US Emergency Department Information System Market Trends and Analysis by 2030

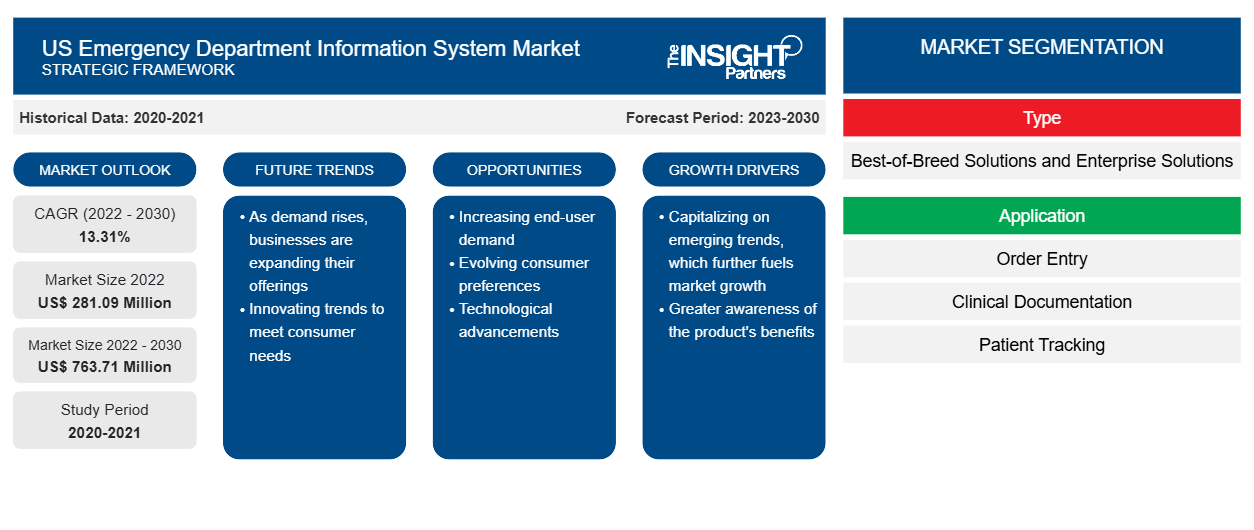

US Emergency Department Information System Market Size and Forecasts (2020 - 2030), Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Best-of-Breed Solutions and Enterprise Solutions); Application (Order Entry, Clinical Documentation, Patient Tracking, E-Prescribing, and Others), End User (Small Hospitals, Medium-Sized Hospitals, and Large Hospitals), and Country

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Status : Published

- Report Code : TIPRE00030068

- Category : Technology, Media and Telecommunications

- No. of Pages : 64

- Available Report Formats :

The US emergency department information system market size was valued at US$ 281.09 million in 2022 and is projected to reach US$ 763.71 million by 2030; it is estimated to register a CAGR of 13.31% from 2022 to 2030.

Market Insights and Analyst View:

An emergency department information system is an expanded electronic health record (EHR) system created specially to handle data and streamline procedures in support of emergency department patient care and operations. The ambulatory and inpatient environments are very dissimilar from the emergency department environment. Emergency care settings are episodic and typically more complex than ambulatory and inpatient settings, which prioritize longitudinal treatment. Patients frequently need quick medical attention and urgent care when they visit the emergency department. From check-in and triage to documentation and order processing, communication with other hospital employees, and discharge, speed, and accuracy are essential throughout the whole ED visit. Factors such as an increase in patient flow at emergency departments, and a rise in adoption of emergency department information systems drive the market growth. However, the huge investments and lack of skilled healthcare hinder the emergency department information system market growth.

