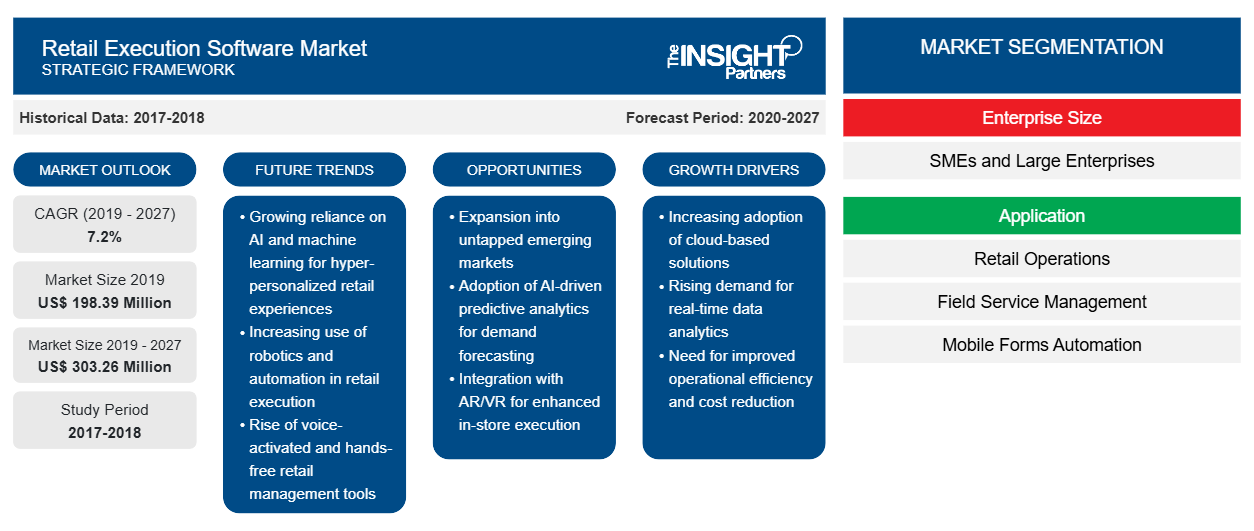

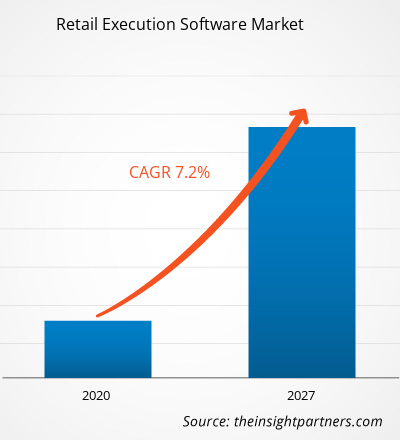

The retail execution software market was valued at US$ 198.39 million in 2019 and it is projected to reach US$ 303.26 million by 2027; it is expected to grow at a CAGR of 7.2% from 2020 to 2027.

