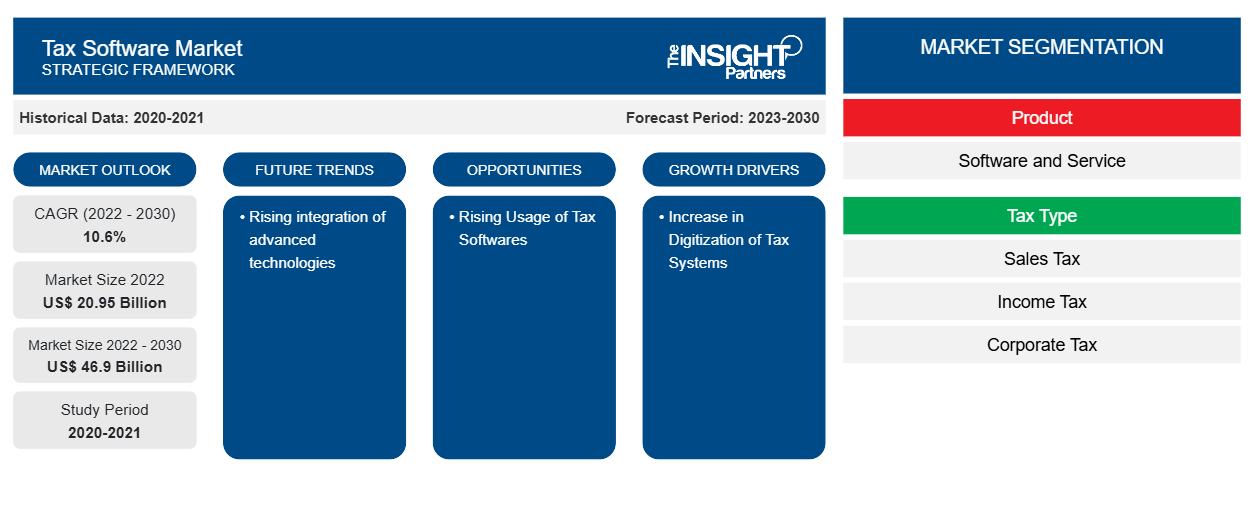

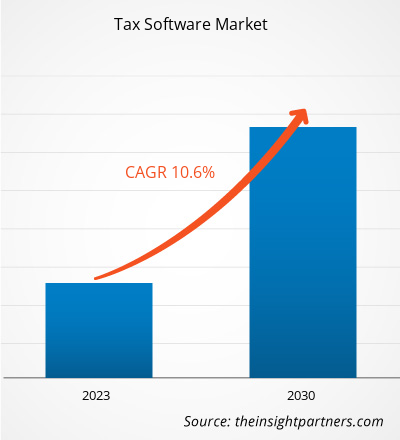

The tax software market size was valued at US$ 20.95 billion in 2022 and is expected to reach US$ 46.90 billion by 2030. The tax software market is estimated to record a CAGR of 10.6% from 2022 to 2030. The rising integration of advanced technologies is likely to remain a key trend in the market.

Tax Software Market Analysis

The key players operating in the tax software market are launching software and services to save their customers' taxes. They are enabled with automation to simplify the sales tax for businesses of all sizes. For instance, in August 2023, Stripe, a financial infrastructure platform for businesses, launched Stripe Tax for platforms, enabling platforms using Stripe Connect to offer Stripe Tax as a service to their customers. Stripe Tax because it’s a logical extension of payment processing, and Stripe has built Tax for platforms so platforms can offer it to their customers and help them with all aspects of the transaction lifecycle. Such product launches are helping to boost the adoption of tax software services globally. In May 2023, the intelligent sales tax solution CereTax, Inc. released a new user interface to simplify the sales tax automation process. Users can manage and automate their sales tax operations, including tax computation, rigorous rules, and in-depth reporting, using the new site, a component of CereTax's cloud-based tax automation platform. All sizes of businesses may function effectively and without hindrance because of the interface's simplicity and usability. Such product launches are helping to boost the adoption of tax software solutions globally.

