Synthetic Aperture Radar Market Drivers and Trends by 2031

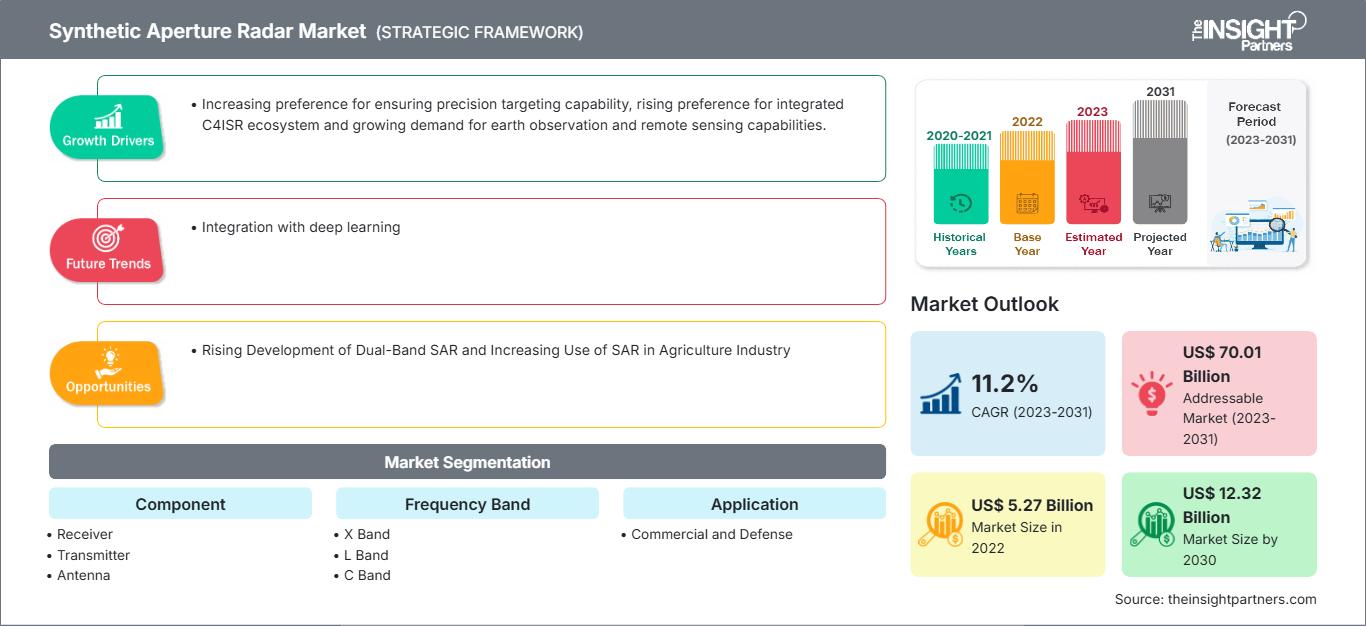

Synthetic Aperture Radar Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Receiver, Transmitter, and Antenna), Frequency Band (X Band, L Band, C Band, S Band, and Others), Application (Commercial and Defense), Platform (Ground and Airborne), Mode (Single and Multi), and Geography

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2031- Report Date : Feb 2024

- Report Code : TIPRE00006745

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 223

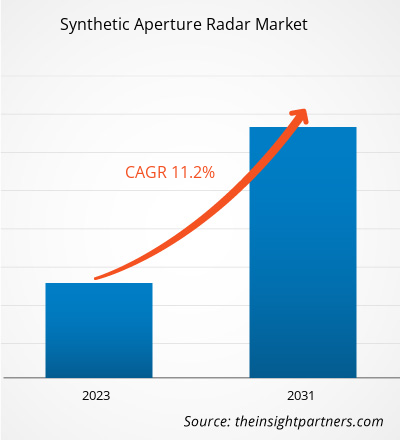

The synthetic aperture radar market size is projected to reach US$ 12.32 billion by 2030 from US$ 5.27 billion in 2022. The market is expected to register a CAGR of 11.2% during 2022–2030. Integration with deep learning is likely to remain a key trend in the market.

Synthetic Aperture Radar Market Analysis

Various reasons fuel the synthetic aperture radar market growth. Factors such as the rising demand for advanced technologies that offer enhanced environmental awareness, the increasing need for efficient surveillance and communication networks, the growing deployment of space-based radars, and the increasing utilization of SAR for environmental awareness and mapping purposes play a crucial role in market expansion. Moreover, the rising development of dual-band SAR is expected to bring new synthetic aperture radar market trends in the coming years.

Synthetic Aperture Radar Market Overview

Synthetic Aperture Radar (SAR) is an innovative remote sensing technique that employs radar technology to generate high-resolution images of the Earth's surface. Optical sensors rely on sunlight; however, SAR utilizes its energy source to illuminate the target area and capture the reflected energy. This active data collection approach enables SAR to operate effectively under any lighting conditions, day or night, and in all kinds of weather, making it a useful and valuable tool for numerous applications. The functioning of SAR involves leveraging the flight trajectory of the radar platform, be it an aircraft or a satellite, to simulate a large antenna electronically. The radar system emits radio waves toward the Earth's surface and records the signals that bounce back, a process known as backscattering. This process is repeated multiple times during transmit/receive cycles, with the resulting data being electronically stored. Subsequently, the stored data is meticulously processed to generate a comprehensive and high-resolution image of the observed terrain.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONSynthetic Aperture Radar Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Synthetic Aperture Radar Market Drivers and Opportunities

