North America Chassis Container Market Analysis, Size, and Share by 2030

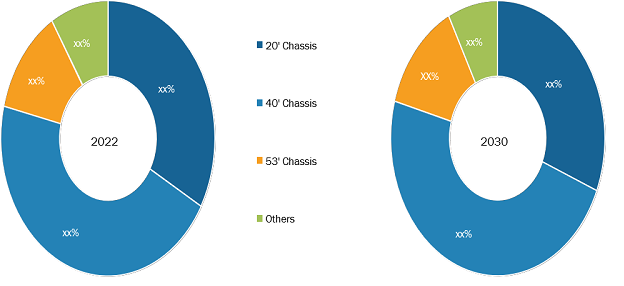

North America Chassis Container Market Size and Forecasts (2020 - 2030), Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Axle (2-Axles, 3-Axles, 4-Axles, and More than 4-Axles), Size (20' Chassis, 40' Chassis, 53' Chassis, and Others), Type (Standard, Extendable, Drop Frame, Tilt Chassis, Special, and Others), and Country

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Oct 2023

- Report Code : TIPRE00030046

- Category : Automotive and Transportation

- Status : Published

- Available Report Formats :

- No. of Pages : 91

The North America chassis container market accounted for US$ 1,077.57 million in 2022 and is expected to register a CAGR of 5.2% during 2022–2030 to account for US$ 1,615.28 million by 2030.

Analyst Perspective:

Based on geography, the North America chassis container market is segmented into the US and Canada. The region is a pioneer in adopting and expanding its business capabilities to meet the growing customer demand. With globalization, there is a rising demand for goods and services across international borders. Further, according to the Bureau of Economic Analysis, a significant rise in import and export activities between the US and China was observed in 2022 compared to 2021. The increase in trade requires large containers and chassis to transport goods from ports and warehouses. Key chassis container market players are thus taking strategic initiatives to boost the sales of container chassis to meet the growing demand. In June 2022, GIC, OMERS Infrastructure, and Wren House jointly acquired Direct Chassis Link Inc. (DCLI), a chassis leasing company in the US. This acquisition will strengthen the DCLI capabilities to reach more customers and leverage the constant support from the GIC, OMERS Infrastructure, and Wren House. Moreover, market players are building new chassis manufacturing units to cater to the rising chassis demand amid the chassis shortage issue in the US. In addition, CIEM expanded its California manufacturing plant in 2020. In March 2022, TRAC Intermodal partnered with American Made Chassis (AMC) to manufacture and supply new marine container chassis. Strategic partnerships among the chassis container market players to manufacture container chassis lead to increased collaboration in design, manufacturing, and distribution capabilities of market players, aiding the chassis container market expansion in North America. Cheetah Chassis Corporation CIE Manufacturing is one of the key players operating in the chassis container market in North America.

Market Overview:

Container chassis is generally used by intermodal equipment providers (IEP), shipping lines, and motor carriers, which involve regional and local movement of containers by trucks. Chassis is used for moving containers from loading areas to the yard and from yard storage areas to the terminals.

Regulatory bodies and regulations such as the Federal Motor Carrier Safety Administration (FMCSA), Container Safety Certificate (CSC), and the International Organization for Standardization (ISO) have a strong influence on the chassis container market. In February 2021, Federal Motor Carrier Safety Administration (FMCSA) enforced its Intermodal Chassis rule that requires intermodal equipment providers (IEPs), motor carriers, and drivers to share responsibility for the safety of intermodal equipment used on highways. Further, government investments in highway and road infrastructure to enhance the quality of roads, railroads, ports, and air transport are anticipated to trigger the chassis container market growth in the coming years. An improved transportation infrastructure would boost logistics operations in the commercial and industrial sectors, thereby aiding in the secure and timely delivery of goods and services. In March 2023, the provincial Government of Newfoundland and Labrador announced an investment of ~US$ 1.4 billion to enhance road and highway transportation infrastructure over the next five years. Container chassis are used in various commercial and industrial transportation. Thus, government investments to boost the commercial and industrial segments of economies by improving road and highway infrastructure are projected to offer promising growth opportunities for the chassis container market during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Chassis Container Market: Strategic Insights

