Diabetic Foot Ulcer Market Growth Opportunities and Forecast by 2030

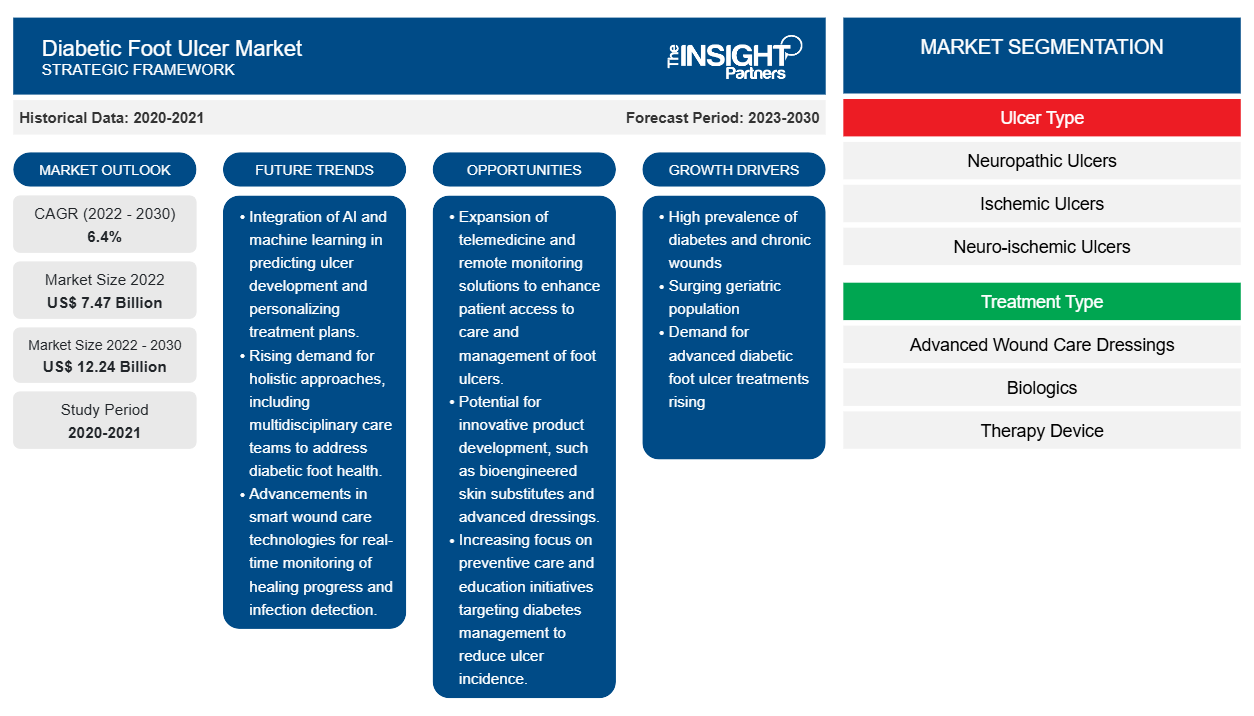

Diabetic Foot Ulcer Market Size and Forecast (2020-2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Coverage: Ulcer Type (Neuropathic Ulcers, Ischemic Ulcers, and Neuro-ischemic Ulcers), Treatment Type (Advanced Wound Care Dressings, Biologics, and Therapy Device), Infection Severity (Moderate, Mild, and Severe), End User (Hospitals, Ambulatory Surgery Centers, and Home Care), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Sep 2023

- Report Code : TIPRE00022321

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 231

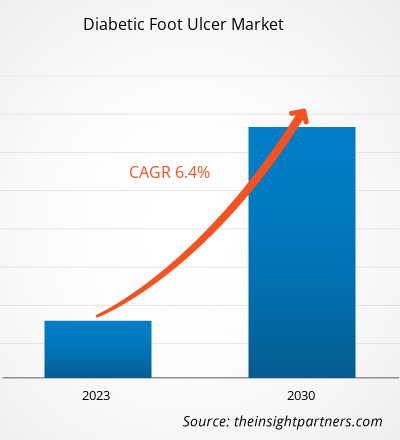

[Research Report] The diabetic foot ulcer market size is expected to grow from US$ 7,470.60 million in 2022 and to reach a value of US$ 12,242.77 million by 2030; it is anticipated to record a CAGR of 6.4% from 2022 to 2030.

Market Insights and Analyst View:

Diabetic foot ulcer is a type of chronic wound that often leads to complications and challenges surgeons to manage such injuries. Diabetic foot ulcer leads to full thickness skin loss on the foot due to neuropathic and/or vascular complications in patients with type 1 or type 2 diabetes mellitus. Diabetic patient who uses insulin are at a higher risk of developing a foot ulcer. Key factors driving the diabetic foot ulcer market growth include high prevalence of diabetes and related chronic wounds and surge in geriatric population. However, the high cost of wound management hinders the market growth.

