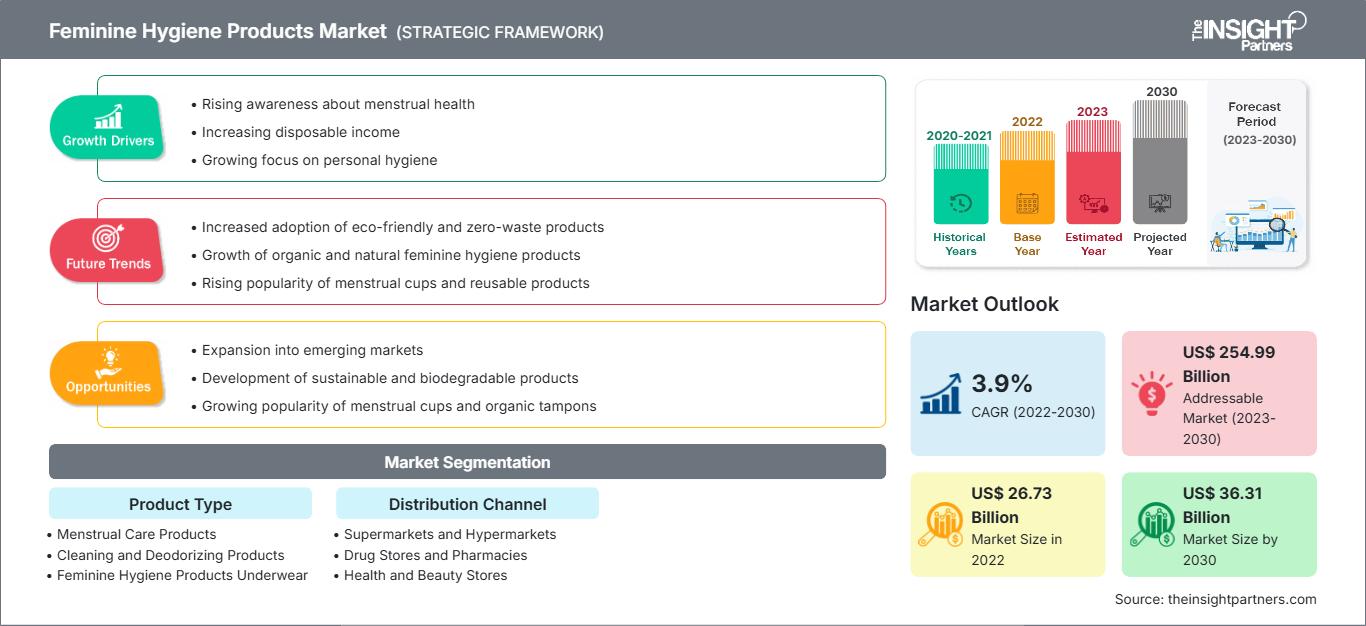

Feminine Hygiene Products Market Drivers and Forecasts by 2030

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030Feminine Hygiene Products Market Forecast to 2030 - Global Analysis by Product Type [Menstrual Care Products (Sanitary Napkins, Tampons, Menstrual Cups, and Others), Cleaning and Deodorizing Products (Hair Removal Products, Hygiene Wash, Intimate Spray, and Others), and Feminine Hygiene Products Underwear (Reusable Period Underwear, Reusable Incontinence Underwear, and Others)]; and Distribution Channel (Supermarkets and Hypermarkets, Drug Stores and Pharmacies, Health and Beauty Stores, Online Retail, and Others)

- Report Date : Jul 2023

- Report Code : TIPRE00006970

- Category : Consumer Goods

- Status : Published

- Available Report Formats :

- No. of Pages : 185

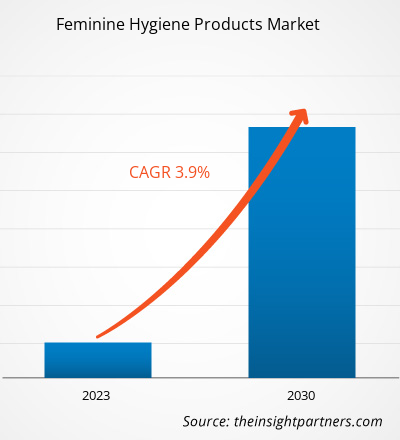

[Research Report] The feminine hygiene products market was valued at US$ 26,733.33 million in 2022 and is projected to reach US$ 36,305.29 million by 2030; it is expected to register a CAGR of 3.9% from 2022 to 2030.

