Infection Surveillance Solutions Market Size, Share, and Analysis by 2025

Infection Surveillance Solutions Market to 2025 - Industry Analysis and Forecasts By Type (Software and Services), End User (Hospitals, Nursing Homes, and Other End Users) and Geography

Historic Data: 2015-2016 | Base Year: 2017 | Forecast Period: 2018-2025- Report Date : Feb 2019

- Report Code : TIPHE100001413

- Category : Technology, Media and Telecommunications

- Status : Published

- Available Report Formats :

- No. of Pages : 183

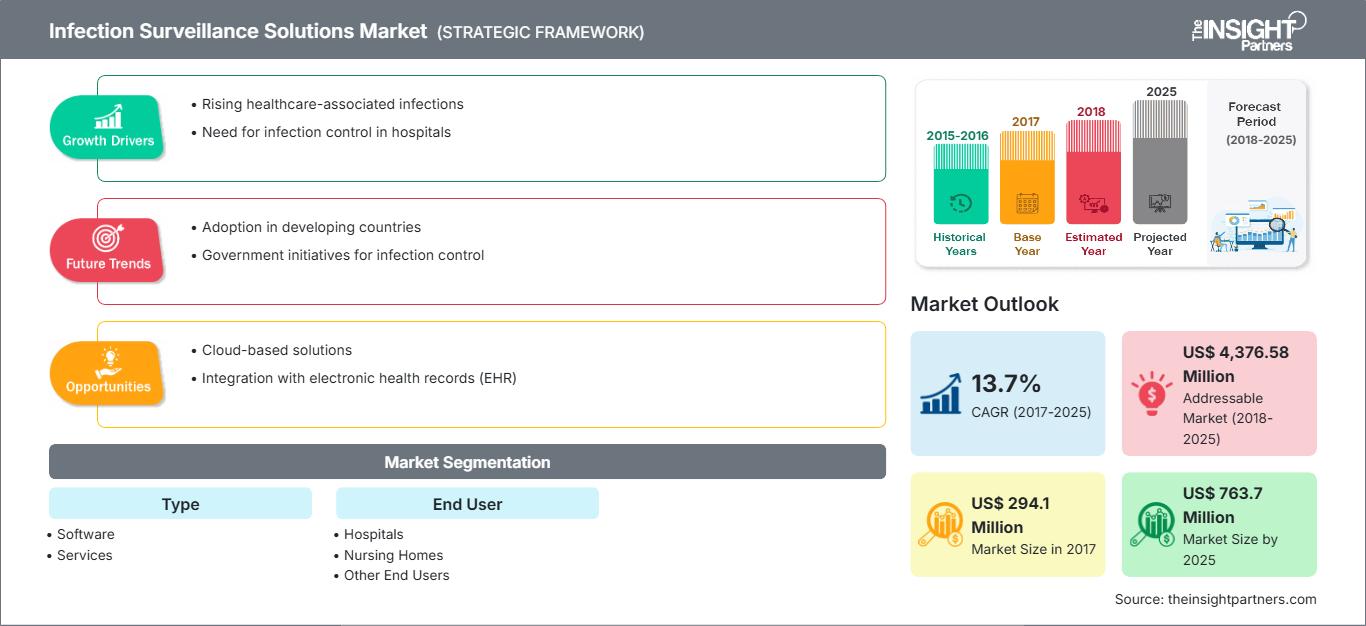

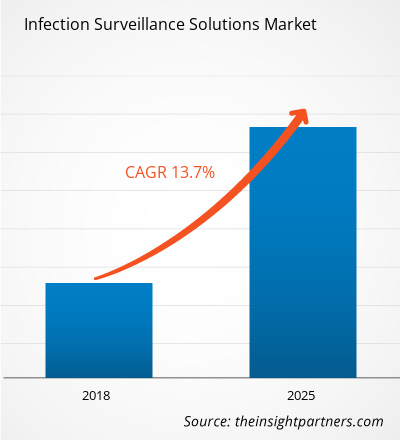

The Infection Surveillance Solutions market was valued at US$ 294.1 million in 2017 and it is projected to reach US$ 763.7 million by 2025; it is expected to grow at a CAGR of 13.7% from 2018 to 2025.

