Meat Substitute Ingredients Market Growth and Analysis by 2030

Meat Substitute Ingredients Market Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Source (Soy, Wheat, Pea, Mycoprotein, and Others), Ingredient Type (Soy Protein, Pea Protein, Tempeh, Tofu, Seitan, and Others), Application (Patties, Nuggets, Sausages, Meatballs, and Others), and Geography

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Feb 2024

- Report Code : TIPRE00020371

- Category : Food and Beverages

- Status : Published

- Available Report Formats :

- No. of Pages : 197

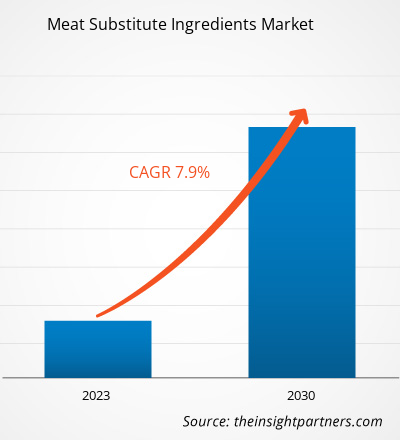

[Research Report] The meat substitute ingredients market size was valued at US$ 2,186.83 million in 2022 and is projected to reach US$ 4,017.43 million by 2030; it is expected to register a CAGR of 7.9% during 2022–2030.

MARKET ANALYSIS

The major sources of meat substitute ingredients are soy, wheat, peas, fava beans, and mycoproteins. Soy is the most predominantly used ingredient to manufacture plant-based meat due to its texture and protein content. Soy is also more affordable than other plant sources, and it provides ideal texture to the products, which is similar to conventional animal meat products. The rising health consciousness among people owing to the increasing prevalence of obesity, diabetes, and other diseases is compelling people to change their dietary habits. People generally perceive plant-based products to be healthier than the conventional ones. This factor is significantly driving the meat substitute ingredients market growth.

GROWTH DRIVERS AND CHALLENGES

Government bodies across various countries are promoting the consumption of plant-based meat, owing to the rising environmental concerns and health benefits offered by these products. Additionally, the governments are actively investing in R&D and new product launches of plant-based meat products. In 2021, the South Korean Ministry of Agriculture, Food and Rural Affairs established a US$ 70.3 million fund with several sub-funds dedicated to food and agriculture. The Green Bio Fund investments specifically mentioned plant-based and cultivated meat companies. Moreover, in June 2022, the Food Safety and Standards Authority of India (FSSAI) finalized the Vegan Foods Regulations and established a separate regulatory framework for food ingredients free from animal products. Such initiatives by key countries boost the demand for plant-based food.

Several countries have announced investments in meat substitute ingredients such as plant protein. For instance, the Australian Government announced US$ 76 million to support a project led by Australian Plant Proteins to create the largest pulse protein ingredient manufacturing capability in Australia, which is expected to generate up to US$ 2.6 billion in plant-based exports by 2032. Thus, the continuous investment and support by various government bodies are expected to offer lucrative growth opportunities to the meat substitute ingredients market during the forecast period.

Growing veganism is one of the emerging meat substitute ingredients market trends which is projected to amplify the market growth in the coming years. Several dieticians and health practitioners recommend reducing meat consumption and switching to a vegetarian diet to reduce the risks of chronic health issues, such as obesity, heart disease, hypertension, and digestive disorders. According to the Plant-Based Food Association (PBFA), consumer demand rose last year: 19% of households purchased plant-based meat in 2021—up from 18% in 2020—and an impressive 64% of those buyers purchased it multiple times throughout the year. According to Google Trends, veganism was one of the top five searched terms on Google in 2019 in the UK and worldwide.

A report published by Veganuary (a nonprofit organization that encourages individuals worldwide to turn vegan for the whole month of January) states that ~5.8 million people signed up for the Veganuary Campaign in 2021. The increasing adoption of veganism is also attributed to the empathy toward animals and awareness of the ill-treatment of animals in slaughterhouses and similar facilities, which has raised concerns about animal protection among consumers. These factors are boosting the demand for meat substitute ingredients such as soy protein, pea protein, tofu, and tempeh. Thus, surging veganism across the globe is driving the growing meat substitute ingredients market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMeat Substitute Ingredients Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The "Global Meat Substitute Ingredients Market Analysis and Forecast to 2030" is a specialized and in-depth study with a significant focus on global market trends and growth opportunities. The report aims to provide an overview of the global market with detailed market segmentation on the basis of source, ingredient type, application, and geography. The report provides key statistics on the consumption of meat substitute ingredients across the world, along with their demand in major regions and countries. In addition, the report provides a qualitative assessment of various factors affecting meat substitute ingredients market performance in major regions and countries. It also includes a comprehensive analysis of the leading players in the meat substitute ingredients market and their key strategic developments. Analysis of the market dynamics is also included to help identify the key driving factors, market trends, and lucrative opportunities, which, in turn, aids in identifying the major revenue pockets.

The ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global meat substitute ingredients market, which helps understand the entire supply chain and various factors affecting the market growth.

