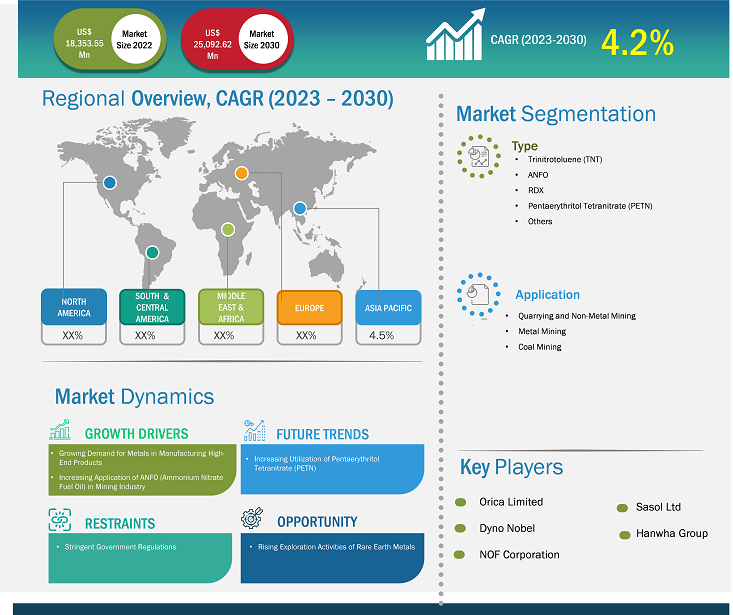

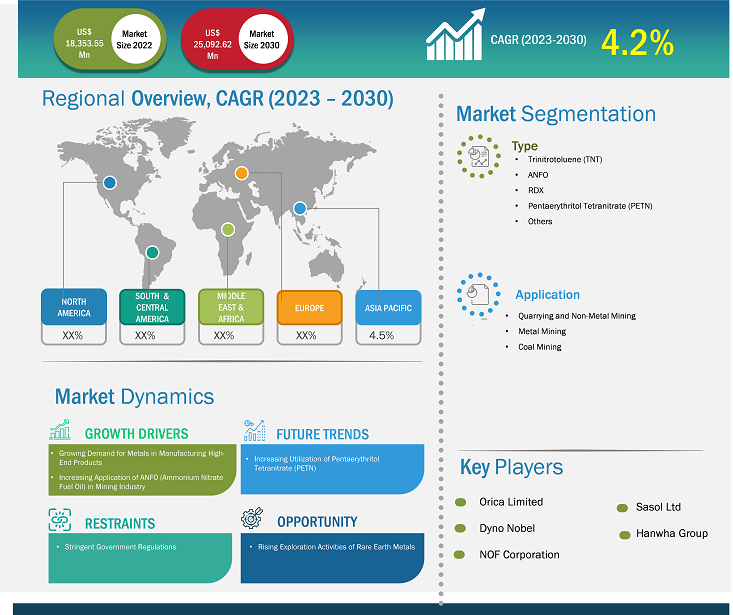

The mining explosives market size was valued at US$ 18,353.55 million in 2022 and is projected to reach US$ 25,092.62 million by 2030; it is expected to record a CAGR of 4.2% from 2023 to 2030.

MARKET ANALYSIS

Mining explosives are chemical compounds that react at high speed. The explosives utilized in mining are classified based on characteristics such as density, detonation velocity, explosive heat, mass strength, critical diameter, and water resistance. Explosives are produced with precise technology, high-quality raw materials, and a strong emphasis on carrying out mining operations safely. Ammonium nitrate fuel oil (ANFO) is one of the most widely used explosives in underground mining and surface hard rock quarrying operations. These explosives are highly used in the coal industry for mining and excavation.

GROWTH DRIVERS AND CHALLENGES

Manufacturing high-end products require a steady supply of raw materials such as metals and minerals. The higher demand for metals necessitates increased mining activity to extract and produce the required raw materials, ultimately leading to extensive use of mining explosives to access ore deposits, remove overburden, and fragment rocks. In addition, with the growing demand for metals, mining companies increasingly focus on improving safety measures and operational efficiency. This includes advancing mining explosive technologies and formulations that can optimize blasting operations. Mining explosives with better fragmentation capabilities, reduced vibrations, and improved safety features can help increase productivity and minimize environmental impacts. Automotive, aerospace, medical devices, electronics, defense & military, energy generation, building & construction, luxury goods, and several high-end product manufacturing industries utilize metals. In the automotive industry, luxury, sports, electronics, and other high-end vehicles are manufactured using lightweight yet strong metals such as aluminum, titanium, and high-strength steel. The growth of the high-end product manufacturing industries, such as aerospace and automotive industries, drives the demand for metals and subsequently bolsters the global mining explosives market. Further, mining operations are subject to stringent environmental and safety standards to minimize their impact on ecosystems, water resources, and communities. Compliance with these standards involves implementing mitigation measures, monitoring programs, and reporting requirements. Mining companies worldwide are required to ensure their operations meet these standards, which can involve high costs and operational adjustments. Thus, this factor may restrain the global mining explosives market growth.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Mining Explosives Market: Strategic Insights

