North America Aircraft MRO Market Analysis and Forecast by Size, Share, Growth, Trends 2031

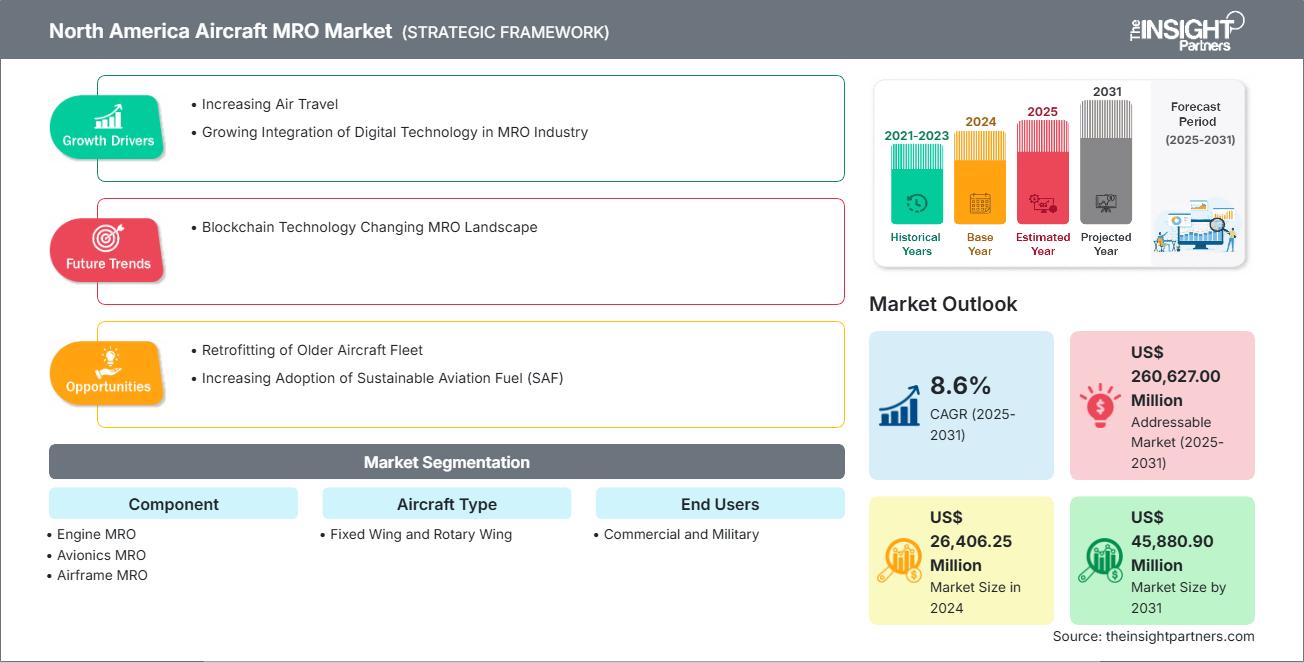

North America Aircraft MRO Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Engine MRO, Avionics MRO, Airframe MRO, Cabin MRO, Landing Gear MRO, and Other Components), Aircraft Type (Fixed Wing and Rotary Wing), and End Use (Commercial and Military)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Oct 2025

- Report Code : TIPRE00022951

- Category : Aerospace and Defense

- Status : Published

- Available Report Formats :

- No. of Pages : 140

The North America aircraft MRO market size is expected to reach US$ 45,880.90 million by 2031 from US$ 26,406.25 million in 2024. The market is estimated to record a CAGR of 8.6% from 2025 to 2031.

Executive Summary and North America Aircraft MRO Market Analysis:

The expansion of the aircraft MRO market in North America is driven by rising air passenger traffic, the need to improve operability and performance, and the need for disassembling, replacing, testing, and repairing sections of aircraft. The North American aviation industry generates higher profits from the US due to high air travel. Because of the existence of many aircraft OEMs in the US, the country is the world's largest aircraft manufacturer. With the launch and purchase of new aircraft, contracts, and agreements are routinely signed between aircraft MRO service providers, airlines, and defense agencies.