Infection surveillance solutions refer to the software and integrated entities that helps to gather the medical data related to factors causing healthcare associated infections (HAIs) in the medical facilities and offer features in order to monitor, analyze, control as well as create a control action plan to reduce and prevent the HAIs. The growth of the Infection Surveillance Solutions market is attributed to the increasing number of healthcare associated infections, government initiatives for prevention of healthcare associated infections (HAIs), rise in the integration of information technology into various healthcare platforms are key drivers for the growth of the market. However, the growth of the market is restrained by various factors such as high costs of the software and dearth of skilled professionals to offer services in remote areas.

The Infection Surveillance Solutions market is expected to witness substantial growth post-pandemic. The Infection Surveillance Solutions market is expected to witness substantial growth post-pandemic. The COVID-19 has affected economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. The COVID-19 crisis has overburdened public health systems in many countries and highlighted the strong need for sustainable investment in health systems. As the COVID-19 pandemic progresses, the healthcare industry is expected to see a drop in growth. The life sciences segment thrives due to increased demand for invitro diagnostic products and rising research and development activities worldwide. However, the medical technologies and imaging segment is witnessing drop in sales due to a smaller number of surgeries being carried out and delayed or prolonged equipment procurement. Additionally, virtual consultations by healthcare professionals are expected to become the mainstream care delivery model post-pandemic. With telehealth transforming care delivery, digital health will continue to thrive in coming years. In addition, disrupted clinical trials and the subsequent delay in drug launches is also expected to pave the way for entirely virtual trials in the future. New technologies such as mRNA is expected to emerge and shift the pharmaceutical industry and market is also expected to witness more vertical integration and joint ventures in coming years.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONInfection Surveillance Solutions Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Growing Applications of Infection Surveillance Solutions in Healthcare to Drive Infection Surveillance Solutions Market Growth

Healthcare associated infections, or nosocomial infections affects the patients in hospitals and other healthcare facilities that are not present in the patients at the time of admission. These infections affect the patients not only during their stay in the hospitals, but also post patient’s discharge from hospitals. Moreover, these occupational infections are observed to be common in within the hospital and nursing staff too. According to the World Health Organization (WHO), hundreds of millions of patients are affected by healthcare associated infections every year leading to significant morbidity and mortality around the world. The WHO Healthcare Associated Infections Fact Sheet of 2016 suggests that of every 100 hospitalized patients at a given time, 7 in the developed countries and 10 in developing countries acquires at least one healthcare associated infection.

Moreover, in high income countries, approximately 30% of patients in intensive care units (ICUs) are affected by at least one HAIs. This rate of HAIs is approximately 2-3 folds higher in the low and middle income countries. In addition, the WHO claims that the newborns are at a higher risk of developing these infections, with infection rates 3-20 times higher in developing countries as compared to high income countries of the globe. As a result of this significant prevalence rate of these infections, the endemic burden of health care associated infections is also turning up higher, majorly among the developing economies of the world. The European Centre for Disease Prevention and Control reports an average prevalence of 7.1% in European countries. The Centre estimates that 4 131 000 patients are affected by approximately 4 544 100 episodes of health care-associated infection every year in Europe. Thus, the increasing prevalence of HAIs is expected to create a demand for infection surveillance solutions promoting market growth across the world.

The healthcare associated infections acts as a major threat to patient safety, affecting one out of every 25 hospital patients at a given point, according to Agency for Healthcare Research & Quality. These infections are significantly increasing the economic burden of the healthcare system among all the countries worldwide. The government and healthcare departments of the high as well medium to low income countries are developing action plans and undertaking several initiatives to reduce this burden as well as prevent the mortality rates occurring as a result of hospital acquired infections or nosocomial infections.

The prevention and reduction of healthcare-associated infections is a top priority for the U.S. Department of Health and Human Services (HHS). The HHS Steering Committee for the Prevention of Healthcare-Associated Infections was established in July 2008. The Steering Committee, along with scientists and program officials across HHS, developed the HHS Action Plan to prevent Healthcare-Associated Infections, providing a roadmap for HAI prevention in acute care hospitals.