Market Size Value in US$ 18,353.55 million in 2022 Market Size Value by US$ 25,092.62 million by 2030 Growth rate CAGR of 4.2% from 2023 to 2030 Forecast Period 2023-2030 Base Year 2022

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Mining Explosives Market: Strategic Insights

| Market Size Value in | US$ 18,353.55 million in 2022 |

| Market Size Value by | US$ 25,092.62 million by 2030 |

| Growth rate | CAGR of 4.2% from 2023 to 2030 |

| Forecast Period | 2023-2030 |

| Base Year | 2022 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

REPORT SEGMENTATION AND SCOPE

The "Global Mining Explosives Market Forecast to 2030" is a specialized and in-depth study with a major focus on the global mining explosives market trends and opportunities. The report aims to provide an overview of the market with detailed market segmentation based on type, application, and geography. The global mining explosives market has witnessed high growth over the recent past and is expected to continue this trend in the coming time. The report provides key statistics on the use of mining explosives worldwide and their demand in major regions and countries. In addition, it provides a qualitative assessment of various factors affecting the mining explosives market performance in major regions and countries. The report also includes a comprehensive analysis of the leading market players and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, market trends, and lucrative mining explosives market opportunities that would, in turn, aid in identifying the major revenue pockets.

Further, ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global mining explosives market, which helps understand the entire supply chain and various factors affecting the market growth.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

SEGMENTAL ANALYSIS

The global mining explosives market is segmented based on type and application. Based on type, the market is segmented into trinitrotoluene (TNT), ANFO, RDX, pentaerythritol tetranitrate (PETN), and others. Based on application, the market is segmented into quarrying and non-metal mining, metal mining, and coal mining.

Based on type, the ANFO segment held a significant global mining explosives market share in 2022. ANFO comprises ~94% ammonium and 6% fuel oil by weight. By application, the coal mining segment led the global mining explosives market with the largest market share. Coal is the most abundant source of electricity in the world, and it generates more than 36% of global electricity. The coal reserves are huge compared to reserves of other minerals. Coal mining is an essential source of electricity generation in many developing economies.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

REGIONAL ANALYSIS

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

The report provides a detailed overview of the global mining explosives market with respect to five major regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and South & Central America. Asia Pacific accounted for a large portion of the global mining explosives market share, and it was valued at ~US$ 13,500 million in 2022. Asia Pacific comprises several developing and developed economies, including China, India, Japan, Indonesia, and Australia. China, India, Indonesia, and Australia are among the major coal producers and rank in the list of top five coal-producing nations worldwide. Further, the mining explosives market in Asia Pacific reported constant demand due to increased metal mining and quarrying activities.

North America is expected to witness considerable growth and is anticipated to reach ~US$ 2,500 million in 2030. North America has a strong mining industry and several associations, including The American Exploration & Mining Association and the International Society of Explosives Engineers. In Europe, there has been a widespread use of explosives in mining activities. This is expected to create lucrative opportunities for the mining explosives market. The mining explosives market in Europe is likely to grow at a CAGR of around 3% from 2022 to 2030.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

Partnerships, acquisitions, and new product launches are among the major strategies adopted by the players operating in the global mining explosives market.

In March 2023, Orica Ltd launched a 4D bulk explosives system, an advanced bulk system for underground, surface coal, and surface metal mining applications. The product offers a wide energy range to match varying rock properties and mine design requirements.

In March 2023, Omnia Holding Ltd's Bulk Mining Explosives signed a Conditional Sale and Purchase of Shares Agreement with PT Multi Nitrotama Kimia and formed a joint venture. The joint venture named PT Kemitraan MNK BME has integrated offering of explosives range for surface and underground mines.

IMPACT OF COVID-19 PANDEMIC/IMPACT OF GEOPOLITICAL SCENARIO/IMPACT OF RECESSION

Lockdowns, travel restrictions, and business shutdowns due to the COVID-19 pandemic adversely affected economies and industries in various countries across the globe. The crisis disturbed global supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. These disruptions restricted the availability of mining explosives. It caused delays in production and increased costs, negatively impacting the overall supply of mining explosives. Many mining operations were temporarily halted or scaled back during the COVID-19 pandemic to comply with lockdown measures and ensure the safety of workers. Reduced mining activities resulted in lower demand for mining explosives. In addition, the pandemic impacted the global economy, leading to fluctuations in commodity prices and reduced demand for minerals and metals. As a result, mining companies were cautious about their investments, which influenced their demand for mining explosives.

