Europe Piling Machines Market Size, Share, and Analysis by 2031

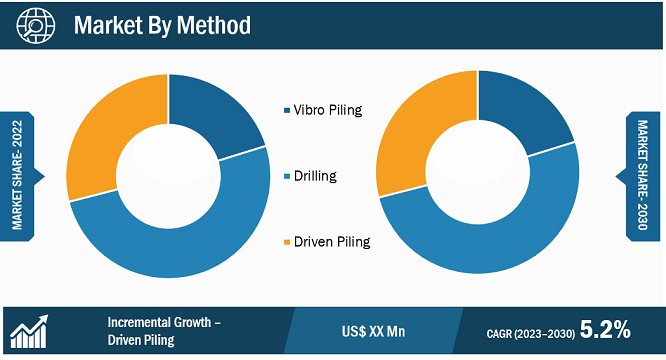

Europe Piling Machines Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Impact Hammers, Piling Rigs, Micro Piling Rigs, Vibratory Drivers, Trench Cutter, Diaphragm Walls, and Others), Method (Vibro Piling, Drilling, and Driven Piling), and Country

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Apr 2024

- Report Code : TIPRE00039017

- Category : Manufacturing and Construction

- Status : Published

- Available Report Formats :

- No. of Pages : 107

The Europe piling machines market size is projected to reach US$ 3,375.54 million by 2031 from US$ 2,248.32 million in 2023; the market is expected to register a CAGR of 5.2% during 2023–2031.

Analyst Perspective:

Raw material/component suppliers, piling machines manufacturers, and end users are major stakeholders in the Europe piling machines market ecosystem. The raw material/component providers include players who manufacture and supply components such as inlet cones, impellers, fan casings, inspection doors, motor pedestals, cooling wheels, unitary base piling rigs, winches, hammers, and drilling rigs, which assist in the production of piling machines. With the rise in demand for piling machines, the business of component providers is positively impacted. However, any impact on the component manufacturers directly impacts the piling machine production. The Europe piling machines market players are the companies that manufacture piling machines and supply the same to end users. The construction industry is the major end user of the market. An increase in infrastructural development across developed and developing countries propels the growth of the industry, thereby bolstering the demand for piling machines. The COVID-19 outbreak pandemic has adversely impacted the growth of the Europe piling machines market. The crisis resulted in a temporary closure of all economic activities, including several construction projects, which declined the demand for piling machines in the industry during the pandemic.

Market Overview:

A piling machine is a device for setting piles in the ground to support compositional structures. Piling machines bore in silt, sand, and others. These machines are utilized for constructing bridges, residential and commercial constructions, tunnels, dams, and others.

Increased investments in the construction industry in the country boost the Europe piling machines market growth. In June 2022, the German government announced its plans to construct 400,000 apartments a year. In addition, in November 2011, Danish firm Femern A/S announced that it had started constructing a tunnel that connects Germany and Denmark. Apart from the infrastructure development program, the governments of the European countries invested in renovation activities. In 2024, Eiffage Construction secured a renovation contract worth more than US$ 99 million in Paris, France. Under this contract, Eiffage will renovate three building structures in Paris. In 2021, various construction projects were commenced in Europe that included A303/A30/A358 Road Corridor Improvement, E39 Herdal-Royskar Motorway, Nizhnekamsk-Naberezhnye Chelny Bypass, Banja Luka-Prijedor-Novi Grad Motorway, and Llogara Tunnel. According to the European Commission, in June 2022, the European Union planned to invest US$ 5.0 billion in sustainable, safe, and efficient transport infrastructure. Apart from investments in the infrastructure, initiatives taken by key market players support the adoption and expansion of the piling machines. In October 2022, BSP TEX Ltd. introduced JX RIG, a self-erecting, radio-controlled piling rig. The rig is attached to a JCB base unit and uses a 12.5m single piling mast and BSP-TEX hydraulically accelerated piling hammers from the DX range. The JX Piling Rig is capable of driving steel, wood, or concrete piles up to 8m in length. In July 2022, Comacchio SpA launched CH 150 at Geofluid. In addition to the Kelly configuration, the CH 150 features a configuration for CFA piles and a setup for making micropiles. Owing to such activities, the Europe piling machines market is growing.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe Piling Machines Market: Strategic Insights

-

Market Size 2023

US$ 2,248.32 Million -

Market Size 2031

US$ 3,375.54 Million

Market Dynamics

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

Regional Overview

- Europe

Market Segmentation

Type

Type

- Impact Hammers

- Piling Rigs

- Micro Piling Rigs

- Vibratory Drivers

- Trench Cutter

- Diaphragm Walls

Method

Method

- Vibro Piling

- Drilling

- Driven Piling

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Rise in Construction Industry Bolsters Europe Piling Machines Market Growth

