Digital Pharmacy Market Outlook and Strategic Insights by 2030

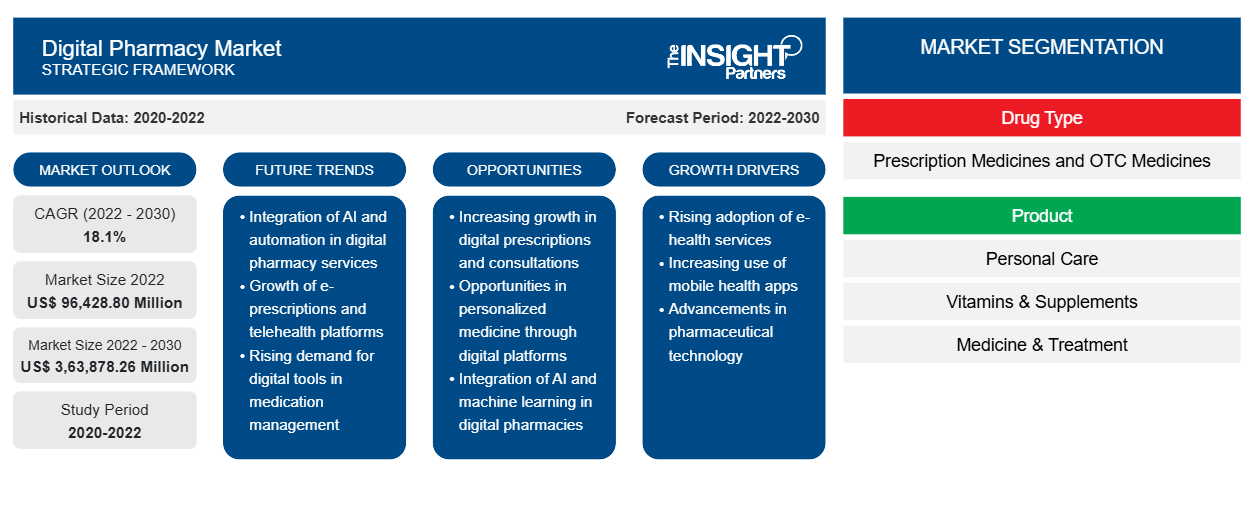

Digital Pharmacy Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Drug Type (Prescription Medicines and OTC Medicines), Product (Personal Care, Vitamins & Supplements, Medicine & Treatment, and Others), Platform (App-Based and Website-Based), and Geography (North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa)

Historic Data: 2020-2022 | Base Year: 2022 | Forecast Period: 2022-2030- Report Date : Apr 2026

- Report Code : TIPRE00031438

- Category : Technology, Media and Telecommunications

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

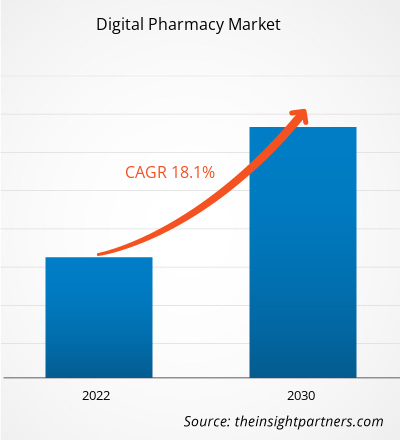

[Research Report] The digital pharmacy market size is expected to grow from US$ 96,428.80 million in 2022 to US$ 3,63,878.26 million by 2030; the market is estimated to register a CAGR of 18.1% from 2022 to 2030.

Analyst’s Viewpoint

The digital pharmacy market analysis explains market drivers such as rising internet usage, access to web-based and online services, and an upsurge in the online purchase of prescription medicines during the COVID-19 pandemic. Further, an innovative e-pharmacy model is expected to introduce new market trends during the forecast period. Based on drug type, the digital pharmacy market is bifurcated into prescription medicines and OTC medicines. The prescription medicine segment held a larger market share in 2022 and is anticipated to register a higher CAGR during 2022–2030. Based on product, the digital pharmacy market is segregated into personal care, vitamins and supplements, medicines and treatments, and others. The medicines and treatments segment held the largest market share in 2022. By platform, the digital pharmacy market is categorized into app-based and website-based. The app-based segment held a larger share of the market in 2022.

