Endoscopy Procedures Market Growth Drivers and Forecast by 2030

Endoscopy Procedures Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Procedures [Endoscopic Retrograde Cholangiopancreatography (ERCP), Endoscopic Submucosal Dissection (ESD), Peroral Endoscopic Myotomy (POEM), Endoscopic Ultrasound (EUS), Interventional Pulmonology and Laparoscopy, Arthroscopy and Bronchoscopy, Colonoscopy and Colposcopy, Proctoscopy and Thoracoscopy, and Others], Offering [Endoscopes, ERCP Accessories, Head positioner and Endotherapy Injection Needles, Sampling Device and Device Clip and Electrosurgical Knife, Endoscopic Ultrasound (EUS) Guided Devices, Guidewire, Forceps, Snare, Irrigation/Insufflation tubing systems, Probes, Hemostasis Clip, Polyp Traps, Single-Use Valves , Trocar sleeves and Tissue Scissors and Cutters, Retrieval Devices, and Others (Kits/Stents/Energy Devices/ Transport pad/Cleaning Brush/OT Lights, etc.)], Product Type (Disposable and Reusable), End User (Hospitals and Clinics, Ambulatory Surgical Centers, Diagnostic Laboratories, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

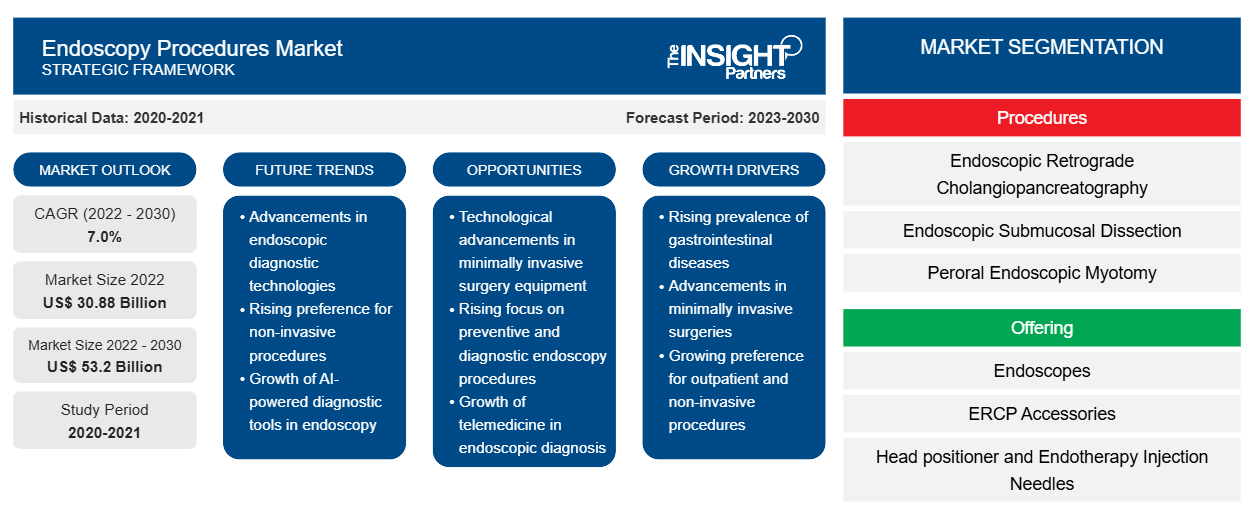

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Sep 2023

- Report Code : TIPRE00030021

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 290

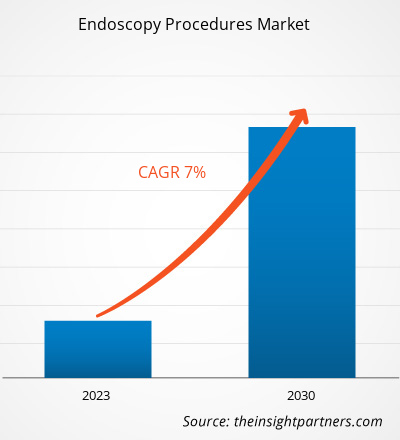

[Research Report] The endoscopy procedures market size was valued at US$ 30,877.37 million in 2022 and is projected to reach US$ 53,196.65 million by 2030. It is estimated to register a CAGR of 7.0% during 2022–2030.

Market Insights and Analyst View:

Endoscopic procedures are minimally invasive medical technique that involve inserting a thin, flexible tube into the body through natural openings or small incisions. These procedures allow doctors to visualize and operate on internal organs, tissues, and structures without the need of major surgeries. Endoscopy is majorly used for diagnosing and treating various conditions in areas such as gastrointestinal tract, respiratory systems and many more. Factors driving the growth of the endoscopy procedures market are growing preference for minimally invasive surgeries and increasing prevalence of cancer. The cost of the endoscopy machines can vary significantly based on the type of endoscope, the complexity of the equipment, the brand, the features it offers. The risks of infections associated with endoscopic procedures could hamper the growth of the market during the forecast period.

