, the data center generator market is segmented into tier 1 & 2, tier 3, and tier 4.

ABB; Atlas Copco AB; Caterpillar; Cummins Inc.; DEUTZ AG; Generac Power Systems, Inc.; HITEC Power Protection; Kirloskar; Kohler Co.; and MITSUBISHI MOTORS CORPORATION are the key data center generator market players considered for the research study. In addition, several other significant data center generator market players have been studied and analyzed in this research report to get a holistic view of the global data center generator market size and its ecosystem.

Frequently Asked Questions

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For