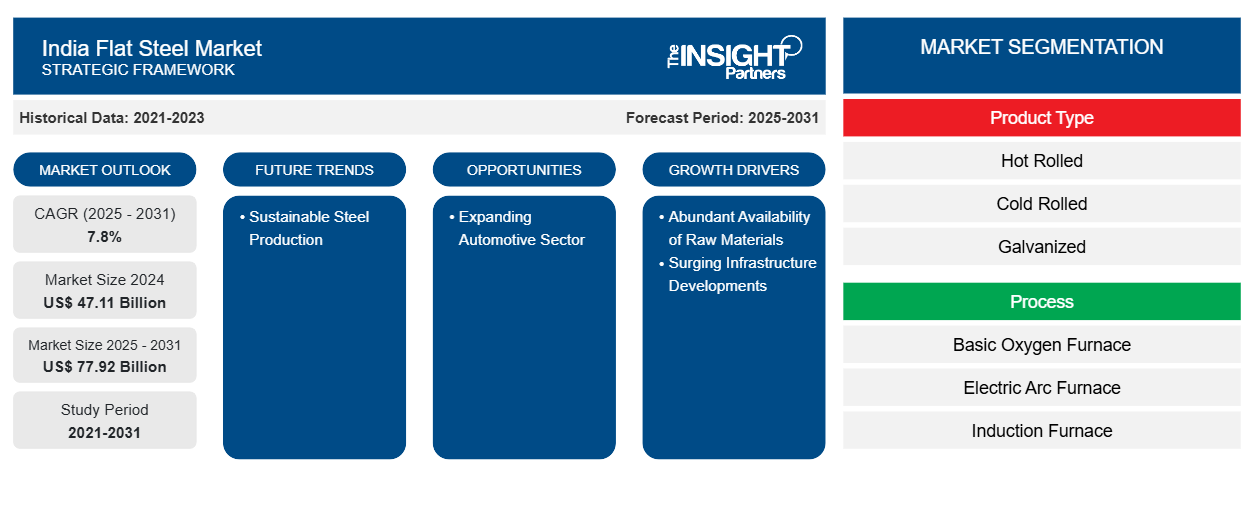

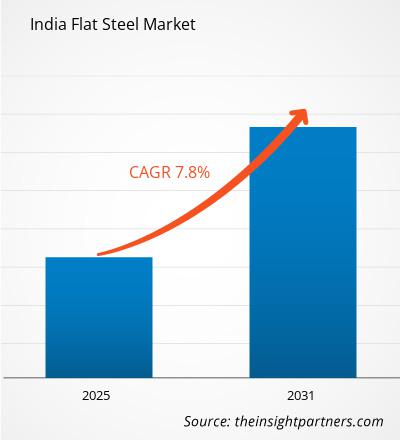

The India flat steel market is projected to grow from US$ 47.11 billion in 2024 to US$ 77.92 billion by 2031; the market is expected to register a CAGR of 7.8% during 2025–2031. The growing demand for sustainable steel production is likely to emerge as a prominent future trend in the market.

India Flat Steel Market Analysis

The India flat steel market is expanding owing to the abundant availability of raw materials and surging infrastructure investments in the country. According to the Confederation of Real Estate Developers' Associations of India, Gujarat witnessed construction commitments of 91 crore sq.ft of area, getting the Real Estate Regulatory Authority (RERA) registered for 2020-2023. In 2021-2022 alone, construction commitments of 26 crore sq.ft of development projects completed RERA registration. Gandhinagar, Ahmedabad, Surat, Rajkot, and Vadodara are among the top districts contributing to the state's construction sector. These districts hold an 82% share in total RERA-registered projects and a 93% share in the project market value. Such growing end-use industries fuel the demand for flat steel products in Gujarat.

India Flat Steel Market Overview

The country is home to the largest steel plants that contribute to the growing steel industry. SAIL's Bokaro and Rourkela Steel Plants, as well as Tata Steel's Jamshedpur facility, are major producers of flat steel products. Odisha is a steel production hub with numerous plants contributing to India's total steel output. The Meramandali plant of Tata Steel in Odisha is among the country's largest flat steel production plants. In February 2024, the JSW Group announced plans to establish a steel plant in Odisha with an investment of US$ 7.8 million and a production capacity of 13.2 million tons annually. Such increased production capacity in these states contributes to the adoption of flat steel in the country.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

India Flat Steel Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

India Flat Steel Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

India Flat Steel Market Drivers and Opportunities

Surging Infrastructure Developments

According to the Press Information Bureau, public infrastructure is the backbone of economic development in India, enhancing connectivity and global trade. Favorable government initiatives and policies support the country's infrastructure development. In 2021, the government launched the PM Gati Shakti National Master Plan, which brought together ministries, including Roadways and Railways, to ensure coordinated execution and integrated planning of infrastructure projects in the country. This initiative aims to provide seamless connectivity for the movement of goods, services, and people across modes of transportation, thereby enhancing last-mile connectivity and reducing time.

According to the same source, India has the second-largest road network globally, and the total length of the country's National Highways expanded from 91,287 kilometers in 2014 to 146,145 kilometers as of 2024, forming the primary arterial network of India. The government has undertaken measures to strengthen and enhance its National Highway network through Bharatmala Pariyojana and the Special Accelerated Road Development Programme.