The global marketplace is recovering from the losses as governments of different countries have announced relaxation in the restrictions. Mining activities are rebounding as countries gradually recover from the pandemic and vaccination efforts continue. Manufacturers are permitted to operate at full capacity to overcome the supply gap. Increased infrastructure investments and stimulus packages in many regions drive the demand for minerals and metals. Thus, the global mining explosives market is anticipated to grow strongly during 2022 to 2030.

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Orica Limited, Al Fajar Al Alamia Co SAOG, Dyno Nobel, China Poly Group Corporation, NOF Corporation, Hanwha Group, Anhui Jiangnan Chemical Co Ltd, Koryo Nobel Explosives, Solar Group, and Omnia Group Company are among the key players operating in the global mining explosives market.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Mexico, Nigeria, Russian Federation, Saudi Arabia, South Africa, United Arab Emirates, United Kingdom, United States, Vietnam, Zimbabwe

Frequently Asked Questions

The coal mining segment is estimated to register the fastest CAGR. The coal sector acts as a backbone for many emerging economies. Coal surface mines rely entirely on explosives to uncover mineral deposits.

The coal mining segment held the largest share of the market in 2022. Coal surface mines rely entirely on explosives to uncover mineral deposits. Blasting is considered an essential component for the successful extraction of coal resources from the deposits. A considerable quantity of explosives is deployed in coal mining, propelling the demand for mining explosives.

Asia Pacific is estimated to register the fastest CAGR in the global mining explosives market over the forecast period. Asia is home to leading mining companies such as Mitsubishi Materials Corporation, Jiangxi Copper Co Ltd, Aluminum Corporation of China Ltd, Coal India Limited, China Molybdenum Co Ltd, and BHP.

The ANFO segment held the largest market share. ANFO is the simplest commercial explosive and one of the most widely used explosives in the mining industry, despite other much more efficient emulsion explosives, due to its uncomplicated manufacturing technology and lower production costs than other explosives.

In 2022, Asia Pacific held the largest revenue share of the global mining explosives market. The mining explosives market growth in Australia, China, India, and Indonesia is attributed to growing mining industry in the region. The demand for mining explosives is directly proportional to the region's mining operations and mineral reserves. Therefore, the high number of potential metal and nonmetal reserves and a rise in mining operations across the region is expected to boost the demand for mining explosives during the forecast period.

The major players operating in the global mining explosives market are Orica Limited, Al Fajar Al Alamia Co SAOG, Dyno Nobel, China Poly Group Corporation, NOF Corporation, Hanwha Group, Anhui Jiangnan Chemical Co Ltd, Koryo Nobel Explosives, Solar Group, and Omnia Group Company.

The List of Companies - Mining Explosives Market

- Orica Limited

- Al Fajar Al Alamia Co SAOG

- Dyno Nobel

- China Poly Group Corporation

- NOF Corporation

- Hanwha Group

- Anhui Jiangnan Chemical Co Ltd

- Koryo Nobel Explosives

- Solar Group

- Omnia Group Company

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Mining Explosives Market

Aug 2023

Construction Additives Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Cement Additives, Concrete Admixtures (Precast Concrete and Ready-Mix Concrete), Paints and Coatings Additives, Adhesives and Sealants Additives, Plastic Additives, Bitumen Additives, and Others], and Application (Residential, Commercial, Infrastructure, and Others)

Aug 2023

Oil Pollution Remediation Materials Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Physical Remediation (Booms, Skimmers, and Adsorbent Materials), Chemical Remediation (Dispersants and Solidifiers), Thermal Remediation, and Bioremediation]

Aug 2023

Greenhouse and Mulch Film Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product Type (Greenhouse Films and Mulch Films), Material (LLDPE, LDPE, HDPE, EVA, PHA, PVC, PC, and Others), and Application (Vegetable Farming, Horticulture, Floriculture, and Others)

Aug 2023

Plastic for SLS 3D Printing Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Polyamide, Thermoplastic Polyurethane (TPU), Polyether Ether Ketone (PEEK), and Others) and End-Use Industry (Healthcare, Aerospace & Defense, Automotive, Electronics, Others)

Aug 2023

Carbon Fiber-Based SMC BMC Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Resin Type (Polyester, Vinyl Ester, Epoxy, and Others) and End-Use Industry (Automotive, Aerospace, Electrical and Electronics, Building and Construction, and Others)

Aug 2023

Thermoplastic Adhesive Films Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Material (Polyethylene, Polyamide, Thermoplastics Polyurethane, Polyester, Polypropylene, Polyolefins, Copolyamides, Copolyesters, and Others); Technology (Cast Film and Blown Film); Application (Membrane Films, Barrier Films, and Blackout Films); End Use (Textile, Automotive, Electrical and Electronics, Medical, Ballistic Protection, Lightweight Hybrid Construction, and Others)