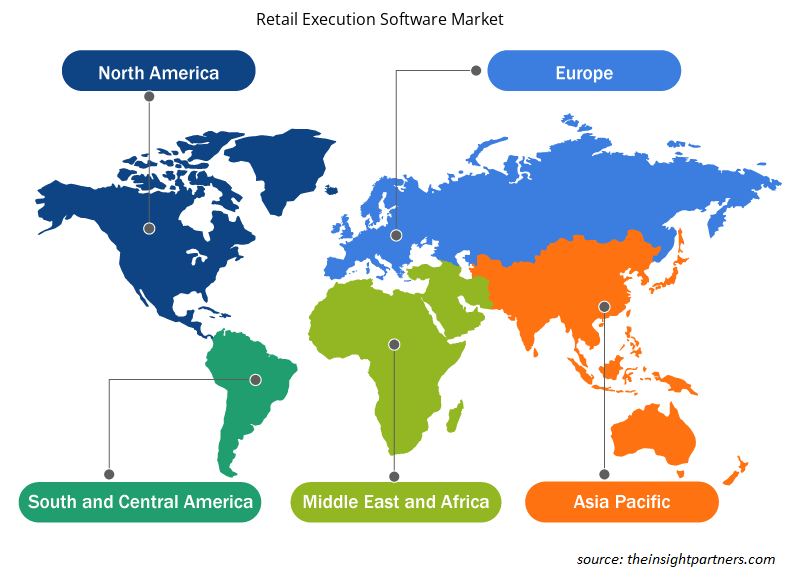

The global retail execution software market is witnessing substantial growth owing to the growing preference of retail and e-commerce platforms and increasing integration of payment gateways with retail execution software. Based on geography, North America led the market with 31.13% revenue share, followed by Europe and APAC. The presence of fast-growing economics, rising adoption of automated technology, increasing penetration of internet, and huge adoption of software by end users are among the prime factors expected to drive the growth of the retail execution software market in these regions. The retail execution software market in APAC is anticipated to grow at the highest CAGR during the forecast period. Rising adoption of advanced technologies in the retail industry drives the adoption rate of retail execution software. Companies invest in software to streamline their business operations. In APAC, the fastest-growing markets for retail and e-commerce are India and China. Consumers of these countries are highly inclined toward online shopping owing to rising internet penetration, and online shopping trends are transforming several areas of retail and e-commerce in the region. Thus, these factors are propelling the growth of the retail execution software market in APAC. Other developing regions, such as MEA and SAM, are also projected to grow at a steady pace owing to the increasing government initiatives to digitalize the economy with the adoption of advanced technologies.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Retail Execution Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Retail Execution Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Retail Execution Software Market

According to the latest report from World Health Organization (WHO), the US, Spain, Italy, France, Germany, the UK, Russia, Turkey, Brazil, Iran, and China are among the worst affected countries due to the COVID-19 outbreak. The crisis is adversely affecting the industries worldwide. The global economy took the worst hit in 2020, and it is likely to continue in 2021 also. The outbreak has created significant disruptions in primary industries such as logistics, retail, and e-commerce. The sharp decline in the international logistics business industry is restraining the growth of the global retail execution software market.

Retail Execution Software Market Insights

Increasing Integration of Payment Gateways with Retail Execution Software

Fuels Growth of Retail Execution Software Market

Online payments are relatively popular in APAC as most consumers use mobiles to pay for goods. Several popular e-payment options are used for mobile digital purchases in countries, such as South Korea, Japan, Singapore, and Australia. Payment gateway companies in these countries are offering comprehensive e-payment solutions to various retail execution software providers in order to catch the wave of technological development. Further, the market growth is attributed to advancements in payment gateway technology and increase in use of mobile wallets. Rising integration of payment gateway systems with retail execution software and rising online shopping, together with advancements in billing methods, are further expected to fuel the demand for retail execution software during the forecast period.

Enterprise Size-Based Market Insights

Based on enterprise size, the retail execution software market is bifurcated into large enterprises and SMEs. In 2019, the large enterprises segment accounted for a significant share in the market. However, the SMEs segment is anticipated to register a significant CAGR during the forecast period.

Application-Based Market Insights

Based on application, the retail execution software market is segmented into retail operations, field service management, mobile forms automation, field sales, trade promotion management, employee engagement, and others. In 2019, the retail operations segment accounted for a significant share in the market. Retail operations involve the management of individuals, supply chain, store layout, cash operations, physical inventory, and management of master data, promotions, and pricing. Retail execution software for retail operations equips brick-and-mortar retail stores with tools to take advantage of their current information and leverage it in a way that benefits their business.

Companies are highly engaged in developing new products to gain traction in the retail execution software market. For instance, Salesforce launched a new industry product, namely, Consumer Goods Cloud, which allows consumer goods companies to fuel revenue growth and increase ROI through enhanced retail execution capabilities. A few developments by key players are listed below:

2020:StayinFront, Inc. retail data insight (RDI) extended its partnership with Field Sales Solutions for real-time analytics. StayinFront RDI’s field view and ROI view, provide actionable insights to field sales teams. The services facilitate and maximize in-store effectiveness, allowing Field Sales Solutions’ clients the ability to do more, know more, and sell more.

