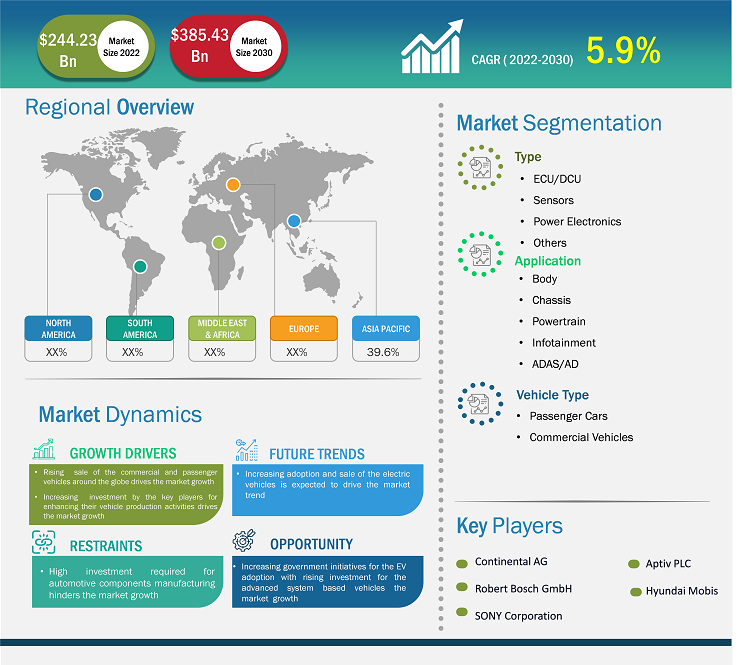

[Research Report] The automotive electronics market is expected to grow from US$ 244.23 billion in 2022 to US$ 385.43 billion by 2031; it is estimated to grow at a CAGR of 5.9% from 2022 to 2031.

Analyst Perspective:

The automotive electronics market has witnessed significant growth in recent years, driven by rising sales of passenger cars and commercial vehicles with increased demand for convenience and driving comfort. Manufacturers are focused on improving fuel efficiency, driving performance, and rider and driver’s comfort. The rising necessity to enhance everything from fuel efficiency to driver safety is causing the increased demand for the number of electronic components to grow with time. As a result, more mechanical systems are being replaced with electrical and electronic ones in mechanisms. Significantly, high-tech automobiles have evolved into auto electronic engines with computer-controlled systems during the forecast period. A contemporary automobile has approximately hundreds of electronic systems. The development of vehicle electronics technology has elevated the simple act of driving to a luxurious, comfortable experience. Embedded systems are now widely used in the manufacturing of automobiles. The rising development of advanced technologies such as machine learning, IoT and artificial intelligence (AI) in automobiles is expected to create lucrative opportunities for market growth. Vehicles are equipped with automated driving assistance. With increasing demand for in-vehicle safety features, automotive infotainment system drives the global automotive electronics market growth.

Furthermore, the rising demand for advanced analog power conversion devices in vehicles driven by the rise in sales and production of hybrid and all-electric vehicles drives the market growth. With increased vehicle production, the global automotive electronics market will continue to expand steadily. According to the European Automobiles Association, in 2022, more than 85.4 million vehicles were manufactured globally, an increase of 5.7% compared to the previous year, 2021. There are many applications of automotive electronic systems, such as car parking systems, remote keyless entry, security and personal infotainment systems, GPS location systems, and e-call functionality. This application requires automotive electronics systems to provide additional features to the vehicles.

Market Overview:

Automotive electronics are the electronic components used in the production of vehicles, including from the engine management to the external automotive infotainment systems. These automotive electronics components include ignition systems, audio-radio systems, automotive telematics, entertainment systems, automotive dashboards, and others.

