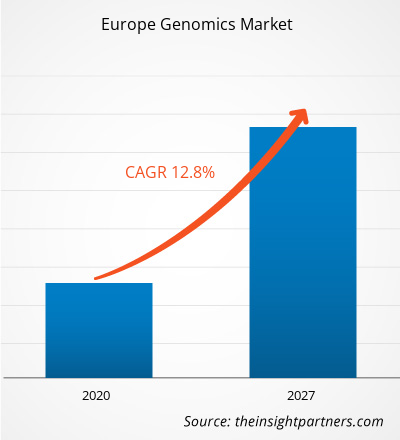

The Europe Genomics market is expected to reach US$ 15,448.81million in 2027 from US$ 6,023.69million in 2019. The market is estimated to grow with a CAGR of 12.8% from 2020-2027.

Genomics is defined as the study of a gene and its functioning. Genomics is used to examine the molecular mechanisms and the interaction of genetic and environmental factors in the diseases. The major factors attributing to the growth of the genomics market are growing government support and increased number of genomics studies, declining sequencing cost, increased genomics applications. The scope of the genomics market includes technology, product and service, application, end-user, and region.

Germany Genomics Market Revenue and Forecasts to 2027 (US$ MN)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

EUROPE GENOMICS MARKET SEGMENTATION

By Technology

- Sequencing

- Microarray

- Polymerase Chain Reaction

- Nucleic Acid Extraction and Purification

- Others

By Product and Services

- Instruments/Systems

- Consumables

- Services

By Application

- Diagnostics

- Drug Discovery and Development

- Precision/Personalized Medicine

- Agriculture & Animal Research

- Others

By End User

- Research Centers

- Hospitals & Clinics

- Biotechnology & Pharmaceutical Companies

- Others

By Country

Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

Company Profiles

- Illumina, Inc.

- Danaher

- F. HOFFMANN-LA ROCHE LTD.

- BIO-RAD LABORATORIES INC.

- General Electric Company

- THERMO FISHER SCIENTIFIC INC.

- Agilent Technologies, Inc.

- Eurofins Scientific

- QIAGEN

- BGI

Europe Genomics Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 6,023.69 Million |

| Market Size by 2027 | US$ 15,448.81 Million |

| Global CAGR (2020 - 2027) | 12.8% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology, Product & Service, Application, End User, and Country

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

UK, Germany, France, Italy, Russia

Trends and growth analysis reports related to Life Sciences : READ MORE..

- Illumina, Inc.

- Danaher

- F. HOFFMANN-LA ROCHE LTD.

- BIO-RAD LABORATORIES INC.

- General Electric Company

- THERMO FISHER SCIENTIFIC INC.

- Agilent Technologies, Inc.

- Eurofins Scientific

- QIAGEN

- BGI

Get Free Sample For

Get Free Sample For