Pulmonary Drug Delivery Systems Market Developments and Forecast by 2031

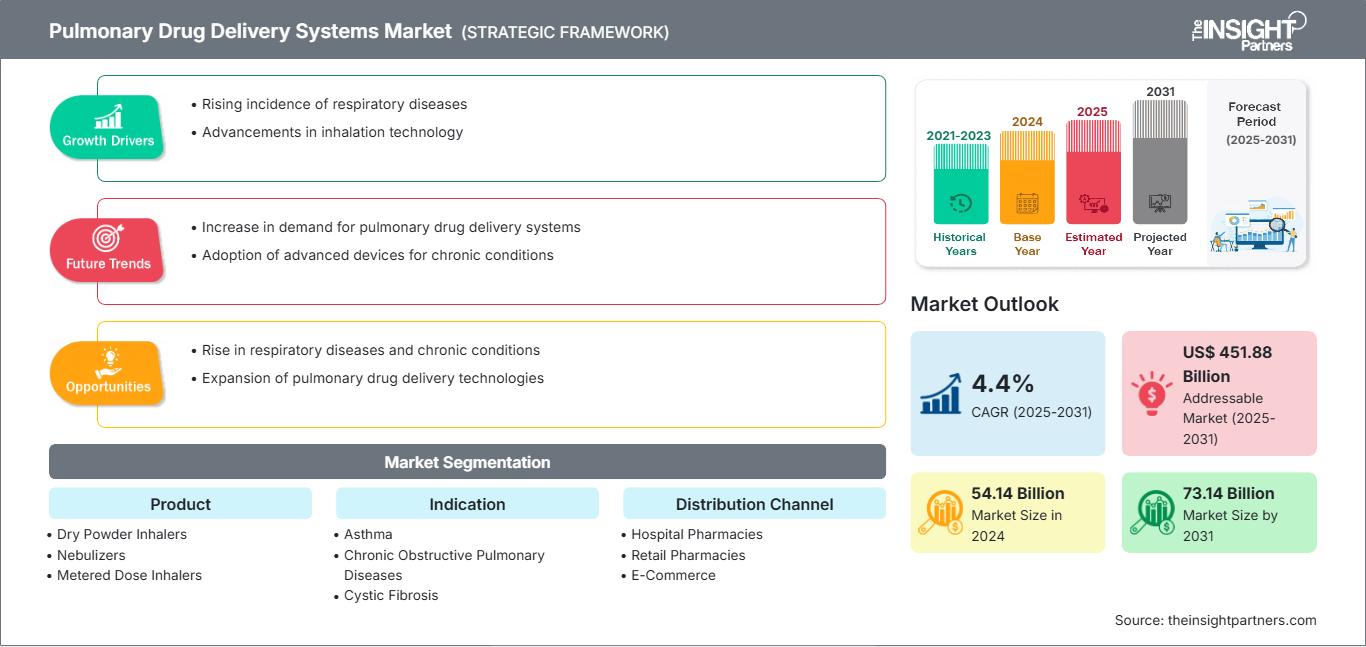

Pulmonary Drug Delivery Systems Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Dry Powder Inhalers, Nebulizers, and Metered Dose Inhalers), Indication (Asthma, Chronic Obstructive Pulmonary Diseases, Cystic Fibrosis, and Others), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and E-Commerce), End User (Hospitals & Clinics and Homecare), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Mar 2026

- Report Code : TIPHE100001256

- Category : Life Sciences

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

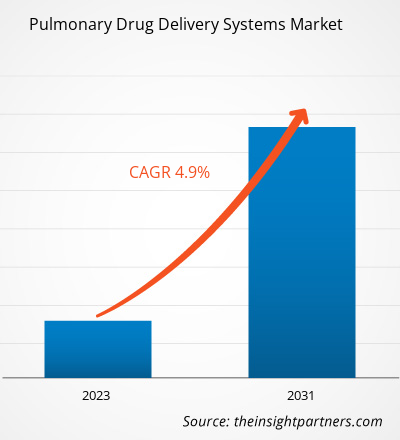

The pulmonary drug delivery systems market size is projected to reach US$ 73.14 billion by 2031 from US$ 54.14 billion in 2024; the market is estimated to record a CAGR of 4.4% during 2025–2031.

