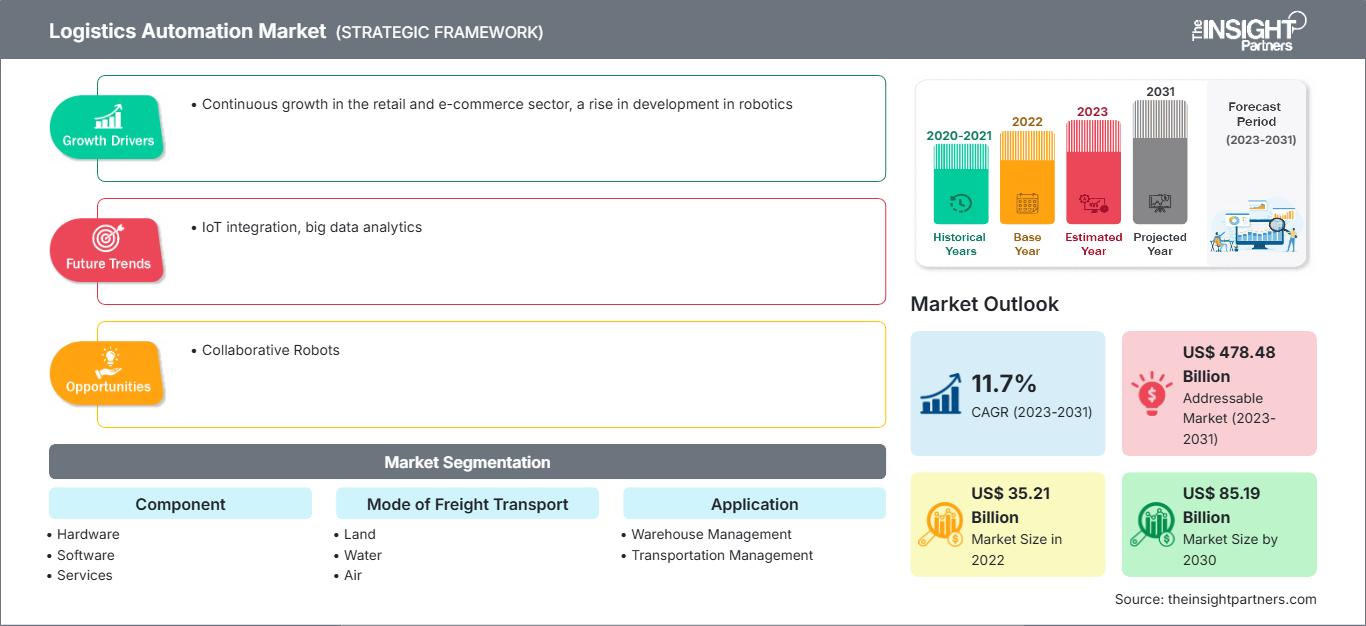

Logistics Automation Market Share and Forecast by 2030

Logistics Automation Market Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Hardware, Software, Services), Mode of Freight Transport (Land, Water, Air), Application (Warehouse Management, Transportation Management), End-user Industry (Manufacturing, Retail and E-Commerce, Oil and Gas, Food and Beverages, Automotive, Healthcare and Pharmaceutical, Others), and Geography

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2031- Report Date : Feb 2024

- Report Code : TIPRE00005708

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 213

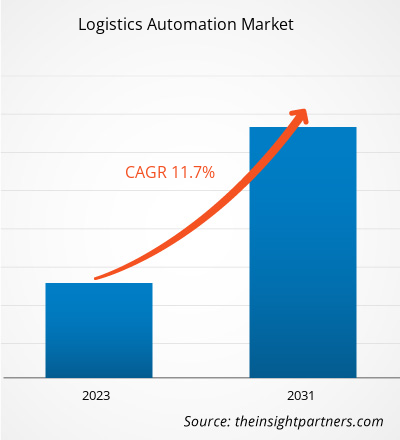

The logistics automation market size is projected to reach US$ 85.19 billion by 2030 from US$ 35.21 billion in 2022. The market is expected to register a CAGR of 11.7% during 2022–2030. IoT integration and big data analytics are likely to remain a key trend in the market.

Logistics Automation Market Analysis

With the increasing consumer expectations, the market players are focusing on investing in IT and operational functions in warehouses. There is growing development in connectivity technology globally, as tech companies make everything from sortation to arranging. They are leveraging the latest supply chain technology and the Internet of Things (IoT). Smart warehouses serve as a hub to enhance the efficiency and speed of the supply chain process. From wearables on workers to sensors and smart equipment, internet-enabled devices and technology can profoundly change logistics management. Warehouse and transport management are proactively adopting logistics automation robots, which automate the storing and moving of goods across the supply chain. The logistics automation robots are integrated across warehouses and storage facilities to organize and transport products. These robots also offer enhanced levels of uptime compared to manual labor, which leads to the growth in productivity and profitability of the industry. The prime application of logistics robots is mobile automated guided vehicles (AGVs) deployed in storage facilities and warehouses for transporting goods. They operate in predefined pathways for shipping and storing the products in different pallets in the warehouses. AGVs help reduce the overall logistics cost and streamline the supply chain efficiently. Therefore, the increasing utilization of robotics in warehouses is likely to have a significant impact on the logistics automation market forecast in the next few years.

