Set Top Box Market Size and Growth 2031

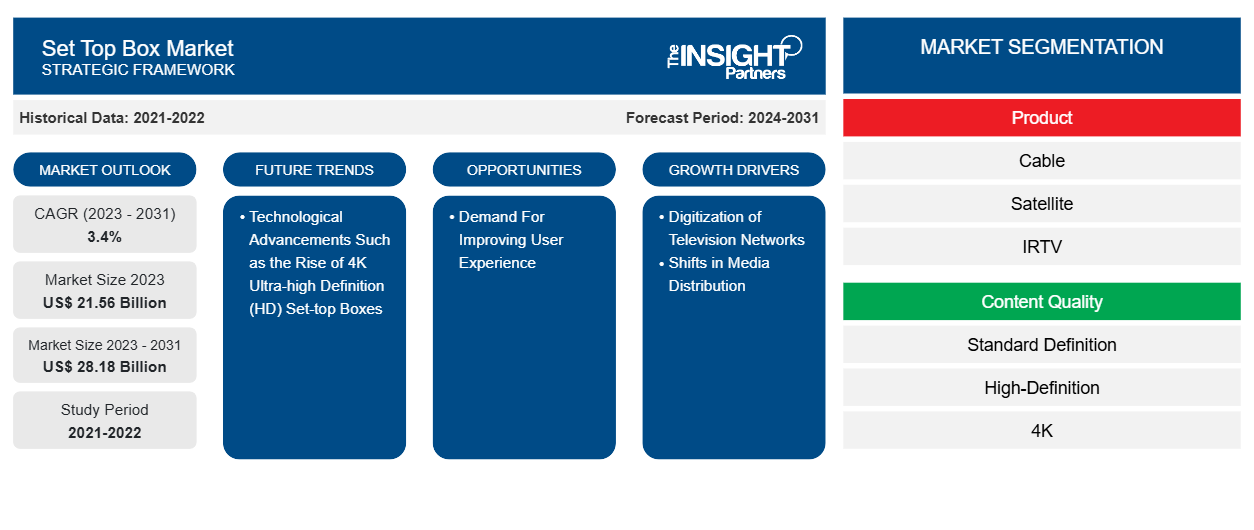

Set Top Box Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (IPTV, Satellite, Cable, and Others), Content Quality (Standard Definition (SD), High-Definition (HD), and 4K), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Jul 2025

- Report Code : TIPRE00008869

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 186

The set top box market size is expected to reach US$ 31.08 billion by 2031 from US$ 25.33 billion in 2024. The market is anticipated to register a CAGR of 3.1% during 2025–2031. Integration with the smart home ecosystem is likely to bring new trends to the market in the coming years.

Set Top Box Market Analysis

Contemporary set-top boxes incorporate advanced technologies such as High-Efficiency Video Coding (HEVC), allowing for efficient compression of 4K content and smoother streaming with lower bandwidth usage. Features such as HDR10+ and Dolby Vision have become standard, delivering enhanced visuals by dynamically adjusting brightness and contrast for each frame, resulting in more realistic image quality. Moreover, AI-powered upscaling leverages machine learning to enhance lower-resolution content in real time, improving sharpness and detail to resemble native 4K resolution.

The increasing adoption of smart TVs, rising demand for high-definition (HD) and ultra-high-definition (UHD) content, and expansion of over-the-top (OTT) streaming services are driving the growth of the set top box market. Moreover, innovation in set-top box (STB) technology is creating lucrative opportunities for the growth of the set top box market.

Set Top Box Market Overview

A set-top box is a hardware-based device integrated with software, primarily designed to receive television and related content via terrestrial, cable, satellite, broadband, or local network connections and to deliver video output through at least one dedicated video interface. Set-top boxes offer enhanced picture quality and expanded channel access, as well as features such as pause, record, and playback capabilities. They are especially valuable in regions with weak signal reception or limited access to traditional cable or satellite services. A set-top box provides access to a wide range of television channels, including high-definition and on-demand content. It supports digital video recording (DVR), parental controls, and interactive program guides. Internet-enabled models also offer compatibility with popular streaming applications. With a user-friendly setup and enhanced audio-visual performance, set-top boxes significantly elevate the home entertainment experience.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONSet Top Box Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Set Top Box Market Drivers and Opportunities

Expansion of Over-the-Top (OTT) Streaming Services

As digital technology and the internet continue to reshape the entertainment landscape, streaming media has become a key driver of content consumption and engagement. Leading this transformation is the Over-The-Top (OTT) set-top box, a device that has revolutionized traditional TV viewing while paving the way for the future of entertainment. OTT set-top boxes enable users to stream content directly over the internet, bypassing conventional distribution channels. These devices provide access to a broad array of OTT streaming services, such as Netflix, Amazon Prime, and Disney+, while integrating features of live TV and radio. These combine the functionalities of traditional cable and satellite TV with the flexibility of streaming platforms. A key advantage of OTT set-top boxes is their extensive variety of content. These devices aggregate a wide array of entertainment options, from streaming services and YouTube videos to traditional TV channels, providing users with access to a diverse range of content in a single platform. Thus, the expansion of OTT streaming services drives market growth.

