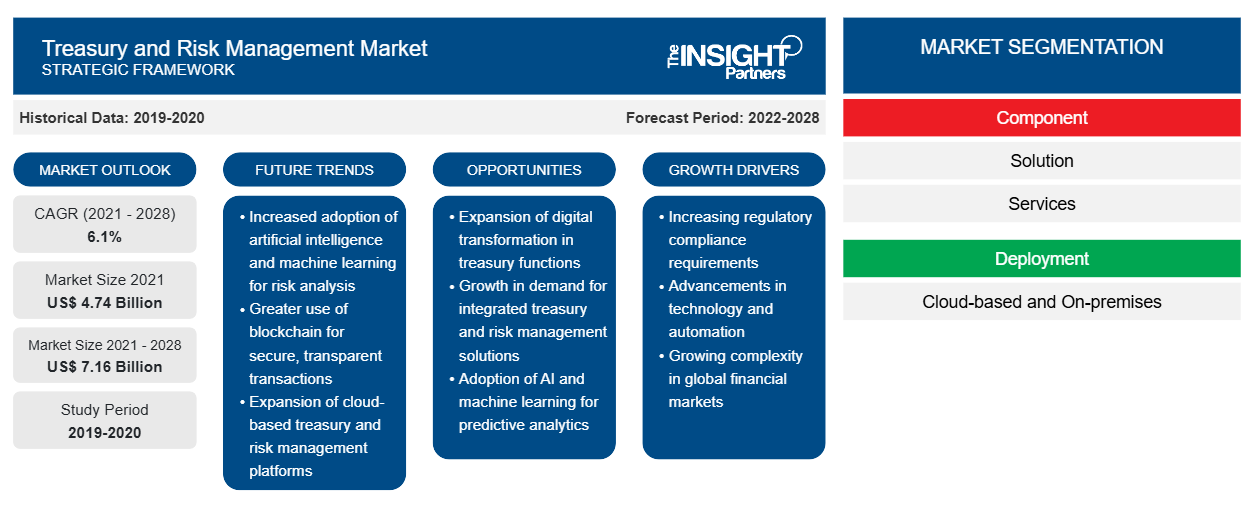

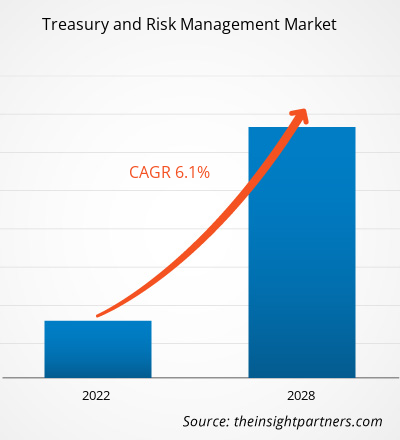

The treasury and risk management market is expected to grow from US$ 4,739.39 million in 2021 to US$ 7,156.90 million by 2028; it is estimated to grow at a CAGR of 6.1% during 2021–2028.

Artificial intelligence (AI) helps the finance industry streamline and optimize different processes, ranging from credit decisions to quantitative analysis in treasury and financial risk management. The AI solutions facilitate more accurate assessments of traditionally underserved borrowers, including millennials, in the credit decision-making process, thus, helping banks and credit lenders make smarter business decisions. Further, AI smoothens and automates the financing process in several banks, investment firms, and wealth management firms. For instance, aixigo AG uses AI-based wealth management solutions for providing digital transformation, private banking, retail banking, robo advisors, and asset management services. The robo advisor software of aixigo AG uses AI to replace human components at the point of sale during the financial investment process. Similarly, Synechron Inc. offers an AI-based solution named Neo for the financial services industry. Neo uniquely combines Synechron’s digital, business, and technology consulting to guide financial institutions through the deployment of AI solutions to overcome complex business challenges. Therefore, the increase in popularity of AI-based assistance in banks, investment firms, and wealth management firms is expected to drive the treasury and risk management market share during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Treasury and Risk Management Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Treasury and Risk Management Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Global Treasury and Risk Management Market

Prior to the COVID-19 pandemic, the demand for treasury and risk management solutions/services was prevalent due to the growing digitalization. For instance, in April 2019, according to the article published by Business Wire, the spending on digital transformation was US$ 1.18 trillion in 2019, an increase of 17.9% over 2018.

