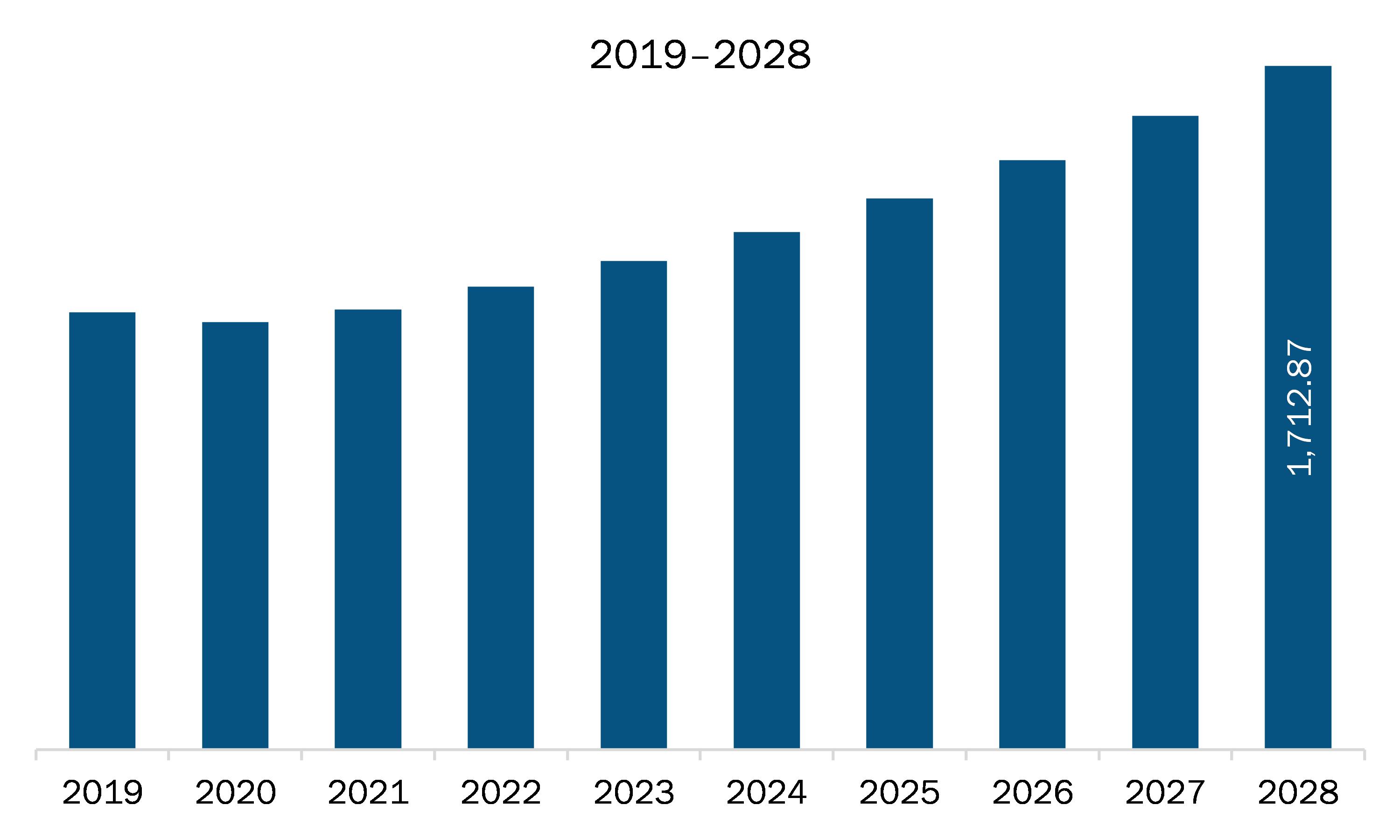

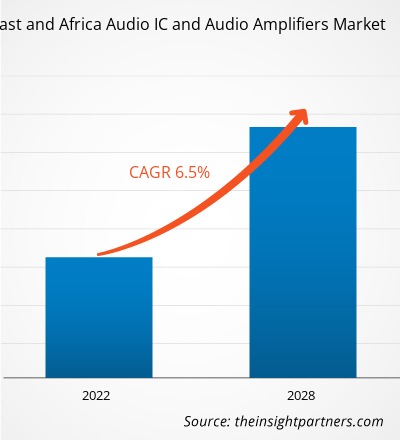

The audio IC and audio amplifiers market in MEA is expected to grow from US$ 1,102.99 million in 2021 to US$ 1,712.87 million by 2028; it is estimated to grow at a CAGR of 6.5% from 2021 to 2028.