Innovation in Set Top Box (STB) Technology

Market players are working on innovation in set-top box technology. For example, in September 2024, ZTE Corporation unveiled its next-generation 4K AI flagship set-top box at the 2024 IBC Show. This innovative device combines the functionalities of a traditional set-top box and a soundbar, offering enhanced computing capabilities and intelligent control. It is positioned as the preferred multi-ecosystem solution for the modern living room; the product supports a wide range of applications and delivers an upgraded home entertainment experience, enabling service providers to drive business growth and increase user engagement. In another example, in January 2022, NXTDIGITAL Limited launched an Android set-top box, Nxtconnect, and a live TV stick, Nxtgo, that gives subscribers access to 700 TV channels and 300,000 hours of OTT content with broadband speeds up to 1,000 Mbps. The Android set-top box features 8GB of storage. It enables subscribers to transform their standard TVs into smart TVs, providing access to a wide range of Android applications beyond OTT, including karaoke and games. For current smart TV users, Nxtgo offers access to up to 700 TV channels, enhancing the overall viewing experience. Thus, advancement in set-top box technology creates a lucrative opportunity for the growth of the set top box market.

Set Top Box Market Report Segmentation Analysis

Key segments that contributed to the derivation of the set top box market analysis are product type and content quality.

- Based on product type, the set top box market is segmented into IPTV, satellite, cable, and others. The IPTV segment dominated the market in 2024.

- By content quality, the set top box market is segmented into standard-definition (SD), high-definition, and 4K. The high-definition segment dominated the market in 2024.

Set Top Box Market Share Analysis by Geography

The set top box market is segmented into five major regions: North America, Europe, Asia Pacific, Middle East & Africa (MEA), and South America. Asia Pacific dominated the market in 2024.

Asia Pacific is experiencing a rise in the adoption of set-top boxes, owing to the rising demand for digital TV, IPTV, and OTT services. Increased internet penetration, competitive pricing, and supportive government initiatives have contributed to this growth, positioning set-top boxes as essential devices for accessing a wide range of content across multiple platforms. For example, in January 2023, Under the Broadcast Infrastructure Network Development (BIND) Scheme, the Indian government planned to distribute over 8 lakh (US$ 0.8 million) Doordarshan DTH receiver sets for free in remote, border, and Left Wing Extremism (LWE)-affected areas. With a budget of Rs 25.39 billion (US$ 304.75 million), the initiative aims to enhance the reach of All India Radio (AIR) and Doordarshan, improving infrastructure and expanding FM coverage to over 80%. The project also includes strengthening mobile TV production and FM networks, with a completion target by 2025–2026.

Set Top Box Market Regional Insights

The regional trends and factors influencing the Set Top Box Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Set Top Box Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Set Top Box Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 25.33 Billion |

| Market Size by 2031 | US$ 31.08 Billion |

| Global CAGR (2025 - 2031) | 3.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Set Top Box Market Players Density: Understanding Its Impact on Business Dynamics

The Set Top Box Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Set Top Box Market top key players overview

Set Top Box Market News and Recent Developments

The set top box market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the set top box market are listed below:

- Skyworth announced that they have partnered with Fetch TV on the design, production, and launch of the new Fetch Mini G5 set-top box. The device is small, measuring just 10cm square x 2.3cm high, but feature-packed. It includes a DVB-T2 tuner for broadcast TV, 4GB RAM, and a powerful Amlogic S905X4 chip, making it a high-performance entertainment aggregation device delivering a seamless user experience.

(Source: Skyworth, Press Release, September 2024)

- CommScope announced that it has joined forces with du to launch the latest advancement in du TV for the United Arab Emirates (UAE) market, introducing the VIP7802 Ultra-HD set-top box. The VIP7802 represents CommScope’s next-generation set-top box, featuring a fast quad-core CPU, a Vulkan 3D-capable GPU, and dual-band Wi-Fi 6. This high-end, set-top box is designed with a compact footprint, offering users a superior viewing experience with support for 4K UltraHD resolution and High Dynamic Range (HDR) formats that enhance colour, contrast, and brightness.

(Source: CommScope, Press Release, January 2024)

Set Top Box Market Report Coverage and Deliverables

The "Set Top Box Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Set top box market size and forecast at regional and country levels for all the key market segments covered under the scope

- Set top box market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Set top box market analysis covering key market trends, regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the set top box market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For