Automotive electronics includes several components, including transistors, diodes, resistors, capacitors, and other common electrical components such as switches and lighting. Individual cables or printed circuit boards are used to link each of these parts. Automotive electronic systems also include specialized parts known as sensors or actuators that allow the electronic system to communicate with the relevant vehicle mechanical systems.

Strategic Insights

Market Driver:

Increased Demand for Autonomous and Comfortable Driving with Increasing Automotive Production to Drive Growth of Automotive Electronics Market

Rising sales and the production of passenger cars and light commercial vehicles around the globe, with increased disposable income of the people, drive the market growth. According to the European Associations for Automotive Manufacturing, global vehicle production reached around 85.4 million in 2022, increased by 5.7% compared to 2021. Increased demand for automotive electronics and software drives the market growth during the forecast period. In automotive electronics, domain control unit (DCU) and electronic control unit segments are expected to have the largest share in 2022, and electronic control unit (ECU) sales are increasing at the highest CAGR during the forecast period. Also, the automotive sensors requirement in the overall automotive electronics industry is growing at a rapid pace with increased demand for AD/ADAS sensors.

Changes in consumer preferences, laws that prioritize safety and permit higher levels of autonomous driving, and technological advancements like the availability of high-performance computers, sophisticated software, or light detection and ranging (LiDAR) sensors will all accelerate the adoption of driver assistance systems and AD. For instance, by 2031, the demand for Level 2 advanced driver assistance systems (ADAS) is expected to show an annual growth of up to 30%, partly owing to rules requiring these sensors in all new vehicles. The German automaker, which had previously made a costly bet on Ford's now closed self-driving car unit, Argo, has been partnering with supplier Mobileye in a strategic shift.

Further, the global automotive electronics market growth is driven by rising demand for connected vehicles with additional features such as location-based GPS services, in-car payments, and infotainment systems. The market is driven by increasingly stringent rules and regulations to automate the fuel efficiency of vehicles, with increased EV sales and increasing premium features-based vehicles. The rapid adoption of green transportation, such as electric and hybrid vehicles, drives the global automotive electronics market growth. These electric vehicles consist of advanced electronic systems to achieve maximum reliability and efficiency, which is expected to create ample opportunity for the automotive electronics market growth.

Further, the rising development of autonomous cars with self-driving features is expected to create ample opportunity in the upcoming future. In July 2023, Volkswagen planned to launch self-driving autonomous vehicles for goods delivery and ride-hailing services in Austin, Texas, US, by 2031.

Segmental Analysis:

Based on type, the market is segmented into ECU/DCU, sensors, power electronics, and others. The ECU/DCU segment held the largest share of the market in 2022. In contrast, the power electronics segment is anticipated to register the highest CAGR in the market during the forecast period. ECU/DCU has emerged as the dominant share in the automotive electronics market, owing to rising demand for connected cars. According to the International Energy Agency (IEA), the sales of connected cars increased by 12% in 2022. The US and Europe remained the dominant market share for connected cars, followed by Japan and South Korea.

Further, rising consumers' preference for additional features-based vehicles such as enhanced GPS & navigation systems, in-vehicle infotainment systems, predictive maintenance, and over-the-air capabilities are driving the ECU/DCU segmental growth. All of such features are provided in the connected cars. ECU/DCU is used to automate the vehicles using various sensors and electronics capabilities.

Regional Analysis:

The Asia Pacific automotive electronics market, is expected to dominate the global automotive electronics market owing to the presence of several automotive component manufacturers and increasing sales of EVs and hybrid vehicles. Electric car sale has seen exponential growth in recent years, with sale surpassing more than 10 million in 2022 and is expected to reach 14 million by 2031. With total vehicle sales, around 14% of the automotives sold are electric. In Asia Pacific, China dominated global sales of the electric vehicles market. China accounted for more than 60% of the world’s electric car sales. China accounts for more than half of the world’s electric cars on roads, and the country exceeded its sales target for energy-efficient vehicle sales.