Market Insights and Analyst View:

Pulmonary drug delivery systems are used to deliver aerosols directly to epithelial cells and respiratory epithelium through inhalation. The systems include devices such as inhalers and nebulizers for delivering drugs to the lungs to treat patients affected by respiratory diseases. Pulmonary drug delivery devices are based on diverse delivery mechanisms and contain various drug formulations. Asthma, chronic obstructive pulmonary diseases (COPD), acute respiratory tract infections, allergic rhinitis, and cystic fibrosis are major respiratory diseases that require the use of drug delivery devices. The increasing burden of respiratory diseases and growing strategic initiatives by companies favor the pulmonary drug delivery systems market growth. The pulmonary drug delivery systems market trends include the advancements in inhaler technologies that will favor the growth of the market in the future.

Growth Drivers:

Companies operating in the pulmonary drug delivery systems market constantly focus on strategic developments such as collaboration, agreements, partnerships, and new product launches. These strategies help them improve their sales, increase their geographic reach, and enhance their capacities to serve a greater than existing customer base. The new product launches are mainly directed toward increased security, user-friendly features, better dosing capabilities, etc., to attract a large patient base. Following are a few noteworthy developments in the pulmonary drug delivery systems market:

- In September 2021, BreatheSuite Inc. received 510(K) clearances from the US Food and Drug Administration (FDA) for its BreatheSuite metered-dose inhaler V1 device for prescription and over-the-counter use. The BreatheSuite V1 transforms existing metered-dose inhalers into smart inhalers by automatically and accurately monitoring and providing feedback on inhaler adherence and technique for asthma and COPD patients.

- In June 2021, Glenmark Pharmaceuticals Ltd launched Tiogiva, a bioequivalent version of Tiotropium Bromide dry powder inhaler, in the UK to treat COPD.

- In April 2021, KINDEVA DRUG DELIVERY collaborated with Cambridge Healthcare Innovations Limited (CHI) to develop and commercialize CHI’s αeolus dry-powder inhaler (DPI) platform technology.

- In December 2020, AireHealth, an innovative digital health company, received 510(k) clearance for its connected nebulizer. The device is a portable and electronic vibrating mesh nebulizer. It is designed to nebulize liquid medications for inhalation by a patient. It is marketed under the brand name VitalMed.

- In September 2020, GlaxoSmithKline plc and Innoviva, Inc. received FDA approval for Trelegy Ellipta as the first once-daily single inhaler triple therapy to treat asthma and COPD patients aged 18 years and above in the US.

Thus, the growing number of strategic developments and product launches by the companies to remain competitive in the market propels the pulmonary drug delivery systems market growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONPulmonary Drug Delivery Systems Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The pulmonary drug delivery systems market analysis has been carried out by considering the following segments: product, indication, distribution channel, end user, and geography. In terms of product, the market is segmented into dry powder inhalers, nebulizers, and metered dose inhalers. By indication, the market is classified into chronic obstructive pulmonary diseases, asthma, cystic fibrosis, and others. Based on distribution channel, the market is categorized into hospital pharmacies, retail pharmacies, and e-commerce. Based on end user, the market is bifurcated into hospitals & clinics and homecare. The scope of pulmonary drug delivery systems market report covers North America (the US, Canada, and Mexico), Europe (France, Germany, the UK, Spain, Italy, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), the Middle East & Africa (Saudi Arabia, South Africa, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

The pulmonary drug delivery systems market, by product, is categorized into dry powder inhalers, nebulizers, and metered dose inhalers. The dry powder inhalers segment held a significant market share in 2023. It is anticipated to record the highest CAGR in the market during 2023–2031.

