Psychedelic API Market 2026-2034 | Growth, Opportunities & Forecast

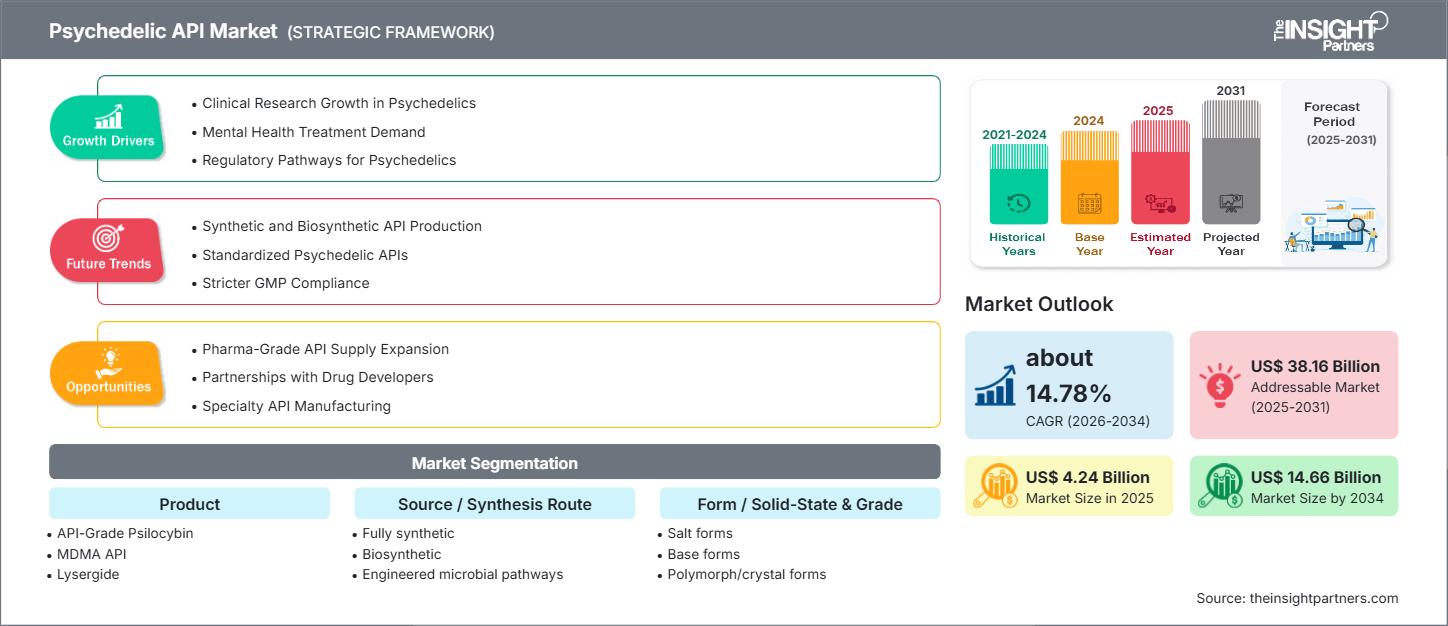

Psychedelic API Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (API-Grade Psilocybin, MDMA API, Lysergide, Ketamine Class APIs, Tryptamines, Others & Next-gen Psychoplastogens); Source/Synthesis Route (Fully synthetic, Biosynthetic, Engineered microbial pathways, Botanical extraction); Form/Solid-State & Grade (Salt forms, Base forms, Polymorph/crystal forms, Micronized/particle-size controlled grades); Contracting Model/Supply-Chain (CDMO outsourcing, Captive/in-house API manufacturing, Dual-sourcing/tech-transfer, Pathway/IP licensing); End-Use Industry (Branded Rx developers/sponsors, Clinic networks/licensed compounding, State-regulated service providers, Academic/investigator-initiated programs); and Geography