Further, Europe is growing at a rapid pace with increasing sales of EVs and hybrid vehicles. Electric car sales in Europe increased by more than 15% in 2022. Also, in Europe, one in every five cars being sold were electric in 2022.

The rising advancement in the electronic component in the automotive industry across the Indian and Chinese markets has strengthened the market growth. China and India are increasing the popularity of advanced vehicles at a rapid pace owing to an increase in vehicle sales and rising demand for premium vehicles. Asia Pacific OEMs and suppliers have a lucrative opportunity to utilize advanced electronics owing to rising sales and urbanization with growth in population.

Further, North American countries such as the US and Canada are growing at a rapid pace with rising adoption of autonomous vehicles, EVs and connected car sales. Electric car sales in the US show growth of 55% in 2022 compared to 2021. Such rising sale of EVs is expected to create ample opportunity for the autonomous electronics market growth during the forecast period.

North America comprises several leading automotive brand manufacturers, including General Motors Co., Ford Motor Co., PACCAR Inc., Tesla Inc., Navistar International Corp, Rivian Automotive Inc., and BMW AG. These leading players require several automotive components to manufacture commercial and passenger vehicles. In North America, the government supports increasing the local production of automobiles and their parts. Hence, the United States government has imposed several favorable policies in support of manufacturing automotive components in North America.

Key players operating in Canada are making substantial investments to increase in-house production of the vehicles. For instance, between 2021 and 2022, Canadian subsidiaries of U.S. automotive manufacturers have made substantial investments in Canada. In 2021, General Motors invested more than US$ 785 million, Ford Motors invested US$1.5 billion, and Stellantis invested US$ 1.14 billion to expand their production facilities. Such an increase in production activities with significant investment is expected to drive the global automotive electronics market growth.

Key Player Analysis:

The automotive electronics market analysis consists of the players such as Continental AG, Robert Bosch GmbH, SONY Corporation, Aptiv PLC, Hyundai Mobis, ZF Friedrichshafen AG, Autoliv Inc., Magna International Inc., Aisin Seiki Co. Ltd, Philips N.V. and Among the players in the automotive electronics market.

Recent Developments:

The strategies adopted by these players include mergers and acquisitions, new product launches, and mergers and acquisitions. Some of the key strategies adopted by the market players are listed below:

- In January 2023- HARMAN International Industries, incorporated a subsidiary of the Samsung Electronics Ltd. Automotive infotainment manufacturer, launched advanced electronics products for the vehicles. The company showcased its product offering at the CES event held in 2023. HARMAN showcased several product lines, including Ready Display, Ready Care, Ready on Demand, Ready Vision, Ready Upgrade, Sound & Vibration Sensor and External Microphones for the automotive.

- In December 2019, Renesas Electronics Corporation, a supplier of advanced semiconductors, launched two advanced microcontrollers (MCUs) for automotive electronics. These MCUs were used in the automotive sensor and actuator applications supporting the next-generation automotive electronic and electrical systems.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Have a question?