Tax Software Market Overview

The tax software platform can be an excellent resource for many taxpayers filing their tax returns. It is designed to make the tax preparation process more efficient and help the average taxpayer understand the various nuances of tax law. The primary purpose of tax software is to automate the tax return filing process. The tax software has various features, including e-filing, a method that is more secure and reduces errors and processing time. Many tax software programs will store tax returns in the cloud for several years so businesses can access them easily during tax filing.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Tax Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Tax Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Tax Software Market Drivers and Opportunities

Increase in Digitization of Tax Systems to Favor Market

The ongoing digital revolution presents enormous scope for businesses—digital services and automation help to modify business models and traditional processes for improving operational efficiencies and revenues. Digital transformation or automation in businesses is characterized by the integration of digital technology in various business processes, organizational activities, and business models. The digitalization of tax systems aids in enhanced operational efficiencies, end-to-end business process optimization, and cost and human error reduction.

Rising Usage of Tax Software

The tax software market has grown strongly in the past few years, and one major driving factor for this has to be digitalization in tax software systems. Owing to advanced technologies and increasing demand from businesses for streamlined and effective tax processes, the demand for digital solutions has been spiraling upward to make all activities related to taxes easier. Digitization of any tax software system has a lot of benefits associated with it for businesses of all scales and any person. One of the major advantages is the automation of all tasks related to taxation. This reduces manual effort and hence reduces the possibility of errors to a minimum. Through tax software, data entry, tax calculations, and reporting can be automated, ensuring accuracy and compliance with tax laws.

Tax Software Market Report Segmentation Analysis

Key segments that contributed to the derivation of the tax software market analysis are product, deployment type, tax type, enterprise size, vertical, and end user.

- Based on components, the global tax software market is segmented into software and service. The software segment dominated the market in 2022.

- Based on tax type, the tax software market is bifurcated into sales tax, income tax, corporate tax, and others. The sales tax segment dominated the market in 2022.

- Based on end users' type, the tax software market is bifurcated into individual and commercial. The commercial segment dominated the market in 2022.

- Based on enterprise size, the market is segmented into small, medium, and large enterprises. The large enterprise segment dominated the market in 2022.

- Based on vertical, the commercial enterprises market is bifurcated into BFSI, government, IT & telecom, healthcare, retail, and others. The BFSI segment dominated the market in 2022.