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Apr 2026

- Report Code : TIPRE00042209

- Category : Life Sciences

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

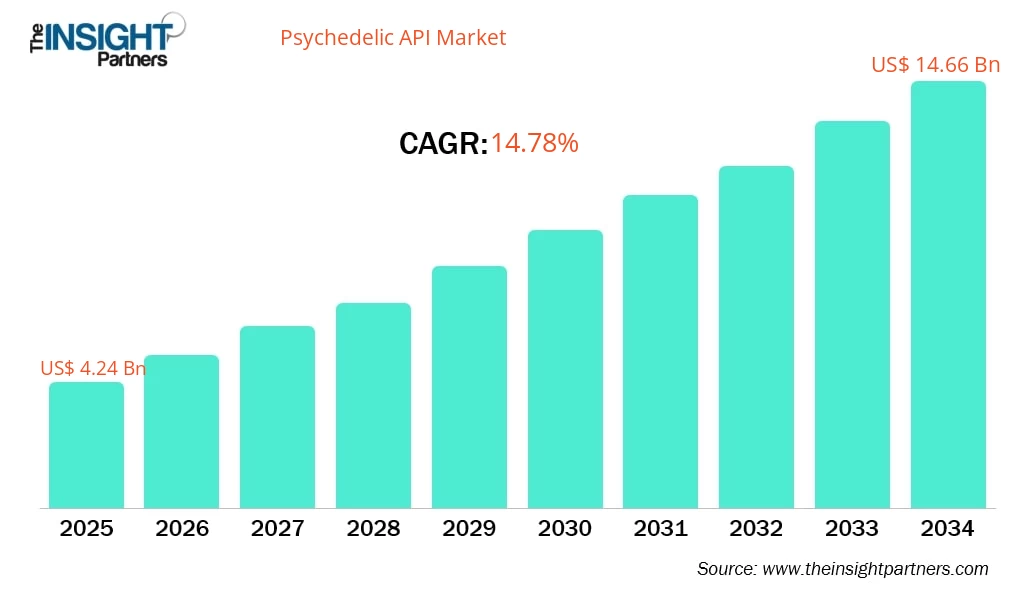

The Psychedelic API Market size is expected to reach US$ 14.66 billion by 2034 from approximately US$ 4.24 billion in 2025. The market is anticipated to register a CAGR of about 14.78% during 2026–2034.

Psychedelic API Market Analysis

The Psychedelic API Market forecast indicates robust growth, owing to expanding clinical research into psychedelic compounds, an increasing focus on mental-health treatments (particularly treatment-resistant depression, PTSD, anxiety), and evolving regulatory frameworks that are beginning to recognise psychedelics as valid therapeutic agents. For example, manufacturers of APIs for compounds such as psilocybin, LSD, MDMA, and ketamine are scaling up in response to clinical-trial volumes and demand for pharmaceutical-grade APIs.

Furthermore, the shift towards fully synthetic and biosynthetic production routes of psychedelics (rather than plant extraction) lends scalability, reproducibility, and regulatory compliance, which in turn supports growth in the API market. Supply-chain evolution (CDMOs, tech transfers), growing outsourcing of API manufacturing, and increasing private and institutional investments into the psychedelic space are additional enablers.

Psychedelic API Market Overview

Active Pharmaceutical Ingredients (APIs) of psychedelic compounds are key chemical substances used by pharmaceutical developers in the manufacturing of dosage forms for clinical trials and eventual commercial therapies. In this context, the Psychedelic API Market covers cGMP-grade APIs (e.g., psilocybin, LSD, MDMA, ketamine class, tryptamines) intended for research and therapeutic use, rather than recreational use.