A digital pharmacy is a licensed pharmacy combining high-tech and efficient solutions by giving its services a personal touch, which helps commercialize new, existing, and digital therapies. The state-of-the-art solutions simplify the process of filling prescriptions, enhance stakeholders' experiences, and clarify the prescription journey with actionable insights for biopharma manufacturers. Digital pharmacies can help biopharma companies remove barriers, enabling dispensing pharmacies to receive clean and ready-to-dispense prescriptions.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONDigital Pharmacy Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Rising Internet Usage and Access to Web-Based Services & Online Services Propels Digital Pharmacy Market Growth

Health information technology (HIT) involves information processing through computer hardware and software, enabling the storage; retrieval; sharing; and use of healthcare information, data, and knowledge for communication and decision-making. For example, research published in a Centers for Disease Control and Prevention (CDC) report on HIT reveals that 74% of adults in the US use the Internet, among which 61% use the Internet to search for healthcare or medical information. Also, adults from the age group of 18–49 are more likely to utilize HIT than senior adults.

The National Institute of Health report reveals that the use of the Internet for purchasing products and services has risen over the past two decades. Also, there has been an increase in the trend of purchasing online medicines globally. Online medicine purchases have evolved in various ways with the introduction of different models worldwide due to diverse regulatory, economic, and cultural environments. For example, in the US, Internet pharmacies operate majorly as a prescription-based model, while in Europe, they operate via a non-prescription-based model.

Market Trend

Innovative E-Pharmacy Model

According to the Sustaining Health Outcomes through the Private Sector (SHOPS) Plus report published in December 2019, a project team in India has announced a partnership with the State Government of Madhya Pradesh and Medlife International (a pharma company) to launch an innovative, drug-to-doorstep e-pharmacy model as a part of the fight against tuberculosis (TB). The SHOPS Plus Prohect team has designed the service delivery model to strengthen the TB services through an e-pharmacy model/platform. Despite the mitigating TB epidemic in India, the country still holds the most significant number of TB patients, with half a million cases carried undiagnosed annually. Therefore, SHOP Plus is working to utilize technology to provide diagnosis and treatment support services at the patient's doorstep through an e-pharmacy model. With advancements in e-pharmacy platforms designed by the SHOP Plus project, doctors can prescribe home sputum testing materials for TB patients, and the test can be performed remotely. An agent from an e-pharmacy would pick up these materials and deliver them to the lab facility. After processing the sputum material, the lab would upload the patient's report on the e-pharmacy platform. TB patients can view the report, and physicians can prescribe the treatment for the patient accordingly. The e-pharmacy platform also features communication technology to follow up with patients' treatment adherence and future orders. Such innovative e-pharmacy models are likely to provide a lucrative opportunity for the growth of the digital pharmacy market during the forecast period.

Report Segmentation and Scope

Drug Type-Based Insights

Based on drug type, the digital pharmacy market is bifurcated into prescription medicine and OTC medicine. The prescription medicine segment held the largest market share in 2022 and is anticipated to register the highest CAGR for the forecast period 2022–2030. A doctor fills out a digital prescription online and sends it directly to prescription centers over the internet. Prescription centers are electronic databases that issue and process medicines, baby food, and medical devices. Prescriptions are by default public, but they can only be changed by the concerned doctor. In the private prescription, only patients are allowed to purchase prescribed medicines, while in the authorized prescription, prescription medicines can be purchased at a pharmacy by the patient or by people authorized by the patient on the online portal. Individuals purchasing the prescribed medicines need to show the pharmacist their identity documents, including a photograph and an identification number. If the medicine is purchased for another person, the buyer must also know their personal identification number. Post buyers’ verification, pharmacists would locate the correct prescription in the prescription center based on the buyer's identification code (mentioned in the prescription).

Product-Based Insights

Based on product, the digital pharmacy market is segregated into personal care, vitamins and supplements, medicine and treatment, and others. The medicine & treatment segment held the largest market share in 2022. "Express Scripts" offered by Cigna provides home delivery for medicines. Express Scripts Pharmacy has made it easy for consumers to order or renew prescriptions by reducing waiting time at stores. The platform allows transferring prescriptions, easily tracking orders, and interacting with pharmacists. It also offers free standard shipping along with a hassle-free automatic refill program, helpful digital tools to make it easier to keep track of medications, and 24×7 access to pharmacists.