According to the report published by the International Air Transport Association (IATA) in January 2025, North American carriers reported a 6.8% annual traffic rise compared to 2023, with capacity increasing by 7.4% in 2024. Despite a slight decline in load factor by 0.5 percentage points to 84.2%, the overall demand for air travel remains strong. December 2024, traffic rose by 5.1% year-on-year, indicating a robust finish to the year. This growth in passenger traffic is part of a broader trend, as the commercial aircraft services market in North America is projected to grow from US$35 billion today to US$ 50 billion by 2043, reflecting a 43% increase.

According to Airbus' latest Global Market Forecast published in April 2025, passenger traffic in North America is rising at a steady compound annual growth rate (CAGR) of 2.9%. This sustained demand necessitates maintenance, repair, and overhaul (MRO) services, as airlines will require more frequent maintenance to ensure safety and reliability. The maintenance market alone is forecasted to grow from US$30.5 billion to US$42.3 billion, representing a 1.7% CAGR over the next 20 years. This growth is essential for managing the rising demand for air travel and enhancing fleet efficiency. As airlines expand their operations to accommodate increased passenger numbers, the implementation of new digital solutions and predictive maintenance will become vital. These advancements will help reduce downtime, optimize efficiency, and address maintenance delays, ultimately increasing aircraft availability and reducing operational costs.

MRO service providers are focusing on digital MRO technology, which enables service providers to carry out MRO activities efficiently. North American behemoths such as GE Aviation, Barnes Group Inc., Rolls-Royce PLC, Delta TechOps, and Collins Aerospace are engaged in offering MRO services to gain momentum in the industry. International MRO service providers such as Southwest Airlines and United Airlines are preparing to open new aircraft hangars for their MRO operations in Houston and Los Angeles. Further, airlines in the region are engaging in MRO outsourcing activities to cut costs associated with MRO activities.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONNorth America Aircraft MRO Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Aircraft MRO Market Segmentation Analysis:

Key segments that contributed to the derivation of the North America aircraft MRO market analysis are component, aircraft type, and end users.

- Based on component, the North America aircraft MRO market is segmented into engine MRO, avionics MRO, airframe MRO, cabin MRO, landing gear MRO, and others. The engine MRO segment held the largest share of the market in 2024.

- Based on aircraft type, the North America aircraft MRO market is bifurcated into fixed wing and rotary wing. The fixed wing segment held a larger share of the market in 2024.

- Based on end users, the North America aircraft MRO market is bifurcated into commercial and military. The commercial segment held a larger share of the market in 2024.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 26,406.25 Million |

| Market Size by 2031 | US$ 45,880.90 Million |

| CAGR (2025 - 2031) | 8.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

North America Aircraft MRO Market Players Density: Understanding Its Impact on Business Dynamics

The North America Aircraft MRO Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

North America Aircraft MRO Market Outlook

MRO services in the aviation industry play an irreplaceable role in assuring the durability, safety, and profitability of commercial and military airlines. To maintain their market position in the future, businesses should embrace flexibility in adopting new and trending technologies. This approach will help digitalize their processes, reducing reliance on human intervention. Advanced technologies such as blockchain improve processes in MRO organizations. The technology has massive potential in the MRO space. The adoption of blockchain technology has been low so far; however, soon, this technology will contribute a considerable share to the overall growth of the aircraft MRO market. With the help of blockchain technology, companies can record the configuration details of MRO components. This also makes the documentation process across component manufacturers and MRO service providers effortless. Additionally, the deployment of this technology also enables MRO service providers to offer verifiable documentation about the parts they have installed, thereby maintaining transparency in their operations. A few instances of various aircraft MRO market players opting for blockchain technology are given below.

- In March 2021, the Government Blockchain Association and Digital Innovation Group formed a joint venture named GBA Aviation & Aerospace Working Group. This joint venture is formed to explore the use of blockchain in the aerospace and aviation sectors for MRO services, supply chains, and airports.

