Testing, Inspection and Certification Market Share and Forecast by 2027

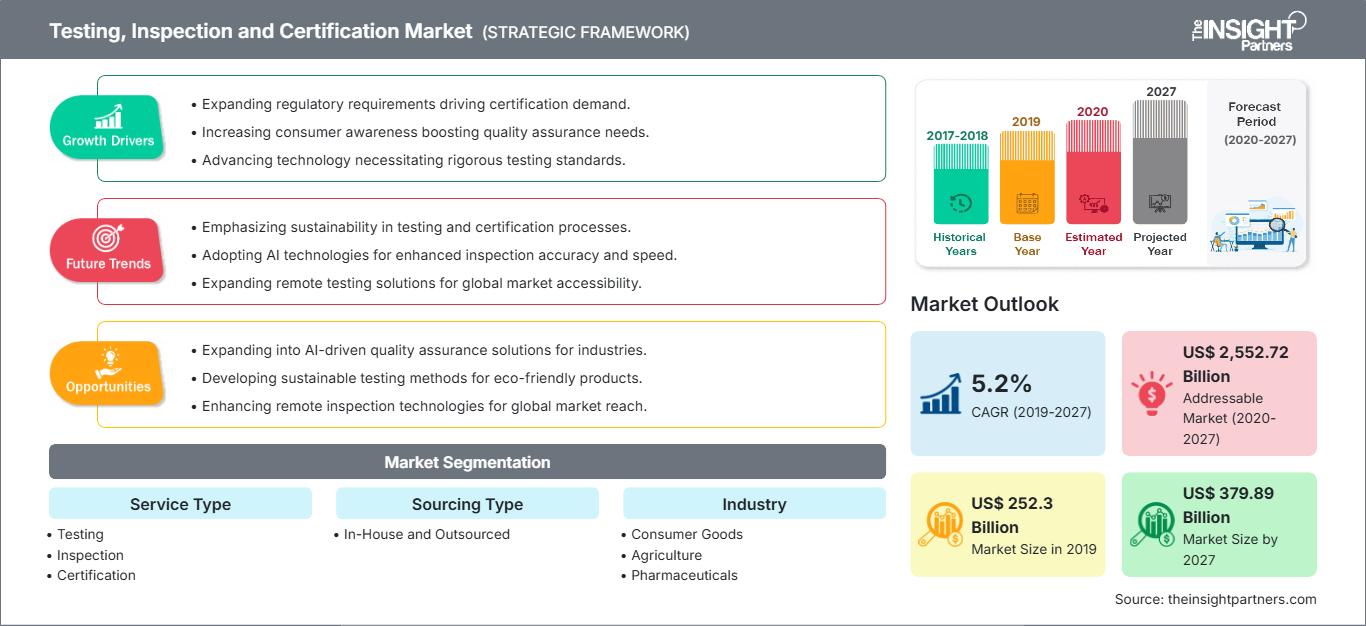

Testing, Inspection and Certification Market Size and Forecasts (2019 - 2027), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Service Type (Testing, Inspection, Certification); by Sourcing Type (In-House and Outsourced); by Industry (Consumer Goods, Agriculture, Pharmaceuticals, Chemical, Oil and Gas, Others), and by Geography (North America, Europe, Asia Pacific, and South and Central America)

Historic Data: 2017-2018 | Base Year: 2019 | Forecast Period: 2020-2027- Report Date : Jun 2019

- Report Code : TIPRE00004293

- Category : Technology, Media and Telecommunications

- Status : Published

- Available Report Formats :

- No. of Pages : 150

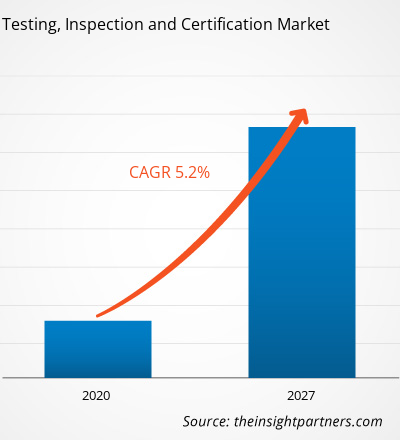

[Research Report] The Testing, Inspection and Certification market is estimated to grow from US$ 252.30 billion in 2019 to US$ 379.89 billion by 2027; it is projected to grow at a CAGR of 5.2% from 2019 to 2027.