As per treasury and risk management market analysis, in 2020, the COVID-19 pandemic remarkably influenced the operations of enterprises and changed some fundamental aspects of businesses. The spread of COVID-19 in 2020 led to global lockdowns in several countries to avert the crisis and minimize the risk of infection. This created a major boom in the adoption of digital technologies to keep enterprises functional during the COVID-19 outbreak. Most enterprises shifted to cloud infrastructure and continued their operations while maintaining lockdown restrictions. Moreover, the COVID-19 pandemic pushed businesses to think of the future of corporate treasury in line with digitization, integrated risk management, and a renewed focus on cost optimization and cash management. Thus, the adoption of treasury and risk management solutions/services witnessed a rise in 2020. Therefore, the overall COVID-19 pandemic impact on the treasury and risk management market was positive in 2020.

As per treasury and risk management market analysis in 2021 and 2022, the relaxation of lockdown measures, adoption of cloud technologies by several businesses, and organizations moving toward automation with technologies such as artificial intelligence (AI) and machine learning for cash management have positively impacted the treasury and risk management market growth. For instance, in May 2021, Refinitiv and IBSFINtech announced a collaboration to launch a new cloud-based automated treasury management solution. The solution named InTReaX would be a management solution for cash & liquidity and currency risk. Thus, the adoption of cloud-based treasury management solutions by several businesses will create multiple opportunities for the market players.

The treasury and risk management market size before the COVID-19 pandemic was US$ 4,337.46 million in 2019. The market size during the pandemic was US$ 4,526.57 million in 2020. Furthermore, in 2021, the market size was US$ 4,739.39 million. Therefore, the overall impact of the COVID-19 pandemic on the market was positive in 2020.

Treasury and Risk Management Market Insights

Increasing Demand for Financial Analytics Services

Organizations use financial analytics tools to gain insights into a few present and future trends to improve their business performance. Financial analytics services offer financial data quality analysis, data layout, client analytics, predictive analytics, principal component analysis, and financial data collection. These analytics require detailed financial and other relevant data to identify patterns. Based on this analysis, enterprises make predictions regarding their customers’ purchases and their employees' tenure period. Thus, financial analytics services help organizations improve profitability, cash flow, and business value. They can use the insights gained through these analytics to improve their revenues and business processes. For instance, Accenture PLC provides the newest data and analytics solutions for financial service providers and assists them in deploying the same. The treasury and risk management report analysis include services for these firms with cost analytics and enterprise performance analytics. With a prime focus on income statements, balance sheets, and cash flow statements, financial analysis is used to evaluate economic trends, set financial policies, formulate long-term business plans, and pinpoint projects or companies for investments. Financial service providers such as investment banks generate and store more data than other businesses, as finance is a transaction-heavy business. Banks use the data to estimate risks to improve the overall profitability. Thus, with multiple benefits in banks and investment firms, the demand for financial analytics services is increasing significantly, thus, boosting the treasury and risk management market growth.

The treasury functions are clear beneficiaries of financial analytics, which provide better insights into customers, competitors, profitability, and processes. Financial analytics can also strengthen the chief financial officer’s (CFO) ability to drive strategic decision-making and investment planning. Thus, creating an analytics-driven organization has also become the top driver of collaboration between the CFO and chief information officer (CIO). Thus, the demand for financial analytics services is growing significantly, driving the treasury and risk management market.

Component-Based Market Insights

Based on component, the treasury and risk management market is bifurcated into solution and services. The solution segment led the market with a larger share in 2020.