Platform-Based Insights

In terms of platform, the digital pharmacy market is categorized as app-based and website-based. The app-based segment held a larger share of the market in 2022 and is anticipated to register a higher CAGR during 2022–2030. Mobile device technologies have led to remarkable advancements in the healthcare sector. For example, rising smartphone users with internet connectivity, customers are getting discounts on prices, home delivery, and easy access to online pharmacies. "Closeloop," a leading medicine delivery app, provides consumers with the ability to search or filter out medicines [prescription-based or over-the-counter (OTC)], upload prescriptions, make online transactions and payments, set reminders, and get refilling and re-ordering done. Therefore, companies designing innovative apps for e-pharmacies provide easy access to consumers to allow them to order medicines through online channels.

Regional Analysis

North America accounts the largest share for the digital pharmacy market. The market in North America is subsegmented into the US, Canada, and Mexico. The US holds the largest share of the digital pharmacy market in this region. Several start-ups in the US have entered the online pharmacy space after receiving substantial venture capital funding. For example, Amazon, an e-commerce giant, has partnered with different online pharmacies to enter into the e-pharmacy segment, while many physical stores are launching their online services. Small pharmacies and distributors in the US have established online shops, which have reported small-scale online sales. An upsurge in the popularity of online platforms and e-commerce has triggered the digitalization of pharmacy [prescription drugs and over-the-counter (OTC) medication] in the US.

Nimble, formerly operating as a conventional physical pharmacy, is now adapting to online presence. The company raised ~US$ 60 million in funding from Y Combinator, Sequoia Capital, DAG Ventures, First Round Capital, and Khosla Ventures. It further seeks to partner with physical pharmacies to offer delivery services. In 2020, Walmart acquired the startup CareZone and purchased its prescription management technology to make Walmart’s online channel more competitive. The CareZone mobile app helps individuals and families manage a variety of chronic illnesses and medications. Families can access their insurance information and scan labels, aiding speedy and convenient operations. Through this acquisition, Walmart plans to boost its digital health and wellness tools.

The majority of people in the US live within 5 miles of community pharmacies, but rural and urban patients have difficulty accessing pharmacy services. Moreover, store shutdowns, transportation problems, disability related problems, and economic challenges further hamper the access to medicines, leading to pharmacy deserts, as stated by the US Department of Agriculture. A study published in 2023 in the Journal of the American Medical Association reported that states that adopted telepharmacy policies experienced a decrease in pharmacy deserts, and telepharmacies are virtually closer to people with high medical needs than traditional pharmacies. There are currently 28 states in the US that permit the practice of telepharmacy, with differing statuses and regulations.

Digital Pharmacy Market Regional InsightsThe regional trends and factors influencing the Digital Pharmacy Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Digital Pharmacy Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Digital Pharmacy Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 96,428.80 Million |

| Market Size by 2030 | US$ 3,63,878.26 Million |

| Global CAGR (2022 - 2030) | 18.1% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Drug Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Digital Pharmacy Market Players Density: Understanding Its Impact on Business Dynamics

The Digital Pharmacy Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Digital Pharmacy Market top key players overview

The integration of artificial intelligence (AI) and machine learning allows the automation of processes such as medication monitoring, smart reminders, and personalized treatment recommendations. Moreover, the advent of advanced communication platforms and the integration of augmented reality (AR) and virtual reality (VR) with telepharmacy has the potential to revolutionize medicine dispensation, consultations, and patient care, in turn, addressing the surging demands for convenient healthcare services.

The report profiles leading players operating in the global digital pharmacy market. These include Amazon.com Inc, Goodrx Holdings Inc, the Cigna Group, CVS Health Corp, Walmart Inc, Hims & Hers Health Inc, Roman Health Pharmacy LLC, Apex Pharmacy Inc, LloydsPharmacy Ltd, Pharmacy2U Ltd, Docmorris NV, and Truepill. In September 2023, GoodRx announced a collaboration with MedImpact to offer a seamless experience for MedImpact members at pharmacy counters. Additionally, companies in collaboration plan to offer a program for seamless data integration. Based on MedImpact's rigorous drug safety review, the program would also notify patients about any negative drug interactions.

Company Profiles

- Amazon.com Inc

- Goodrx Holdings Inc

- The Cigna Group

- CVS Health Corp

- Walmart Inc

- Hims & Hers Health Inc

- Roman Health Pharmacy LLC

- Apex Pharmacy Inc

- LloydsPharmacy Ltd

- Pharmacy2U Ltd

- Docmorris NV

- Truepill

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For