These APIs support the design, development, and commercialisation of psychedelic-assisted therapies, enabling standardised production, quality control, regulatory compliance, and integration into pharmaceutical supply chains. As the potential of psychedelic therapies gains acceptance, the importance of robust API production and supply becomes critical for the wider ecosystem of psychedelics in medicine.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONPsychedelic API Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Psychedelic API Market Drivers and Opportunities

Market Drivers:

- Rising demand for novel treatments in mental health: The prevalence of treatment-resistant depression, PTSD, anxiety disorders, and the limitations of conventional pharmacotherapies are driving interest in psychedelic-based APIs.

- Regulatory momentum and changing policy: Governments and regulators are increasingly supportive of psychedelic therapies, which in turn increases demand for compliant APIs and manufacturing routes.

- Growth of specialised API manufacturing capability & CDMOs for psychedelics: The emergence of facilities capable of Schedule I/II compound manufacture, and companies specialising in psychedelic APIs, supports supply-side growth.

Market Opportunities:

- Expansion in emerging markets & manufacturing geographies: As cost-efficient API production becomes critical, regions such as India, China, and other APAC countries may increasingly play a role in psychedelic API supply chains.

- Integration with advanced manufacturing technologies and biosynthesis: The transition from purely synthetic routes to fermentation, microbial pathways, and engineered biosynthesis presents efficiency and scalability opportunities.

- Outsourcing and tech-transfer models: API producers can partner with pharmaceutical developers to offer captive/in-house to CDMO models, dual-sourcing, and tech-transfer services, meeting the needs of evolving psychedelic drug development pipelines.

Psychedelic API Market Report Segmentation Analysis

By Product:

- API-Grade Psilocybin

- MDMA API

- Lysergide

- Ketamine Class APIs

- Tryptamines

- Others & Next-gen Psychoplastogens

By Source / Synthesis Route:

- Fully synthetic

- Biosynthetic

- Engineered microbial pathways

- Botanical extraction

By Form / Solid-State & Grade:

- Salt forms

- Base forms

- Polymorph/crystal forms

- Micronized / particle-size controlled grades

By Contracting Model / Supply-Chain:

- CDMO outsourcing

- Captive/in-house API manufacturing

- Dual-sourcing / tech-transfer

- Pathway / IP licensing

By End-Use Industry:

- Branded Rx developers/sponsors

- Clinic networks / licensed compounding

- State-regulated service providers

- Academic / investigator-initiated programs

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Psychedelic API Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 4.24 Billion |

| Market Size by 2034 | US$ 14.66 Billion |

| Global CAGR (2026 - 2034) | about 14.78% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Psychedelic API Market Players Density: Understanding Its Impact on Business Dynamics

The Psychedelic API Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Psychedelic API Market Share Analysis by Geography

1. North America

Market Share: Dominant region, holding the largest market share in 2025 (~49%).

Key Drivers:

- Mature clinical-trial infrastructure for psychedelic therapies

- Established regulatory and dispensary ecosystems for advanced psychopharmacology

Trends: Growth in manufacturing capacity for psychedelic APIs, increasing outsourcing of Schedule I manufacturing.

2. Europe

Market Share: Significant share driven by strong research base and government funding.

Key Drivers:

- Government-funded trials, strong mental health awareness

- Regulatory push for alternative treatments in mental health

Trends: Rise of region-specific API manufacturing, cross-border supply chain realignments.

3. Asia Pacific

Market Share: Fastest-growing region during the forecast period.

Key Drivers:

- Emerging pharmaceutical manufacturing economies (India, China)

- Rising awareness of mental-health conditions and interest in novel therapies

Trends: Adoption of biosynthetic APIs, partnerships with Western biotech companies to supply psychedelics.

4. South & Central America

Market Share: Emerging region with growing interest.

Key Drivers:

- Need for cost-effective manufacturing and supply of APIs

- Growth of private clinics & mental-health services

Trends: Cloud sourcing of psychedelic APIs from global CDMOs to serve Latin-American markets.

5. Middle East & Africa

Market Share: Developing region with high growth potential.

Key Drivers:

- Increasing healthcare investment and interest in mental-health therapies

- Need for regional manufacturing capacities to reduce import dependencies.