SEGMENTAL ANALYSIS

The global meat substitute ingredients market is segmented on the basis of source, ingredient type, and application. Based on source, the market is segmented into soy, wheat, pea, mycoprotein, and others. The soy segment accounted for over 49% of the meat substitute ingredients market share in 2022. The mycoprotein segment is projected to register the fastest CAGR of 10.0% from 2022 to 2030. Mycoprotein, also known as fungal protein, is a single-cell protein derived from fungi. Mycoprotein has been considered Generally Recognized as Safe (GRAS) by the Food and Drug Administration (FDA) in the US since 2002. Several producers of mycoprotein have reported that production of mycoprotein has an environmental impact of over 90% less than beef. Thus, mycoprotein is significantly used as a meat substitute ingredient.

Consumers prefer mycoprotein food because of its higher nutrient content, such as fiber, which helps control blood cholesterol and blood sugar. Mycoprotein helps prevent weight gain and overeating. Additionally, mycoprotein provides all essential amino acids, which are rarely found in other protein sources. Quorn, a mycoprotein brand, offers super-protein, healthy, and meat-substitute meals using mycoprotein sources for consumers. The rising adoption of mycoprotein as a significant source of meat substitute ingredients is driving the meat substitute ingredients market.

REGIONAL ANALYSIS

The global meat substitute ingredients market report provides a detailed overview of the market with respect to five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America.

In terms of revenue, Europe dominated the meat substitute ingredients market share, accounting for more than US$ 829.68 million in 2022. North America is projected to register a significant CAGR of 8.6% from 2022 to 2030.

The meat substitute ingredients market in Europe is significantly growing owing to the considerable demand for plant-based meat products in countries such as Germany, France, Spain, and the UK. The increasing health consciousness and the rising trend of veganism have made Europe a significant market for meat substitute ingredients. According to the Good Food Institute (GFI), plant-based meat sales alone accounted for US$ 2.1 billion in 2022—up 19% compared with 2020. Similarly, according to “The Smart Protein Project report,” the sales value of plant-based food in Germany grew by 97% during 2018–2020, while the sales volume increased by 80%. Moreover, consumers are highly inclined toward plant-based meat products due to rising awareness of animal welfare and environmental sustainability.

The popularity of plant-based meat products is increasing in Europe due to the shift in consumer demand from animal protein to plant protein owing to factors such as health awareness, sustainability issues, ethical or religious views, environmental concerns, and animal rights. According to the World Health Organization (WHO), consuming natural fats and proteins, including pea and soy, can offer several health benefits, including a healthy gut. Thus, rising health awareness in the region further boosts the demand for meat alternatives made from natural plant-based proteins such as soy, cottonseed, peas, fava beans, and wheat.

The meat substitute ingredients market in North America is also growing at a rapid pace. In the US, consumers are becoming more aware of the importance of a plant-based healthy diet due to the high prevalence of diabetes and obesity. Plant-based meat has a low-fat content and is rich in fiber and protein, which reduces cholesterol levels and blood pressure. According to the Plant-Based Food Association (PBFA), consumer demand increased last year: 19% of households purchased plant-based meat in 2021—as compared to 18% in 2020—and an impressive 64% of those buyers purchased it multiple times throughout the year.

In Canada as well, consumers are increasingly drawn to the health benefits of meat substitutes such as low fat and fiber. Canada emerged as a key country for plant-based food consumption. The innovation supercluster, Protein Industries Canada (PIC), funds 45 plant-based protein R&D projects, including US$ 1.6 million, into a Regulatory Centre of Excellence to promote evidence-based regulatory policy for plant-based foods. The supercluster provided US$ 1 million to help a British Columbia-based plant-based food producer increase the production capacity of their 100-percent Canadian-grown chickpea tofu. Thus, the rising plant-based meat popularity in North American countries drives the meat substitute ingredients market growth.

Meat Substitute Ingredients

Meat Substitute Ingredients Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2.19 Billion |

| Market Size by 2030 | US$ 4.02 Billion |

| Global CAGR (2022 - 2030) | 7.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Source

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Meat Substitute Ingredients Market Players Density: Understanding Its Impact on Business Dynamics

The Meat Substitute Ingredients Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

Various initiatives taken by the key players operating in the meat substitute ingredients market are listed below:

- In November 2022, Ingredion Incorporated announced its plan to acquire 100% ownership in Verdient Foods Inc., a joint venture that aims to accelerate growth in plant-based proteins. The acquisition enables Ingredion to accelerate net sales growth, expand manufacturing capabilities, and co-create with customers to serve the increasing consumer demand for plant-based foods.

- In August 2022, ADM and Benson Hill Inc., a food technology firm, established a long-term strategic agreement to expand new soy products in order to fulfill the rapidly increasing demand for plant-based proteins. The partnership will cater to the needs of savory, sweet, and dairy customers by serving a range of plant-based food & beverage industries.

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Crespel & Deiters GmbH & Co KG, SOTEXPRO SA, DuPont de Nemours Inc, Ingredion Inc, Wilmar International Ltd, Archer-Daniels-Midland Co, Axiom Foods Inc, Kerry Group Plc, Roquette Freres SA, and The Scoular Co are among the prominent companies profiled in the meat substitute ingredients market report. These companies focus on launching innovative products with gluten-free, genetically modified organisms-free (GMO-free), allergen-free, organic, and sugar-free claims. Moreover, they are increasing the nutritional value of the products to meet the requirements of consumers. Such innovative products offer a competitive advantage to the companies, increasing market competitiveness. Further, companies adopt merger and acquisition, partnership, and collaboration strategies to expand their consumer base and strengthen their market position. These factors are anticipated to increase the competition among meat substitute ingredient manufacturers worldwide. Thus, the meat substitute ingredients market forecast and trend analysis can help stakeholders plan their growth strategies.

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For