Growth Drivers and Restraints:

Diabetic patients are vulnerable to wounds, and the healing process is usually longer. Depending on healing timeframe, wounds are classified as acute and chronic. Diabetes is a life-threatening chronic disease with no functional cure. Diabetes can lead to various complications in different body parts and increase the overall risk of premature death. According to the International Diabetes Federation (IDF), in 2021, there were ∼537 million adults living with diabetes worldwide. The number is anticipated to increase to 643 million by 2030 and 783 million by 2045. Blood vessels and nerves in the feet of diabetic patients are prone to damages, resulting in numbness. Due to this, diabetic patients have a higher chance of developing diabetic foot ulceration. According to a study published in 2021 in National Center for Biotechnology Information (NCBI), the risk of developing diabetic foot ulcers is between 19% and 34%. A recurrence rate of ~40% is experienced by patients within 1 year of recovery, 60% within 3 years, and 65% within 5 years. As per same study, it is reported that infection develops in 50–60% of ulcers and is the principal cause that damages diabetic feet. Thus, the demand for diabetic foot ulcer treatments is on rise globally, thereby fueling the market growth.

The diabetic foot ulcer market is further driven by surging geriatric population. Age-associated diabetes is common globally. The deficiency of insulin secretion develops with age and the insulin resistance increases due to a change in body composition and sarcopenia. According to Endocrine Society, an estimated 33% of adults aged 65 or older have diabetes. Additionally, the population is more at risk of developing diabetes-related complications. According to the Global Ageing Survey 2019, there will be a notable rise in the number of people aged 65 or above from 1 in 11 in 2019 to 1 in 6 inhabitants by 2025. As per the US Census Bureau, the number of Americans aged 65 and above is anticipated to double from 46 million in 2016 to more than 98 million by 2060, and the share of the elderly population in the global population will increase from 15% to ~24% in the same period. Moreover, the pace of aging (i.e., people aged 60 and above) by 2050 will be nearly a quarter or more in most regions across the world. Older adults are more likely to be diabetic and are further anticipated to develop diabetic foot ulcers and chronic wounds that can severely impact the quality of life. Therefore, with the growing aging population, the demand for advanced diabetic foot ulcer treatments will continue to increase in the coming years.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONDiabetic Foot Ulcer Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

According to Integra LifeSciences Corporation, the cost of diabetic foot ulcers treatment has an enormous burden on the US healthcare system—ranging between US$ 9 and US$ 13 billion annually. According to the data published by the University of Huddersfield, the cost of treating health care associated infections (HCAIs), particularly surgical site infections (SSIs), has been estimated to represent £1 billion (~US$ 1.26 billion) in the UK. Further, according to Diabetes Australia, diabetes-associated limb amputation costs nearly US$ 23,555, with an additional annual expense of US$ 6,065 post surgery. Over five years, diabetes-related amputation amounts to almost US$ 50,000 for the health system, excluding social costs. The area of a wound and the complexity of procedures also determine the cost of the treatment.

The cost of diabetic foot ulcer treatment is also high in Asia Pacific countries such as India, China, and South Korea. According to a study published in 2022 by Elsevier, the cost of diabetic foot ulcer treatment is ~US$ 21,372/patient in China covering amputations, hospitalizations and medical treatments. Similarly, in India, the cost is around ~US$ 19,599/patient including antibiotics, neuropathic drugs, dressings, collagen scaffolds, growth factors, negative pressure wound therapy, and surgery. Thus, the high cost of advanced wound care treatments, despite the availability of reimbursements, is a key factor restraining the diabetic foot ulcer market growth globally.

Report Segmentation and Scope:

The “Global Diabetic Foot Ulcer Market” is segmented on the basis of ulcer type, treatment type, infection severity, and end user. The global diabetic foot ulcer market, by treatment type, is segmented into advanced wound care dressings, biologics, and therapy device. Based on ulcer type, the market is segmented into neuropathic ulcers, ischemic ulcers, neuro-ischemic ulcers. The global diabetic foot ulcer market, by infection severity, is segmented into moderate, mild, and severe. The global diabetic foot ulcer market, by end user, is segmented into ambulatory surgical centers, hospitals, and home care.

The diabetic foot ulcer market, based on geography, is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

The global diabetic foot ulcer market, by ulcer type, is segmented into neuropathic ulcers, ischemic ulcers, neuro-ischemic ulcers. The neuro-ischemic ulcers segment held the largest market share in 2022 and is anticipated to register the highest CAGR from 2022 to 2030. Neuro-ischemia predominately leads to the development of ulcers on the foot, toes, and dorsum margins, especially on pressure sites occurring among people using poorly fitting shoes. The management of such types of wounds is comparatively complex. The wound requires prompt care, appropriate footwear, offloading, dressings, and infection treatment. Neuro-ischemic ulcers are the most common diabetic foot ulcers (DFUs).