Market Insights and Analyst View:

The feminine hygiene products market in Europe is mainly driven by a surge in awareness toward maintaining personal hygiene and increasing initiatives by the governing bodies regarding feminine hygiene. Also, the awareness regarding personal hygiene in women is increasing due to various government initiatives and social media campaigns. These initiatives and campaigns contribute to a better understanding and acceptance of female hygiene products. Therefore, the rise in awareness toward personal hygiene is propelling the growth of the feminine hygiene products market. The regions such as North America, Europe, and Asia Pacific are hub of Edgewell Personal Care Co, Kimberly-Clark Corp, Lune Group Oy Ltd, Me Luna Gmbh, Mooncup Ltd, Ontex BV, Essity Ab, Wuka Ltd, Cotton High Tech SL, and The Procter & Gamble Co, which generate a high demand for feminine hygiene products. Hence, the presence of such companies drives the global feminine hygiene products market growth.

Growth Drivers and Challenges:

Strategic initiatives by key market players have been driving the global feminine hygiene products market growth. Manufacturers are heavily investing in research and development projects, partnerships, expansion plans, and collaborations to launch innovative products to attract a large consumer base. For instance, in June 2020, Pee Safe launched a new range of intimate hygiene products, including undergarment sanitizer spray, reusable sanitary pads, oxo-biodegradable disposable bags, and an intimate hygiene powder. Key market players are adopting strategic initiatives such as mergers and acquisitions to expand their product portfolio and geographical presence. For instance, in November 2022, Edgewell Personal Care company announced the acquisition of Billie Inc. The acquisition was aimed at expanding its product portfolio of premier feminine shave and body care brands.

Additionally, natural and clean hair removal products are gaining popularity worldwide due to the greater awareness of the harmful effects of chemicals and the rising inclination toward using green and clean personal care products. This trend has prompted manufacturers to develop natural products based on customer requirements. For instance, Reckitt Benckiser Group Plc launched the Veet Pure range of hair removal creams in 2022, thereby reformulating its products. The product range includes natural cucumber extracts, aloe vera, and grapeseed oil. Thus, such product launches and other strategies to cater to the increasing consumer demand aids the market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Feminine Hygiene Products Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The global feminine hygiene products market is segmented on the basis of product type, distribution channel, and geography. Based on product type, the feminine hygiene products market is segmented into menstrual care products, cleaning and deodorizing products, and feminine hygiene underwear. On the basis of distribution channel, the feminine hygiene products market is segmented into supermarkets and hypermarkets, drug stores and pharmacies, health and beauty stores, online retail, and others. The feminine hygiene products market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

Based on product type, the feminine hygiene products market is segmented into menstrual care products, cleaning and deodorizing products, and feminine hygiene underwear. The menstrual care products segment held a significant share in the feminine hygiene products market growth and is expected to register substantial growth during the forecast period. Menstrual care products, including menstrual pads, period panties, panty liner, feminine wipes, tampons and menstrual cups, sanitary napkins, and sanitary pads, are gaining traction due to the rising awareness about feminine hygiene among females worldwide. In addition, the rising usage of these products is encouraging environmental sensitivity among the population. Hence, the working female professionals and other environment-sensitive populations are adopting menstrual products which are comfortable and disposable.

Menstrual care products are usually disposed of and lead to landfills and generate enormous volumes of waste, which is nonbiodegradable. As a result, it persists in the environment in the form of microplastics, posing a significant threat to aquatic and terrestrial ecosystems. Owing to the increased awareness of this concern, many are switching to reusable menstrual products such as menstrual cups and discs and reusable pads made of cloth. According to an article published on the BBC website and Google Trends Index of Search Terms, searches for reusable period products have spurred every year.