Growth Drivers:

Cancer is a major global public health problem and the leading cause of death in North America. Increasing gastrointestinal disorders and cancer cases in North America also accelerate the adoption of endoscopes and market growth. According to the American Cancer Society, colorectal cancer is the second most common cause of death in the US. The risk of developing this disease during the course of life is 4.3% in men and 4.0% in women. The American Cancer Society anticipated deaths of nearly 52,580 people in 2022 due to colorectal cancer in the US.

According to Globocan 2020, the incidence of stomach cancer in Canada was 3,505 in 2020, which is expected to reach 5,230 by 2040. According to Statistics Canada, lung cancer is the most commonly diagnosed cancer and the leading cause of death in Canada than colorectal, pancreatic, and breast cancers combined. In 2021 alone, ~21,000 Canadians died of lung cancer. The high mortality rate from lung cancer reflects its low survival rate.

Lung cancer incidence and mortality rates dramatically increase with age. Incidence rates peak among Canadians aged 75–84 years (396 per 100,000 people), while mortality rates are largely observed among Canadians aged 85 years and older (366 per 100,000 people). Overall, the lung cancer incidence rate is 1/10 higher among men than women, and the mortality rate is almost 1/3 higher among men than women. However, for Canadians younger than 55, rates are higher among women than men.

Western countries, such as the US and Canada, report a high GI incidence rate due to increasing obesity in the adult population and less consumption of dietary fiber. As per the Centers for Disease Control and Prevention, December 2022, ~37.2 million cases of digestive system diseases are recorded in physician offices in the US.

IBD is a term for two conditions—ulcerative colitis and Crohn's disease. Moreover, in the last few years, cases of IBD have increased worldwide due to a sedentary lifestyle; changing dietary habits; stress; and poor nutritional choices, including a high intake of ultra-processed foods and trans-fats. As per the Crohn’s & Colitis Foundation of America, around 70,000 new cases of IBD are diagnosed every year in the US. Further, chronic inflammation and reduced immunosurveillance caused due to IBD may contribute to the development of gastric cancer.

This rising burden of cancer in Canada indicates the high requirement for endoscopic devices, thereby driving the market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONEndoscopy Procedures Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Global Endoscopy Procedures Market” is segmented on the basis of procedure, offering, product type, and end user. Based on procedure, the market is categorized into endoscopic retrograde cholangiopancreatography (ERCP), endoscopic submucosal dissection (ESD), peroral endoscopic myotomy (POEM), endoscopic ultrasound (EUS), interventional pulmonology and laparoscopy, arthroscopy and bronchoscopy, colonoscopy and colposcopy, proctoscopy and thoracoscopy, and others. In terms of offering, the market is segmented into endoscopes, ERCP accessories, visualization system, head positioner and endotherapy injection needles, sampling device and device clip and electrosurgical knife, endoscopic ultrasound guided devices, guidewire, forceps, snare, irrigation/insufflation tubing systems, probes, hemostats clip, polyps traps, single-use valves, trocar sleeves and tissue scissors and cutters, retrieval devices, and others. The endoscopy procedures market, by product type, is bifurcated into disposable and reusable. The endoscopy procedures market, by end user, is segmented into hospitals and clinics, ambulatory surgical centers, diagnostic laboratories, and others. The endoscopy procedures market, based on geography, is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on procedure, the endoscopy procedures market is segmented into is endoscopic retrograde cholangiopancreatography (ERCP), endoscopic submucosal dissection (ESD), peroral endoscopic myotomy (POEM), endoscopic ultrasound (EUS), interventional pulmonology and laparoscopy, arthroscopy and bronchoscopy, colonoscopy and colposcopy, proctoscopy and thoracoscopy, and others. In 2022, the arthroscopy and bronchoscopy segment held the largest share of the market. The endoscopic retrograde cholangiopancreatography (ERCP) segment is expected to grow at the fastest rate during the forecast period. Arthroscopy is a minimally invasive endoscopic offering for the diagnosis and surgical treatment of joint injuries. The essence of offering lies in the fact that the arthroscope is inserted into the joint cavity through 2 small incisions, which allows the surgeon to fully examine the joint, obtain information about its condition and identify the presence of intra-articular damage. Arthroscopy allows arthroscopic treatment of injuries of the knee joint.

This technique allows you to remove the damaged part of the meniscus, restore ligaments, damaged cartilage and perform many other surgical interventions. Bronchoscopy is an endoscopic offering for examining the upper and lower (trachea, bronchi) respiratory tract using a bronchoscope.

Based by offering, the market is segmented into endoscopes, ERCP accessories, visualization system, head positioner and endotherapy injection needles, sampling device and device clip and electrosurgical knife, endoscopic ultrasound guided devices, guidewire, forceps, snare, irrigation/insufflation tubing systems, probes, hemostats clip, polyps traps, single-use valves, trocar sleeves and tissue scissors and cutters, retrieval devices, and others. In 2022, the endoscopes segment held the largest share of the market. The ERCP accessories segment is expected to grow at the fastest rate during the forecast period.