Deployment-Based Market Insights

Based on deployment, the treasury and risk management market is bifurcated into cloud-based and on-premises. The cloud-based segment led the market with a larger share in 2020.

Enterprise Size-Based Market Insights

Based on enterprise size, the treasury and risk management market is bifurcated into small & medium-size enterprises and large enterprises. The large enterprises segment led the market with a larger share in 2020.

Application-Based Market Insights

Based on application, the treasury and risk management market is segmented into account management, cash & liquidity management, compliance & risk management, and financial resource management. The cash & liquidity management segment accounted for the largest market share in 2020.

End User-Based Market Insights

Based on end user, the market is segmented into BFSI, IT & telecom, retail & ecommerce, healthcare, manufacturing & automotive, and others. The BFSI segment led the treasury and risk management market with the largest share in 2020.

The players operating in the treasury and risk management market adopt strategies such as mergers, acquisitions, and market initiatives to maintain their positions in the market. A few developments by key players are listed below:

- In July 2021, FIS launched a new series of artificial intelligence (AI)-enabled risk solutions. FIS had announced a new set of products created in collaboration with C3 AI to assist capital markets organizations in better managing regulatory compliance and risk by using the power of their organizational data.

- In November 2020, Nordic challenger bank, Lunar, selected FIS’ cloud-based solution in the treasury and risk management industry with a target to gain support in liquidity optimization, risk management, and expansion. Lunar selected FIS’ private cloud-based Ambit Quantum for simplifying hedge accounting and regulatory compliance. Lunar utilizes FIS SWIFT Service Bureau to connect its treasury and payment operation to banking partners through SWIFT and other industry exchanges and networks.

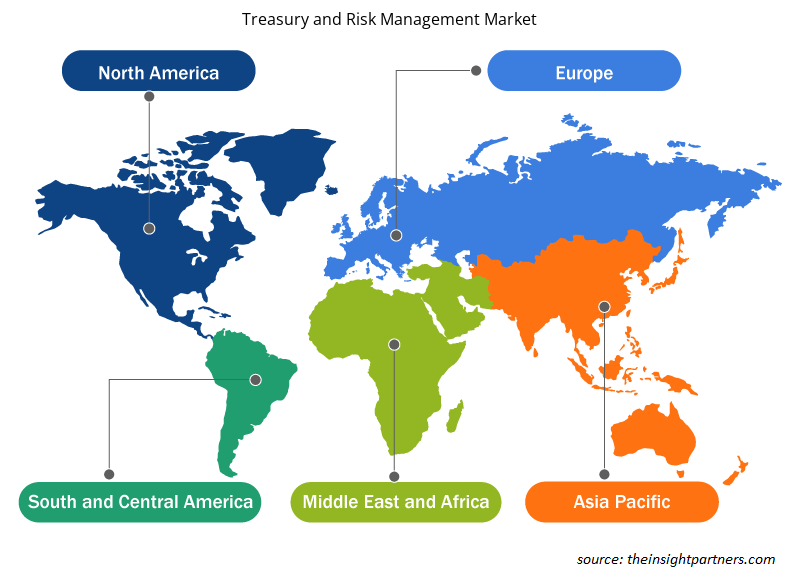

Treasury and Risk Management Market Regional Insights

The regional trends and factors influencing the Treasury and Risk Management Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Treasury and Risk Management Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Treasury and Risk Management Market

Treasury and Risk Management Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 4.74 Billion |

| Market Size by 2028 | US$ 7.16 Billion |

| Global CAGR (2021 - 2028) | 6.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Treasury and Risk Management Market Players Density: Understanding Its Impact on Business Dynamics

The Treasury and Risk Management Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Treasury and Risk Management Market are:

- Broadridge Financial Solutions, Inc.

- FIS

- Oracle Corporation

- Pricewaterhousecoopers International Limited (PWC)

- SAP SE

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Treasury and Risk Management Market top key players overview

Company Profiles

- Broadridge Financial Solutions, Inc.