Growth Drivers and Challenges:

Emergency department information systems help enhance hospitals' decision-making by providing comprehensive real-time data for hospital administrations. Furthermore, the use of emergency department information systems during COVID-19 has grown dramatically, and crowding in emergency departments (EDs) affects both adult and pediatric hospitals. However, there has been an increase in pediatric patients visiting EDs in recent years. Data from the 2018 National Hospital Ambulatory Medical Care Survey showed 130 million annual ED visits, with 25.6 million, or one-third, made by patients under 15. In addition, a record number of pediatric behavioral health concerns, RSV, influenza, COVID-19, and ED visits from children occurred in late 2022 and early 2023. The demand for emergency department information systems is high in North America due to the wide acceptance of technology in countries such as the US and Canada. Also, the rising adoption of telematics healthcare digital transformation in healthcare settings, the growing expenditure in healthcare infrastructure, and the availability of technologically advanced devices are driving the US emergency department information systems market. In addition, the rapidly increasing adoption of hospital IT for greater efficiency in administrative processes propels the emergency department information system market growth.

High capital requirements for implementing emergency department information systems and low perceived return on investments are the major forces obstructing the adoption of these emergency department information systems. The installation of EDIS requires massive organizational changes and leads to alterations in the pattern of providing healthcare services in emergency departments. The financial and clinical outcomes of healthcare facilities are correlated, and this correlation dictates, to a reasonable extent, the investments suitable for achieving a particular health outcome. The cost of implementation, operation, and maintenance of EDIS is also a significant barrier to adopting such systems. Thus, despite the benefits of e-prescription systems, end users are reluctant to adopt e-prescribing solutions. The expenses are not limited to the one-time purchase price of a system. They involve recurrent costs incurred by implementation services, maintenance and support services, e-prescribing and EHR/EMR integration services, and, sometimes, training and education. As a result, smaller hospitals and office-based physicians refrain from investing in emergency department information systems.

The lack of expertise and skills required for handling modern healthcare IT and informatics solutions is another challenge healthcare providers face. Demand for research and healthcare is anticipated to rise with the aging of the baby boomer population. Simultaneously, a large percentage of skilled and experienced IT workforce is reaching the age of retirement. On the other hand, the number of younger workers available is not sufficient to fill this gap. The lack of expertise and administrative capacity required for data collection, health information analysis, and reporting is a common overarching challenge that limits EDIS implementation, thereby restraining market expansion.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONUS Emergency Department Information System Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “US Emergency Department Information System Market” is segmented on the basis of type, application, infection severity, end user, and country.

Segmental Analysis:

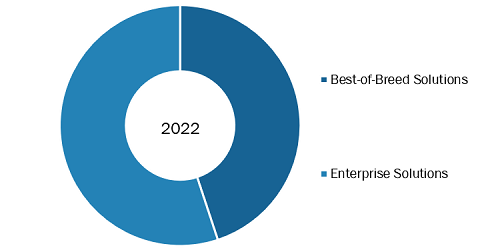

Based on type, the US emergency department information system market is segmented into enterprise solutions and best-of-breed solutions. The best-of-breed solutions segment is likely to hold the largest share of the market in 2022. and the same segment projected to register the highest CAGR in the market during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Enterprise solutions integrate a provider's branches and multiple legal entities through a centralized and distributed architecture in which data is synchronized to create a single database. The solution complies with the WHO, healthcare legal requirements, and insurance requirements. It is a cloud-based system that aids users in accessing real-time data from anywhere at any time. A centralized system manages all legal and financial entities in the enterprise solution, which makes business productive. The increasing acceptance of EHR/EMR, rising usage of big data in healthcare, financing for the preservation of electronic patient health records, and regulatory mandates are propelling the enterprise solutions segment growth.

The US emergency department information system market, by application, is segmented into computerized physician order entry (CPOE), clinical documentation, patient tracking, e-prescribing, and others. The computerized physician order entry (CPOE) segment held the largest share of the US emergency department information system market in 2022 and is anticipated to register the highest CAGR during 2022–2030. Computerized physician order entry (CPOE) is a software tool that assists doctors in entering medical orders into computer systems in inpatient and ambulatory settings. Many old ways of enlisting medicine orders, including spoken (in person or over the phone), written (paper prescriptions), and fax, are being replaced by CPOE. Users can define prescription orders, as well as laboratory, referral, admission, imaging, and treatment orders, electronically using these platforms. Government attempts to upgrade the IT infrastructure and information technology that aids in the lowering of healthcare expenses are driving the market for the CPOE segment.