Naveen

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Application, Vehicle Type

Regional Scope

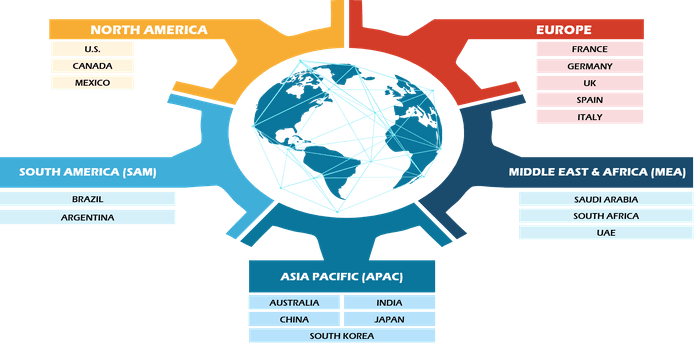

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

TABLE OF CONTENTS

1. INTRODUCTION

1.1. SCOPE OF THE STUDY

1.2. THE INSIGHT PARTNERS RESEARCH REPORT GUIDANCE

1.3. MARKET SEGMENTATION

1.3.1 Automotive Electronics Market - By Vehicle Type

1.3.2 Automotive Electronics Market - By Sales Channel

1.3.3 Automotive Electronics Market - By Application

1.3.4 Automotive Electronics Market - By Region

1.3.4.1 By Country

2. KEY TAKEAWAYS

3. RESEARCH METHODOLOGY

4. AUTOMOTIVE ELECTRONICS MARKET LANDSCAPE

4.1. OVERVIEW

4.2. PORTER'S FIVE FORCES ANALYSIS

4.2.1 Bargaining Power of Buyers

4.2.1 Bargaining Power of Suppliers

4.2.1 Threat of Substitute

4.2.1 Threat of New Entrants

4.2.1 Competitive Rivalry

4.3. ECOSYSTEM ANALYSIS

4.4. EXPERT OPINIONS

5. AUTOMOTIVE ELECTRONICS MARKET - KEY MARKET DYNAMICS

5.1. KEY MARKET DRIVERS

5.2. KEY MARKET RESTRAINTS

5.3. KEY MARKET OPPORTUNITIES

5.4. FUTURE TRENDS

5.5. IMPACT ANALYSIS OF DRIVERS AND RESTRAINTS

6. AUTOMOTIVE ELECTRONICS MARKET - GLOBAL MARKET ANALYSIS

6.1. AUTOMOTIVE ELECTRONICS - GLOBAL MARKET OVERVIEW

6.2. AUTOMOTIVE ELECTRONICS - GLOBAL MARKET AND FORECAST TO 2028

6.3. MARKET POSITIONING/MARKET SHARE

7. AUTOMOTIVE ELECTRONICS MARKET - REVENUE AND FORECASTS TO 2028 - VEHICLE TYPE

7.1. OVERVIEW

7.2. VEHICLE TYPE MARKET FORECASTS AND ANALYSIS

7.3. PASSENGER CARS

7.3.1. Overview

7.3.2. Passenger cars Market Forecast and Analysis

7.4. LIGHT COMMERCIAL VEHICLES

7.4.1. Overview

7.4.2. Light Commercial Vehicles Market Forecast and Analysis

7.5. HEAVY COMMERCIAL VEHICLES

7.5.1. Overview

7.5.2. Heavy Commercial Vehicles Market Forecast and Analysis

8. AUTOMOTIVE ELECTRONICS MARKET - REVENUE AND FORECASTS TO 2028 - SALES CHANNEL

8.1. OVERVIEW

8.2. SALES CHANNEL MARKET FORECASTS AND ANALYSIS

8.3. OEM

8.3.1. Overview

8.3.2. OEM Market Forecast and Analysis

8.4. AFTERMARKET

8.4.1. Overview

8.4.2. Aftermarket Market Forecast and Analysis

9. AUTOMOTIVE ELECTRONICS MARKET - REVENUE AND FORECASTS TO 2028 - APPLICATION

9.1. OVERVIEW

9.2. APPLICATION MARKET FORECASTS AND ANALYSIS

9.3. ADVANCED DRIVER ASSISTANCE SYSTEMS

9.3.1. Overview

9.3.2. Advanced Driver Assistance Systems Market Forecast and Analysis

9.4. BODY ELECTRONICS

9.4.1. Overview

9.4.2. Body Electronics Market Forecast and Analysis

9.5. ENTERTAINMENT

9.5.1. Overview

9.5.2. Entertainment Market Forecast and Analysis

9.6. POWERTRAIN

9.6.1. Overview

9.6.2. Powertrain Market Forecast and Analysis

9.7. SAFETY SYSTEMS

9.7.1. Overview

9.7.2. Safety Systems Market Forecast and Analysis

10. AUTOMOTIVE ELECTRONICS MARKET REVENUE AND FORECASTS TO 2028 - GEOGRAPHICAL ANALYSIS

10.1. NORTH AMERICA

10.1.1 North America Automotive Electronics Market Overview

10.1.2 North America Automotive Electronics Market Forecasts and Analysis

10.1.3 North America Automotive Electronics Market Forecasts and Analysis - By Vehicle Type

10.1.4 North America Automotive Electronics Market Forecasts and Analysis - By Sales Channel

10.1.5 North America Automotive Electronics Market Forecasts and Analysis - By Application

10.1.6 North America Automotive Electronics Market Forecasts and Analysis - By Countries