2018:Intelligence Retail approached IBM to enhance its main offering and allow its customers to take advantage of tracking the key store audit indicators in actual-time. A new analytical module of the Intelligence Retail solution, based on the embedded IBM Watson Analytics technologies, is designed to help effectively track the key indicators of the retail audit by actual-time processing big data, including the availability of goods on the shelf, shelf share, prices, and promotions

Retail Execution Software Market Regional Insights

The regional trends and factors influencing the Retail Execution Software Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Retail Execution Software Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Retail Execution Software Market

Retail Execution Software Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 198.39 Million |

| Market Size by 2027 | US$ 303.26 Million |

| Global CAGR (2019 - 2027) | 7.2% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Enterprise Size

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Retail Execution Software Market Players Density: Understanding Its Impact on Business Dynamics

The Retail Execution Software Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Retail Execution Software Market are:

- Bizom (Mobisy Technologies Private Limited)

- EdgeCG (StayinFront, Inc.),

- Intelligence Retail

- Mobisoft

- POPProbe

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Retail Execution Software Market top key players overview

By Enterprise Size

- Large Enterprises

- SMEs

By Application

- Retail Operations

- Field Service Management

- Mobile Forms Automation

- Field Sales

- Trade Promotion Management

- Employee Engagement

- Others

By Geography

North America

- US

- Canada

- Mexico

Europe

- France

- Germany

- Italy

- UK

- Russia

- Rest of Europe

Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of APAC

Middle East & Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

South America (SAM)

- Brazil

- Argentina

- Rest of SAM

Company Profiles

- Bizom (Mobisy Technologies Private Limited)

- EdgeCG (StayinFront, Inc.)

- Intelligence Retail

- Mobisoft

- POPProbe

- Spring Mobile Solutions, Inc.

- Trax Technology Solutions Pte Ltd.

- Valomnia

- WINIT

- Kantar Group

Frequently Asked Questions

Which industry led the Retail Execution Software market?

The retail operations segment led the retail execution software market with a market share of 33.3% in 2019. Further, it is expected to garner 30.9% share by 2027. Retail operations involves the management of individuals, supply chain, store layout, cash operations, physical inventory, and management of master data, promotions and pricing, etc. Retail execution software for retail operations equips brick-and-mortar retail stores with tools to take advantage of their current information and leverage it in a way that benefits their business. This information is often obtained from POS systems, retail management systems, and other retail use software daily. This information is taken and analyzed by the retail operations platform, providing managers and business owners with usable insights. Pricing, inventory management, or store layout can be the focus of these insights. The objective is to optimize a store user data that the store is already collecting for maximum sales. Retail operations may be integrated to manage retail POS software, retail management systems, or retail task management software.

Which region held the largest share in 2019 of the Retail Execution Software market?

North America dominated the retail execution software market in 2019 with a share of 31.1%; and is expected to lose its market share during the forecast period. APAC is anticipated to hold the largest market share by 2027, followed by North America and Europe. APAC is anticipated to grow at the highest CAGR during the forecast period. The region comprises prime nations such as China, India, Japan, South Korea, and Australia. Rising adoption of advanced technologies in the retail industry is drives the adoption rate of retail execution software. Companies invest in software to streamline their business operations.

Which factor is driving growth of the Retail Execution Software market?

The retail and e-commerce industry provides a huge platform for shopping. It is increasing at an unprecedented rate across the globe. Retail and e-commerce platforms also help various businesses to reach their customers easily; hence, necessary exposure to business is achieved. According to the Census Bureau of the Department of Commerce, US retail e-commerce sales were US$ 160.3 billion for the first quarter of 2020, an increase of 2.4% from the fourth quarter of 2019. Growing retail and e-commerce industries in APAC and North America are thriving in the business for retail execution software. The retail execution software is used for planning, managing, and monitoring the in-store activities in the consumer packaged goods (CPG) industry—such as retail operations, field sales, trade promotion management, field service management, mobile forms automation, and employee engagement. These software facilitate to enhance the collaboration between CPG companies and retailers to increase profits and optimize in-store sales. This factor is scaling up the retail execution software market size year-on-year.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Parking Meter Apps Market

- eSIM Market

- Advanced Distributed Management System Market

- Online Exam Proctoring Market

- Electronic Data Interchange Market

- Barcode Software Market

- Maritime Analytics Market

- Cloud Manufacturing Execution System (MES) Market

- Robotic Process Automation Market

- Digital Signature Market

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Retail Execution Software Market

- Bizom (Mobisy Technologies Private Limited)

- EdgeCG (StayinFront, Inc.),

- Intelligence Retail

- Mobisoft

- POPProbe

- Spring Mobile Solutions, Inc.

- Trax Technology Solutions Pte Ltd.

- Valomnia

- WINIT

- Kantar Group

Get Free Sample For

Get Free Sample For