The inventory tags market was valued at US$ 4,995.36 million in 2020 and is projected to reach US$ 7,264.42 million by 2028; it is expected to grow at a CAGR of 5.0% during 2021–2028.

The radio-frequency identification (RFID) technology is a commonly used technology in retail operations and warehouse management, as RFID tag-based operations consume less time. Therefore, the retail industry has witnessed rapid growth in the last few years. The inventory tags market is growing at a substantial pace due to the growth in the retail sector. Growing concerns about forgery, rising demand for inventory tags in various verticals, and increasing per capita disposable income in numerous developing countries are the key factors driving the growth of the global inventory tags market.

Impact of COVID-19 Pandemic on Inventory Tags Market

The US is one of the prominent markets for inventory tags due to the growing retail and e-commerce, and healthcare sectors. An increase in the number of confirmed cases and rising reported deaths has affected above-mentioned industries. The factory and business shutdowns across the US, Canada, and Mexico impacted the adoption of the inventory tags. The retail sector has faced considerable shifts, consumer spending on groceries continue to increase. However, spending on apparel and other accessories decreased substantially in 2020.

Moreover, in the Mid-2020, the retail and e-commerce sales have increased gradually, leading to a slight growth in the inventory tags market in North America. Moreover, RFID technology is highly used in the healthcare industry to track their assets. To combat the COVID-19, the region has started shipping vaccines and PPE kits within the region where RFID technology has made a comeback to track and authenticate test kits, PPE, and vaccines, which, in turn has promoted the market growth.

COVID-19 has had a severe impact on transportation and automotive, and trade activity. North America is home to a large number of manufacturing and technology companies. Thus, the impact of COVID-19 outbreak was quite severe in 2020 and is likely to continue in 2021. However, the impact of COVID-19 is short-term, and is likely to decrease in the coming years.

Lucrative Regions in Inventory Tags Market

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Market Insights–Inventory Tags Market

Rising Popularity of RFID Technology

The increasing disposable incomes in several emerging countries are augmenting the demand for retail products. The retail industry is fueled by a mounting set of suppliers selling various products online and changing buying behavior of consumers. The retail sector in India is one of the fastest-growing markets in the world due to economic growth. As per the Indian Brand Equity Foundation, the retail sector in the country has raised US$ 672 billion in 2017 and it is estimated to reach US$ 1,200 billion by the end of 2021. E-commerce is the fastest-growing segment of the retail industry in North America and Europe. As per the Centre for Retail Research Limited, in 2019, the combined e-commerce sales in the UK, France, France, the Netherlands, Italy, and Spain were US$ 313.53 billion. Besides, as per the Census Bureau of the Department of Commerce, the retail e-commerce sales in the US were US$ 160.3 billion in the first quarter of 2020, with an increase of 2.4% from the fourth quarter of 2019.

RFID tags are heavily adopted by the retail industry, especially for apparels. The apparel suppliers are increasingly leveraging big data analytics and digitalization with the help of RFID technology, which helps identify objects based on the caught data or track the location of the same.

RFID is also installed to increase visibility in inventory, which allows for much higher stock accuracy levels. Giants, such as H&M, Nike, and Zara, in the retail sector use this technology for inventory management to generate an effective supply chain, combat counterfeit items, and prevent out-of-stock situations. RFID deployments code and read products in their warehouses. When shipments reach store locations, RFID identifies which sizes and models to restock.

Inditex Group, the owner of retail brands such as Pull and Bear, Bershka, Massimo Dutti, Zara, Stradivarius, and Oysho, has given Tyco Retail Solutions a contract for RFID-based inventory intelligence. The Tyco solution has been installed in 700 Zara stores in 22 countries. Thus, the increasing deployment of RFID tags among major retailers is fueling the market growth.

