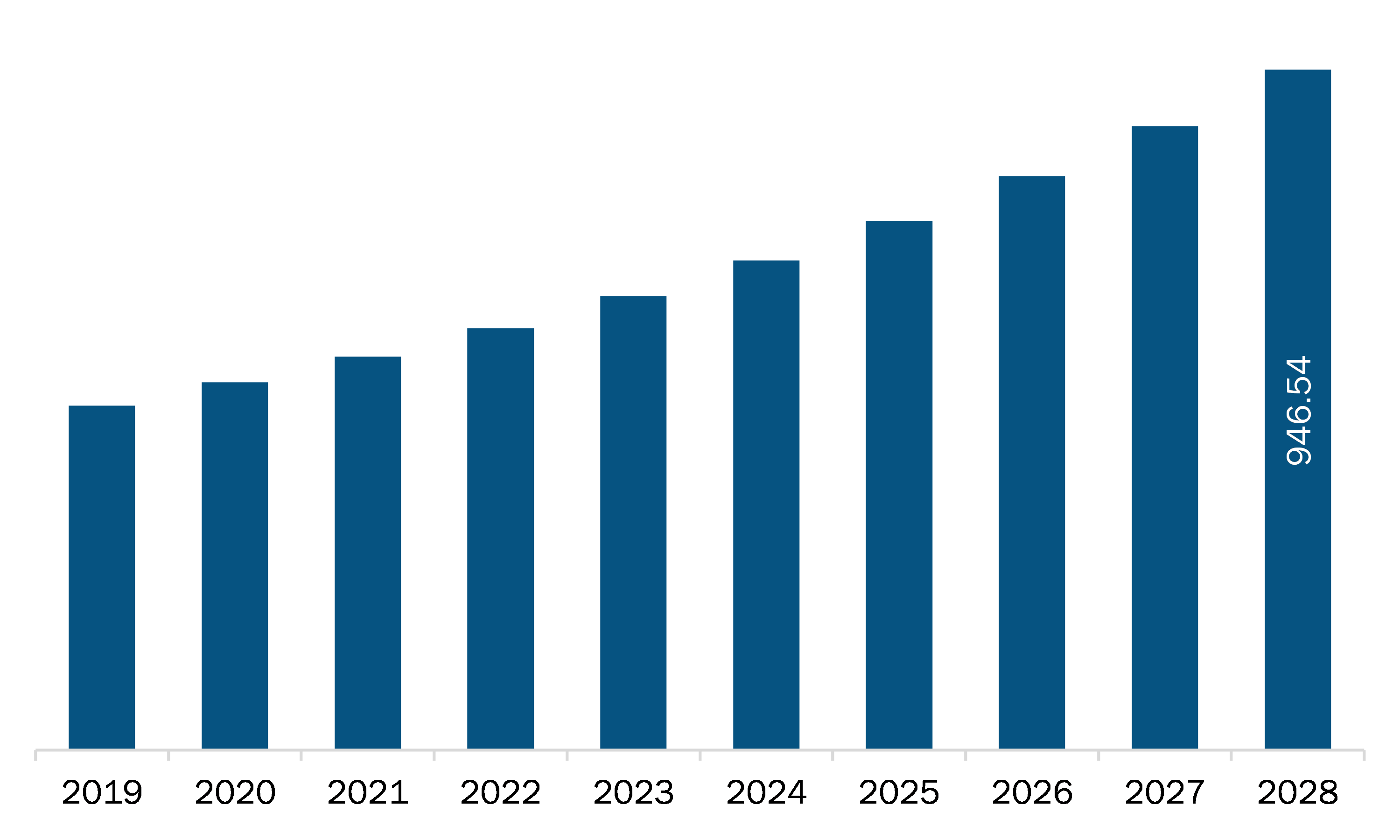

The SAM radiopharmaceuticals market is expected to grow from US$ 547.43 million in 2021 to US$ 946.54 million by 2028; it is estimated to grow at a CAGR of 8.1% from 2021 to 2028.