Analyst Perspective:

The Testing, Inspection and Certification market has grown significantly. Factors including the increasing demand from businesses and organizations to ensure secure and effective Testing, Inspection and Certification processes drive the growth of the Testing, Inspection and Certification market.

Market Overview:

Testing, Inspection and Certification (TIC) services encompass various offerings, including auditing, inspection, testing, verification, quality assurance, and certification for different products and equipment. These services enhance production efficiency and mitigate risks by minimizing errors. TIC services find applications across multiple sectors, such as oil and gas, food, pharmaceuticals, and chemical industries. Testing is a systematic approach to evaluating a product or service against established standards. It involves a series of inspections to determine if the item meets the required criteria. These inspections cover various aspects such as performance, reliability, durability, and safety. Inspection, on the other hand, is the careful examination of goods, processes, or services to ensure compliance with rules and guidelines. This stage ensures that the product or service meets the set quality standards. Inspections can occur at various stages of the production process, from raw materials to the final product. Independent third-party organizations often conduct certification procedures. Customers and stakeholders trust certified products or services due to their reliability, safety, and quality. Certifications cover various topics, including product performance requirements, worker health and safety, and environmental sustainability.

The rising demand from businesses for reliable and efficient Testing, Inspection and Certification (TIC) practices drives the growth of the Testing, Inspection and Certification market. Implementing secure and effective testing and inspection procedures allows companies to uphold the highest quality standards, ensuring enhanced productivity and efficiency. Leveraging TIC practices, businesses can tailor their supply chain operations to meet their specific requirements, streamlining their overall business processes.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONTesting, Inspection and Certification Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Increasing Urbanization and Construction Industry to Drive Growth of The Testing, Inspection and Certification Market

The increasing urbanization and construction industry are significant factors driving the growth of Testing, Inspection and Certification. As urban populations grow, there is a higher demand for new construction projects, including housing, commercial buildings, and infrastructure. This demand leads to increased construction activities, which drives the need for Testing, Inspection and Certification services to ensure compliance with quality and safety standards.

Moreover, the construction industry is crucial in aiding rapid urbanization by providing the necessary infrastructure. Expanding urban and suburban areas requires more homes and structures, fueling the demand for construction services. As a result, businesses in the construction industry need to engage in TIC practices to ensure the quality, safety, and compliance of their projects.

Segmentation and Scope:

The "Testing, Inspection and Certification Market" is segmented based on service type, sourcing type, industry, and geography. Based on the service type, the Testing, Inspection and Certification market is segmented by Testing, Inspection and Certification. The Testing, Inspection and Certification market is segmented into in-house and outsourced based on the sourcing type. Based on industry, the Testing, Inspection and Certification market is segmented into consumer goods, agriculture, pharmaceuticals, chemicals, oil and gas, and others. The Testing, Inspection and Certification market is segmented based on geography into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Segmental Analysis:

The Testing, Inspection and Certification market is segmented into in-house and outsourced based on sourcing type. The in-house segment holds a significant market share in the Testing, Inspection and Certification market. Implementing in-house testing and inspection methods allows companies to effectively carry out practical TIC (Testing, Inspection and Certification) activities. This is made possible by having on-site resources and the ability to recruit skilled personnel and establish customized practices tailored to the company's specific needs and preferences. Additionally, deploying in-house TIC teams provides enhanced control and a more comprehensive understanding of business operations, offering organizational advantages. Conducting testing and inspection in-house allows companies to have greater control over the process and ensures that it aligns with their specific requirements and standards. The availability of advanced testing and inspection technologies has made it more feasible for companies to conduct these activities in-house, leading to increased adoption.

Regional Analysis:

The European region in the Testing, Inspection and Certification market is poised to experience significant growth in the foreseeable future. This growth is attributed to the robust automotive industries in Germany and France, which necessitate efficient testing and inspection systems within their respective companies. Moreover, numerous fashion brands, consumer goods manufacturers, and retail corporations in countries like Italy and the U.K. further contribute to the expansion and development of the region's Testing, Inspection and Certification market.