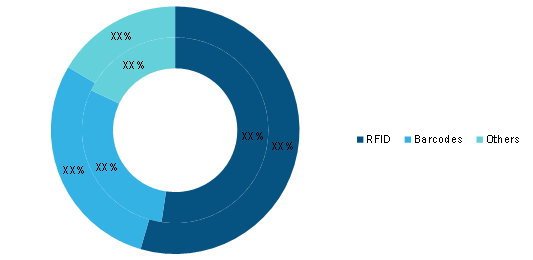

Technology-Based Insights

Based on technology, the inventory tags market is segmented into RFID, barcode, and other. The RFID segment led the inventory tags market in 2020. The Radio Frequency Identification (RFID) is used in keeping track and visibility of objects that are on the move. The RFID is a portable memory device on a chip that replaces the earlier called Universal Product Code (UPC) as it carries more dynamic information compared to the earlier UPC. This memory chip can be easily embedded in any kind of object that is to be considered for tracking. Radio Frequency Communications is employed between a host computer and an RFID device consisting of the memory chip. An RFID system comprises a tag that contains data, an antenna to communicate with the tag and a controller that is used to manage the communication between the antenna and the host computer.

Inventory Tags Market, by Type (% Share)

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Label Type -Based Insights

Based on label type, the inventory tags market is sub-segmented into plastics, paper, metal, and others. The plastics segment led the inventory tags market in 2020. The plastic inventory tags are the most widely used inventory tags, as the plastic tags are cheaper and have a long lifecycle. The market players offer plastic inventory tags in various forms such as rectangular, square, and round, and are also offered in different color combinations. Moreover, owing to capabilities of being lightweight, non-conductive, non-corrosive, and impact-resistant, there is increasing adoption of plastic inventory tags among end users. However, the rising concern over the recyclability of plastics and sustainability is hampering the adoption of plastics inventory tags.

Printing Technology -Based Insights

Based on printing technology, the inventory tags market is sub-segmented into offset printing, digital printing, flexography printing, gravure printing, and others. The offset printing segment led the inventory tags market in 2020. Due to offset printing’s advantages, such as cost effective for larger quantities (lower marginal costs), high quality of print, and capability of using variety of paper and ink types, it is a widely used technology in various industries.

End-User -Based Insights

Based on end-user, the inventory tags market is sub-segmented into retail, transportation and logistics, industrial, and others. The transportation and logistics segment led the inventory tags market in 2020. Barcodes and RFID technology is the widely used technology for automatic identification and data capture in the transportation and logistics sector. Although, the advantages associated with the RFID tools are anticipated to take over barcodes in the coming years. Most applications involve applying a smart label to the logistics container, which could be a carton, pallet, case, barrel, or tote, to provide shipment information or for long time container tracking. The key benefit of using barcode and RFID system is the ability to read the entire contents of diverse pallets during material shipping and handling operations such as truck loading or unloading.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Inventory Tags Market: Strategic Insights

Market Size Value in US$ 4,995.36 Million in 2020 Market Size Value by US$ 7,264.42 Million by 2028 Growth rate CAGR of 5.0% from 2021-2028 Forecast Period 2021-2028 Base Year 2021

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Inventory Tags Market: Strategic Insights

| Market Size Value in | US$ 4,995.36 Million in 2020 |

| Market Size Value by | US$ 7,264.42 Million by 2028 |

| Growth rate | CAGR of 5.0% from 2021-2028 |

| Forecast Period | 2021-2028 |

| Base Year | 2021 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Players operating in the inventory tags market are focusing on the development of advanced and efficient products.

- In 2020, Sato Holdings Corporation announced the launch of ASETRA, RFID Asset Management System for manufacturers and logistics service providers. The package system that utilizes RAIN RFID tags, QR codes and barcodes to streamline management of tools and returnable items.

The Global Inventory Tags Market Has Been Segmented As Follows:

Inventory Tags Market– by Technology

- RFID

- Barcodes

- Others

Inventory Tags Market– by Label Type

- Plastics

- Papers

- Metals

- Others

Inventory Tags Market– by Printing Technology

- Offset Printing

- Digital Printing

- Flexography Printing

- Gravure Printing

- Others

Inventory Tags Market– by End-User

- Retail

- Transportation and Logistics

- Industrial

- Others

Inventory Tags Market–by Geography

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- Italy

- UK

- Russia

- Rest of Europe

Asia Pacific (APAC)

- Australia

- China

- India

- Japan

- South Korea

- Rest of APAC

Middle East and Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

South America (SAM)

- Brazil

- Argentina

- Rest of SAM

Inventory Tags Market–Company Profiles

- 3M

- Alien Technology, LLC

- Brady Worldwide, Inc.

- Camcode

- CCL Industries Inc.

- Cenveo

- Honeywell International Inc.

