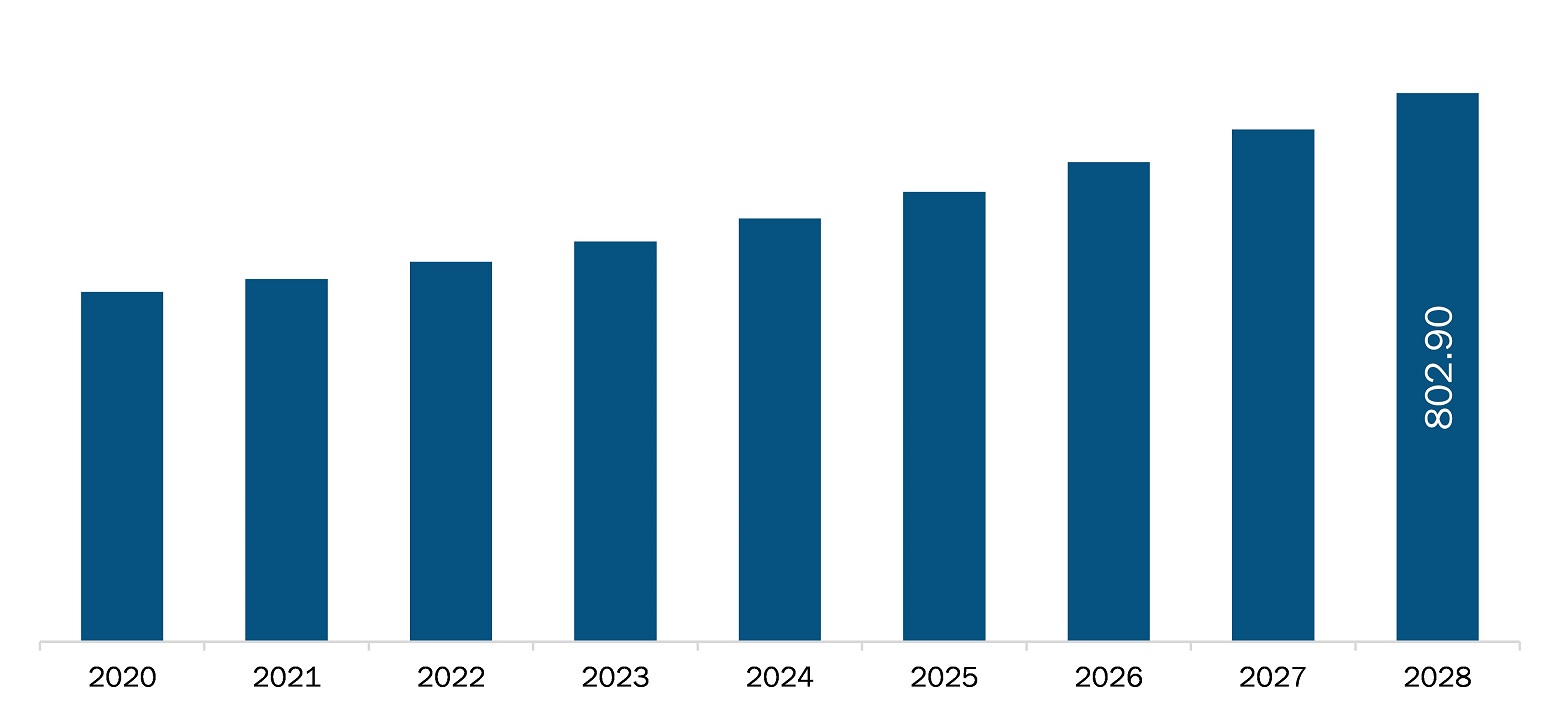

The North America OTC braces and support market is expected to reach US$ 802.90 million by 2028 from US$ 531.18 million in 2021; it is estimated to register a CAGR of 6.1% from 2021 to 2028.

The growth of the OTC braces and support market is attributed to rising chronic conditions and increasing geriatric population. However, the availability of alternative therapies is restraining the market growth. In increasing number of sports injuries among players and athletes is driving the growth of the OTC braces and support market. According to the estimates of a study published by Stanford Children’s Health in 2020, 30 million children and teenagers participate in sports annually in the US, and ~3.5 million injuries are reported in these organized sports each year. Further, most common injuries observed among children and teenagers are sprains and strains. The increasing number of participations in sports leads to the surge in sports injuries among the participants. Furthermore, the number of joint and orthopedic diseases have been increasing leading to the requirement of OTC braces and support for joint pain and muscle ailment relief. As per the World Health Organization (WHO) factsheet updated in 2018, musculoskeletal conditions are the second-largest contributor to disabilities worldwide. Moreover, the prevalence and impact of these disorders are expected to rise with the increase in aging population and surge in the prevalence of risk factors of noncommunicable diseases (NCDs) worldwide. The OTC braces and support devices serve as primary therapy devices that are generally used by people of all ages without seeking a prescription from the physicians. Thus, the elevating number of people suffering from sports injuries and orthopedic diseases is contributing to the OTC braces and support market growth.

North America has been witnessing growing number of COVID-19 cases since its outbreak. As a result, health care systems are overburdened, and the delivery of medical care to all patients has become a challenge in the region. As the COVID-19 pandemic continues to unfold, medical device companies are finding difficulties in managing their operations. Many companies offering products for OTC braces and support have their business operations in the US and business are adversely being affected by the effects of a widespread outbreak of COVID-19. This has disrupted and restricted company’s ability to distribute products, as well as lead to temporary closures of company’s facilities. Also, to free-up limited space for people being treated for the virus, hospitals have postponed orthodontic procedures, or cancelled them. Cancelling elective surgeries to reduce exposure to COVID-19 in the hospital and operating rooms into intensive care units is also negatively affecting the growth of the OTC braces and support market.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

NORTH AMERICA OTC BRACES AND SUPPORT MARKET SEGMENTATION

By Product

- Knee Braces and Support

- Back Hip and Spine Braces and Support

- Foot Walkers and Orthoses

- Neck and Cervical Braces and Support

- Shoulder Braces and Support

- Elbow Braces and Support

- Hand and Wrist Braces and Support

- Facial Braces and Support

By Type

- Soft and Elastic Braces and Support

- Hard and Rigid Braces and Support

- Hinged Braces and Support

By Application

- Ligament Injury Repair

- Preventive Care

- Osteoarthritis

- Compression Therapy

- Other Applications

By End User

- Hospitals

- Ambulatory Surgical Centres

- Specialty Clinics

- Others

By Country

- US

- Canada

- Mexico

Company Profiles

- DJO Global, Inc.

- ORTHOFIX MEDICAL INC. (Breg, Inc.)

- Bauerfeind

- DeRoyal Industries, Inc.

- Becker Orthopedic

- OPPO Medical Inc.

- Zimmer Biomet

- OTTOBOCK

- 3M

- Bird and Cronin Inc.

North America OTC Braces And Support Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 531.18 Million |

| Market Size by 2028 | US$ 802.90 Million |

| CAGR (2021 - 2028) | 6.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For