Based on end user, the market is divided into hospitals and clinics, ambulatory surgical centers, diagnostic laboratories, and others. In 2022, the hospitals and clinics segment held the largest share of the market. The diagnostic laboratories segment is expected to grow at the fastest rate during the forecast period. Several endoscopic procedures are performed in hospitals and clinics, which can be used to diagnose and treat digestive disorders, including peptic ulcers, polyps, cancers, and blockages of the bile ducts caused by stones, inflammation, and tumors. The endoscopic clinics are specialized in treating bleeding issues from intestines, pre-cancerous abnormalities such as Barrett's esophagus, and familial adenomatous polyposis syndromes. The clinics also specialize in evaluating and developing new forms of endoscopes and endoscopic techniques. Thus, the factors mentioned above are driving the growth of the hospitals and clinics segment of the endoscopy procedure market.

Regional Analysis:

Based on geography, the endoscopy procedures market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. The market in North America has been analyzed with a prime focus on three major countries—the US, Canada, and Mexico. The US is estimated to hold the largest endoscopy procedures market share during the forecast period. The rising healthcare expenditure is estimated to increase the adoption of various equipment for patient care, fueling the demand for endoscopy procedure products. According to the Global Burden of Disease Study published in October 2020, there is a high burden of various diseases in the US, such as colorectal cancer, cirrhosis, chronic kidney diseases, heart diseases, and cancer. Additionally, according to the US Department of Health and Human Services, 2021, chronic kidney disease (CKD) affects 1 in 7 US adults—i.e., an estimated 37 million Americans. The US endoscopy procedure market has recently witnessed several technological advancements and breakthroughs. The country has a broad pool of global endoscopy product manufacturers such as Boston Scientific Corp, PENTAX Medical, Stryker Corporation, and Steris Corporation. Therefore, the endoscope product approvals in the US fueled the market growth. In February 2023, Boston Scientific Corporation received US Food and Drug Administration (FDA) 510(k) clearance of the LithoVue Elite Single-Use Digital Flexible Ureteroscope System, the first ureteroscope system with the ability to monitor intrarenal pressure in real-time during ureteroscopy procedures. Thus, the need for facility and device sterilization rises with the surge in surgical procedures.

Endoscopy Procedures Market Regional InsightsThe regional trends and factors influencing the Endoscopy Procedures Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Endoscopy Procedures Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Endoscopy Procedures Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 30.88 Billion |

| Market Size by 2030 | US$ 53.2 Billion |

| Global CAGR (2022 - 2030) | 7.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Procedures

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Endoscopy Procedures Market Players Density: Understanding Its Impact on Business Dynamics

The Endoscopy Procedures Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Endoscopy Procedures Market top key players overview

Endoscopy Procedures Market Opportunity:

The field of endoscopy in North America has witnessed various technological advancements and product launches. Such advancements are not only expected to help in the accurate diagnosis of a condition but also will help improve the safety of endoscopic procedures. Some recent technological advancements and product launches in the endoscopy devices market are listed below:

- In April 2021, Olympus announced the addition to its US bronchoscopy portfolio of the 510(k)-cleared H-SteriScope Single-Use Bronchoscopes, a line of five premium endoscopes for use in advanced diagnostic and therapeutic procedures. The introduction of the H-SteriScope portfolio has been a collaboration between Veran Medical Technologies, Inc., a wholly owned Olympus subsidiary, and Hunan Vathin Medical Instrument Co., Ltd.

- In April 2021, Ambu Inc. received Health Canada authorization for the aScope 4 Cysto, the company's unique flexible cystoscope platform for urology. Ambu’s aScope 4 Cysto is a cost-effective, high-quality flexible endoscope featuring excellent maneuverability and optics. Unlike traditional reusable endoscopes, single-use eliminates the significant capital, repair, and cleaning costs required to ensure a patient-ready instrument for every procedure. Each aScope 4 cystoscope is sterile from the package and ready when needed, enabling facilities to improve workflow efficiencies and reallocate staff from complex, time-consuming endoscope cleaning to more productive activities.

Competitive Landscape and Key Companies:

A few of the prominent endoscopy equipment manufacturers operating in the global endoscopic procedures market are Steris Plc, Conmed Corp, Olympus Corp, Boston Scientific Corp, PENTAX Medical , Erbe Elektromedizin Gmbh, Micro-Tech Nanjing Co Ltd, Merit Medical Systems Inc, Cook Medical LLC, Stryker Corp, and Johnson & Johnson. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. For instance, in June 2022, Stryker opened its new research and development facility, Stryker’s Global Technology Centre, at the International Tech Park, Gurgaon. The 150,000-square-foot facility further supported the company’s mission to make healthcare better.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For