Rising Preference for Integrated C4ISR Ecosystem to Favor Market

The market is driven by the increasing preference for an integrated Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance (C4ISR) ecosystem. Traditionally, C4ISR systems have relied on separate stand-alone units, each equipped for specific functions and mission requirements. This approach often leads to the use of separate systems and displays for collecting and analyzing information, resulting in a rigorous and time-consuming process. To address these challenges, defense agencies are leaning toward adopting an enterprise integration approach. This approach advocates for the integration of secure and interoperable C4ISR networks and systems to streamline the entire process. In this integrated C4ISR approach, governments take responsibility for designing enterprise blueprints and intersystem interfaces. At the same time, vendors deliver individual systems and sub-components that can be seamlessly integrated into the overall C4ISR environment.

Rising Development of Dual-Band SAR

Dual-band synthetic aperture radar (SAR) technology operates in two frequency bands simultaneously, allowing for enhanced imaging capabilities and improved image quality compared to single-band SAR systems. The use of dual-band SAR offers several advantages. Firstly, it enables better target discrimination and identification, as the combination of two different frequency bands provides more detailed and accurate imaging. This is particularly valuable in applications such as military surveillance, border control, and maritime monitoring, where the ability to distinguish between objects and detect subtle changes is crucial. Secondly, dual-band SAR technology enhances the system's ability to penetrate and detect objects under challenging environmental conditions. Utilizing two different frequency bands, SAR systems can overcome limitations posed by factors such as vegetation cover, weather conditions, and surface roughness. Thus, dual-band synthetic aperture radar (SAR) technology has emerged as a significant advancement in the synthetic aperture radar market, presenting new opportunities for market growth and expansion.

Synthetic Aperture Radar Market Report Segmentation Analysis

Key segments that contributed to the derivation of the synthetic aperture radar market analysis are the component, frequency band, application, platform, and mode.

- Based on the components, the synthetic aperture radar market is divided into receiver, transmitter, and antenna. The antenna segment will hold a significant market share in 2022.

- By frequency band, the market is segmented into X band, L band, C band, S band, and others. The X band segment held the largest market share in 2022.

- In terms of application, the market is segmented into commercial and defense. The defense segment is expected to grow with the highest CAGR over the forecast period.

- In terms of platform, the market is segmented into ground and airborne. The airborne segment is expected to grow with the highest CAGR over the forecast period.

- In terms of mode, the market is segmented into single and multi. The multi-segment is expected to grow with the highest CAGR over the forecast period.

Synthetic Aperture Radar Market Share Analysis by Geography

The geographic scope of the synthetic aperture radar market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The North American market has gained prominence in the region for several reasons. The US dominated the synthetic aperture radar market share in 2022. Synthetic aperture radar technology is widely used in various applications, including military & defense, monitoring, exploration, agriculture, urban planning, infrastructure development, and natural resource management. Various factors drive the demand for synthetic aperture radar technology. In military applications, synthetic aperture radar (SAR) is used for surveillance, detection of surface features, and topographical mapping. The US military is replacing its legacy systems with advanced synthetic aperture radars, which is contributing to the growth of the market. Additionally, the need for geospatial information is increasing in sectors such as agriculture, urban planning, infrastructure development, and natural resource management. Synthetic aperture radar provides valuable data for these applications, further fuelling the synthetic aperture radar market growth.

Synthetic Aperture Radar

Synthetic Aperture Radar Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 5.27 Billion |

| Market Size by 2030 | US$ 12.32 Billion |

| Global CAGR (2023 - 2031) | 11.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Synthetic Aperture Radar Market Players Density: Understanding Its Impact on Business Dynamics

The Synthetic Aperture Radar Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Synthetic Aperture Radar Market News and Recent Developments

The synthetic aperture radar market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the synthetic aperture radar market are listed below:

- Israel Aerospace Industries (IAI) launched Singapore's DS-SAR radar satellite, showcasing the company's expertise in the development of observation satellites. With a track record of 35 years in creating advanced-generation satellites, including OptSat and TecSAR, IAI has leveraged its experience to create the DS-SAR satellite. This satellite features a synthetic aperture radar sensor payload, which enables the collection of extensive and high-resolution data regardless of weather conditions, day or night. The launch of DS-SAR reinforces IAI's position in the market and highlights its ability to deliver cutting-edge solutions in the field of satellite technology. (Source: Israel Aerospace Industries (IAI), Press Release, July 2023)

- BAE Systems' research and development organization, FAST Labs, was granted a US$ 14 million contract by the Defense Advanced Research Projects Agency (DARPA) for the MAX program. This partnership aims to develop cutting-edge technology that facilitates the implementation of advanced signal processing and computation on smaller military platforms. The project aligns with BAE Systems' commitment to innovation and its focus on providing state-of-the-art solutions for the defense industry. Through this collaboration, BAE Systems aims to enhance military capabilities by enabling the deployment of advanced technologies on smaller military platforms, ultimately contributing to the company's growth and success in the defense sector. (Source: BAE Systems, Press Release, August 2020)

Synthetic Aperture Radar Market Report Coverage and Deliverables

The “Synthetic Aperture Radar Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Synthetic aperture radar market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Synthetic aperture radar market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Synthetic aperture radar market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the synthetic aperture radar market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For