- FIS

- Oracle Corporation

- Pricewaterhousecoopers International Limited (PWC)

- SAP SE

- Fiserv, Inc.

- Calypso Technology, Inc (Adenza)

- Kyriba Corp

- Mors Software

- Wolters Kluwer

Frequently Asked Questions

Which primary factor is driving the Treasury and Risk Management Market?

Financial analytics services offer financial data quality analysis, data layout, client analytics, predictive analytics, principal component analysis, and financial data collection. These analytics require detailed financial and other relevant data to identify patterns; based on these predictions, enterprises make predictions regarding their customers purchases and their employees' tenures period.

Which country is leading the Treasury and Risk Management market in 2021?

The US held the largest market share in the Treasury and Risk Management market. The treasury and risk management market are increasing in the US due to the rise in the technological sector. As per CompTIACyberstates report, 2022 of the economic impacts of the technology sector, the direct economic impact the dollar value of goods and services produced during a given year amounts to 10.5% of US economic value, which translates to over US$ 2.0 trillion.

Which segment by component type led the Treasury and Risk Management market in 2021?

Based on the component type, the market is segmented into solution and services. The solution segment led the treasury and risk management market in 2021. Treasury and risk management solutions integrate tools such as payments, cash management, and bank connectivity with an extensive library of financial instruments, advanced risk analytics, and hedge accounting to provide overall visibility across the enterprise. A comprehensive risk management solution offers a holistic approach to compliance, financial, and operational risk management. Such as, Fidelity National Information Services, Inc. (FIS) offers treasury management solutions that support a digital and modernized treasury function.

Which are the five key companies in the Treasury and Risk Management market?

FIS (Fidelity National Information Services Inc); Oracle Corporation; PricewaterhouseCoopers International Limited (PwC); SAP SE; and Fiserv, Inc. are the five key players in the Treasury and Risk Management market. These companies have shown consistent growth in revenue and larger volumes of sales. Additionally, the well-established top five players are offering a comprehensive product portfolio and have a prominent presence in terms of share in the Treasury and Risk Management market.

Which segment by deployment type is expected to grow at the fastest CAGR during the forecast period?

Based on deployment type, the treasury and risk management market are bifurcated into cloud-based and on-premises. The cloud-based segment led the treasury and risk management market in 2021. The technology sector has been increasingly witnessing a significant rise in cloud-based platforms in recent times. The cloud-based platform simplifies the deployment time and significantly reduces the cost of deployment. A few benefits of a cloud-based treasury and risk management platform are the secure hosting of critical data, improved security and scalability, and quick recovery of files. The backups are stored on a private or shared cloud host platform. Therefore, organizations can quickly recover several critical data.

What are the market opportunities for the Treasury and Risk Management market?

Global spending on the information and communications technology (ICT) sector continues to rise. The article published by Innovation, Science and Economic Development Canada stated that over ~40,000 businesses in the Canadian ICT sector fell within the software and computer services segment in 2020. With the growing spending on the ICT sector, especially on the software/platform segment, the development and adoption of advanced technologies by businesses globally will grow in the coming years. Thus, the rising spending on the ICT sector will lead to more advanced development in the treasury and risk management systems, which will boost the demand for treasury and risk management solutions.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Parking Meter Apps Market

- eSIM Market

- Advanced Distributed Management System Market

- Online Exam Proctoring Market

- Electronic Data Interchange Market

- Barcode Software Market

- Maritime Analytics Market

- Cloud Manufacturing Execution System (MES) Market

- Robotic Process Automation Market

- Digital Signature Market

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Treasury and Risk Management Market

- Broadridge Financial Solutions, Inc.

- FIS

- Oracle Corporation

- Pricewaterhousecoopers International Limited (PWC)

- SAP SE

- Fiserv, Inc.

- Calypso Technology, Inc (Adenza)

- Kyriba Corp

- Mors Software

- Wolters Kluwer

Get Free Sample For

Get Free Sample For