In July 2022, UL LLC, a global leader in safety certification services, announced its acquisition of Method Park. Method Park, a German company specializing in software solutions, process engineering, training, and advisory services for automotive, aerospace, and medical industries, has now become part of UL LLC. This strategic acquisition strengthens UL LLC's capabilities in assisting customers in driving innovation, implementing adequate safety measures, and ensuring compliance with regulatory standards, thereby supporting their business transformation endeavors.

Key Player Analysis:

The Testing, Inspection and Certification market analysis consists of players such as SGS S.A., Bureau Veritas, Intertek Group plc, Eurofins Scientific, DEKRA SE, TÜV SÜD, DNV GL, TÜV RHEINLAND, Applus+, and ALS, are among the vital Testing, Inspection and Certification market players profiled in the report.

Testing, Inspection and Certification Market Regional InsightsThe regional trends and factors influencing the Testing, Inspection and Certification Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Testing, Inspection and Certification Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Testing, Inspection and Certification Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 252.3 Billion |

| Market Size by 2027 | US$ 379.89 Billion |

| Global CAGR (2019 - 2027) | 5.2% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Service Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Testing, Inspection and Certification Market Players Density: Understanding Its Impact on Business Dynamics

The Testing, Inspection and Certification Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Testing, Inspection and Certification Market top key players overview

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions, new product launches, expansion, and diversification are highly adopted by companies in the Testing, Inspection and Certification market. A few recent key developments in the Testing, Inspection and Certification market are listed below:

- In August 2023, SGS announced the expansion of its Textile Exchange product certification services into the Indian market. This expansion aims to provide comprehensive certification solutions for manufacturers, retailers, and buyers in the textile and footwear industry. The expanded services now include certifications for recycled content (RCS) and organic content (OCS), as well as responsible sourcing of down (RDS) and animal fibers (RAF). With strategically positioned laboratories throughout India, SGS is now well-equipped to assist organizations in effectively meeting their sustainable sourcing objectives.

- In April 2023, Intertek acquired Controle Analítico, a prominent Brazilian environmental testing company with expertise in water analysis. This strategic acquisition allows Intertek to enhance its environmental testing capabilities in Brazil, complementing its current food and agri-business services portfolio. The integration of Controle Analítico aligns with Intertek's unwavering dedication to delivering exceptional quality, safety, and sustainability solutions to its clients.

- In December 2023, ALS completed the acquisition of the ExplorTech Division of Earthlabs Inc., previously known as GoldSpot Discoveries Corp. This strategic acquisition bolsters ALS's presence in the environmental testing and consulting sector. The addition of ExplorTech's specialized knowledge in geochemistry, metallurgy, and ecological analysis aligns seamlessly with ALS's existing capabilities. Integrating these resources is anticipated to strengthen ALS's capacity to deliver comprehensive services to clients in various industries, including mining, energy, and environmental management. This acquisition further solidifies ALS's commitment to providing exceptional solutions and expertise to meet the evolving needs of its clientele.

- In February 2022, Applus+, a multinational firm specializing in Testing, Inspection and Certification, revealed its acquisition of Lightship Security, Inc., a renowned provider of product certification services in North America. This strategic move aligns with Applus+ Laboratories' mission to enhance its expertise in crucial technologies and capabilities. By integrating Lightship Security, Applus+ aims to support clients in better navigating the global technological transformation driven by energy transition, electrification, and connectivity. This acquisition strengthens Applus+'s position as a leading player in the industry and enables them to provide comprehensive solutions to meet the evolving needs of their clients.

- In August 2023, ALS Limited, one of the global leaders in Testing, Inspection and Certification, announced the acquisition of the Proanaliz Group of Laboratories, a food testing group based in Antalye, Türkiye. The group’s strong technical team and excellent reputation help make it the country’s market leader in pesticide testing. With satellite labs strategically located in the municipalities of Kumluca, Alasehir, Demre, and Fethiye, the group’s proximity to Turkish agricultural producers has enabled it to provide clients with exceptional turnaround times of hours rather than days.

- In June 2023, Applus+, a global leader in the Testing, Inspection and Certification (TIC) sector, announced the acquisition of the entire share capital of Rescoll, a leading material testing and R&D technological partner based in France.

- In May 2022, Bureau Veritas, a world leader in Testing, Inspection and Certification (TIC) services, announced the opening of its third U.S. microbiology laboratory in Reno, Nevada. The new laboratory offers rapid pathogen testing as well as microbiology indicator analyses to ensure the safety of food and agriculture commodities.

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For