-

Market Size 2022

US$ 1,077.57 Million -

Market Size 2030

US$ 1,615.28 Million

Market Dynamics

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

- XXXXXXX

Regional Overview

- North America

Market Segmentation

Axle

Axle

- 2-Axles

- 3-Axles

- 4-Axles

- More than 4-Axles

Size

Size

- 20' Chassis

- 40' Chassis

- 53' Chassis

Type

Type

- Standard

- Extendable

- Drop Frame

- Tilt Chassis

- Special

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Rise in Trading Operations is Boosting the North America Chassis Container Market Growth

Containers are widely used to transport consumer goods, industrial goods, raw materials such as steel and chemicals, construction materials, and agricultural products. In general, containers are used to ship a wide range of goods across international borders due to their ability to accommodate large volumes of cargo and their suitability for intermodal transportation. A rise in trade activities worldwide propels the demand for larger containers for transferring goods from one point to another. According to the World Trade Organization (WTO), in 2022, world trade has increased by an annual average of 4% in terms of volume and 6% in terms of value since 1995. As a result, North American countries also invest heavily in the shipping industry to enhance trading operations. For instance, the US Department of Agriculture (USDA) partnered with Port Houston to develop a dedicated chassis pool system at Port Houston terminals. According to the USDA, a trade worth nearly half a billion dollars of poultry and beef has been witnessed at Port of Houston in 2021. Thus, to meet the storage demand, the USDA has initiated a new program with the Port of Houston, which will upsurge the demand for shipping goods and drive the chassis container market. Further, container chassis are not limited to transferring goods by sea and land. They are also used for the intermodal transfer of containers via different modes of transportation, such as ships, trains, and trucks. Thus, the continuously growing trade activities across North America bolster the growth of the chassis container market.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

Based on axle, the North America chassis container market share is segmented into 2-Axles, 3-Axles, 4-Axles, and more than 4-Axles.

3-Axles are chassis designed to provide additional support and stability when transporting heavy loads. This 3-axles design is particularly suited for hauling overweight containers or cargo, as the added axle helps distribute the weight more evenly, reducing the stress on each individual axle. Owing to the reduced stress of each axle, it further increases the life span of the chassis. The additional axle enables heavier load transportation that also helps enhance stability and reduce the risk of accidents, ensuring safer transportation of goods. Owing to such advantages, the 3-axle chassis is suitable for various applications and industries, including agriculture, oil & gas, construction, and shipping. Various key chassis container market players are introducing new products by leveraging the versatile application of 3-axle chassis.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Regional Analysis:

The chassis container market share in Canada is highly competitive due to the booming logistics and transportation industry in the region. DHL, DTDC, and FedEx are among the top logistics companies in Canada. These logistic companies use containers for shipping goods. According to the International Trade Administration, there were over 27 million e-Commerce users in Canada in 2022, accounting for 75% of the Canadian population. Thus, the demand for logistics and transportation is high in Canada, due to which the chassis container market share of Canada will continue to flourish in the upcoming years.

Key Player Analysis:

ChassisKing Inc, Cheetah Chassis Corp, Direct ChassisLink Inc, Max-Atlas Equipement Inc, STI HOLDINGS INC, CIE Manufacturing Inc, Bull Chassis, Jansteel USA Inc, Pro-Haul Manufacturing Inc, and Hercules Enterprise LLC are among the prominent market participants in the North America chassis container market.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the North America chassis container market. The market initiative is a strategy adopted by companies to expand their footprint across the world and to meet the growing customer demand. The market players present in the North America chassis container market mainly focus on product and service enhancements by integrating advanced features and technologies into their offerings. A few recent developments by the North America chassis container market players are listed below:

Year |

News |

|

Jan 2023 |

Max-Atlas Equipment International Inc. of Saint-Jean-sur-Richelieu, the largest container chassis manufacturer in Canada, announces announced the sale of the Company company to a new group of four shareholders. The transaction, which closed on January 1, 2023, involved the transfer of all Company company shares held by the founders, Tibor Varga and Andrew Morena, to the new owners. One of the new shareholders, Stéphane Guérin, will serve as President and Chief Executive Officer of Max-Atlas. |

|

Apr 2022 |

Stoughton Trailers, LLC, a one of the leaders in transportation equipment, announced the company signed an agreement to purchase property on highways 51 in the far northwest corner of the City of Stoughton. Depending on feasibility and local interest, the company’s plans for the site includeto constructing a new corporate headquarters building and possibly additional public and private developments. |

North America Chassis Container Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,077.57 Million |

| Market Size by 2030 | US$ 1,615.28 Million |

| CAGR (2022 - 2030) | 5.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Axle

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For