Flat steel bars are embedded in concrete for road foundations, pavement slabs, and retaining walls. This reinforcement improves load-bearing capacity, longevity, and resistance to cracking, ensuring the road surface can withstand heavy traffic and environmental stresses. Thus, the rising number of infrastructural developments drives the demand for flat steel products in the country.

Expanding Automotive Sector

India's automotive sector is expanding due to rising domestic production. The soaring interest of companies in exploring the rural markets contributes to the automobile sector's growth. The increasing logistics and passenger transportation sectors drive the commercial vehicle demand. According to the India Brand Equity Foundation, India is the largest producer of tractors, the second-largest bus producer, and the third-largest heavy truck manufacturer globally. The country's annual automobile production increased from 25.93 million in 2023 to 28.43 million in 2024. High-end automotive manufacturers witnessed an increase in their sales. In December 2024, Mercedes-Benz AG sold 1,468 luxury automotive units in India, the highest in the passenger vehicles segment. The nation's electric vehicle sales increased from 82,688 units in 2023 to 100,000 units in 2024. According to the India Energy Storage Alliance, the electric vehicle market size in India is anticipated to increase by 36% by 2026.

Automotive manufacturers manufacture engine components, including cylinder blocks and crankshafts, using flat-rolled carbon steel products. They also manufacture suspension components, such as struts, springs, and control arms. Flat-rolled carbon steel is durable and strong, which makes it ideal for the crucial components in automobiles required to withstand stress. It also helps reduce emissions and improve fuel efficiency. Thus, the growing automotive sector fuels the demand for flat steel products.

India Flat Steel Market Report Segmentation Analysis

Key segments that contributed to the derivation of the India flat steel market analysis are product type, process type, end use category, and end use industry.

- Based on product type, the market is segmented into hot-rolled, cold-rolled, galvanized, coated steel, and others. The hot rolled segment held the largest share of the India flat steel market in 2024.

- By process, the India flat steel market is divided into basic oxygen furnace, electric arc furnace, and induction furnace. The basic oxygen furnace segment held the largest share of the India flat steel market in 2024.

- Per end use category, the market is bifurcated into OEMs and MSMEs. The MSMEs segment held a larger share of the market in 2024.

- As per end use industry, the market is segmented into infrastructure, solar, automotive, electrical, marine, and others. The infrastructure segment is expected to dominate the market over the forecast period.

India Flat Steel Market Share Analysis by Region

South India leads India in per capita steel consumption, reflecting its industrial base and infrastructure growth. The region's steel production relies on a mix of iron ore, DRI (direct reduced iron), and scrap, supporting traditional and green steelmaking. According to the Ministry of Steel (PIB), the total number of finished steel products stood at 26.24 million tons as of 2024. The region's hot-rolled, cold-rolled, and galvanized steel capacity is expanding to meet rising infrastructure, automotive, and manufacturing demand while leading India's transition toward greener steel production. According to the Department of Electronics, Information Technology and Biotechnology, Karnataka is India's 4th largest automobile manufacturer, accounting for approximately 8.5% of the country's total.

The India flat steel market is growing due to favorable investments. Haryana is among the major steel-producing states in the Northern region. In May 2025, Jindal India, a major producer of galvanized coils, color-coated coils, and cold rolled steel, expanded its coated flat product capacity in Haryana with a current of 3 million tons annually, ramping up capacity to 4.2 million tons by 2027. The company's flat steel production capacity in 2025 is estimated at 2–3 MTPA for hot rolled, 1–2 MTPA for cold rolled, and 1.5–2 for MTPA, propelling the demand for flat steel in North India.

India Flat Steel Market Regional Insights

The regional trends and factors influencing the India Flat Steel Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses India Flat Steel Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for India Flat Steel Market

India Flat Steel Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 47.11 Billion |

| Market Size by 2031 | US$ 77.92 Billion |

| Global CAGR (2025 - 2031) | 7.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | India

|

| Market leaders and key company profiles |

India Flat Steel Market Players Density: Understanding Its Impact on Business Dynamics

The India Flat Steel Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the India Flat Steel Market are:

- JSW Steel Ltd

- Tata Steel Ltd

- Jindal Steel and Power Ltd

- Posco Holdings Inc

- ArcelorMittal Nippon Steel India

- Namco Industries Pvt Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the India Flat Steel Market top key players overview

India Flat Steel Market News and Recent Developments

The India flat steel market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases.

India Flat Steel Market Report Coverage and Deliverables

The "India Flat Steel Market Share and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- India flat steel market trends and forecast for all the key market segments covered under the scope

- India flat steel market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- India flat steel market analysis covering key market trends, country framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the India flat steel market

- Detailed company profiles

Frequently Asked Questions

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - India Flat Steel Market

- JSW Steel Ltd

- Tata Steel Ltd

- Jindal Steel & Power Ltd

- Posco Holdings Inc

- ArcelorMittal Nippon Steel India

- Namco Industries Pvt Ltd

- Shah Alloys Ltd

- Asian Mills Pvt Ltd

- Asian Tubes Pvt Ltd

- Asian Tubes Pvt Ltd CR Division

Get Free Sample For

Get Free Sample For