- In October 2023, Lufthansa Industry Solutions announced the Blockchain initiative to increase the adoption of blockchain in the aviation industry.

- In 2023, SITA partnered with ILS to create a new authenticity-assured parts service leveraging a blockchain-based digital passport for an expanding aftermarket in the commercial and defense aerospace industry.

Thus, aviation industry players such as aircraft manufacturers, aircraft MRO service providers, and aviation technology developers are emphasizing the adoption of blockchain technology to track their MRO processes. This factor is anticipated to stimulate the aircraft MRO market's growth in the coming years.

North America Aircraft MRO Market Country Insights

Based on country, the North America aircraft MRO market comprises US, Canada, and the Mexico. The US held the largest share in 2024.

The US aircraft MRO market is experiencing sluggish growth due to higher labor costs, which resulted in the outsourcing of airplanes for heavy checks. The airlines in the country experience a higher density of air traveling passengers, owing to which the flying hours of each aircraft are higher, and consequently, demand frequent aircraft maintenance. The presence of independent MRO service providers has enabled airlines to opt for frequent A-checks, B-checks, and C-checks in the country. The US Department of Defense (US DoD) continuously procures a newer aircraft fleet. However, the existing aircraft fleet is higher than in other countries across the world. In January 2023, SupplyCore secured a contract of US$ 375 million from the Defense Logistics Agency for the maintenance, repair, and operation of US military facilities. The defense budget and expenditure from the US DoD allow the forces to opt for frequent MRO activities of the aircraft fleet and facilitate the forces to be mission-ready.

In June 2023, RTX made an announcement regarding its Collins Aerospace division. Collins Aerospace has entered into a multi-year FlightSense flight-hour contract with Envoy Air. This agreement entails the provision of MRO services for systems installed on Envoy Air's fleet of 128 Embraer E175 aircraft. The scope of Collins' responsibilities under this contract encompasses critical components, including electric power systems, fire protection systems, and sensors. This collaboration signifies a strategic partnership aimed at ensuring the operational reliability and safety of Envoy Air's aircraft fleet. In April 2025, Satair and Collins Aerospace, a division of RTX, extended their cabin interior parts distribution agreement for an additional four years, furthering a partnership that has lasted over five decades. This renewed agreement guarantees an efficient delivery of distribution rights for Collins' range of oxygen systems, Goodrich® lighting solutions, and beverage makers, applicable to Airbus, Boeing, and other platforms. As Collins Aerospace provides MRO services for Envoy Air's fleet of Embraer E175 aircraft, it translates to a higher volume of work for MRO providers in the US. The FlightSense flight-hour contract between Collins Aerospace and Envoy Air stimulates business activities and job growth. It also highlights the region's expertise in aerospace maintenance, potentially attracting more customers and opportunities.

North America Aircraft MRO Market Company Profiles

Some of the key players operating in the market include AAR CORP; Barnes Group Inc; GE Aerospace; FLTechnics, UAB.; Turkish Technic Inc.; Singapore Technologies Engineering Ltd; Lufthansa Technik; Delta TechOps; Rolls-Royce Holdings Plc; and Collins Aerospace, among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

North America Aircraft MRO Market Research Methodology :

The following methodology has been followed for the collection and analysis of data presented in this report:

Secondary Research

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

- Company websites, annual reports, financial statements, broker analyses, and investor presentations.

- Industry trade journals and other relevant publications.

- Government documents, statistical databases, and market reports.

- News articles, press releases, and webcasts specific to companies operating in the market.

Note:

All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

Primary Research

The Insights Partners' conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

- Validate and refine findings from secondary research.

- Enhance the expertise and market understanding of the analysis team.

- Gain insights into market size, trends, growth patterns, competitive dynamics, and future prospects.

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

- Industry stakeholders: Vice Presidents, business development managers, market intelligence managers, and national sales managers

- External experts: Valuation specialists, research analysts, and key opinion leaders with industry-specific expertise

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For