Brazil and Argentina are major economies in SAM. Suitability of alpha radio immunotherapy in targeted cancer treatment is expected to fuel the market growth. The Targeted alpha therapy (TAT) is the latest and evolving technique used for local and systemic cancer treatment. Preclinical research and clinical trials prove that alpha-emitting radionuclides kill targeted cancer cells and do not harm the healthy cells (selective cytotoxicity). 211At, 213Bi, 225Ac, and 227Th are among the alpha-emitting radioisotopes used to label targeting vectors such as monoclonal antibodies; the monoclonal antibodies labeled with α-emitting radionuclides are emerging as an effective radioimmunotherapy. Shorter-range radioisotopes (α particles) are used for treating patients with hematological cancer. Alpha radiations are suitable for killing isolated cancer cells in the vascular and lymphatic systems as well as in regressing tumors by disturbing tumor capillary networks for targeting and killing tumor capillary endothelial cells (ECs). The Radium-223 dichloride alpha therapy is the only approved concept for internal alpha-emitting radioisotope cancer treatment. The decay of radioactive elements after reaching the malignant tissue releases tumor-destroying radiations without causing significant damage to the adjoining healthy tissues. The alpha radiations are much localized, and they penetrate a maximum of 2–10 cell layers. Healthy cells in the surrounding tissue can recover from any damage caused by the radiation to a certain extent themselves. Nuclear imaging uses gamma emitters that have a long lifespan, which allows blood clearance as the tumor increases its uptake of the conjugate over time, so improving contrast. Nuclear imaging agents allow the diagnosis of tumor and organs. In addition, the rise in awareness about alpha radioimmunotherapy and surge in the availability of therapies for cancer treatment procedures are propelling the demand for nuclear imaging. Thus, the preferred use of alpha radioimmunotherapy in the treatment of cancer is fueling the SAM radiopharmaceuticals market growth.

In case of COVID-19, SAM is highly affected especially Brazil, followed by Peru, Chile, Ecuador, and Venezuela. With the outbreak of second wave COVID-19, there has been an increasing number of cases in the South American countries. According to the International Council of Nurses, the number of deaths of health professionals in Brazil are above other countries due to high transmission of the virus. Brazil has many populated regions with small houses with 6-7 people per house, the virus spreads like wildfire. Currently, the countries in this region are rapidly increasing its clinical programs to fight against the novel corona virus. In this scenario, Brazil has observed enormous difficulties in management of chronic neurological disorders, from headache to neurodegenerative diseases. Due to inadequate monitoring, many patients end up being admitted to emergency departments due to decompensation of their neurological disease. During the pandemic, stroke patients as well as other neurological conditions have been arriving late at the hospital, outside the therapeutic window for acute intervention. In addition, the country also faced difficulties in obtaining beds in the intensive care unit for management of the diseases during the acute phase. These factors are likely to have negative impact on the market growth.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the SAM radiopharmaceuticals market. The SAM radiopharmaceuticals market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

SAM Radiopharmaceuticals Market Segmentation

SAM Radiopharmaceuticals Market – By Type

- Diagnostic Nuclear Medicine

- SPECT

- PET

- Therapeutic Nuclear Medicine

- Alpha Emitters

- Beta Emitters

- Brachytherapy Isotopes

SAM Radiopharmaceuticals Market – By Application

- Oncology

- Cardiology

- Neurology

- Others

SAM Radiopharmaceuticals Market – By End User

- Hospitals

- Imaging Centers

- Academic and Research Centers

- Others

SAM Radiopharmaceuticals Market, by Country

- Brazil

- Argentina

- Rest of SAM

SAM Radiopharmaceuticals Market -Companies Mentioned

- Cardinal Health Inc

- Curium

- GENERAL ELECTRIC

- Lantheus Medical Imaging, Inc.

- Bayer AG

- Bracco Imaging S.p.A

- Nordion

South America Radiopharmaceuticals Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 547.43 Million |

| Market Size by 2028 | US$ 946.54 Million |

| CAGR (2021 - 2028) | 8.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For