10.1.6.1 United States Automotive Electronics Market

10.1.6.1.1 United States Automotive Electronics Market by Vehicle Type

10.1.6.1.2 United States Automotive Electronics Market by Sales Channel

10.1.6.1.3 United States Automotive Electronics Market by Application

10.1.6.2 Canada Automotive Electronics Market

10.1.6.2.1 Canada Automotive Electronics Market by Vehicle Type

10.1.6.2.2 Canada Automotive Electronics Market by Sales Channel

10.1.6.2.3 Canada Automotive Electronics Market by Application

10.1.6.3 Mexico Automotive Electronics Market

10.1.6.3.1 Mexico Automotive Electronics Market by Vehicle Type

10.1.6.3.2 Mexico Automotive Electronics Market by Sales Channel

10.1.6.3.3 Mexico Automotive Electronics Market by Application

10.2. EUROPE

10.2.1 Europe Automotive Electronics Market Overview

10.2.2 Europe Automotive Electronics Market Forecasts and Analysis

10.2.3 Europe Automotive Electronics Market Forecasts and Analysis - By Vehicle Type

10.2.4 Europe Automotive Electronics Market Forecasts and Analysis - By Sales Channel

10.2.5 Europe Automotive Electronics Market Forecasts and Analysis - By Application

10.2.6 Europe Automotive Electronics Market Forecasts and Analysis - By Countries

10.2.6.1 Germany Automotive Electronics Market

10.2.6.1.1 Germany Automotive Electronics Market by Vehicle Type

10.2.6.1.2 Germany Automotive Electronics Market by Sales Channel

10.2.6.1.3 Germany Automotive Electronics Market by Application

10.2.6.2 France Automotive Electronics Market

10.2.6.2.1 France Automotive Electronics Market by Vehicle Type

10.2.6.2.2 France Automotive Electronics Market by Sales Channel

10.2.6.2.3 France Automotive Electronics Market by Application

10.2.6.3 Italy Automotive Electronics Market

10.2.6.3.1 Italy Automotive Electronics Market by Vehicle Type

10.2.6.3.2 Italy Automotive Electronics Market by Sales Channel

10.2.6.3.3 Italy Automotive Electronics Market by Application

10.2.6.4 United Kingdom Automotive Electronics Market

10.2.6.4.1 United Kingdom Automotive Electronics Market by Vehicle Type

10.2.6.4.2 United Kingdom Automotive Electronics Market by Sales Channel

10.2.6.4.3 United Kingdom Automotive Electronics Market by Application

10.2.6.5 Russia Automotive Electronics Market

10.2.6.5.1 Russia Automotive Electronics Market by Vehicle Type

10.2.6.5.2 Russia Automotive Electronics Market by Sales Channel

10.2.6.5.3 Russia Automotive Electronics Market by Application

10.2.6.6 Rest of Europe Automotive Electronics Market

10.2.6.6.1 Rest of Europe Automotive Electronics Market by Vehicle Type

10.2.6.6.2 Rest of Europe Automotive Electronics Market by Sales Channel

10.2.6.6.3 Rest of Europe Automotive Electronics Market by Application

10.3. ASIA-PACIFIC

10.3.1 Asia-Pacific Automotive Electronics Market Overview

10.3.2 Asia-Pacific Automotive Electronics Market Forecasts and Analysis

10.3.3 Asia-Pacific Automotive Electronics Market Forecasts and Analysis - By Vehicle Type

10.3.4 Asia-Pacific Automotive Electronics Market Forecasts and Analysis - By Sales Channel

10.3.5 Asia-Pacific Automotive Electronics Market Forecasts and Analysis - By Application

10.3.6 Asia-Pacific Automotive Electronics Market Forecasts and Analysis - By Countries

10.3.6.1 Australia Automotive Electronics Market