The global diabetic foot ulcer market, by treatment type, is segmented into advanced wound care dressings, biologics, and therapy device. The advanced wound care dressings segment held the largest market share in 2022. The biologics segment is anticipated to register the highest CAGR during 2022–2030. The global diabetic foot ulcer market, by infection severity, is segmented into moderate, mild, and severe. The mild segment held the largest market share in 2022 and is anticipated to register the highest CAGR during the forecast period (2022–2030). The global diabetic foot ulcer market, by end user, is segmented into ambulatory surgical centers, hospitals, and home care. The hospital segment held the largest market share in 2022 and is anticipated to register the highest CAGR from 2022 to 2030.

Regional Analysis:

Based on geography, the global diabetic foot ulcer market is segmented into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2022, North America held the largest share of the global diabetic foot ulcer market size. Asia Pacific is estimated to register the highest CAGR from 2022 to 2030.

The US diabetic foot ulcers market is primarily driven by the increasing prevalence of diabetes in the country. As per the American Podiatric Medical Association, in the US, nearly 14–24% of patients with diabetes who develop foot ulcers require an amputation. According to the Health Innovation Program, ~2 million people in America develop a diabetic foot ulcer annually. Furthermore, according to a study published in NCBI in 2022, ~5% of patients in the US with diabetes mellitus develop foot ulcers, and 1% end up with an amputation. The growing geriatric population in the region also boosts the market growth. According to the Administration on Aging (US Department of Health and Human Services) report published in 2022, there were 55.7 million people aged 65 and above in 2020 in the US. The old age group represents 17% of the population, i.e., 1 in every 6 Americans. As per estimates by the Urban Institute (Washington, DC-based think tank), the number of people aged 65 and older will double over the next 40 years, reaching 80 million in 2040 in the US. Additionally, In 2020, diabetes is regarded as among the leading chronic conditions among adults aged 65 and above. In recent years, several joint ventures, initiatives, and collaborations contributed in accelerating the diabetic foot ulcers market expansion in North America. For instance, in 2020, six research institutions in the US launched the first-ever multicenter network funded by the National Institutes of Health to study diabetic foot ulcers in the US. Additionally, the Diabetic Foot Canada program was launched in Canada to prevent diabetic foot complications. Thus, the high prevalence of diabetes and the increasing geriatric population will drive the market growth in the region.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global diabetic foot ulcer market are listed below:

- In January 2023, Convatec announced the launch of ConvaFoam, a family of advanced foam dressings designed to address the needs of healthcare providers and their patients. ConvaFoam can be used on a broad spectrum of wound types at any stage of the wound journey, making it the simple dressing choice for wound management and skin protection.

- In January 2023, MiMedx Group Inc announced that it had entered into an exclusive distribution agreement with GUNZE MEDICAL LIMITED (“Gunze Medical”), a subsidiary of Gunze Limited, for sales of EPIFIX in Japan. Gunze Medical is a leading distributor of products used in a wide range of wound and surgical settings, including bioabsorbable devices and materials, such as sutures and sheet products.

- In March 2022, Convatec entered the attractive wound biologics segment by acquiring Triad Life Sciences Inc. The company develops biologically derived innovative products to address unmet clinical needs in surgical wounds, chronic wounds, and burns.

- In July 2022, Smith+Nephew announced the launch of the WOUND COMPASS Clinical Support App. It is a comprehensive digital support tool for healthcare professionals that aids wound assessment and decision-making to help reduce practice variation. The App helps improve nurse confidence when assessing and treating wounds and reassuring specialist nurses that their formulary is followed.

- In January 2020, Convatec Group Plc announced the launch of ConvaMax, the new superabsorber dressing. It is used to manage highly exuding wounds, including leg ulcers, pressure ulcers, diabetic foot ulcers, and dehisced surgical wounds.

Diabetic Foot Ulcer

Diabetic Foot Ulcer Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 7.47 Billion |

| Market Size by 2030 | US$ 12.24 Billion |

| Global CAGR (2022 - 2030) | 6.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Ulcer Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Diabetic Foot Ulcer Market Players Density: Understanding Its Impact on Business Dynamics

The Diabetic Foot Ulcer Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Competitive Landscape and Key Companies:

Convatec Group Plc, 3M Co, Coloplast AS, Smith & Nephew Plc, B. Braun SE, Molnlycke Health Care AB, MiMedx Group Inc, URGO MEDICAL Australia Pty Ltd, Medline Industries LP, and Organogenesis Inc are among the prominent players operating in the diabetic foot ulcer market. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For