In terms of indication, the pulmonary drug delivery systems market is classified into chronic obstructive pulmonary diseases, asthma, cystic fibrosis, and others. The chronic obstructive pulmonary diseases segment held a significant market share in 2023 and is projected to register the highest CAGR during 2023–2031.

Based on distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and e-commerce. The hospital pharmacies segment held a significant pulmonary drug delivery systems market share in 2023. The e-commerce segment is expected to register the highest CAGR during 2023–2031.

Based on end user, the pulmonary drug delivery systems market is bifurcated into hospitals & clinics and homecare. The hospitals & clinics segment held a significant market share in 2023. The homecare segment is estimated to register a higher CAGR during 2023–2031.

Regional Analysis:

Geographically, the pulmonary drug delivery systems market is segmented into North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2023, North America held a significant share of the market. In 2023, the US held the largest share of the market in the region. The market growth in North America is attributed to the rising incidence of respiratory diseases such as asthma, COPD, and others; increasing geriatric population; growing demand for diagnostic devices; and the strong presence of key market players. According to the Centers for Disease Control and Prevention (CDC), 2020, about 5.0% of adults are diagnosed with COPD or chronic bronchitis in the US. About 25 million people are affected by asthma, and 14.8 million have COPD. In addition, the Canadian Nurse Association estimated that ~3 million people in Canada suffer from one of serious respiratory diseases such as COPD, cystic fibrosis, asthma, and occupational lung diseases.

According to the Canadian Lung Association, respiratory diseases are responsible for the third highest share of hospitalizations, and approximately one in five people in Canada suffer from serious respiratory diseases, such as asthma, COPD, lung cancer, tuberculosis, cystic fibrosis, and respiratory distress syndrome. The rising number of patients suffering from various respiratory diseases propels the demand for innovative and effective pulmonary drug delivery systems such as metered dose inhalers or nebulizers.

Pulmonary Drug Delivery Systems Market Regional InsightsThe regional trends and factors influencing the Pulmonary Drug Delivery Systems Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Pulmonary Drug Delivery Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Pulmonary Drug Delivery Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | 54.14 Billion |

| Market Size by 2031 | 73.14 Billion |

| Global CAGR (2025 - 2031) | 4.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Pulmonary Drug Delivery Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Pulmonary Drug Delivery Systems Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Pulmonary Drug Delivery Systems Market top key players overview

Industry Developments and Future Opportunities:

The pulmonary drug delivery systems market report includes company positioning and concentration to evaluate the performance of competitors in the market. As per company press releases, below are a few initiatives taken by key players operating in the market:

- In March 2021, PARI Pharma GmbH received the authorization of LAMIRA Nebulizer System for delivery of Insmed’s drug product ARIKAYCE (amikacin liposome inhalation suspension) in Japan. Insmed received approval for ARIKAYCE by Japan’s Ministry of Health, Labour, and Welfare in March 2021. The approval of ARIKAYCE in the country follows earlier approvals in the US and Europe.

- In December 2020, the European Commission approved AstraZeneca’s Trixeo Aerosphere in the European Union for COPD. It is used in the treatment of adult patients suffering from moderate to severe COPD. Trixeo Aerosphere is a single-inhaler, fixed-dose triple-combination of formoterol fumarate, glycopyrronium bromide, with budesonide, and an inhaled corticosteroid, and delivered in a pressurized metered-dose inhaler.

Competitive Landscape and Key Companies:

The pulmonary drug delivery systems market forecast can help stakeholders plan their growth strategies. AstraZeneca, GlaxoSmithKline Plc, Novartis AG, Koninklijke Philips NV, Boehringer Ingelheim International GmbH, Cipla Inc., OMRON Corp., PARI GmbH, Glenmark Pharmaceuticals, and Gilbert Technologies are among the prominent players in the market. These companies focus on introducing new high-tech products, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For