The presence of several well-established and emerging players in construction industry contributes to the growing Europe piling machines market size. The European economy relies heavily on the construction sector. With over 3 million businesses, it accounts for around 9% of the European Union's (EU) GDP. The construction industry is rapidly growing in various countries across Europe owing to rising government investments and increasing demand for residential construction projects. In 2021, the European Union (EU) invested 5.6% of its GDP in housing. This percentage varied throughout the member states, ranging from 7.6% in Cyprus, 7.2% in Germany, 2.1% in Ireland, and 2.2% in Latvia to 2.3% in Poland. In January 2024, The European Climate, Environment, and Infrastructure Executive Agency received ∼ 400 applications requesting US$ 20 billion for transport infrastructure projects. The rising population is another factor that is increasing the demand for public infrastructure and the development of new transport networks and residential structures. As per the data published by the European Union in 2023, the EU’s population increased from 446.7 million in January 2022 to 448.4 million in January 2023. Such an increase in the population directly propels the need for public infrastructure and residential construction. In 2021, various construction projects were commenced that included A303/A30/A358 Road Corridor Improvement; E39 Herdal-Royskar Motorway, Nizhnekamsk-Naberezhnye Chelny Bypass, Banja Luka-Prijedor-Novi Grad Motorway, and Llogara Tunnel. Further, according to the European Commission, in June 2022, the European Union has planned to invest US$ 5.0 billion in sustainable, safe, and efficient transport infrastructure. The increasing investments by governments of countries in Europe in infrastructure and industrial development also boost the Europe piling machines market growth.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

The Europe piling machines market analysis is carried out by considering the following subsegments: type and method. By type, the market is segmented into impact hammers, piling rigs, micro piling rigs, vibratory drivers, trench Cutters, diaphragm walls, and others (soil mixing equipment). The piling rigs segment is projected to dominate the Europe piling machines market share owing to their wide range of applications and efficiency in usage. However, the micro piling rigs segment is projected to register a notable CAGR during the forecast period. One of the primary factors behind the increased adoption of micro piling rigs is their use case in areas where open working space is limited. In addition, it can be efficiently used in the extreme environment.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Regional Analysis:

The scope of the Europe piling machines market report encompasses Europe (Spain, the UK, Portugal, Germany, France, Italy, and the Rest of Europe). As per the data published by the German government in 2024, for 2024–2027, the German government announced an investment of US$ 40 billion for rail projects. The Hauptverband Deutsche Bauindustrie (HDB), a German construction industry association, predicts that the construction industry will contribute significantly to Germany's GDP in the coming years. The expansion of this industry is majorly attributed to the rise in residential and commercial or public infrastructure construction projects. As the country is one of the popular tourist destinations across the region, there is a constant growth in the construction of hotels and malls in the country. With the rising construction of mentioned commercial buildings, the demand for piling machines is also increasing. According to the European Union’s data published in 2022, by 2100, Italy is projected to become the most populated country after France and Germany. Increased population is expected to increase the requirement for residential construction and public infrastructure. Such projects are expected to drive the adoption of piling machines in the country in the coming years. Currently, Italy is heavily investing in the development of the energy infrastructure. In December 2023, Neoen initiated the construction of three solar plants in Central and Northern Italy. In October 2022, Webuild Group announced 29 infrastructure projects in Italy. The contractual value of this contract exceeded US$ 3.5 billion in 2021. In addition, in July 2023, the Rome government announced a major construction project to develop a road in the city. This project will start in 2025, the Jubilee year of Rome. Thus, owing to the increasing population, growing government investments are driving the earth management equipment, ultimately driving the adoption of Europe piling machines market share across Italy.

Key Player Analysis:

Junttan Oy, Bauer AG, Liebherr-Werk Nenzing GmbH, Soilmec SpA, Casagrande SpA, Comacchio SpA, ABI GmbH, IMT Srl, LeBoTec BV, and Sany Heavy Industry Co Ltd are among the key players profiled in the Europe piling machines market report. The report includes growth prospects in light of the current market trends and driving factors influencing the market growth.

Recent Developments:

A few recent developments by the Europe piling machines market players, as per their press releases, are listed below:

Year |

News |

|

January 2024 |

Casagrande delivered its B240 XP-2 piling rig to Australia, marking a strategic market expansion and innovation in foundation equipment. The rig, equipped with a powerful engine and advanced hydraulic system, can tackle challenging soil conditions and accommodate an extensive range of drilling techniques. Its intelligent control systems and advanced safety features enhance operational efficiency and prioritize operator well-being. The rig is set to showcase its capabilities in Australia, a market witnessing unprecedented growth in construction and infrastructure development. Casagrande's dedication to providing innovative solutions is evident as the rig enters the Australian market. |

Europe Piling Machines Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2,248.32 Million |

| Market Size by 2031 | US$ 3,375.54 Million |

| CAGR (2023 - 2031) | 5.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

Frequently Asked Questions

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For