Logistics Automation Market Overview

In the logistics automation market, the importance of autonomous cars in the logistics business has grown in recent years as they have increasingly been deployed in precisely controlled environments such as warehouses and yards. However, deploying autonomous vehicles in shared and public locations, such as highways and city streets, might be the industry's next great step in optimizing logistics operations and increasing safety. The expanding technological developments in AI, as well as the increasing substantial investments in the development of sensors and visual technologies, can assist in self-driving vehicles. Autonomous vehicles and drones are important components of automated logistics systems. Google and Tesla, for example, have made substantial advances in driverless vehicle technologies. Autonomous driving has progressed from science fiction to a very feasible possibility in the last two decades, owing to significant advances in radar technology and computer power. Because portable technology has improved sufficiently to allow ultra-light hardware to make decisions based on self-improving algorithms, engineers have a better chance of mimicking human decision-making in autonomous vehicles.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONLogistics Automation Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Logistics Automation Market Drivers and Opportunities

Continuous Growth in the Retail and E-Commerce Sector to Favor the Market

Logistics automation is one of the substantial components of e-commerce for managing the issues of inventory, tracking, packing, warehousing, and shipping. In retail and e-commerce, the business is liable for safeguarding timely delivery and return policy. If the goods or products need to be replaced, the company must handle all the operations in reverse logistics. In the retail and e-commerce business, a logistics automation provider delivers upgraded technology, scalability, flexibility, and efficiency. Additionally, the e-commerce sector is growing. For instance, India has gained 125 million online shoppers since 2020, with another 80 million expected by 2025.

The logistics requirements and services provided by the logistic automation software firms to retail and e-commerce businesses include warehouse management, supply chain management, consolidated services, and order fulfillment. There are several benefits related to e-commerce that can be fulfilled if the company outsources its logistics requirements through a logistic automation service provider. This allows the retail and e-commerce participants to perform their specific roles. Logistics automation firms specialize in supply chain management, allowing online stores to accentuate marketing and other business operations. The logistics automation software allows warehouse managers to deal efficiently with various processes such as multiline item sorting, split case picking, and palletizing. Therefore, logistics automation software has an enormous opportunity in the retail & e-commerce sector globally. This can propel the logistics automation market growth.

Collaborative Robots

Since the introduction of cobots in numerous business sectors and industry processes, the logistics and warehousing industry has experienced a boost in productivity and efficiency, allowing diverse service providers to satisfy rising demand. Cobot technology is evolving, and as Industry 4.0 emerges, supply chain efficiency and the warehousing industry will continue to benefit. Because they are constructed and engineered to collaborate with humans in any particular workspace, such as warehouses and distribution centers, cobots perform a variety of functions that help to lessen the risk of human injury. Cobots are created to perform properly and efficiently using artificial intelligence (AI) and machine learning technology.

Logistics Automation Market Report Segmentation Analysis

Key segments that contributed to the derivation of the logistics automation market analysis are components, modes of freight transport, application, and end-user industry.

- Based on component, the logistics automation market is divided into hardware, software, and services. The hardware segment held the largest share in 2022.

- By mode of freight transport, the market is segmented into land, water, and air.

- By application, the market is segmented into warehouse management and transportation management.

- By end-user industry, the market is segmented into manufacturing, retail and e-commerce, oil and gas, food and beverages, automotive, healthcare and pharmaceutical, and others.

Logistics Automation Market Share Analysis by Geography

The geographic scope of the Logistics Automation market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific is the fastest growing region in the logistics automation market in 2022. Asia Pacific has a growing economy, which is leading to growth in a wide variety of sectors, including retail & e-commerce, manufacturing, oil & gas, food & beverages, automotive, and healthcare. The adoption of advanced and innovative technologies across the region is high. The deployment of logistics automation solutions has increased in Asian countries over time, owing to the investments and various initiatives taken by governments for the development of the retail & e-commerce industry.

The region has a strong e-commerce industry. The warehouses present in the region are implementing cutting-edge technology. Also, the growing number of products from suppliers is encouraging warehouse management to adopt robotics and logistics automation software for systematic and feasible operations. Emerging markets in Asian countries face challenges such as growing market competitiveness, cost pressures, inflation triggers, and market volatility. Thus, the planning and execution of the supply chain becomes complex. To address these issues, manufacturers and suppliers eagerly look ahead to logistics automation services to maximize the control of outbound and inbound supply chains by improving visibility and enhancing the inventory management process.

Logistics Automation Market Regional Insights

The regional trends and factors influencing the Logistics Automation Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Logistics Automation Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Logistics Automation Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 35.21 Billion |

| Market Size by 2030 | US$ 85.19 Billion |

| Global CAGR (2023 - 2031) | 11.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Logistics Automation Market Players Density: Understanding Its Impact on Business Dynamics

The Logistics Automation Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Logistics Automation Market top key players overview

Logistics Automation Market News and Recent Developments

The logistics automation market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the logistics automation market are listed below:

- OMRON announced the opening of its first automation center for logistics in Singapore to cater to the customer base of Singapore, Southeast Asia, and Oceania. (Source: OMRON, Press Release, December 2022)

- FM Logistic opened its fifth multi-customer facility (and first owned) in India. (Source: FM Logistic, Press Release, May 2022)

Logistics Automation Market Report Coverage and Deliverables

The “Logistics Automation Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Logistics automation market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Logistics automation market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Logistics automation market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the logistics automation market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For