The US emergency department information system market by end user is segmented into small hospitals, medium-sized hospitals, and large hospitals. The medium-sized hospitals segment is likely to lead the market for the US emergency department information systems in 2022 and is expected to retain its dominance during the forecast period 2022–2030. To lower the expenses and improve care quality, hospitals invest in information technology such as EDIS and EHR. Hospitals classified as medium-sized have between 94 and 277 general and surgical beds. The removal of decision support or patient level from the model resulted in insignificant correlations between all postulated paths, according to further study of the EHR construct.

Research further reveals that the presence of these two variables alone resulted in a statistically meaningful association with general safety, whereas all other routes were found to be insignificant. As a result, medium-sized hospitals should think about investing in emergency department information systems or electronic health record technologies that focus on decision support and patient-level data. According to the research, these applications can improve overall safety in medium-sized hospitals.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Competitive Landscape and Key Companies:

Developments in the US emergency department information system market have been characterized as organic and inorganic growth strategies. Various companies are focusing on organic growth strategies such as launches, expansion, enhancement, and relocation. Inorganic growth strategies witnessed in the US emergency department information system market were mergers & acquisitions, partnerships, and collaborations. These activities have cemented the way for the expansion of the business and customer base of US emergency department information system market players.

- In March 2023, Vital, a leading AI-driven digital health company that improves the patient experience, raised US$ 24.7 million in Series B funding to drive expansion and support the rapid growth of its modern software. Vital’s solutions make it easier for healthcare providers and health systems to communicate with and engage patients during emergency department (ED) and inpatient visits. The funding round was headed by Transformation Capital, with support from strategic health system investors, Threshold Ventures, and Vital CEO / Mint.com creator Aaron Patzer, bringing Vital’s total funding to over US$ 40 million.

- In June 2022, Oracle acquired health IT company Cerner Corporation through an all-cash tender offer for US$ 95.00 per share, or ~US$ 28.3 billion in equity value. Cerner Corporation is a leading provider of digital information systems used to empower medical professionals to provide better healthcare to individual patients and communities within hospitals and health systems. The transaction is Oracle's largest acquisition and one of the largest takeovers in the year.

- In January 2022, the Gippsland Health Alliance (GHA) planned to expand its Allscripts Sunrise electronic health record (EHR) across the Victoria, Australia, region of Gippsland. GHA’s EHR Community Health project Phase 3 witnessed the deployment of the Sunrise Emergency Care module at the emergency department facilities of the Central Gippsland Health Service, West Gippsland Healthcare Group, Bairnsdale Regional Health Service, and Bass Coast Health, which covers the Southern part of the region.

- In February 2020, Medsphere Systems Corporation announced that KLAS Research recognizes the company’s Wellsoft Emergency Department Information System as the best solution of its kind. In the 2020 Best in KLAS Awards: Software and Services report, KLAS named Wellsoft the number one EDIS software system for the ninth consecutive year and fifteenth time overall.

- In January 2020, FastMed, an urgent care clinic operator, was the first of its kind to implement Epic Systems EHR. FastMed patients gain access to Epic’s patient portal, MyChart, giving patients 24-hour access to their health information, online appointment scheduling, secure direct messaging and communication with their care team, and online bill pay. On top of adding an urgent care clinic provider, several hospitals have recently implemented Epic Systems EHR. In late 2019, Tanner Health System in Georgia adopted Epic EHR.

- In November 2020, Vital, AI-powered software for hospital emergency departments and patients, collaborated with Collective Medical to improve the patient experience in the emergency department by keeping patients & their families informed throughout every step of a visit. Collective’s thousands of client partners rely on these systems for rich, real-time clinical insights to improve care decisions and the patient experience. These providers can also access Vital’s platform without additional IT integration to provide real-time patient updates.

Company Profiles

- Veradigm LLC

- eHealth-Tec

- Epic Systems Corp

- Medical Information Technology, Inc

- Q-nomy Inc

- Picis

- Vital

- MEDHOST

- Oracle Corp

- Medsphere Systems Corporation

US Emergency Department Information System Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 281.09 Million |

| Market Size by 2030 | US$ 763.71 Million |

| CAGR (2022 - 2030) | 13.31% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

United States

|

| Market leaders and key company profiles |

|

Frequently Asked Questions

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For