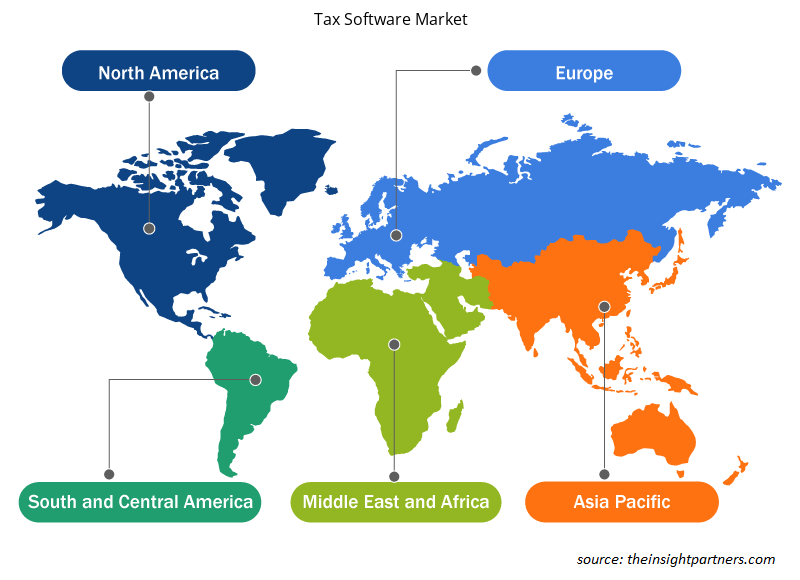

Tax Software Market Share Analysis by Geography

The geographic scope of the tax software market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America dominated the market in 2022. The region has a mature market when it comes to the adoption of software solutions. For example, according to Employbl Inc., in August 2023, there were over 6,727 software companies across the US. A vast presence of tax software providers, such as Avalara, Sage Group Plc, Thomson Reuters Corp, and Xero Ltd, provide advanced tax software solutions to individuals and businesses to offer them efficient and errorless tax filing processes. Thus, the presence of several leading tax software providers is positively influencing the tax software market growth in North America. Short-workforce businesses are focused on adopting technologies to improve their operations and workflow rather than hiring skilled labor. They are learning to adopt artificial intelligence (AI) solutions. Thus, the growing awareness and popularity of AI solutions among individuals and professionals regarding the benefits of AI fuels the adoption of AI-based tax software solutions.

Tax Software Market Regional Insights

The regional trends and factors influencing the Tax Software Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Tax Software Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Tax Software Market

Tax Software Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 20.95 Billion |

| Market Size by 2030 | US$ 46.9 Billion |

| Global CAGR (2022 - 2030) | 10.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Tax Software Market Players Density: Understanding Its Impact on Business Dynamics

The Tax Software Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Tax Software Market are:

- Sage Group Plc

- Thomson Reuters Corp

- Xero Ltd

- IRIS Software Group Ltd

- Wolters Kluwer NV

- Intuit Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Tax Software Market top key players overview

Tax Software Market News and Recent Developments

The Tax Software market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Tax Software market are listed below:

- Right Networks, a firm that offers intelligent cloud purpose-built for accounting firms and professionals, partnered with Thomson Reuters, a global content and technology company, to offer cloud hosting of its tax and accounting solutions in the US. (Source: Right Networks, Press Release, August 2023)

- Thomson Reuters announced its plans to invest US$ 100 million per year in artificial intelligence (AI) starting next year, with plans to integrate technology in its tax research and tax preparation systems as well as other areas. (Source: Thomson Reuters, Press Release, July 2023)

Tax Software Market Report Coverage and Deliverables

The “Tax Software Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Tax Software market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Tax Software market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Tax Software market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the superconductor market

- Detailed company profiles

Frequently Asked Questions

What would be the estimated value of the tax software market by 2030?

The estimated value of the tax software market is expected to reach US$ 46.9 billion by 2030.

What is the expected CAGR of the tax software market?

The market is expected to grow at a CAGR of 10.6% over the forecast period.

Which are the leading players operating in the tax software market?

Sage Group Plc, Thomson Reuters Corp, Xero Ltd, IRIS Software Group Ltd, Wolters and Kluwer NV are among the leading players in the tax software market.

What are the future trends of the tax software market?

The rising integration of advanced technologies is likely to remain a key trend in the market.

What are the driving factors impacting the tax software market?

The tax software market has grown strongly in the past few years, and one major driving factor for this has to be digitalization in tax software systems. Owing to advanced technologies and increasing demand from businesses for streamlined and effective tax processes, the demand for digital solutions has been spiraling upward to make all activities related to taxes easier.

Which region dominated the tax software market in 2022?

North America dominated the tax software market in 2022.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Parking Meter Apps Market

- eSIM Market

- Advanced Distributed Management System Market

- Online Exam Proctoring Market

- Electronic Data Interchange Market

- Barcode Software Market

- Maritime Analytics Market

- Cloud Manufacturing Execution System (MES) Market

- Robotic Process Automation Market

- Digital Signature Market

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Tax Software Market

- Sage Group Plc

- Thomson Reuters Corp

- Xero Ltd

- IRIS Software Group Ltd

- Wolters Kluwer NV

- Intuit Inc

- HRB Digital LLC

- Wealthsimple Technologies Inc

- SAP SE

- CloudTax Inc

Get Free Sample For

Get Free Sample For