Regional Analysis:

Based on geography, the feminine hygiene products market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. The global feminine hygiene products market was dominated by North America and recorded ~US$ 5,000 million in 2022. Europe is a second major contributor holding more than 20% share of the global market. Asia Pacific is expected to grow at a CAGR of over 5% during the forecast period. The North America feminine hygiene products market is segmented into the US, Canada, and Mexico. The feminine hygiene products market growth in North America is attributed to a higher standard of living, better sanitation practices, and greater income levels for women. The industry has witnessed continuous innovation in feminine hygiene products, with companies introducing new and improved products to cater to the different needs and preferences of customers. Moreover, the growing concern for environmental issues, such as the increased plastic population and global warming, has encouraged women to opt for sustainable and eco-friendly products. In North America, ~20 billion sanitary napkins, tampons, and applicators are sent to landfills annually. The products such as menstrual cups and cloth pads have gained popularity owing to their cost-effectiveness and reduced environmental impact. Surging demand for sustainable and eco-friendly feminine hygiene products has resulted in product innovation and the launch of products in the market. For instance, In December 2022, Trace Femcare announced the launch of Climate Beneficial Cotton and regenerative hemp fiber tampon. The products addressed the increasing plastic population and global warming caused by non-disposable tampons. Therefore, all the above factors influence the feminine hygiene products market growth across North America.

Industry Developments and Future Opportunities:

Various initiatives taken by the key players operating in the feminine hygiene products market are listed below:

- In November 2021, Ontex BV launched its brand NAT in China. The products launched were tampons, towels, pantyliners, and menstruation pants.

- In May 2021, Poise, a Kimberly Clark brand, announced its partnership with Whitney Port and launched its 2-in-1liners and pads.

The regional trends and factors influencing the Feminine Hygiene Products Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Feminine Hygiene Products Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Feminine Hygiene Products Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 26.73 Billion |

| Market Size by 2030 | US$ 36.31 Billion |

| Global CAGR (2022 - 2030) | 3.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Feminine Hygiene Products Market Players Density: Understanding Its Impact on Business Dynamics

The Feminine Hygiene Products Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Feminine Hygiene Products Market top key players overview

COVID-19 Impact:

The rising female literacy rate and greater menstrual hygiene awareness primarily drove the feminine hygiene products market before the onset of the COVID-19 pandemic. However, the consumer goods industry experienced adverse impacts of the pandemic during the first quarter of 2020. The COVID-19 pandemic also led to an economic recession in the initial months of 2020, which created financial difficulties for low-income and mid-income consumers. As a result, people only purchased primary essential products—such as groceries and critical medical products—lowering the sales of feminine hygiene products.

Many businesses recovered as the governments of various countries eased the restrictions after the initial months of lockdown in 2020. The introduction of the COVID-19 vaccine offered further relief from the distressing pandemic situation, leading to a rise in business activities. The resumption of operations in the manufacturing units positively impacted the feminine hygiene products market and led to the recovery of the production of feminine hygiene products. Manufacturers overcame the demand and supply gap as they were permitted to operate at total capacity.

Competitive Landscape and Key Companies:

A few of the prominent players operating in the global feminine hygiene products market include Edgewell Personal Care Co, Kimberly-Clark Corp, Lune Group Oy Ltd, Me Luna Gmbh, Mooncup Ltd, Ontex Bv, Essity Ab, Wuka Ltd, Cotton High Tech SL, and The Procter & Gamble Co. among others. These players offer cutting-edge feminine hygiene products with innovative features to deliver a superior experience to consumers.

Frequently Asked Questions

Based on the product type, why does the menstrual care products segment have the largest revenue share?

What are the opportunities for feminine hygiene products in the global market?

What is the largest region of the global feminine hygiene products market?

What are the key drivers for the growth of the global feminine hygiene products market?

Can you list some of the major players operating in the global feminine hygiene products market?

Based on the distribution channel, which segment is projected to grow at the fastest CAGR over the forecast period?

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For