10.3.6.1.1 Australia Automotive Electronics Market by Vehicle Type

10.3.6.1.2 Australia Automotive Electronics Market by Sales Channel

10.3.6.1.3 Australia Automotive Electronics Market by Application

10.3.6.2 China Automotive Electronics Market

10.3.6.2.1 China Automotive Electronics Market by Vehicle Type

10.3.6.2.2 China Automotive Electronics Market by Sales Channel

10.3.6.2.3 China Automotive Electronics Market by Application

10.3.6.3 India Automotive Electronics Market

10.3.6.3.1 India Automotive Electronics Market by Vehicle Type

10.3.6.3.2 India Automotive Electronics Market by Sales Channel

10.3.6.3.3 India Automotive Electronics Market by Application

10.3.6.4 Japan Automotive Electronics Market

10.3.6.4.1 Japan Automotive Electronics Market by Vehicle Type

10.3.6.4.2 Japan Automotive Electronics Market by Sales Channel

10.3.6.4.3 Japan Automotive Electronics Market by Application

10.3.6.5 South Korea Automotive Electronics Market

10.3.6.5.1 South Korea Automotive Electronics Market by Vehicle Type

10.3.6.5.2 South Korea Automotive Electronics Market by Sales Channel

10.3.6.5.3 South Korea Automotive Electronics Market by Application

10.3.6.6 Rest of Asia-Pacific Automotive Electronics Market

10.3.6.6.1 Rest of Asia-Pacific Automotive Electronics Market by Vehicle Type

10.3.6.6.2 Rest of Asia-Pacific Automotive Electronics Market by Sales Channel

10.3.6.6.3 Rest of Asia-Pacific Automotive Electronics Market by Application

10.4. MIDDLE EAST AND AFRICA

10.4.1 Middle East and Africa Automotive Electronics Market Overview

10.4.2 Middle East and Africa Automotive Electronics Market Forecasts and Analysis

10.4.3 Middle East and Africa Automotive Electronics Market Forecasts and Analysis - By Vehicle Type

10.4.4 Middle East and Africa Automotive Electronics Market Forecasts and Analysis - By Sales Channel

10.4.5 Middle East and Africa Automotive Electronics Market Forecasts and Analysis - By Application

10.4.6 Middle East and Africa Automotive Electronics Market Forecasts and Analysis - By Countries

10.4.6.1 South Africa Automotive Electronics Market

10.4.6.1.1 South Africa Automotive Electronics Market by Vehicle Type

10.4.6.1.2 South Africa Automotive Electronics Market by Sales Channel

10.4.6.1.3 South Africa Automotive Electronics Market by Application

10.4.6.2 Saudi Arabia Automotive Electronics Market

10.4.6.2.1 Saudi Arabia Automotive Electronics Market by Vehicle Type

10.4.6.2.2 Saudi Arabia Automotive Electronics Market by Sales Channel

10.4.6.2.3 Saudi Arabia Automotive Electronics Market by Application

10.4.6.3 U.A.E Automotive Electronics Market

10.4.6.3.1 U.A.E Automotive Electronics Market by Vehicle Type

10.4.6.3.2 U.A.E Automotive Electronics Market by Sales Channel

10.4.6.3.3 U.A.E Automotive Electronics Market by Application

10.4.6.4 Rest of Middle East and Africa Automotive Electronics Market

10.4.6.4.1 Rest of Middle East and Africa Automotive Electronics Market by Vehicle Type

10.4.6.4.2 Rest of Middle East and Africa Automotive Electronics Market by Sales Channel

10.4.6.4.3 Rest of Middle East and Africa Automotive Electronics Market by Application

10.5. SOUTH AND CENTRAL AMERICA

10.5.1 South and Central America Automotive Electronics Market Overview