Saudi Arabia, South Africa, and UAE are major economies in MEA. Audio devices compatible with 5G Technology is the major factor driving the growth of the MEA audio IC and audio amplifiers market. The 5G connectivity would integrate mobile technologies such as, Big Data, IoT, and cloud computing, and provide rise to applications like enhanced mobile broadband (eMBB) services, intelligent driving, smart power grids, smart manufacturing, and mobile medicine. The next generation 5G mobile radio networks will offer the platform for innovative applications requiring extreme short latency times and / or high data rates up to 10 Gbps. So, the 5G technology is likely to ease the efficiency of audio signal transmission over internet (i.e., AoIP); moreover, it would help reduce the sound latency and will allow 200 times higher bandwidths compared to commercial mobile radio infrastructure. The rising penetration of the 5G technology in smartphones would provide major opportunities for the audio IC and audio amplifier market players. As the demand for high quality output will increases with increasing sale of 5G smartphones. The audio data transmission will increase in 5G era creating demand for more audio equipment supporting high quality audio formats.

Based on audio amplifier class, the class D segment led the MEA audio IC and audio amplifiers market in 2020. Class D amplifiers use pulse-width modulation (PWM) to produce a rail-to-rail digital output signal with a variable duty cycle to approximate the analog input signal. Electronics vendors commonly use high-efficiency, filter less, analog-input Class D amplifiers to manage the power requirements of portable audio speakers found in cell phones, tablet computers, and personal navigation devices. The growing use of portable devices such as smart speakers, soundbars, and headphones in home audio systems fuels the demand for class D audio amplifiers as they dissipate less heat and offer extended battery life. They also provide extended functionalities for live streaming music and news, setting alarms, and ordering household supplies.

Major countries facing the economic impact of COVID-19 include Iran, Saudi Arabia, UAE, Egypt, Morocco, and Kuwait. The region is projected to register a swift decline in the supply of raw materials and products from various manufacturers across North America, Europe, and Asia-Pacific. These regions have halted their production activities, which subsequently disrupted the import of components and products to other countries and regions. Moreover, the recent nationwide lockdowns across South Africa, Saudi Arabia, and the UAE have negatively impacted the development of audio IC and audio amplifiers. Hence, the region is expected to witness a slight decline in its various countries' market growth during the coming few months. Therefore, the overall impact of COVID-19 on the MEA region is moderate.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the MEA audio IC and audio amplifiers market. The MEA audio IC and audio amplifiers market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

MEA Audio IC and Audio Amplifiers Market Segmentation

MEA Audio IC and Audio Amplifiers Market – By Audio IC Type

- A/D converter IC

- Processor IC

- Amplifier IC

- D/A converter IC

- Others

MEA Audio IC and Audio Amplifiers Market – By Audio Amplifier Class

- Class A/B

- Class D

- Class G

- Class H

MEA Audio IC and Audio Amplifiers Market, by Country

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

MEA Audio IC and Audio Amplifiers Market - Companies Mentioned

- Infineon Technologies AG

- Maxim Integrated

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- Semiconductor Components Industries, LLC

- STMicroelectronics

- Texas Instruments Incorporated

- Toshiba Corporation

Middle East and Africa Audio IC and Audio Amplifiers Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1,102.99 Million |

| Market Size by 2028 | US$ 1,712.87 Million |

| Global CAGR (2021 - 2028) | 6.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Audio IC Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

- Infineon Technologies AG

- Maxim Integrated

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- Semiconductor Components Industries, LLC

- STMicroelectronics

- Texas Instruments Incorporated

- Toshiba Corporation

Get Free Sample For

Get Free Sample For