Moreover, the US Department of Health & Human Services have employed Agency for Healthcare Research and Quality that funds various works in the US to help the frontline clinicians and other healthcare staff to prevent HAIs by improving safety and care delivery to the patients. Not only in the North America and European high-income countries, major economies in Asia Pacific including Japan China and India are also significantly working to develop surveillance programs and promote the use of monitoring software for the prevention of these infections. For instance, Japan Healthcare System employed active surveillance, hand hygiene promotion, isolation cohort of resistant microorganism and bundle care for HAI prevention in various healthcare facilities. Additionally, the Australian Commission on Safety and Quality in Healthcare developed a Healthcare Associated Infection (HAI) Prevention Program aims to build on facility and jurisdictional initiatives to develop a national approach to reducing HAI by identifying and addressing systemic problems and gaps, and ensuring comprehensive actions are undertaken in a nationally coordinated way by leaders and decision makers in both public and private health care sectors. Thus, various government initiatives to reduce healthcare associated infections by adaption of advanced techniques such as surveillance software are expected to propel the growth of the global infection surveillance solutions market over the forecast yearsOver the years, technology has improved the way healthcare providers treat and take care of the patients. There have been a number of ways in which these changes in the healthcare systems are incorporated. The major one of these changes includes intersection of advanced healthcare and information technology. Health IT is often considered to be a silent partner in healthcare, which is not evidently noticed, however plays a crucial part of the system. The growing ageing population and rise in costly chronic care needs are exerting considerable demands on our health systems. Governments are expected to do more in the face of healthcare funding challenges and skilled labor shortage. As computer and technology use in hospitals, clinics and private practice expands, information technology is being used in countless ways to improve healthcare delivery, patient safety, and the relationship between patients and healthcare providers.

Surveillance of healthcare associated infections is of prime importance in prevention of infections. The methods and practices for surveillance have evolved as technology becomes more advanced. The availability of electronic surveillance software (ESS) has increased, and yet adoption of ESS is slow. The infection control software offers way to rebalance the time by monitoring several data feeds, alerting infection prevention, simplifying reporting, tracking trends graphically as well as improving outbreak identification. Due to the advantages offered by these software systems, government is investing significantly to promote the innovation in healthcare IT based systems. For instance, in 2017, the US health IT investment total whopped to US$ 7.1 billion. Thus, massive adoption of IT based platforms in healthcare is expected to support the growth of infection surveillance solutions market over the forecast years.

Type-Based Insights

In terms of type, the Infection Surveillance Solutions market is segmented into software and services. In 2017, the software segment held a largest market share of 62.5% of the infection surveillance solutions market, by technology.

End User-Based Insights

In terms of end user, the Infection Surveillance Solutions market is segmented into hospitals, nursing homes, and other end users. The hospitals segment is anticipated to grow at a CAGR of 12.8% during the forecast period. The high prevalence of the hospital associated infection across the world is likely to enforce the healthcare setting for the adoption of these solutions in their infrastructure to prevent the healthcare associated infections.

The Infection Surveillance Solutions market players are adopting the product launch and expansion strategies to cater to changing customer demands worldwide, which also allows them to maintain their brand name globally.

Infection Surveillance Solutions Market Regional InsightsThe regional trends and factors influencing the Infection Surveillance Solutions Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Infection Surveillance Solutions Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Infection Surveillance Solutions Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2017 | US$ 294.1 Million |

| Market Size by 2025 | US$ 763.7 Million |

| Global CAGR (2017 - 2025) | 13.7% |

| Historical Data | 2015-2016 |

| Forecast period | 2018-2025 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Infection Surveillance Solutions Market Players Density: Understanding Its Impact on Business Dynamics

The Infection Surveillance Solutions Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Infection Surveillance Solutions Market top key players overview

Infection Surveillance Solutions Market – by Type

- Software

o Web-Based Software

o On-Premises Software

- Services

o Implementation Services

o Support and Maintenance Services

- o Training and Consulting Services

Infection Surveillance Solutions Market – by End User

- Hospitals

- Nursing Homes

- Others

Infection Surveillance Solutions Market – by Geography

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- UK

- Spain

- Rest of Europe

-

Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of APAC

-

Middle East & Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

-

South America and Central America (SCAM)

- Brazil

- Argentina

- Rest of SCAM

Company Profiles

- BD

- Wolters Kluwer

- Sunquest Information Systems, Inc.

- Premier

- Baxter (ICNet Systems, Inc.)

- GOJO Industries, Inc.

- Cerner Corporation

- Deb Group Ltd.

- VigiLanz Corporation

- PeraHealth

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For