10.5.2 South and Central America Automotive Electronics Market Forecasts and Analysis

10.5.3 South and Central America Automotive Electronics Market Forecasts and Analysis - By Vehicle Type

10.5.4 South and Central America Automotive Electronics Market Forecasts and Analysis - By Sales Channel

10.5.5 South and Central America Automotive Electronics Market Forecasts and Analysis - By Application

10.5.6 South and Central America Automotive Electronics Market Forecasts and Analysis - By Countries

10.5.6.1 Brazil Automotive Electronics Market

10.5.6.1.1 Brazil Automotive Electronics Market by Vehicle Type

10.5.6.1.2 Brazil Automotive Electronics Market by Sales Channel

10.5.6.1.3 Brazil Automotive Electronics Market by Application

10.5.6.2 Argentina Automotive Electronics Market

10.5.6.2.1 Argentina Automotive Electronics Market by Vehicle Type

10.5.6.2.2 Argentina Automotive Electronics Market by Sales Channel

10.5.6.2.3 Argentina Automotive Electronics Market by Application

10.5.6.3 Rest of South and Central America Automotive Electronics Market

10.5.6.3.1 Rest of South and Central America Automotive Electronics Market by Vehicle Type

10.5.6.3.2 Rest of South and Central America Automotive Electronics Market by Sales Channel

10.5.6.3.3 Rest of South and Central America Automotive Electronics Market by Application

11. INDUSTRY LANDSCAPE

11.1. MERGERS AND ACQUISITIONS

11.2. AGREEMENTS, COLLABORATIONS AND JOIN VENTURES

11.3. NEW PRODUCT LAUNCHES

11.4. EXPANSIONS AND OTHER STRATEGIC DEVELOPMENTS

12. AUTOMOTIVE ELECTRONICS MARKET, KEY COMPANY PROFILES

12.1. DENSO CORPORATION

12.1.1. Key Facts

12.1.2. Business Description

12.1.3. Products and Services

12.1.4. Financial Overview

12.1.5. SWOT Analysis

12.1.6. Key Developments

12.2. HGM AUTOMOTIVE ELECTRONICS

12.2.1. Key Facts

12.2.2. Business Description

12.2.3. Products and Services

12.2.4. Financial Overview

12.2.5. SWOT Analysis

12.2.6. Key Developments

12.3. HITACHI, LTD.

12.3.1. Key Facts

12.3.2. Business Description

12.3.3. Products and Services

12.3.4. Financial Overview

12.3.5. SWOT Analysis

12.3.6. Key Developments

12.4. INFINEON TECHNOLOGIES AG

12.4.1. Key Facts

12.4.2. Business Description

12.4.3. Products and Services

12.4.4. Financial Overview

12.4.5. SWOT Analysis

12.4.6. Key Developments

12.5. MICROCHIP TECHNOLOGY INC.

12.5.1. Key Facts

12.5.2. Business Description

12.5.3. Products and Services

12.5.4. Financial Overview

12.5.5. SWOT Analysis

12.5.6. Key Developments

12.6. NXP SEMICONDUCTOR

12.6.1. Key Facts

12.6.2. Business Description

12.6.3. Products and Services

12.6.4. Financial Overview

12.6.5. SWOT Analysis

12.6.6. Key Developments

12.7. ROBERT BOSCH GMBH

12.7.1. Key Facts

12.7.2. Business Description

12.7.3. Products and Services

12.7.4. Financial Overview

12.7.5. SWOT Analysis

12.7.6. Key Developments

12.8. SONY INDIA

12.8.1. Key Facts

12.8.2. Business Description

12.8.3. Products and Services

12.8.4. Financial Overview

12.8.5. SWOT Analysis

12.8.6. Key Developments

12.9. TEXAS INSTRUMENTS INCORPORATED

12.9.1. Key Facts

12.9.2. Business Description

12.9.3. Products and Services

12.9.4. Financial Overview

12.9.5. SWOT Analysis

12.9.6. Key Developments

12.10. ZF FRIEDRICHSHAFEN AG

12.10.1. Key Facts

12.10.2. Business Description

12.10.3. Products and Services