Trends: Integration of psychedelic API manufacturing into broader pharmaceutical investment strategies.

Psychedelic API Market Players Density: Understanding Its Impact on Business Dynamics

The Psychedelic API Market is relatively nascent but becoming increasingly competitive. Companies with manufacturing scale, regulatory compliance expertise (Schedule I/II), and strong linkages to psychedelic therapeutic pipelines are differentiating.

Competition is intensifying due to:

- Need for seamless integration with drug-development pipelines (psychedelic compounds)

- Scalable, compliant manufacturing of high-potency/controlled substances

- Interoperability of supply chains (CDMOs, in-house, dual-sourcing)

- Adoption of synthetic/fermentation routes & technology innovation

Strategic Moves:

- Partnering with biotech firms and clinical-trial sponsors to secure a supply of required APIs

- Incorporating next-gen manufacturing (biosynthesis, microbial engineering) to reduce cost and improve scalability

- Establishing global manufacturing footprints and regulatory registrations/licensing to support international supply

Major Companies operating in the Psychedelic API Market are:

- Core One Labs Inc.

- Cayman Chemical Company

- COMPASS Pathways plc

- Beckley Psytech

- Atai Life Sciences

- Tryp Therapeutics

- Filament Health

- Psygen Pharmaceutical

- BetterLife Pharma

- Mindset Pharma

Other companies analysed during the course of research:

- Silo Wellness Inc.

- Eleusis Benefit Corporation

- Delic Holdings Inc.

- Havn Life Sciences

- NRx Pharmaceuticals, Inc.

- Usona Institute

- Cybin Inc.

- Seelos Therapeutics

- Ehave Inc.

- Psyched Wellness

Psychedelic API Market News and Recent Developments

- AbbVie Inc. announced a deal worth up to US$1.2 billion to acquire a psychedelic-based depression drug candidate from Gilgamesh Pharmaceuticals, signalling major pharmaceutical interest in psychedelic APIs and therapies.

- Benuvia Inc. received approval from the U.S. DEA to manufacture psychedelic APIs (including psilocybin, DMT, MDMA) in its cGMP/Schedule-I certified facility.

- Purisys LLC (US-based CDMO) provides pharmaceutical-grade psychedelic APIs (psilocybin, psilocin, MDMA, LSD, DMT, ketamine) in FDA-inspected / DEA-licensed facilities, highlighting the growing supply-side maturity of the API ecosystem.

Psychedelic API Market Report Coverage and Deliverables

The “Psychedelic API Market Size and Forecast (2026–2034)” report provides a detailed analysis covering below areas:

- Psychedelic API Market size and forecast at global, regional, and country levels for all key market segments covered under the scope

- Trends and market dynamics, such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis of the Psychedelic API Market

- Market analysis covering key market trends, global and regional frameworks, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat-map analysis, prominent players, and recent developments

- Detailed company profiles of major manufacturers, CDMOs, and API suppliers in the psychedelic space

Frequently Asked Questions

1. Rising demand for novel treatments in mental health (e.g., treatment-resistant depression, PTSD) that use psychedelic compounds.

2. Regulatory momentum and changing policies that support the therapeutic use of psychedelics, thus boosting API demand.

3. Growth of specialised API manufacturing and outsourcing models (CDMOs) for psychedelic compounds, enabling scalable supply.

1. North America leads the market and holds the largest share (~49%).

2. Europe holds a significant share, driven by research infrastructure.

3. Asia-Pacific is projected to be the fastest-growing region over the forecast period, supported by increasing manufacturing and research investment.

1. Branded Rx developers/sponsors (pharmaceutical companies developing psychedelic-based drugs)

2. Clinic networks / licensed compounding services involved in psychedelic therapies.

3. State-regulated service providers offering psychedelic treatments under special access/regulation.

4. Academic / investigator-initiated research programs using psychedelic APIs for trials and development

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For