- Johnson Controls, Inc.

- SATO Holdings Corporation

- Zebra Technologies Corporation

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology ; Label Type ; Printing Technology ; End-User , Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

North America led the inventory tags market in 2020. The retail sector in North America is a huge adopter of the RFID technology that facilitates data transfer from tags attached to objects, using a wireless scanning system, thereby enabling automatic identification and tracking. Further, according to the International Trade Administration (ITA), there were 19.8 million e-commerce users in Canada in 2018, and the count is estimated to be rise by 5.21 million by 2021. The retail e-commerce sales in Canada were valued at US$ 2.2 million in 2019 and US$ 47.9 million in 2020. Thus, in addition to the growing retail sector, escalation in e-commerce activities is contributing to the inventory tags market in North America.

RFID tags are heavily adopted by the retail industry, especially for apparels. The apparel suppliers are increasingly leveraging big data analytics and digitalization with the help of RFID technology, which helps identify objects based on the caught data or track the location of the same. The increasing deployment of RFID tags among major retailers is fueling the market growth.

The RFID is the leading technology in the market. Industrial, healthcare, retail, and defense are the various end-users sector where RFID finds its applications. In the commercial and military sector where supply chain management becomes extremely critical, an RFID can be used to maintain complete track of the object being transported.

The List of Companies - Inventory Tags Market

- 3M

- Alien Technology, LLC

- Brady Worldwide, Inc.

- Camcode

- CCL Industries Inc.

- Cenveo

- Honeywell International Inc.

- Johnson Controls, Inc.

- SATO Holdings Corporation

- Zebra Technologies Corporation

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Inventory Tags Market

Mar 2021

Robotic Crawler Camera System Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component [Hardware (Cameras, Crawlers, Cable Drums, Control Units, and Others), Software, and Service], Application (Drain Inspection, Pipeline Inspection, and Tank Void Capacity or Conduit Inspection), and End User (Residential, Commercial, Municipal, and Industrial)

Mar 2021

Inertial Sensor for Land Defense Systems Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (FOG, MEMS, and Others) and Application (Stabilization Missile Systems, Stabilization Turret-Cannon Systems, Land Navigation Including Land Survey, Missile GGM-SSM, Stabilization Active Protection System, Stabilization of Optronics System, and Others)

Mar 2021

Drone Lithium Battery Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Battery Type (Li-ion, Li-Po, and Li-S), Battery Capacity (Below 3,000 mAh; 3,000–5,000 mAh; and Above 5,000 mAh), Drone MTOW (Below 100 Kgs, 100–200 Kgs, and Above 200 Kgs), Wing Type (Fixed Wing and Rotary Wing), and End Use (Military and Commercial)

Mar 2021

ASRS for Garments on Hangers Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Type (Garment Rail System, Garment Conveyor, Garment Property Storage, and Others) and Application (Warehousing and Logistics, Retail 3PL, Hotels, Hospitals and Institutes, and Others)

Mar 2021

Analog to Digital Converter Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Integrating Analog to Digital Converters, Delta-Sigma Analog to Digital Converters, Successive Approximation Analog to Digital Converters, Ramp Analog to Digital Converters, and Others), Resolution (8-Bit, 10-Bit, 12-Bit, 14-Bit, 16-Bit, and Others), and Application (Industrial, Consumer Electronics, Automotive, Healthcare, Telecommunication, and Others)

Mar 2021

Laser Distance Sensor Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Distance (Between 2 and 10 Meters, Between 11 and 100 Meters, Between 101 and 200 Meters, and Between 201 and 500 Meters), Accuracy (1 mm at 2 Sigma, 3 mm with 2 Sigma, and 5 mm at 2 Sigma), and End User (Manufacturing, Construction, Automotive and Robotics, Aerospace and Defense, Geospatial Industry, and Others)

Mar 2021

Rugged Tablet Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis By Type (Fully Rugged Tablet, Semi Rugged Tablet, and Ultra Rugged Tablet); Operating System (Android, Windows, and iOS); and Application (Aerospace & Defense, Automotive, Construction, Energy & Utilities, Manufacturing, Oil & Gas, and Others)

Mar 2021

Rear Door Heat Exchanger Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Active and Passive) and End User (Data Center, IT and Telecommunication, Semiconductor, Education, Government, and Others)