12.10.4. Financial Overview

12.10.5. SWOT Analysis

12.10.6. Key Developments

13. APPENDIX

13.1. ABOUT THE INSIGHT PARTNERS

13.2. GLOSSARY OF TERMS

The List of Companies

1. Denso Corporation

2. HGM Automotive Electronics

3. Hitachi, Ltd.

4. Infineon Technologies AG

5. Microchip Technology Inc.

6. NXP Semiconductor

7. Robert Bosch GmbH

8. SONY INDIA

9. Texas Instruments Incorporated

10. ZF Friedrichshafen AG

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Automotive Electronics Market

Apr 2024

Remote Access Solution Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Secure Remote Access-VPN, Identity and Access Management (IAM) Solutions, Multi-Factor Authentication, Single Sign-On (SSO), Endpoint Security, and Others], Mode of Deployment (Cloud and On-Premise), End-Use Industry (IT and Telecommunications, BFSI, Healthcare, Government, Manufacturing, and Others), and Geography

Apr 2024

Hall Effect Teslameter Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Analog Hall Effect Teslameters and Digital Hall Effect Teslameters), End Users (Automotive, Industrial, Healthcare, Aerospace, Laboratory, and Others), and Geography

Apr 2024

Automotive Board to Board Connector Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Pin Headers, Sockets, Floating Connector, and Card Edge Connector), Pin Headers (Stacked Headers and Shrouded Headers), Application (Powertrain Control Systems, Infotainment and Navigation Systems, Advanced Driver Assistance Systems (ADAS), Electric Vehicles (EV) and Hybrid Vehicle Systems, Lighting Control Systems, Autonomous Vehicles, and Others), Pitch (Less Than 1 mm, 1–2 mm, and More Than 2 mm), Number of Pin (2–12 Pin, 13–30 Pin, 31–50 Pin, 51–100 Pin, and 100+ Pin), and Geography

Apr 2024

Radiation Hardened Motor Controller and Motor Drive Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Motor Controller and Motor Drive), Motor Drive (AC Drive, DC Drive, and BLDC), Application (Space Exploration, Military and Defense, Nuclear Power Plants, and Others), and Geography

Apr 2024

Pluggable Optics for Data Center Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Switches, Routers, and Servers), Data Rate (100–400 Gb/s, 400–800 Gb/s, and 800 Gb/s and above), and Geography

Apr 2024

Doors and Windows Automation Market

Size and Forecast (2021–2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Pedestrian Doors, Industrial Doors, and Windows), Component (Sensors and Detectors, Access Control Systems, Control Panels, Motors and Actuators, and Others), Industry Vertical (Commercial, Industrial, and Residential), Control System (Fully Automatic, Semi-Automatic, and Power Assist), and Geography

Apr 2024

Substrate-Like PCB Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Line/Space (25/25 and 30/30 µm and Less than 25/25 µm), Fabrication Process (MSAP and UV LDI), Application (Consumer Electronics, Automotive, Industrial, Medical, and Others), and Geography

Apr 2024

LED Flashlight Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Rechargeable LED Flashlight and Non-Rechargeable LED Flashlight), Product (Everyday Carry Flashlights, Tactical Flashlights, and Safety Flashlights), Application (Residential, Commercial, and Military and Law Enforcement), and Geography

Get Free Sample For

Get Free Sample For